Form 2555 Turbotax

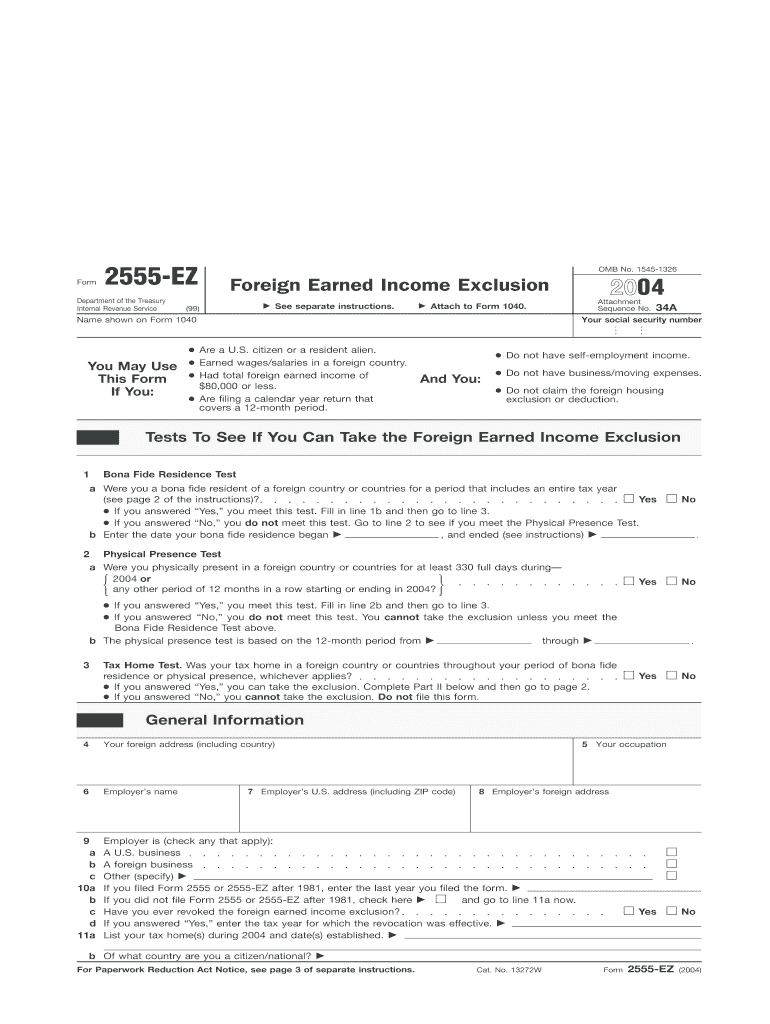

Form 2555 Turbotax - Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Signnow allows users to edit, sign, fill and share all type of documents online. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. If you qualify, you can use form 2555 to figure your foreign. We offer a variety of software related to various fields at great prices. Department of the treasury internal revenue service. Web solved•by turbotax•809•updated january 13, 2023. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Easily sort by irs forms to find the product that best fits your tax situation. Ad webshopadvisors.com has been visited by 100k+ users in the past month You cannot exclude or deduct more than the. Ad explore the collection of software at amazon & take your skills to the next level. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. If you qualify, you can use. Signnow allows users to edit, sign, fill and share all type of documents online. If you were experiencing an error on the address field of the form 2555, that issue is now resolved. Department of the treasury internal revenue service. Go to my account in the top right corner. To enter foreign earned income / exclusion in turbotax deluxe online. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or. Web 1 best answer. If you were experiencing an error on the address field of the form 2555, that issue is now resolved. You must attach form. Go to www.irs.gov/form2555 for instructions. If you qualify, you can use form 2555 to figure your foreign. You must attach form 2555, foreign earned income, to your form 1040 or 1040x to claim the foreign earned income exclusion, the foreign housing. Web 1 best answer. Ad explore the collection of software at amazon & take your skills to the next. You cannot exclude or deduct more than the. If you qualify, you can use form 2555 to figure your foreign. Web 235 rows purpose of form. Total foreign earned income has a value for foreign earned income but dates for the foreign earned income exclusion aren't entered. Web information about form 2555, foreign earned income, including recent updates, related forms,. Web 1 best answer. Easily sort by irs forms to find the product that best fits your tax situation. Web 1 best answer. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes. We offer a variety of software related to various fields at great prices. Go to www.irs.gov/form2555 for instructions. Go to www.irs.gov/form2555 for instructions. Use form 2555 to claim. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web if you meet the requirements, you can complete form 2555 to exclude your foreign wages or salary from income earned in the foreign country. Easily sort by irs forms to find the product that best fits your tax situation. You. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web solved•by turbotax•809•updated january 13, 2023. Go to www.irs.gov/form2555 for instructions. You must attach form 2555, foreign earned income, to your form 1040 or 1040x to claim the foreign earned income exclusion, the foreign housing. You may also qualify to exclude. You must attach form 2555, foreign earned income, to your form 1040 or 1040x to claim the foreign earned income exclusion, the foreign housing. Web 1 best answer. Ad download or email irs 2555 & more fillable forms, try for free now! Easily sort by irs forms to find the product that best fits your tax situation. Signnow allows users. Go to www.irs.gov/form2555 for instructions. You cannot exclude or deduct more than the. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web 1 best answer. Ad download or email irs 2555 & more fillable forms, try for free now! Person works overseas and is able to meet the requirements of the foreign earned income exclusion (feie), they may qualify to file a. If you qualify, you can use form 2555 to figure your foreign. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Go to www.irs.gov/form2555 for instructions. Total foreign earned income has a value for foreign earned income but dates for the foreign earned income exclusion aren't entered. Use form 2555 to claim. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web 235 rows purpose of form. You must attach form 2555, foreign earned income, to your form 1040 or 1040x to claim the foreign earned income exclusion, the foreign housing. Signnow allows users to edit, sign, fill and share all type of documents online. To enter foreign earned income / exclusion in turbotax deluxe online program, here are the steps: Web use form 1116 to claim the foreign tax credit (ftc) and subtract the taxes they paid to another country from whatever they owe the irs. Web solved•by turbotax•809•updated january 13, 2023. Easily sort by irs forms to find the product that best fits your tax situation. Go to my account in the top right corner.Publication 54 Tax Guide for U.S. Citizens and Resident Aliens Abroad

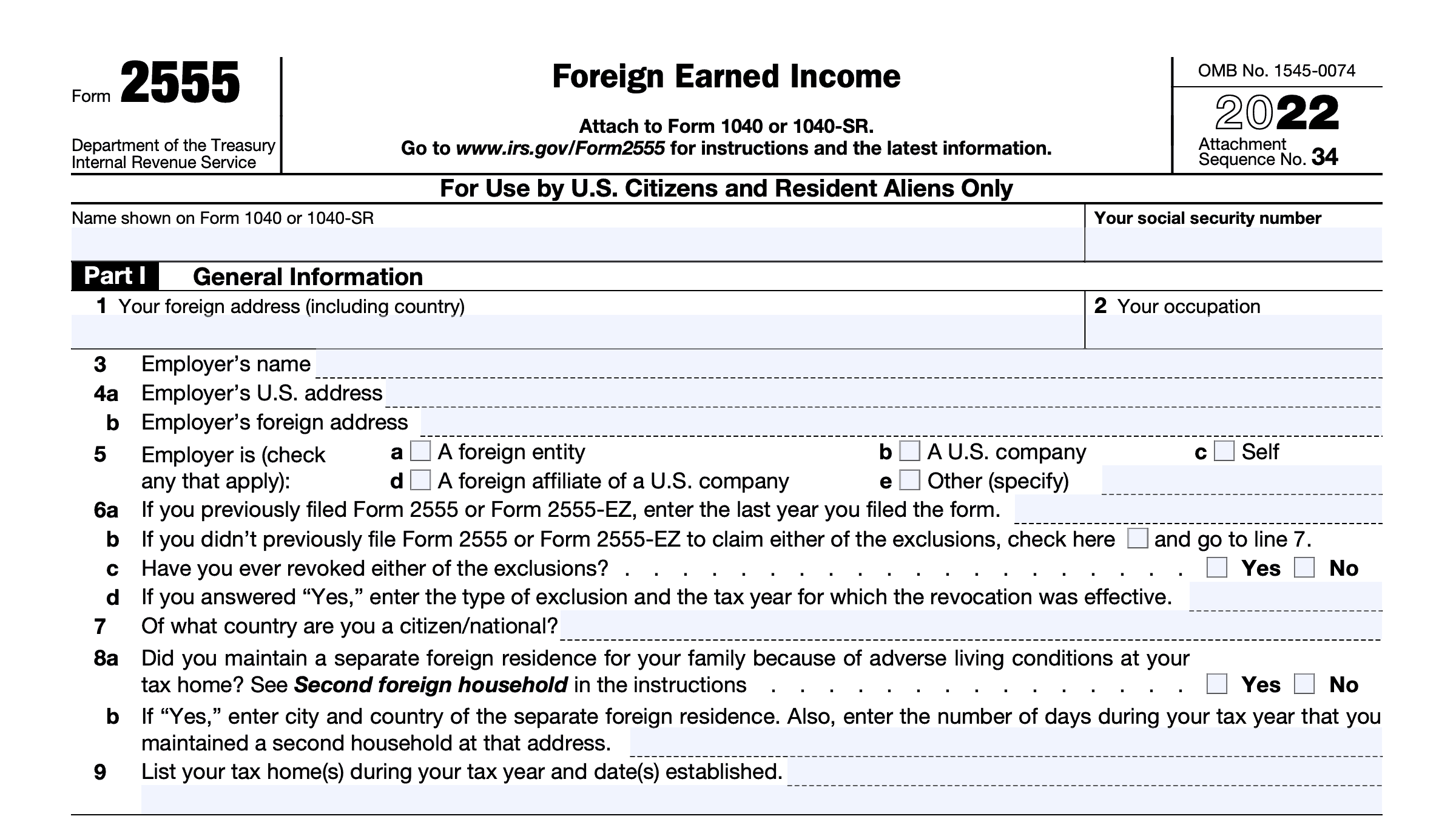

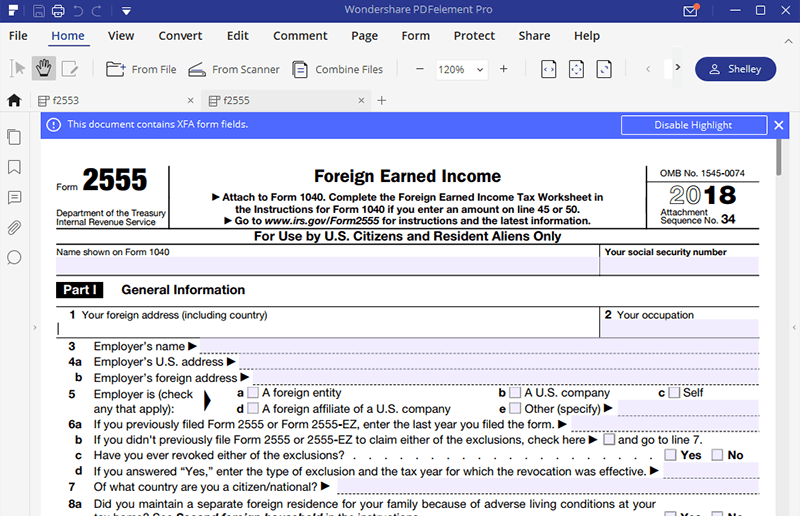

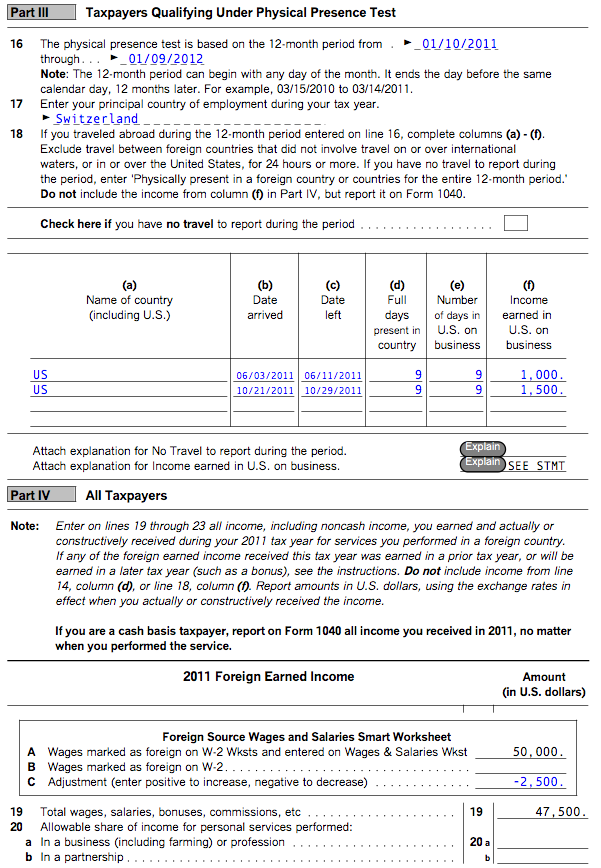

form 2555 turbotax Fill Online, Printable, Fillable Blank irsform

IRS Form 2555 A Foreign Earned Guide

IRS Form 2555 Fill out with Smart Form Filler

Form 2555 Fill Out and Sign Printable PDF Template signNow

Publication 54 Tax Guide for U.S. Citizens and Resident Aliens Abroad

Filing Form 2555 for the Foreign Earned Exclusion

TurboTax for Expats

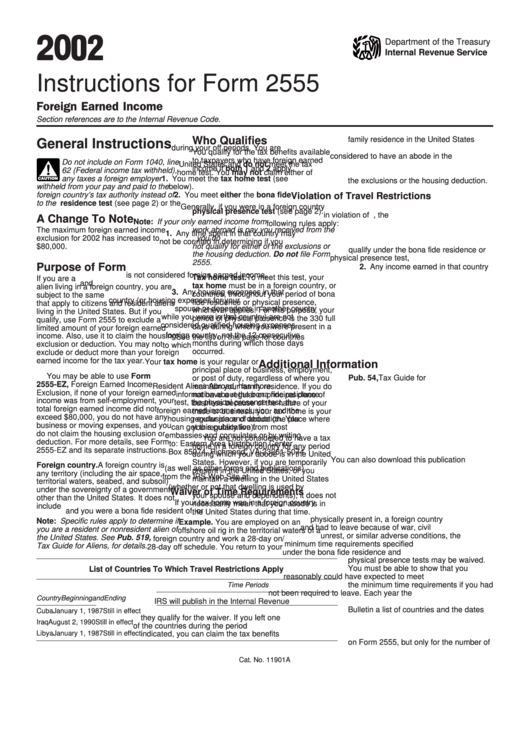

Instructions For Form 2555 Foreign Earned Internal Revenue

Publication 54 Tax Guide for U.S. Citizens and Resident Aliens Abroad

Related Post: