What Is Schedule 2 Tax Form

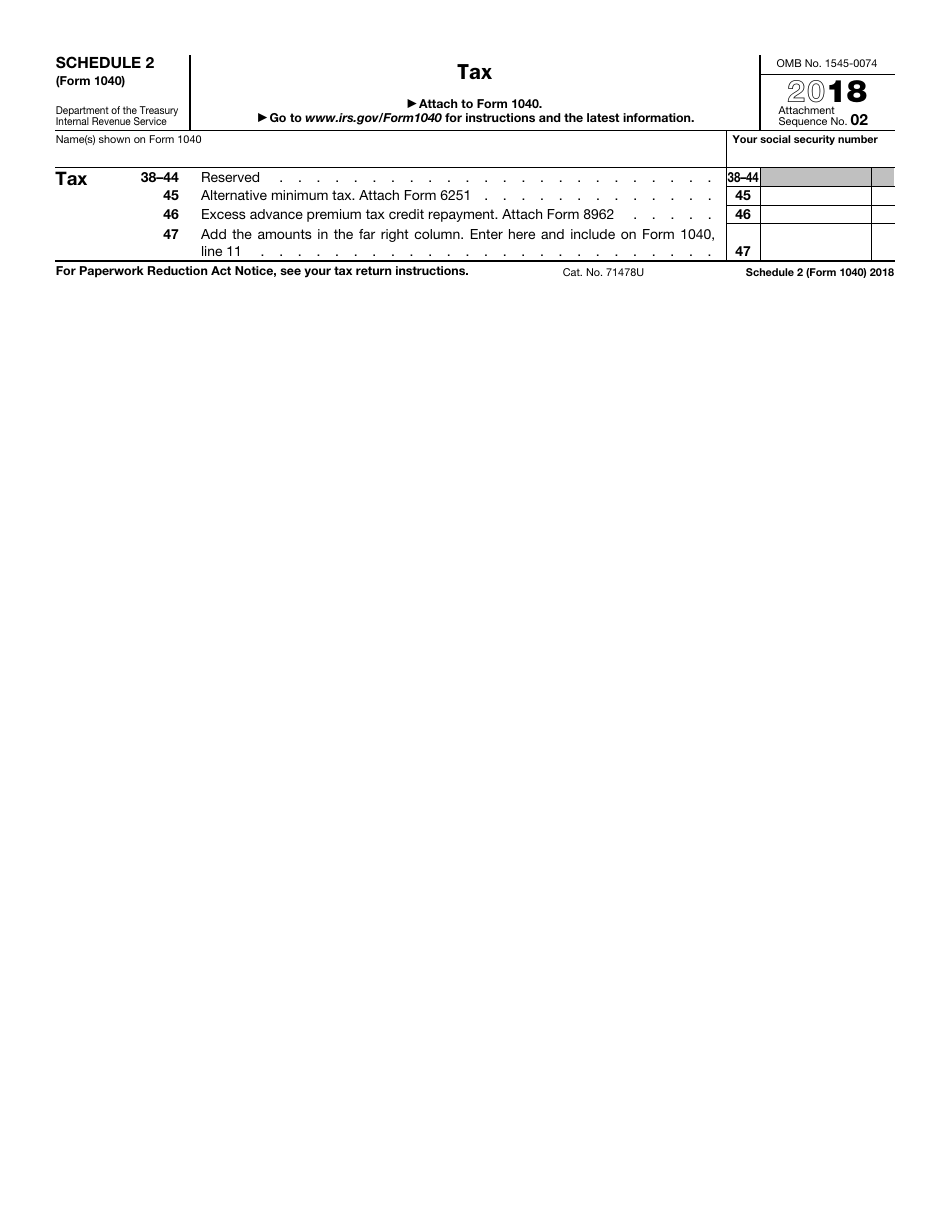

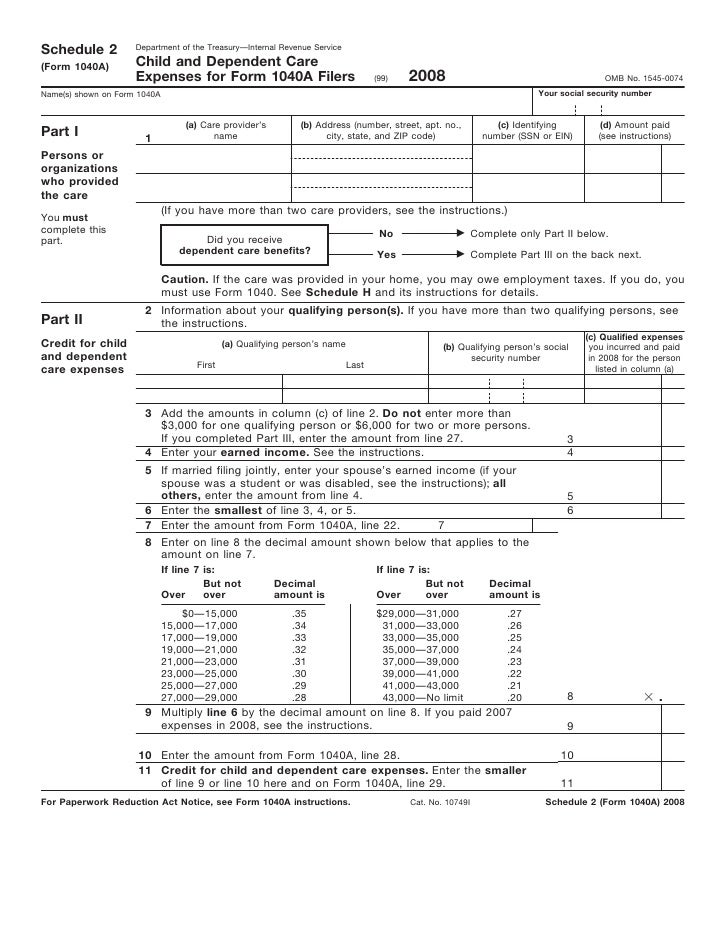

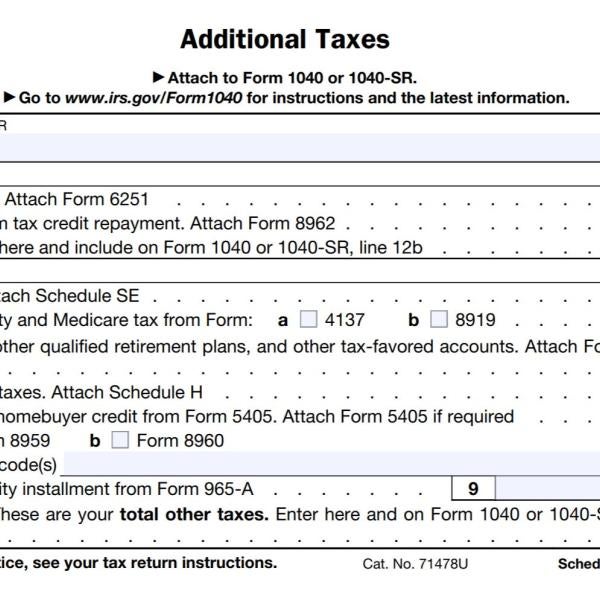

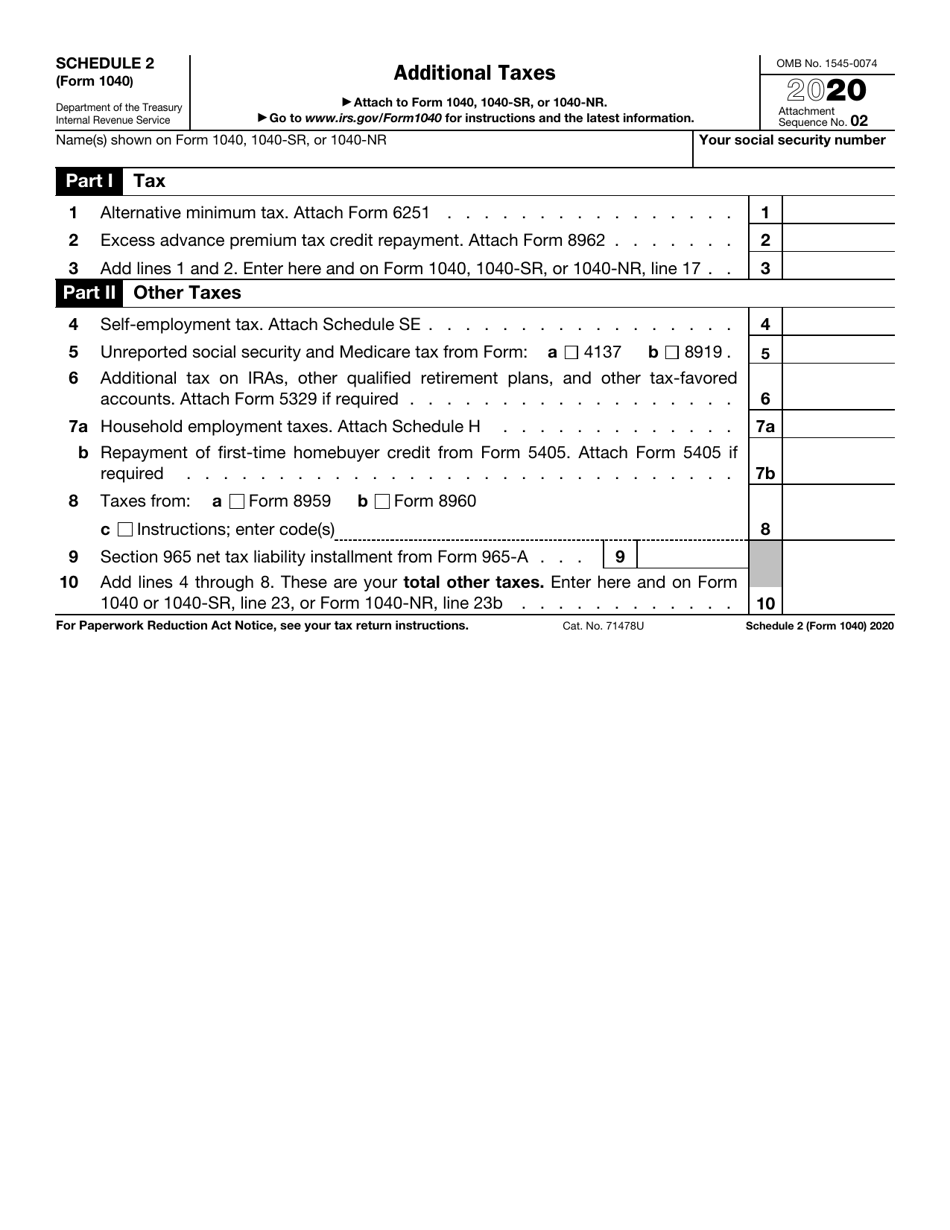

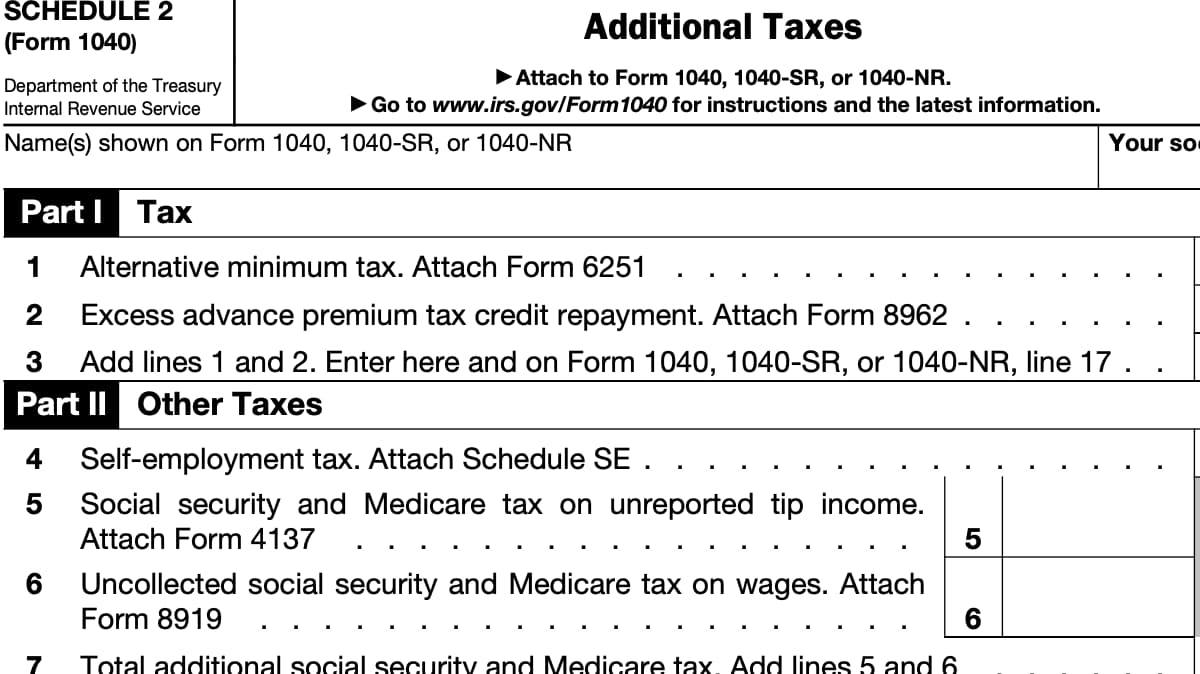

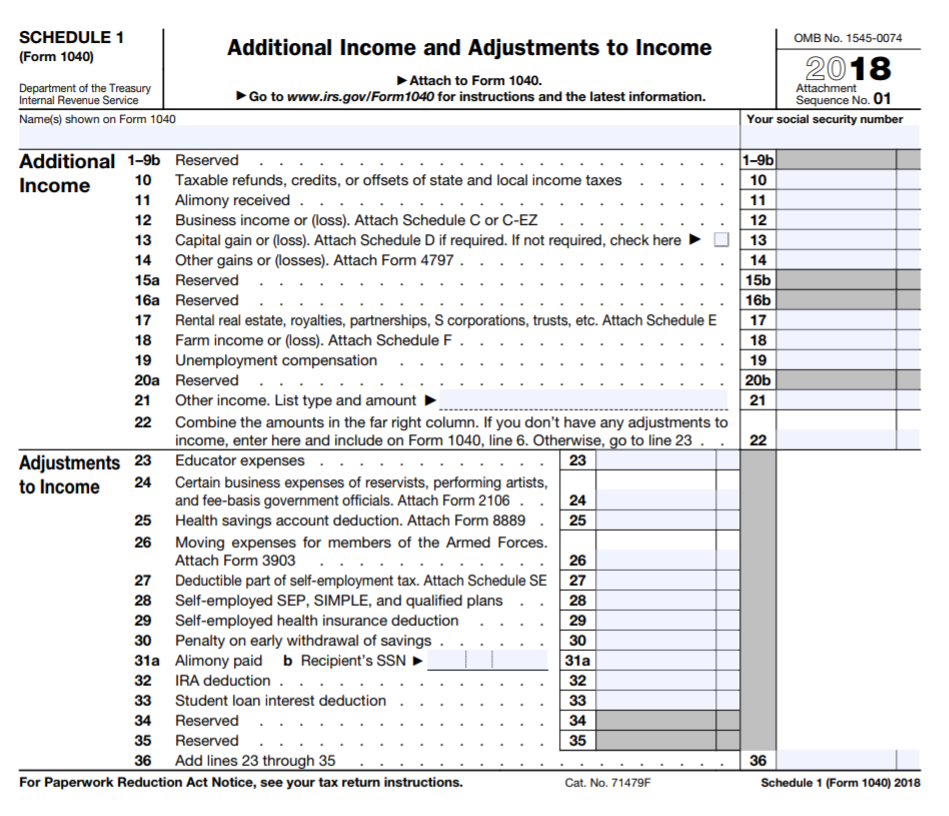

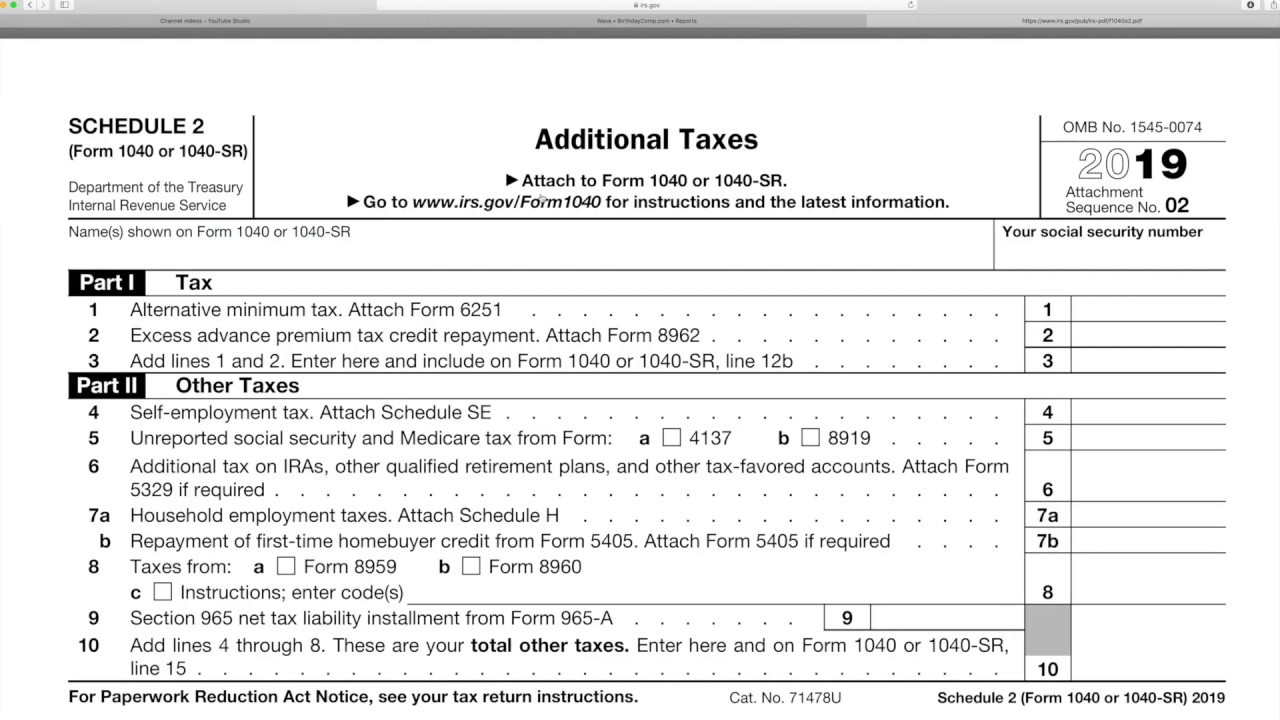

What Is Schedule 2 Tax Form - Web a tax schedule is a tax form that is used to provide more information to the internal revenue service (irs) or other tax agency about amounts reported on a tax. Just enter on line 1 part 1 income. Web 10% off turbotax live full service products see note 2; Web do not enter on w2g worksheet. Individual tax return form 1040 instructions; This schedule is used to report additional taxes. There’s a deduction for student loan interest. Web the deduction is generally the lesser of 20 percent of the business income or 20 percent of the taxable income. Enter the total interest paid to related entities on line 4(a) and the total royalties or other expenses on line 4(b). I would list each w2g on the supporting documentation (click on the letter icon to right of line one) i assume. As part of the benefits of filing a married tax return, you would use this form to claim the transfer of an unused. Supporting documentation for tax form 1040 if box 11b is checked. Web what is the purpose of the schedule 2 tax form? Web do not enter on w2g worksheet. You can file free state and federal. Web but these tax breaks can help ease the pain. Tax and other taxes. taxpayers who need to complete this form include: Department of the treasury internal revenue service. Individual tax return form 1040 instructions; (updated january 9, 2023) 2. Web popular forms & instructions; Web what is schedule 2? In 2018, schedule 2 had just four lines used to. Web forms or a schedule, if necessary. Schedule 2 additional taxes consists of part i tax and part ii other taxes. Adjusted gross income derived from another state (do not enter amount of taxable income from. Web forms or a schedule, if necessary. Web do not enter on w2g worksheet. Web a tax schedule is a form the irs requires you to prepare in addition to your tax return when you have certain types of income or deductions. Web popular forms. (updated january 9, 2023) 2. For instance, if you have student loan interest, it’s. This schedule is used to report additional taxes. Web a tax schedule is a tax form that is used to provide more information to the internal revenue service (irs) or other tax agency about amounts reported on a tax. This schedule is used to report additional. Web what is a schedule 2 tax form. In 2018, schedule 2 had just four lines used to. (updated january 9, 2023) 2. Supporting documentation for tax form 1040 if box 11b is checked. Web the new tax forms take some getting used to, but in many ways, they simplify what you and your fellow taxpayers have to go through. Web schedule 2 (form 1040), additional taxes schedule 3 (form 1040), additional credits and payments recent developments irs issues guidance on state tax payments to help. Web the new tax forms take some getting used to, but in many ways, they simplify what you and your fellow taxpayers have to go through to prepare your returns. You can file free. Supporting documentation for tax form 1040 if box 11b is checked. In ken’s case, the qbid is $1,755 (see figure 2). Web do not enter on w2g worksheet. For instance, if you have student loan interest, it’s. 1 total nebraska tax (line 17, form 1040n). Taxpayers needn’t itemize on schedule a of the form 1040 to take this. Tax and other taxes. taxpayers who need to complete this form include: Enter the total interest paid to related entities on line 4(a) and the total royalties or other expenses on line 4(b). In 2018, schedule 2 had just four lines used to. Web the standard deduction. Web forms or a schedule, if necessary. For instance, if you have student loan interest, it’s. This schedule is used to report additional taxes owed such as the alternative minimum tax,. Web a tax schedule is a tax form that is used to provide more information to the internal revenue service (irs) or other tax agency about amounts reported on. Individual tax return form 1040 instructions; Adjusted gross income derived from another state (do not enter amount of taxable income from. Web the standard deduction is adjusted for inflation every year, and for single taxpayers (and married individuals filing separately), the standard deduction increased. 1 total nebraska tax (line 17, form 1040n). Form 1040 schedule 2 includes two parts: Taxpayers who need to repay a portion of a tax credit for the health insurance marketplace 3. The newly revised schedule 2 will be attached to the 1040 form or the new. Web the deduction is generally the lesser of 20 percent of the business income or 20 percent of the taxable income. Web what is schedule 2? Tax and other taxes. taxpayers who need to complete this form include: Web popular forms & instructions; Supporting documentation for tax form 1040 if box 11b is checked. Web a tax schedule is a form the irs requires you to prepare in addition to your tax return when you have certain types of income or deductions. In ken’s case, the qbid is $1,755 (see figure 2). There’s a deduction for student loan interest. Enter the total interest paid to related entities on line 4(a) and the total royalties or other expenses on line 4(b). Web a tax schedule is a tax form that is used to provide more information to the internal revenue service (irs) or other tax agency about amounts reported on a tax. I would list each w2g on the supporting documentation (click on the letter icon to right of line one) i assume. Web but these tax breaks can help ease the pain. Web schedule 2 was one of the new schedules added to help simplify the 1040 in the wake of the 2017 tax reform law.IRS Form 1040 Schedule 2 2018 Fill Out, Sign Online and Download

Form 1040A, Schedule 2Child and Dependent Care Expenses for Form 104…

Examples of Tax Documents Office of Financial Aid University of

IRS Form 1040 Schedule 2 Download Fillable PDF or Fill Online

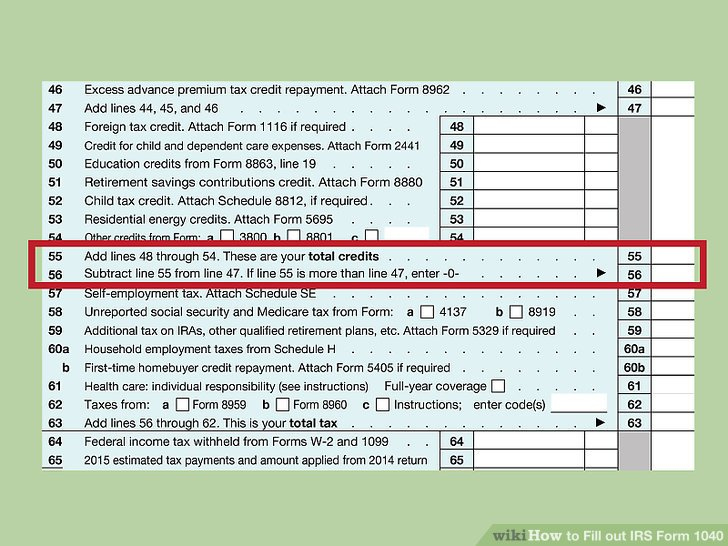

Form 1040 Line 13 Minus Schedule 2 Line 46 1040 Form Printable

Schedule 2 Online File PDF

Understanding the New Tax Forms for Filing 2018 Taxes OTAcademy

2018 form 1040 schedule 2 Fill Online, Printable, Fillable Blank

How to find 1040 schedule 2 Additional Premium Tax credit for

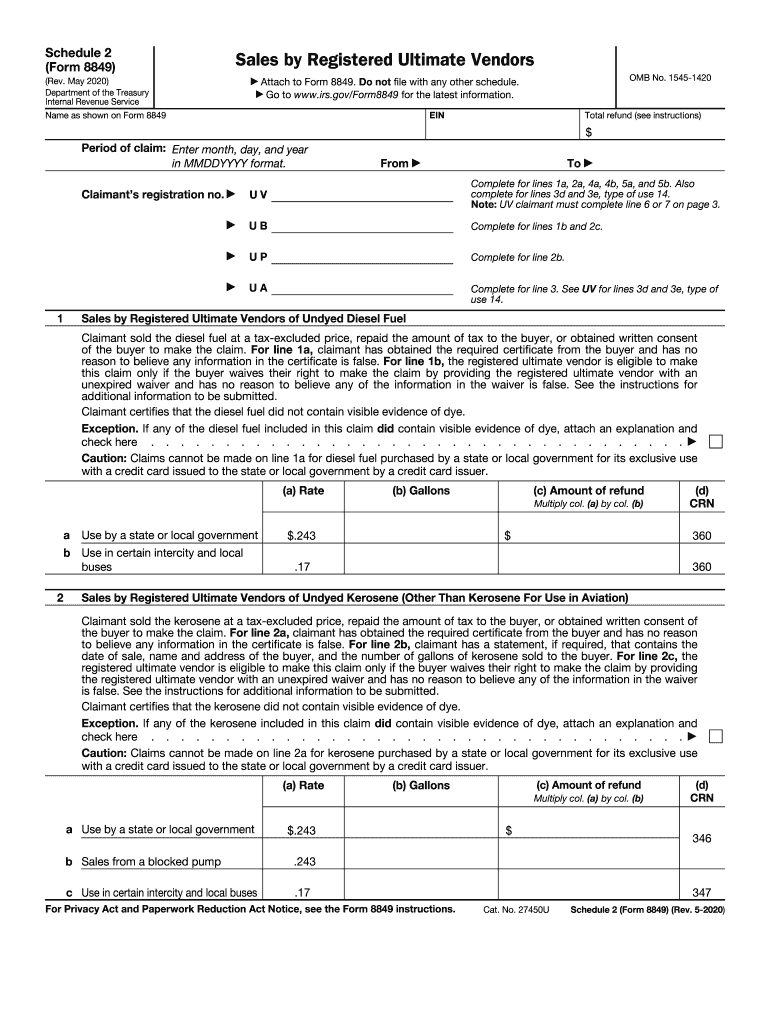

IRS 8849 Schedule 2 20202021 Fill and Sign Printable Template Online

Related Post: