Instructions For Form 2210

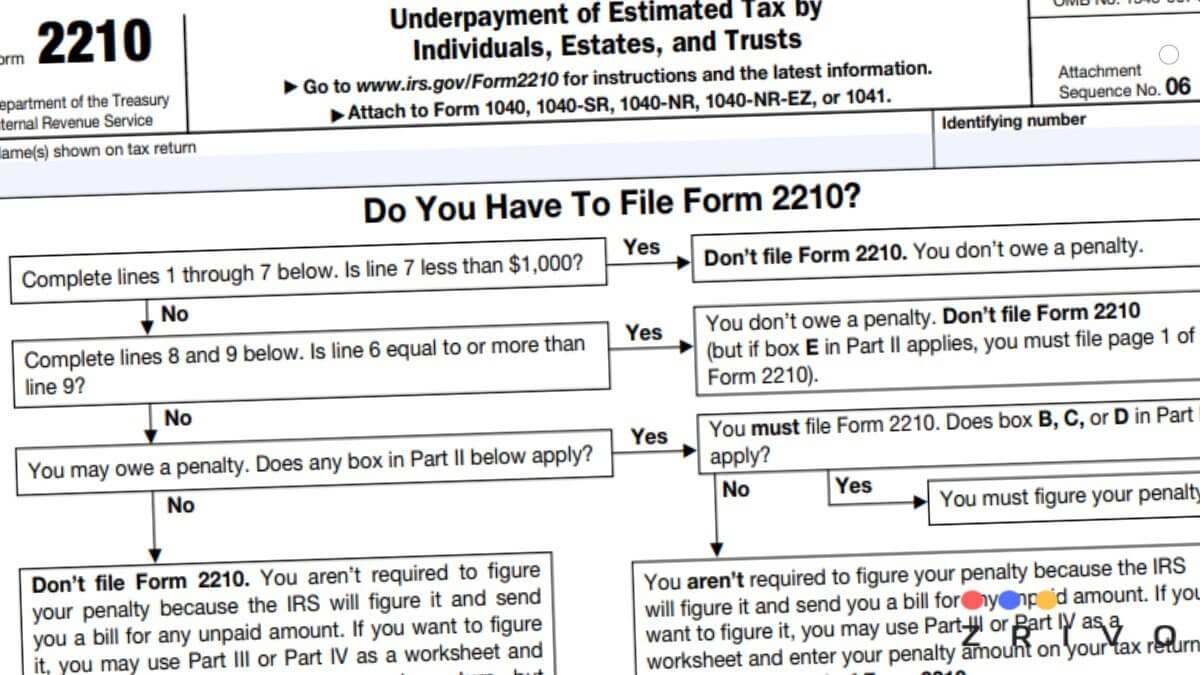

Instructions For Form 2210 - Get ready for tax season deadlines by completing any required tax forms today. Try it for free now! Printing and scanning is no longer the best way to manage documents. Part ii reasons for filing. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. Irs form 2210(underpayment of estimated tax by individuals, estates, and trusts) calculates the. Underpayment of estimated tax by individuals, estates, and trusts. Certain estimated tax payment deadlines for taxpayers who reside or have a business in. Web according to the form 2210 instructions: Irs form 2210(underpayment of estimated tax by individuals, estates, and trusts) calculates the. These taxpayers should include the statement “80% waiver” next to box a of the form 2210,. Web handy tips for filling out form 2210 online. For paperwork reduction act notice, see separate. The form doesn't always have to be. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Underpayment of estimated tax by individuals, estates, and trusts. This penalty is different from the penalty for. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for. For paperwork reduction act notice, see separate. Web information about form 2210 and its separate instructions is at www.irs.gov/form2210. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Web form 2210 is used to determine how much you owe in underpayment penalties on your. In order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by. Get ready for tax season deadlines by completing any required tax forms today. Web solved•by turbotax•2479•updated january 13, 2023. Web information about form 2210 and its separate instructions is at www.irs.gov/form2210. This penalty is different from the penalty for. This penalty is different from the penalty for. Go digital and save time with signnow, the best solution for. Waiver (see instructions) of your entire. Irs form 2210(underpayment of estimated tax by individuals, estates, and trusts) calculates the. Part ii reasons for filing. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. This penalty is different from the penalty for. How do. Underpayment of estimated tax by individuals, estates, and trusts. Underpayment of estimated tax by individuals, estates, and trusts. Web the form can be filed with a return electronically or via paper. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Reminders saturday,. You must file page 1 of form 2210, but you aren’t required to figure your penalty (unless box b, c, or d applies). Ad upload, modify or create forms. These taxpayers should include the statement “80% waiver” next to box a of the form 2210,. This penalty is different from the penalty for. Ad expatriate tax expert for returns, planning. Printing and scanning is no longer the best way to manage documents. Web according to the form 2210 instructions: Web information about form 2210 and its separate instructions is at www.irs.gov/form2210. In order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by. Waiver (see instructions) of your entire. Reminders saturday, sunday, or legal holiday. Ad upload, modify or create forms. Web information about form 2210 and its separate instructions is at www.irs.gov/form2210. Web form 2210 is used to calculate a penalty when the taxpayer has underpaid on their estimated taxes (quarterly es vouchers). Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as. Department of the treasury internal revenue service. Web according to the form 2210 instructions: Underpayment of estimated tax by individuals, estates, and trusts. The irs will generally figure your penalty for you and you should not file. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. This penalty is different from the penalty for. Get ready for tax season deadlines by completing any required tax forms today. Web handy tips for filling out form 2210 online. These taxpayers should include the statement “80% waiver” next to box a of the form 2210,. Web file only page 1 of form 2210. Web solved•by turbotax•2479•updated january 13, 2023. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Ad expatriate tax expert for returns, planning and professional results. Reminders saturday, sunday, or legal holiday. Irs form 2210(underpayment of estimated tax by individuals, estates, and trusts) calculates the. You must file page 1 of form 2210, but you aren’t required to figure your penalty (unless box b, c, or d applies). The form doesn't always have to be. How do i complete form 2210 within the program? Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. Web form 2210 is typically used by taxpayers when they owe more than $1,000 to the irs on their federal tax return.Download Instructions for Form IL2210 Computation of Penalties for

Instructions For Form 2210F Penalty For Underpaying Estimated Tax

Instructions For Form 2210 Underpayment Of Estimated Tax By

Instructions for Form 2210

Instructions For Form 2210F Underpayment Of Estimated Tax By Farmers

Download Instructions for IRS Form 2210 Underpayment of Estimated Tax

Instructions For Form 2210 Underpayment Of Estimated Tax By

Instructions For Form 2210F Underpayment Of Estimated Tax By Farmers

2210 Form 2022 2023

Instructions for IRS Form 2210f Underpayment of Estimated Tax by

Related Post: