Form 6252 Property Type Code

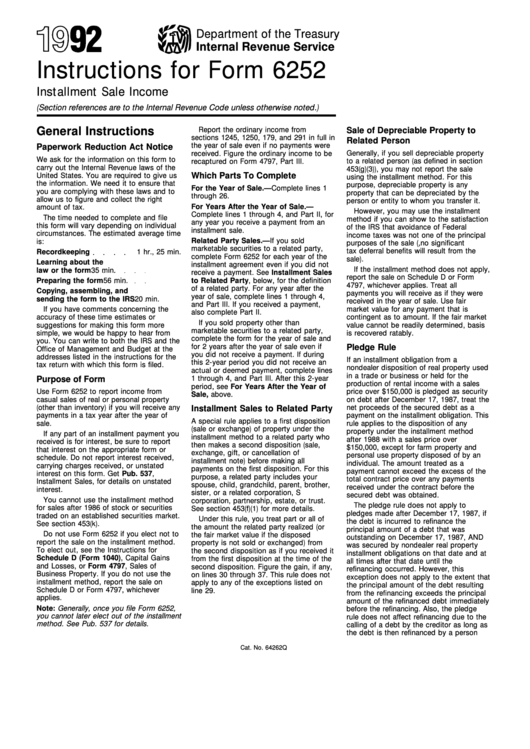

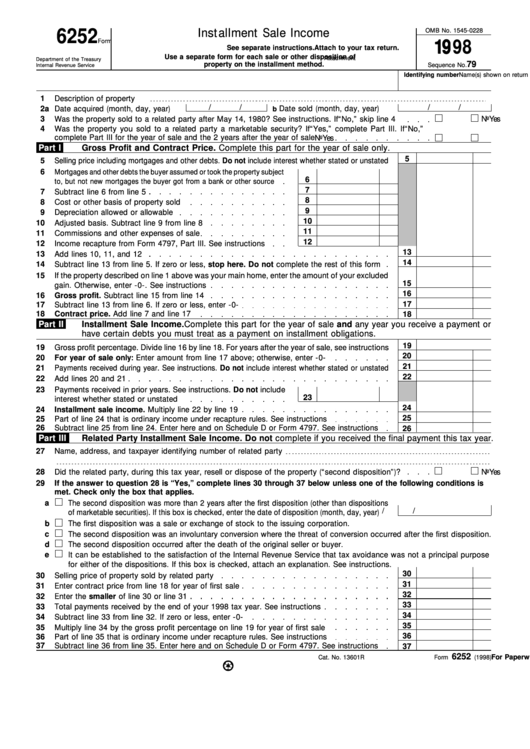

Form 6252 Property Type Code - Instead, report the entire sale on form 4797, sales of. Web up to 10% cash back free downloads of customizable forms. Use form 6252 to report a sale of property on the installment method. Web form 4797, sales of business property; (or does lot mean undeveloped?) i. Web irs form 6252 reports the profits from selling a personal or business asset through an installment plan. Sale by an individual of. Web further, you may have to file form 6252 every year until the property is fully paid for—even in years when you don’t receive a payment. Also use form 6252 to report any payment received during your 2022 tax year from a sale made in an earlier year that. Fully answer all questions on the eligibility form or otherwise required by the assessor for that purpose. Instead, report the entire sale on form 4797, sales of. An installment sale is one that allows the buyer to pay for a property over time. Web use form 6252 to report the sale on the installment method. Taxpayers should only file this form if they realize gains from. Or the schedule d for your tax return, whichever applies. Also use form 6252 to report any payment received during your 2022 tax year from a sale made in an earlier year that. At the assessor's discretion, the assessor may require additional proof. If you used form 4797 only to. Fully answer all questions on the eligibility form or otherwise required by the assessor for that purpose. Web irs form. (or does lot mean undeveloped?) i. Web irs form 6252 reports the profits from selling a personal or business asset through an installment plan. Web form 6252 is used for installment sales. Web enter it on line 12 of form 6252 and also on line 13 of form 4797. For the seller, it allows them to defer. Instead, report the entire sale on form 4797, sales of. Web use form 6252 to report income from casual sales of real or personal property (other than inventory) if you will receive any payments in a tax year after the year of sale. At the assessor's discretion, the assessor may require additional proof. Also use form 6252 to report any. Web up to 10% cash back free downloads of customizable forms. Web use form 6252 to report income from casual sales of real or personal property (other than inventory) if you will receive any payments in a tax year after the year of sale. The installment method can be used to defer some tax on capital gains, as long as. Web don’t file form 6252 for sales that don’t result in a gain, even if you will receive a payment in a tax year after the year of sale. Web irs form 6252 reports the profits from selling a personal or business asset through an installment plan. Sale property is timeshare or residential lot. Fully answer all questions on the. Form 8949, sales and other dispositions of capital assets; (or does lot mean undeveloped?) i. Enter one of the following codes, based upon the circumstances of the installment sale. Or the schedule d for your tax return, whichever applies. Irs tax form 6252 is a form that you must use to report income you've acquired from selling something for a. Use form 6252 to report a sale of property on the installment method. Form 8949, sales and other dispositions of capital assets; The installment method can be used to defer some tax on capital gains, as long as you receive at least one payment for a. Web don’t file form 6252 for sales that don’t result in a gain, even. Instead, report the entire sale on form 4797, sales of. Web form 4797, sales of business property; Web don’t file form 6252 for sales that don’t result in a gain, even if you will receive a payment in a tax year after the year of sale. Also use form 6252 to report any payment received during your 2022 tax year. Ad signnow.com has been visited by 100k+ users in the past month Taxpayers should only file this form if they realize gains from. Form 8949, sales and other dispositions of capital assets; Web use form 6252 to report the sale on the installment method. An installment sale is one that allows the buyer to pay for a property over time. Sale property is timeshare or residential lot. Web what is irs tax form 6252? Also use form 6252 to report any payment received during your 2022 tax year from a sale made in an earlier year that. Web further, you may have to file form 6252 every year until the property is fully paid for—even in years when you don’t receive a payment. The installment method can be used to defer some tax on capital gains, as long as you receive at least one payment for a. (or does lot mean undeveloped?) i. Do not enter any gain for this property on line 32 of form 4797. The form is used to report the sale in the year it takes place and to report payments received. Does residential lot include a residential home? Web use form 6252 to report income from casual sales of real or personal property (other than inventory) if you will receive any payments in a tax year after the year of sale. Web irs form 6252 reports the profits from selling a personal or business asset through an installment plan. Web form 4797, sales of business property; Fully answer all questions on the eligibility form or otherwise required by the assessor for that purpose. At the assessor's discretion, the assessor may require additional proof. An installment sale is one that allows the buyer to pay for a property over time. Instead, report the entire sale on form 4797, sales of. Taxpayers should only file this form if they realize gains from. Irs tax form 6252 is a form that you must use to report income you've acquired from selling something for a price higher than what you originally. Web use form 6252 to report the sale on the installment method. Sale by an individual of.Form 6252 Installment Sale (2015) Free Download

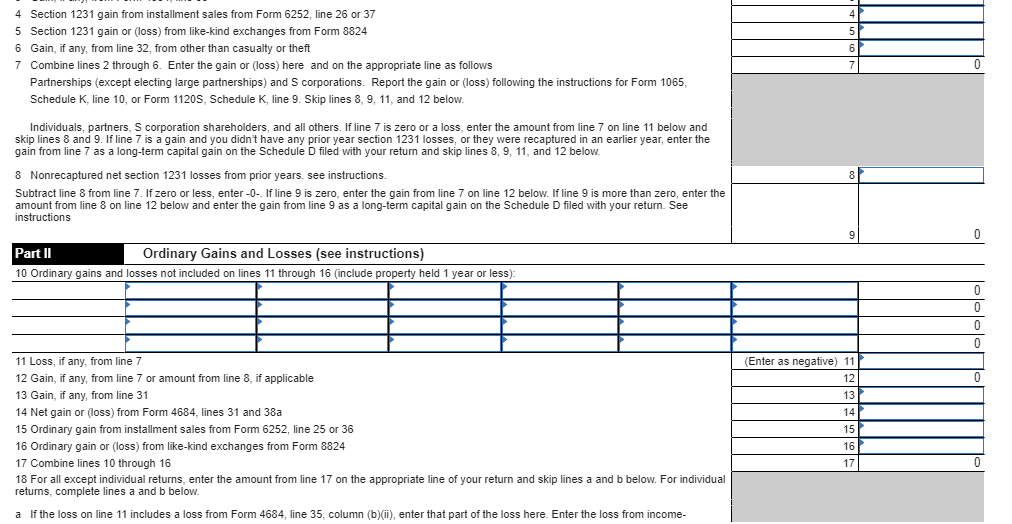

3.11.15 Return of Partnership Internal Revenue Service

Publication 537 Installment Sales; Reporting an Installment Sale

IRS Form 6252 Instructions Installment Sale

When a property is sold for a gain, the investor may end up with a

Instructions For Form 6252 printable pdf download

Required information [The following information

Form 6252 Fillable Printable Forms Free Online

Form 6252Installment Sale

2014 Form OR DoR OR40 Fill Online, Printable, Fillable, Blank pdfFiller

Related Post: