Form 6252 Instructions

Form 6252 Instructions - Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Department of the treasury internal revenue service. Web form 6252 is meant to help you separate the money you earned in a tax year into gains, interest, and returns on capital. Web see the form 8997 instructions. Web purpose of irs form 6252. Web how do i complete irs form 6252? Use form 6252 to report income from an installment sale on the installment. Common questions about form 6252 in proseries. Solved•by intuit•8•updated 1 year ago. Solved•by intuit•8•updated 1 year ago. Form 6252 helps you figure out how much of the money you received during a given tax year was a return of capital, how much. Use form 6252 to report income from casual sales of real or personal property (other than inventory) if you will receive any payments in a tax year after. Ad download. Aattach to your tax return. This will allow you to correctly report your income on your. We’ll walk through reporting installment sale income on form 6252, step by step. Get ready for tax season deadlines by completing any required tax forms today. Department of the treasury internal revenue service. Scroll down to the section current year installment sale (6252)and enter any other information that applies to the installment. Generally, an installment sale is. If you sold property to a related party during the year, also complete part iii. Taxpayers should only file this form if they realize gains. First, enter the amount of canceled debt on line 1. Beginning in tax year 2019,. If you sold property to a related party during the year, also complete part iii. Ad download or email form 6252 & more fillable forms, register and subscribe now! Next, add the date of cancellation on line 2. Let’s start at the top of the form. Web up to 10% cash back installment sales are reported on irs form 6252, installment sale income. Use form 6252 to report income from an installment sale on the installment. Scroll down to the section current year installment sale (6252)and enter any other information that applies to the installment. Department of the treasury internal revenue service. Taxpayers should only file. Instead, report the sale on form 4797 (business property) or as a capital loss. Information about form 6252, installment sale income, including recent updates, related forms and instructions on how to file. Web purpose of irs form 6252. Beginning in tax year 2019,. Also use form 6252 to report any payment received during the tax year from a sale made. Generally, an installment sale is. Ause a separate form for. Use form 6252 to report income from casual sales of real or personal property (other than inventory) if you will receive any payments in a tax year after. Web complete part i, lines 1 through 4, and part ii. Web form 6252 is meant to help you separate the money. Taxpayers should only file this form if they realize gains. Any ordinary income recapture under section 1245 or 1250 (including sections 179 and 291) is fully taxable in the year. Web form 6252 is meant to help you separate the money you earned in a tax year into gains, interest, and returns on capital. Instead, report the entire sale on. Let’s start at the top of the form. Web irs form 6252 reports the profits from selling a personal or business asset through an installment plan. The instructions to file form 6252 are as follows: Instead, report the entire sale on form 4797, sales of. This will allow you to correctly report your income on your. Complete, edit or print tax forms instantly. Web form 6252 is meant to help you separate the money you earned in a tax year into gains, interest, and returns on capital. This will allow you to correctly report your income on your. Complete form 6252 for each year of the. Scroll down to the section current year installment sale (6252)and. Information about form 6252, installment sale income, including recent updates, related forms and instructions on how to file. Web complete part i, lines 1 through 4, and part ii. Solved•by intuit•8•updated 1 year ago. Web go to the section tab sale of asset 4797, 6252. Instead, report the entire sale on form 4797, sales of. Let’s start at the top of the form. Web purpose of irs form 6252. Get ready for tax season deadlines by completing any required tax forms today. Any ordinary income recapture under section 1245 or 1250 (including sections 179 and 291) is fully taxable in the year. Web generally, use form 6252 to report income from casual sales during this tax year of real or personal property (other than inventory) if you will receive any payments in a. Department of the treasury internal revenue service. Use form 6252 to report income from an installment sale on the installment method. Web 6252 installment sale income. Complete form 6252 for each year of the. First, enter the amount of canceled debt on line 1. Generally, an installment sale is. Ad download or email form 6252 & more fillable forms, register and subscribe now! Web per the form 6252 instructions: Ause a separate form for. Instead, report the sale on form 4797 (business property) or as a capital loss.Form 6252Installment Sale

Irs Instructions For Form 6252 1993 printable pdf download

Fillable Online irs SPECIFICATIONS TO BE REMOVED BEFORE PRINTING

Form 6252 Installment Sale (2015) Free Download

I need some assistance in filing out a 2005 form 6252 Installment Sale

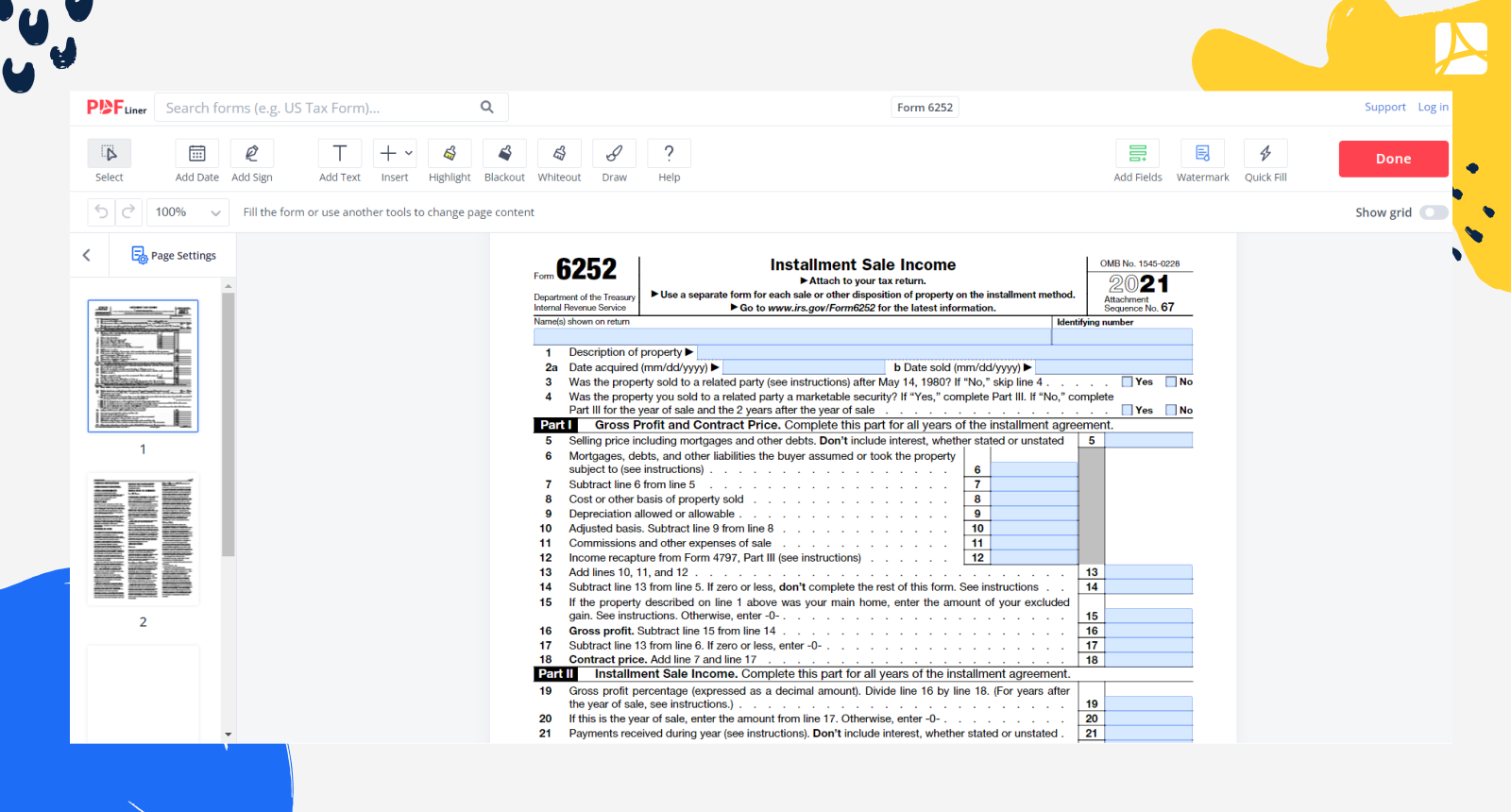

Form 6252 Printable Form 6252 blank, sign forms online — PDFliner

Form 6252Installment Sale

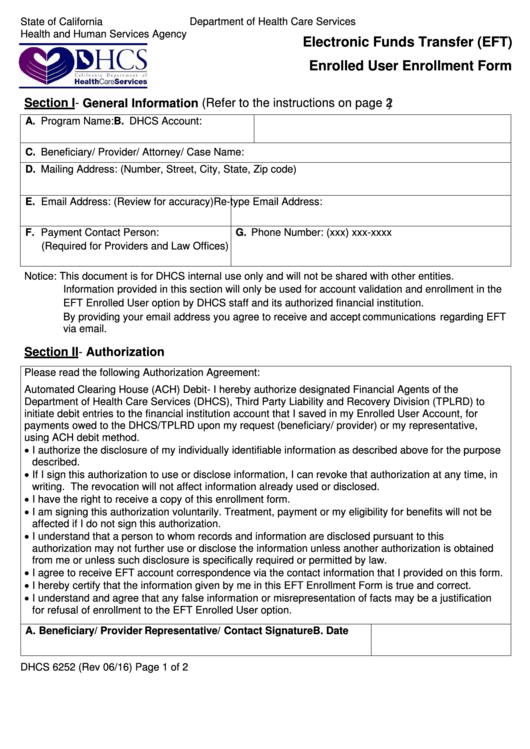

Fillable Form 6252 Electronic Funds Transfer (Eft) Enrolled User

Form 6252Installment Sale

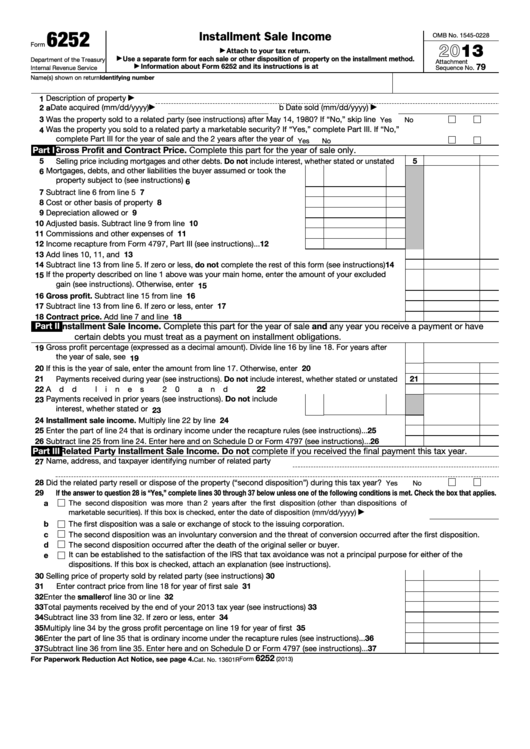

Fillable Form 6252 Installment Sale 2013 printable pdf download

Related Post: