Utah Form Tc 40

Utah Form Tc 40 - This form is for income earned in tax year 2022, with tax returns due in april 2023. $22,318 (if head of household); $14,879 (if single or married filing separately); Do not attach a copy of your federal return. Upload, modify or create forms. Keep a copy with your records. Column a is for utah income and. Filing your income tax return doesn't need to be complex or difficult. You can download or print. Web ustc original form utah state tax commission utah individual income tax return all state income tax dollars support education, children and individuals with disabilities. Web ustc original form utah state tax commission utah individual income tax return all state income tax dollars support education, children and individuals with disabilities. $22,318 (if head of household); Keep a copy with your records. Column a is for utah income and. Write the code and amount of each subtraction from income in part 2. $22,318 (if head of household); Do not attach a copy of your federal return. Try it for free now! Keep a copy with your records. This form is for income earned in tax year 2022, with tax returns due in april 2023. Write the code and amount of each subtraction from income in part 2. $14,879 (if single or married filing separately); Filing your income tax return doesn't need to be complex or difficult. Do not attach a copy of your federal return. $22,318 (if head of household); Write the code and amount of each subtraction from income in part 2. You can download or print. Do not attach a copy of your federal return. Column a is for utah income and. $14,879 (if single or married filing separately); Do not attach a copy of your federal return. Column a is for utah income and. Try it for free now! Keep a copy with your records. Filing your income tax return doesn't need to be complex or difficult. Upload, modify or create forms. Column a is for utah income and. This form is for income earned in tax year 2022, with tax returns due in april 2023. $22,318 (if head of household); Web ustc original form utah state tax commission utah individual income tax return all state income tax dollars support education, children and individuals with disabilities. Write the code and amount of each subtraction from income in part 2. $22,318 (if head of household); Keep a copy with your records. Do not attach a copy of your federal return. Upload, modify or create forms. Upload, modify or create forms. We've put together information to help you understand your state tax requirements. You can download or print. Column a is for utah income and. Keep a copy with your records. Write the code and amount of each subtraction from income in part 2. Column a is for utah income and. This form is for income earned in tax year 2022, with tax returns due in april 2023. Keep a copy with your records. Upload, modify or create forms. This form is for income earned in tax year 2022, with tax returns due in april 2023. Upload, modify or create forms. Web ustc original form utah state tax commission utah individual income tax return all state income tax dollars support education, children and individuals with disabilities. Write the code and amount of each subtraction from income in part 2.. Try it for free now! $14,879 (if single or married filing separately); Do not attach a copy of your federal return. Web ustc original form utah state tax commission utah individual income tax return all state income tax dollars support education, children and individuals with disabilities. You can download or print. $22,318 (if head of household); We've put together information to help you understand your state tax requirements. This form is for income earned in tax year 2022, with tax returns due in april 2023. Write the code and amount of each subtraction from income in part 2. Upload, modify or create forms. This form is for income earned in tax year 2022, with tax returns due in april 2023. Filing your income tax return doesn't need to be complex or difficult. Column a is for utah income and. Keep a copy with your records.tax.utah.gov forms current tc tc40cy

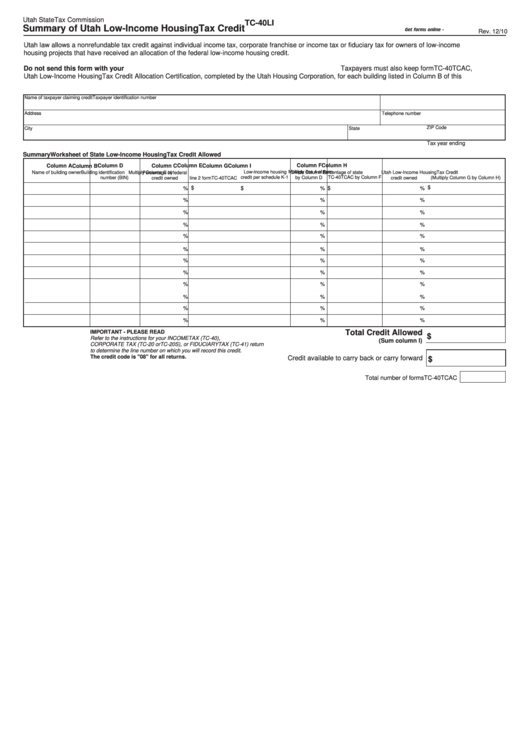

Fillable Form Tc40li Summary Of Utah Housing Tax Credit

tax.utah.gov forms current tc tc40splain

2011 Form UT TC40 Fill Online, Printable, Fillable, Blank pdfFiller

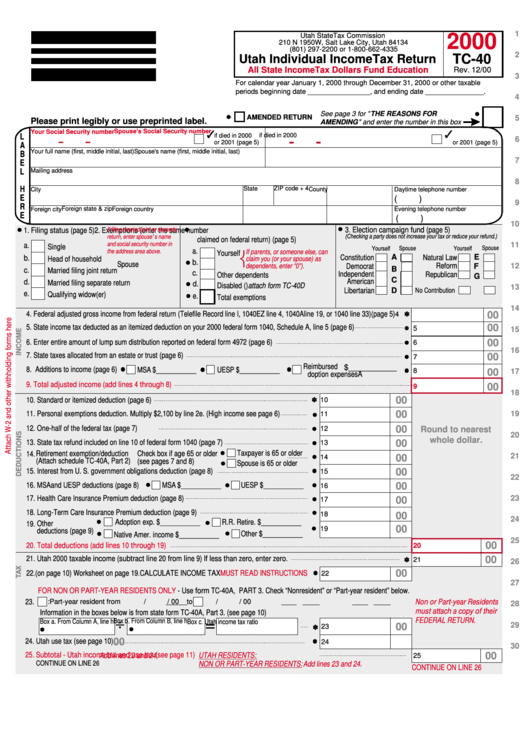

Form Tc40 Utah Individual Tax Return 2000 printable pdf

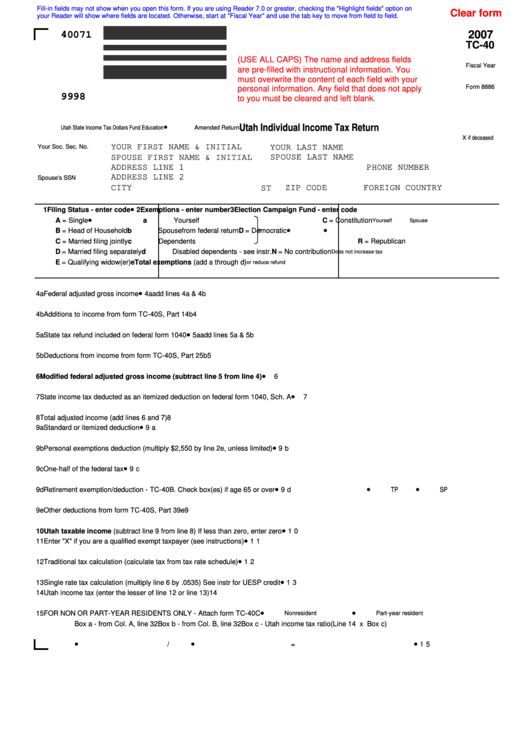

Fillable Form Tc40 Utah Individual Tax Return 2007

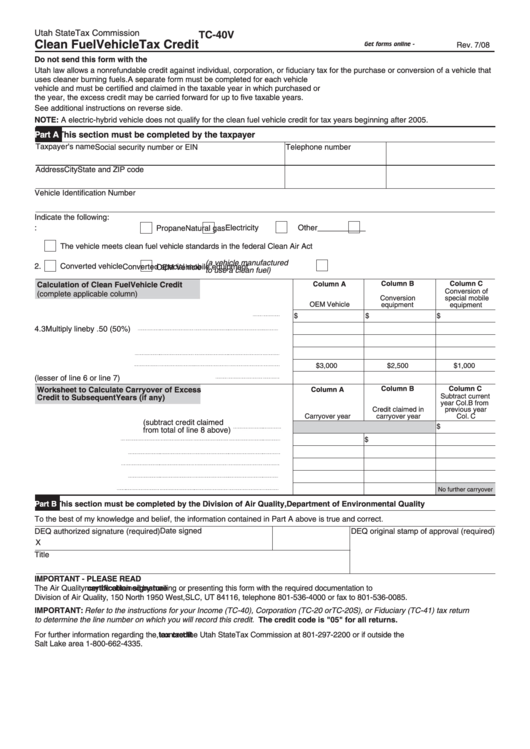

Tc40v 7/08 Clean Fuel Vehicle Tax Credit Utah printable pdf download

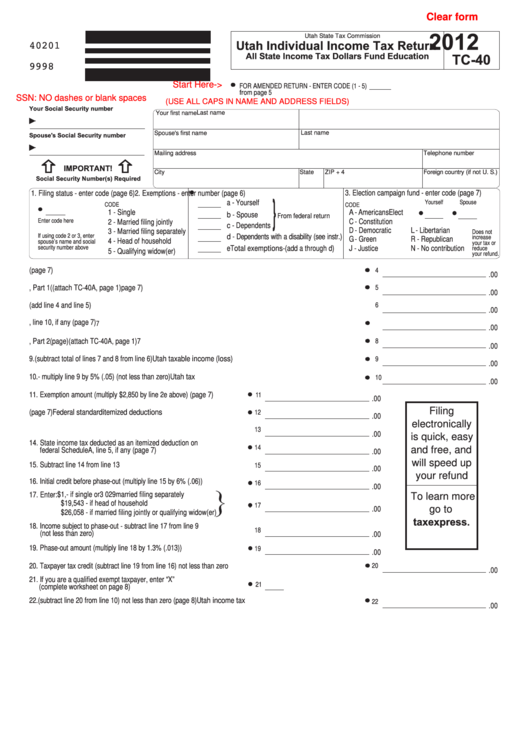

Fillable Form Tc40 Utah Individual Tax Return 2012

2020 UT TC40 Forms & Instructions Fill Online, Printable, Fillable

tax.utah.gov forms current tc tc40w

Related Post: