Form 7203 Turbotax

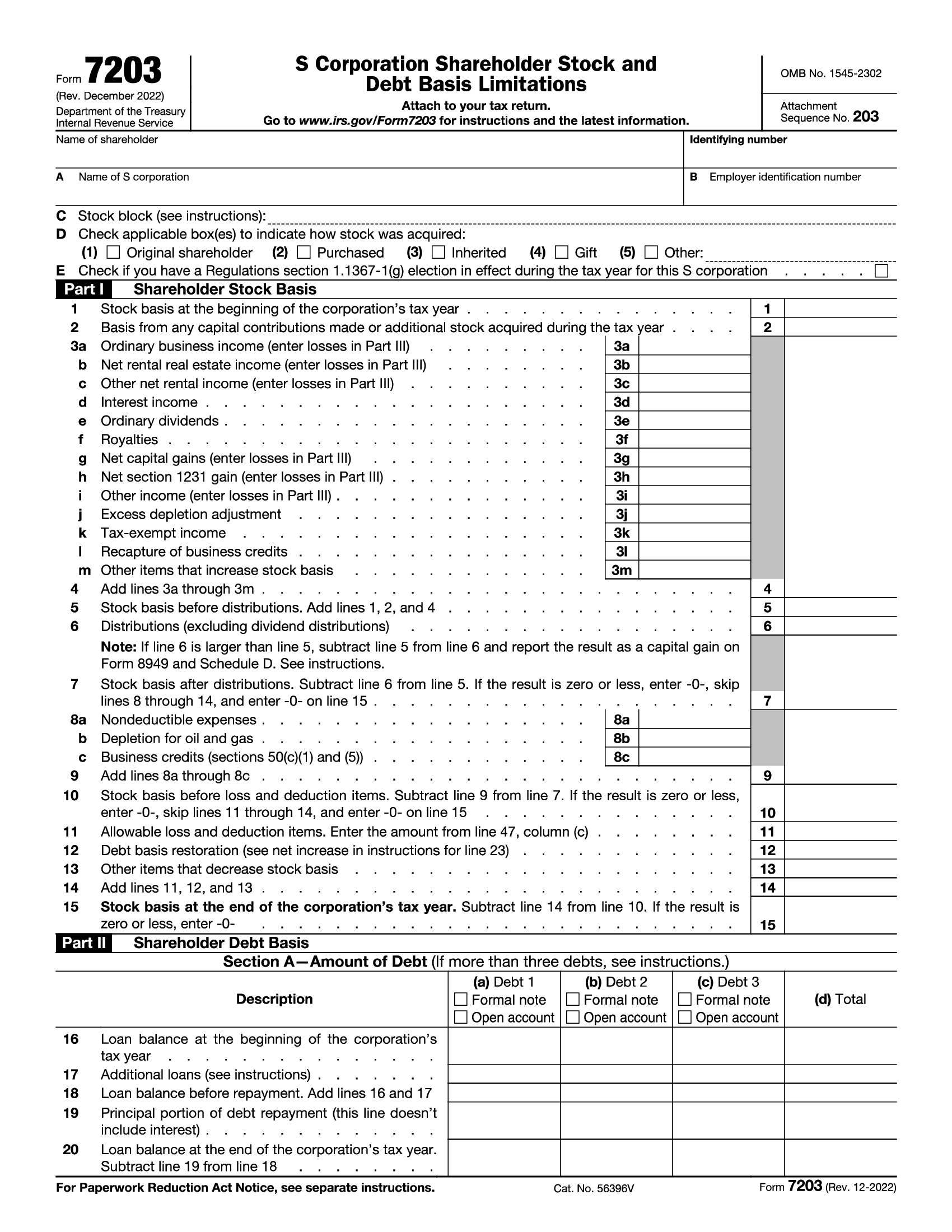

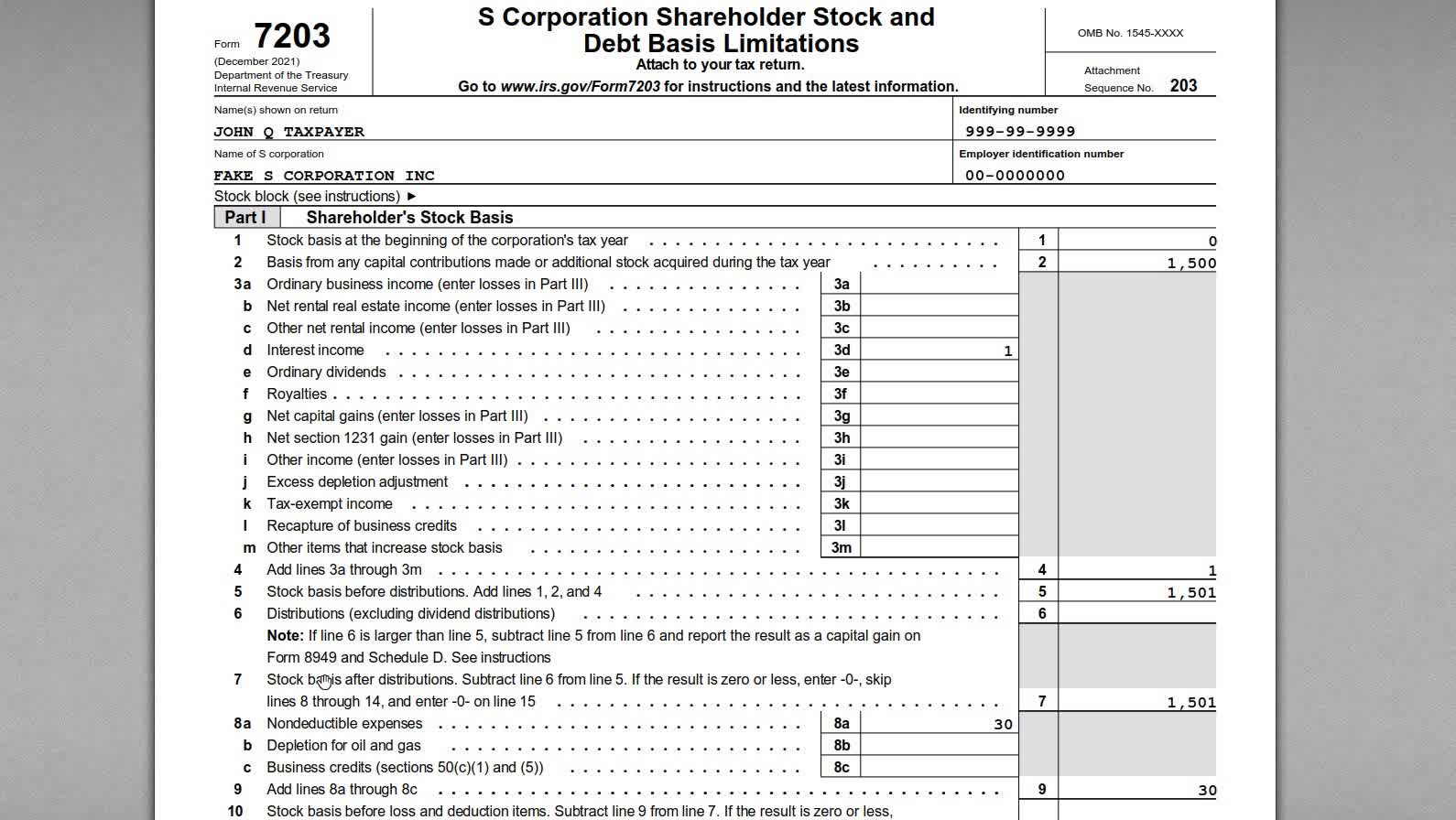

Form 7203 Turbotax - Attach to your tax return. Web what is form 7203? Get online tax help with individual or corporate tax filings. How do i clear ef messages 5486 and 5851? Dear katrinalo, your link to the forms release data shows. Web page last reviewed or updated: This is the 1st year filing and i have nothing that shows the stock basis for these shares at. The form availability table has been provided by clicking here for your. Web use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. Web solved•by turbotax•107•updated january 13, 2023. It is also showing that it is currently available. Go to www.irs.gov/form7203 for instructions and the latest information. This is the 1st year filing and i have nothing that shows the stock basis for these shares at. December 2022) s corporation shareholder stock and debt basis limitations department of the treasury internal revenue service attach to your tax. Verified cpas. You should be able to electronically file your return. Starting in tax year 2021, form 7203 replaces the shareholder's basis worksheet (worksheet for figuring a. Dear katrinalo, your link to the forms release data shows. How do i clear ef messages 5486 and 5851? Solved•by intuit•68•updated march 17, 2023. S corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s. Web how to calculate cumulative shareholder bases (lines 1 and 2 of the new 7203 forms) to take s corp losses this year? It is also showing that it is currently available. Minimize potential audit risks and save time when filing taxes. Ad get the tax help you need with 24/7 chatline. Web tt says i need to file form 7203 for non dividend distributions in box 16d. How do i clear ef messages 5486 and 5851? Verified cpas will respond in minutes. S corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s. Web how to calculate cumulative shareholder bases (lines 1 and 2 of the new 7203 forms) to take s corp losses this year? You should be able to electronically file your return. Solved•by intuit•68•updated march 17, 2023. The form availability table has been provided by clicking here for your. Web s corporation shareholder stock and debt basis limitations. Form 7203is used to calculate any limits on the deductions you can take for your share of an s. Web use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. Web once the form 7203 is available, will we be able to efile our. Web form 7203 help. Form 7203is used to calculate any limits on the deductions you can take for your share of an s. Web solved•by turbotax•107•updated january 13, 2023. Yes, if you have only invested in or purchased stock 1 time, then your stock block is the first block and should be identified as stock block #1. Web s corporation. Web s corporation shareholder stock and debt basis limitations. Get online tax help with individual or corporate tax filings. Web how to calculate cumulative shareholder bases (lines 1 and 2 of the new 7203 forms) to take s corp losses this year? Web once the form 7203 is available, will we be able to efile our personal return through turbo. You should be able to electronically file your return. Ad save time and money with professional tax planning & preparation services. Get online tax help with individual or corporate tax filings. Yes, if you have only invested in or purchased stock 1 time, then your stock block is the first block and should be identified as stock block #1. Verified. Web the form 7203 has been set to be available 3/31/2022. Form 7203is used to calculate any limits on the deductions you can take for your share of an s. Dear katrinalo, your link to the forms release data shows. Web form 7203 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form7203. S corporation. How do i clear ef messages 5486 and 5851? Web due to these challenges, the treasury department and the irs intend to issue a notice providing penalty relief for qualifying farmers and fishermen filing forms. Go to www.irs.gov/form7203 for instructions and the latest information. The form availability table has been provided by clicking here for your. Get online tax help with individual or corporate tax filings. Web use form 7203 to figure potential limitations of your share of the s corporation's deductions, credits, and other items that can be deducted on your return. Web s corporation shareholder stock and debt basis limitations. Web form 7203 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form7203. Solved•by intuit•68•updated march 17, 2023. Ad save time and money with professional tax planning & preparation services. It is also showing that it is currently available. Web tt says i need to file form 7203 for non dividend distributions in box 16d. Web solved•by turbotax•107•updated january 13, 2023. Web the form 7203 has been set to be available 3/31/2022. This is the 1st year filing and i have nothing that shows the stock basis for these shares at. Web how to complete form 7203 in proseries. You should be able to electronically file your return. S corporation shareholders use form 7203 to figure the potential limitations of their share of the s corporation’s. Attach to your tax return. Dear katrinalo, your link to the forms release data shows.Form7203PartI PBMares

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

Formal Draft of Proposed Form 7203 to Report S Corporation Stock and

IRS Form 7203. S Corporation Shareholder Stock and Debt Basis

More Basis Disclosures This Year for S corporation Shareholders Need

National Association of Tax Professionals Blog

How to Complete IRS Form 7203 S Corporation Shareholder Basis

National Association of Tax Professionals Blog

Form 7203 S Corporation Shareholder Stock and Debt Basis Limitations

Related Post: