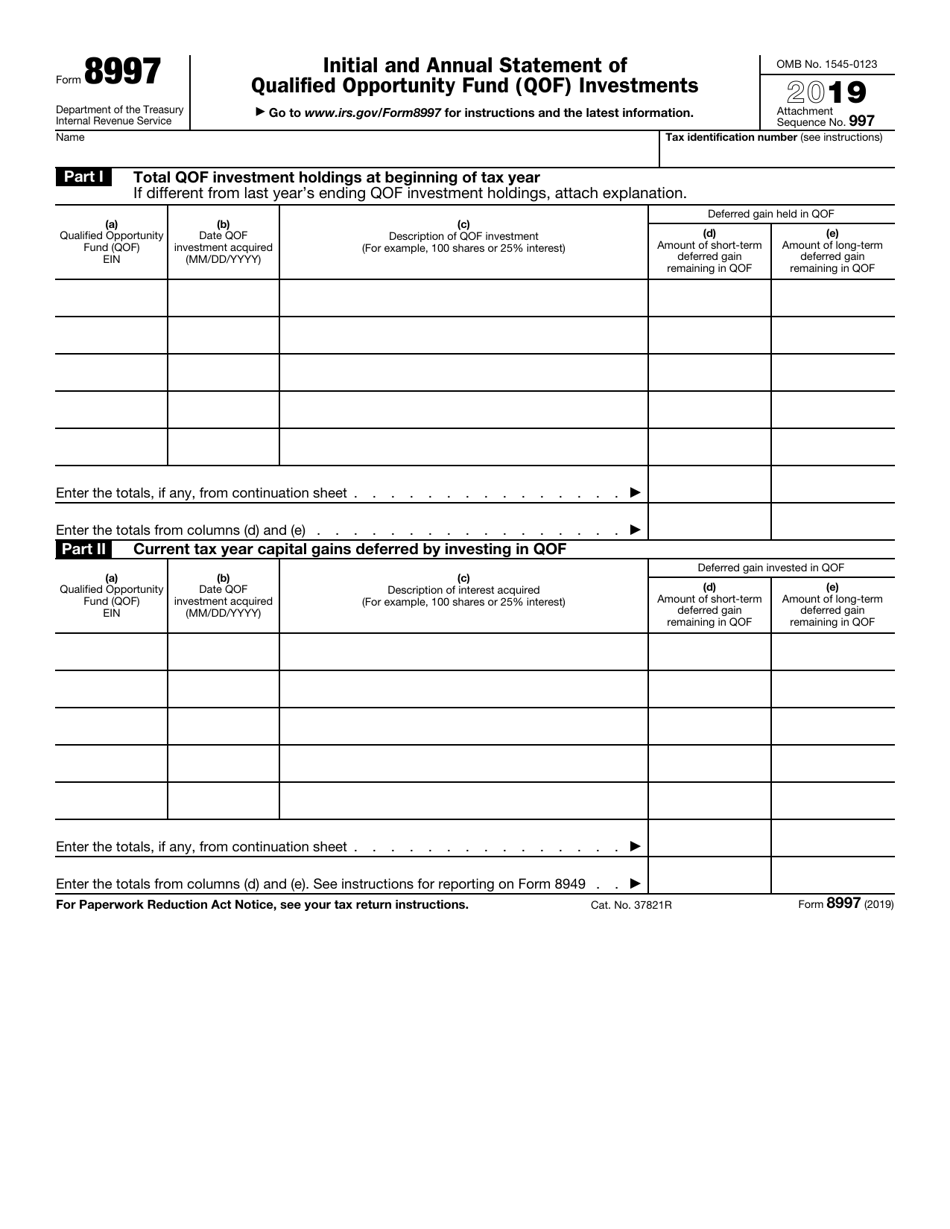

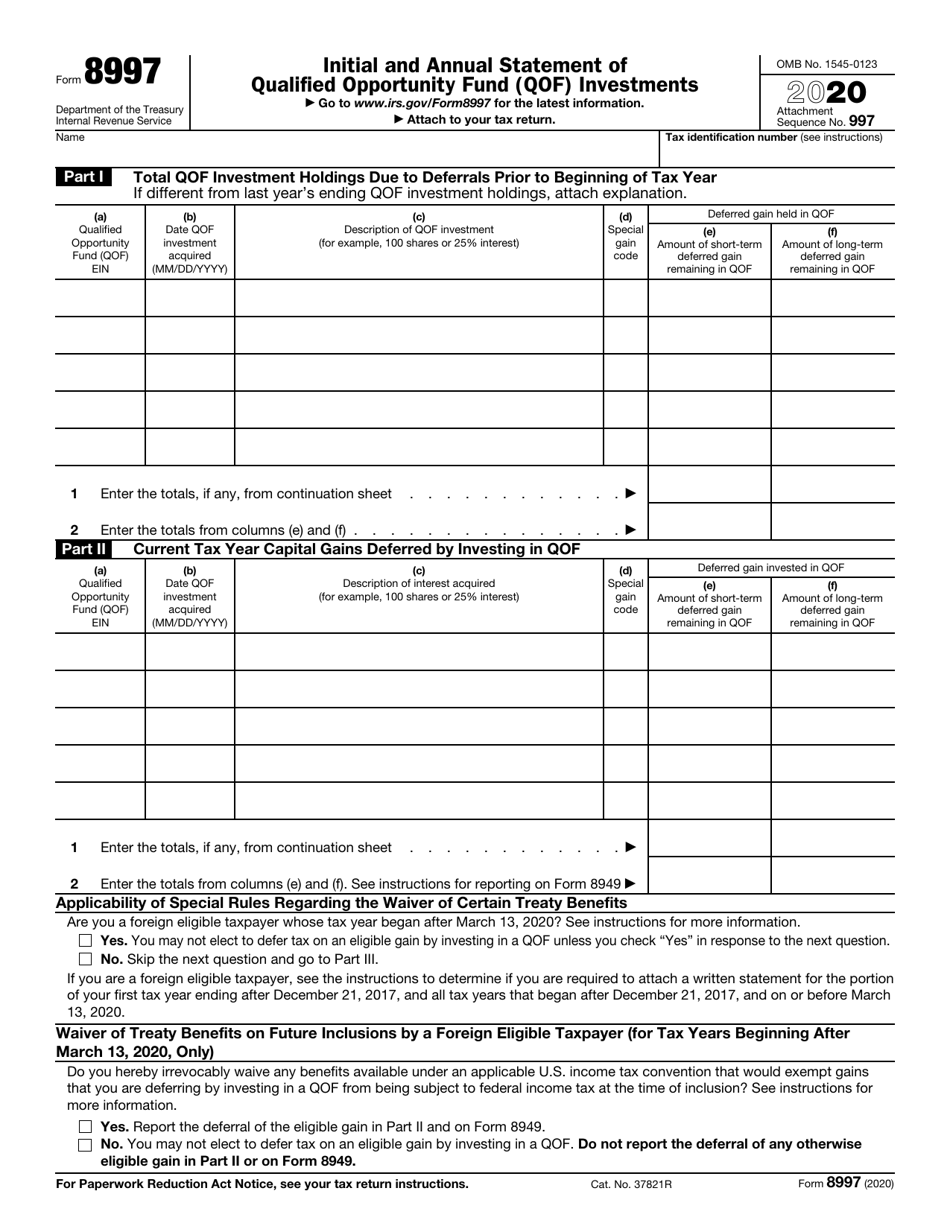

Form 8997 Special Gain Code

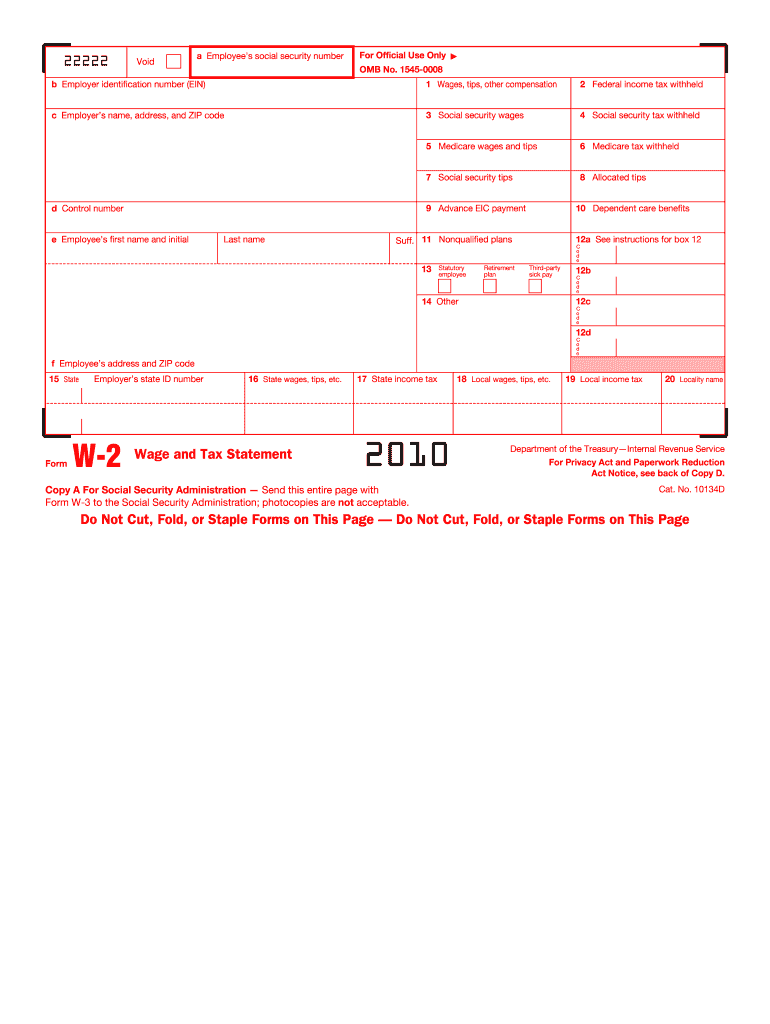

Form 8997 Special Gain Code - Web form 8997 is required to be filed every year in which the taxpayer is deferring a gain through an investment in a qof or qoz. While most of the entries you make in the form. 5k views 1 year ago the opportunity zones podcast. Enter the totals, if any, from continuation. For investors in qualified opportunity zone funds, irs draft. Business property, casualties, and thefts: For an investor who has deferred capital gains into a qualified. An sgc is a code that is entered when the qof investment originated from an elected deferred gain, where the. Web separate form 8997 to the group’s consolidated income tax return for each consolidated subsidiary investor corporation each year. Web capital gains and losses: Will populate with b column (e) gains and losses: Web capital gains and losses: Business property, casualties, and thefts: Enter the totals, if any, from continuation. Web special gain code (sgc). For an investor who has deferred capital gains into a qualified. Enter the totals, if any, from continuation. You can file your tax return without that, however according. An sgc is a code that is entered when the qof investment originated from an elected deferred gain, where the. 5k views 1 year ago the opportunity zones podcast. Web page last reviewed or updated: Will populate with b column (e) gains and losses: Web form 8997 is required to be filed every year in which the taxpayer is deferring a gain through an investment in a qof or qoz. Use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and. For investors in qualified opportunity zone funds, irs draft. Will populate with b column (e) gains and losses: Web qof are not reported on form 8997. Each such consolidated subsidiary investor. Under the opportunity zones (oz) incentive, taxpayers can defer taxes by reinvesting capital gains from an asset sale into a qualified opportunity. For investors in qualified opportunity zone funds, irs draft. Web qof are not reported on form 8997. Business property, casualties, and thefts: For an investor who has deferred capital gains into a qualified. Web form 8997, initial and annual statement of qualified opportunity fund investments is a new form. Qof investments held at the beginning of the current tax year, including the amount of short. Enter the totals, if any, from continuation. An sgc is a code that is entered when the qof investment originated from an elected deferred gain, where the. While most of the entries you make in the form. Irs form 8997 required to track capital. Web the draft 2019 form 8997 requires taxpayers to report for each qof investment: Qof investments held at the beginning of the current tax year, including the amount of short. Under the opportunity zones (oz) incentive, taxpayers can defer taxes by reinvesting capital gains from an asset sale into a qualified opportunity. Enter the totals, if any, from continuation. Web. Enter the totals, if any, from continuation. Web form 8997, initial and annual statement of qualified opportunity fund investments is a new form. Web qof are not reported on form 8997. Web separate form 8997 to the group’s consolidated income tax return for each consolidated subsidiary investor corporation each year. Will populate with b column (e) gains and losses: While most of the entries you make in the form. Web form 8997, initial and annual statement of qualified opportunity fund investments is a new form. Web capital gains and losses: You can file your tax return without that, however according. Irs form 8997 required to track capital gain investments in opportunity zone funds. Web special gain code (sgc). Web form 8997, initial and annual statement of qualified opportunity fund investments is a new form. For an investor who has deferred capital gains into a qualified. Web form 8997 is required to be filed every year in which the taxpayer is deferring a gain through an investment in a qof or qoz. Web page. Web form 8997, initial and annual statement of qualified opportunity fund investments is a new form. Web the draft 2019 form 8997 requires taxpayers to report for each qof investment: For an investor who has deferred capital gains into a qualified. Use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the. Web page last reviewed or updated: An sgc is a code that is entered when the qof investment originated from an elected deferred gain, where the. For investors in qualified opportunity zone funds, irs draft. Web separate form 8997 to the group’s consolidated income tax return for each consolidated subsidiary investor corporation each year. Qof investments held at the beginning of the current tax year, including the amount of short. Enter the totals, if any, from continuation. You can file your tax return without that, however according. Under the opportunity zones (oz) incentive, taxpayers can defer taxes by reinvesting capital gains from an asset sale into a qualified opportunity. Enter the totals, if any, from continuation. Web special gain code (sgc). An sgc is a code that is entered when the qof investment originated from an elected deferred gain, where the gain was: Irs form 8997 required to track capital gain investments in opportunity zone funds. An sgc is a code that is entered when the qof investment originated from an elected deferred gain, where the. Web qof are not reported on form 8997. Business property, casualties, and thefts: While most of the entries you make in the form.What The Form W2 Box 12 Codes Mean 2021

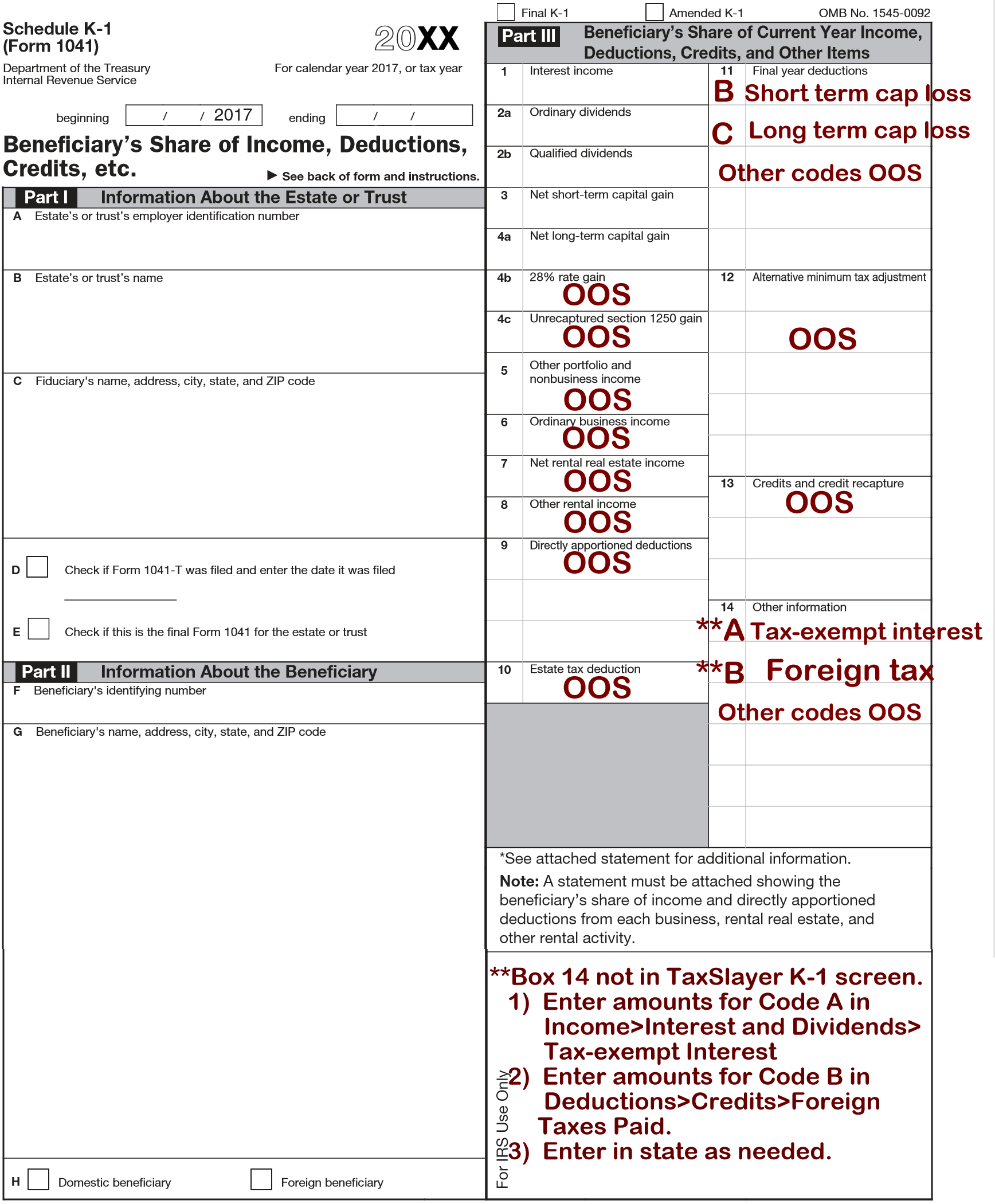

1099B Noncovered Securities (1099B)

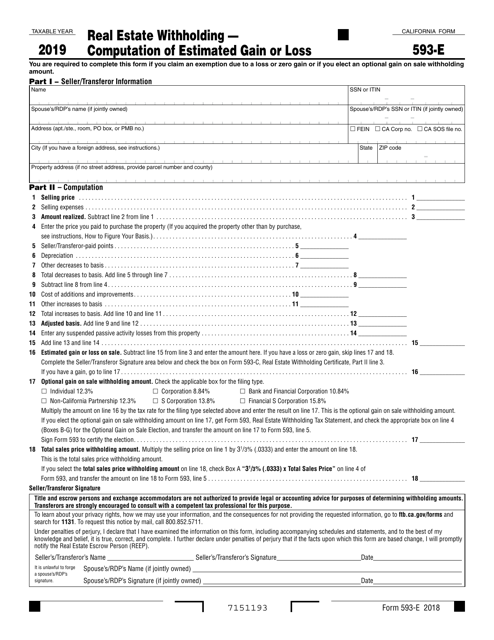

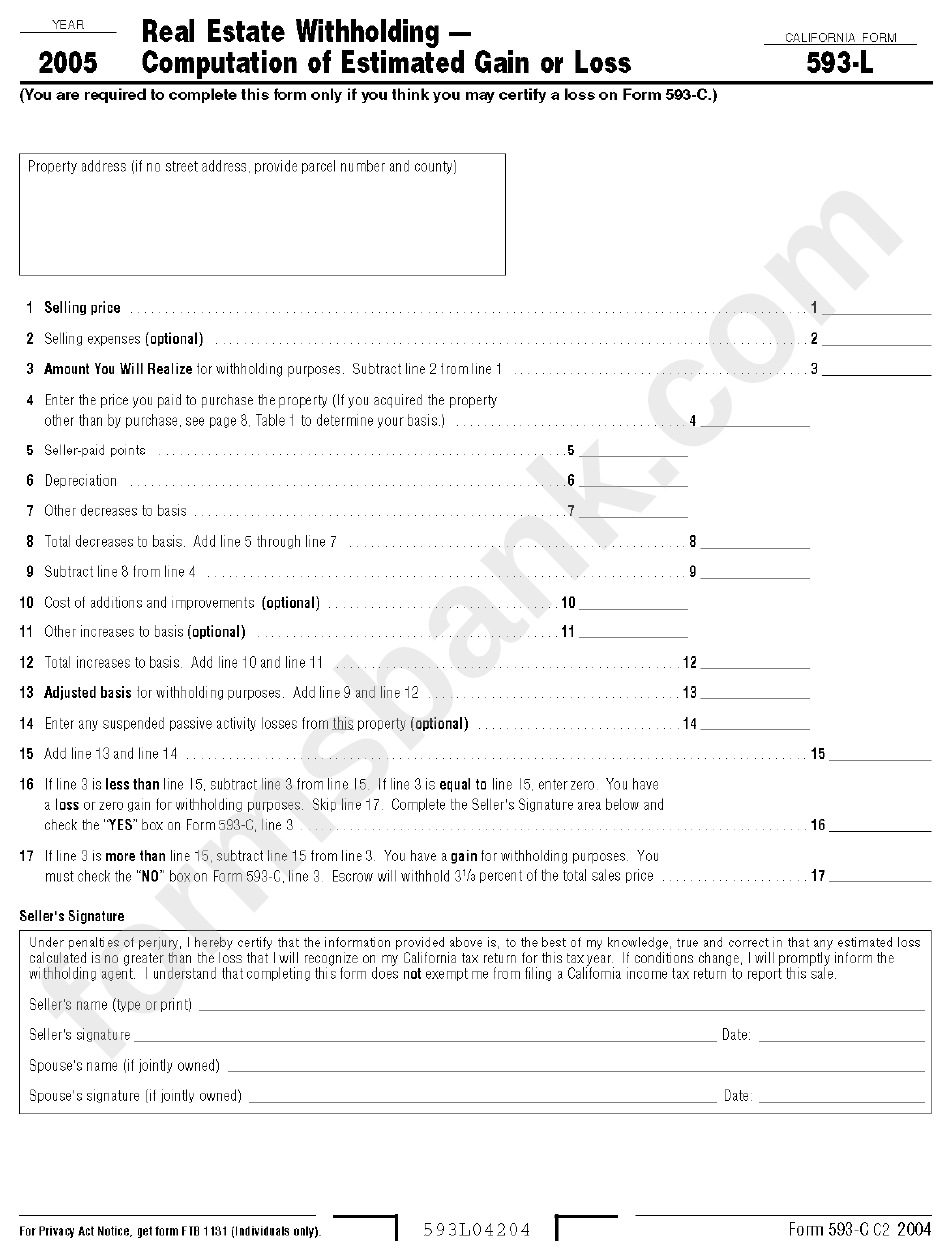

Form 593E Download Fillable PDF or Fill Online Real Estate Withholding

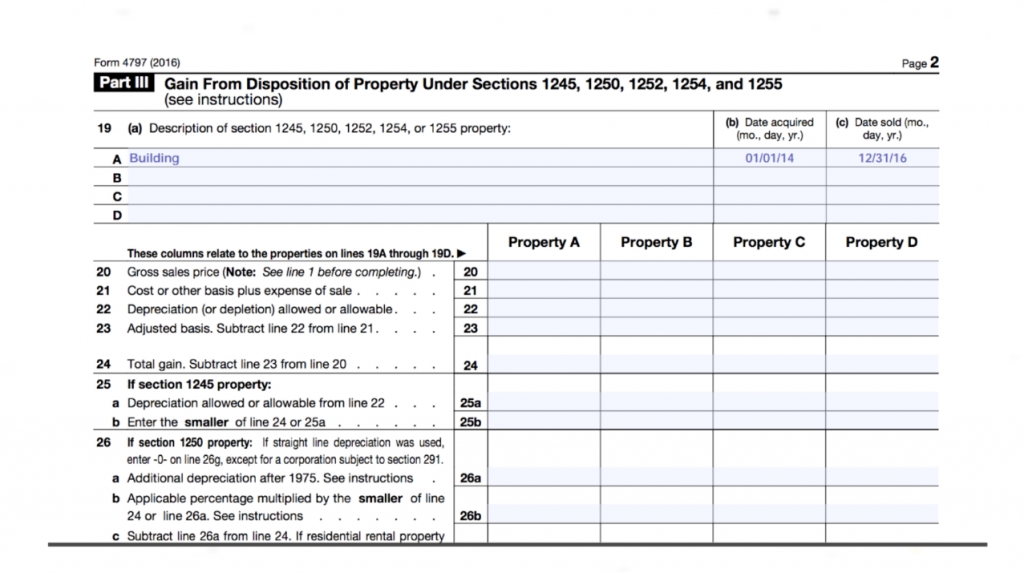

How to Report the Sale of a U.S. Rental Property Madan CA

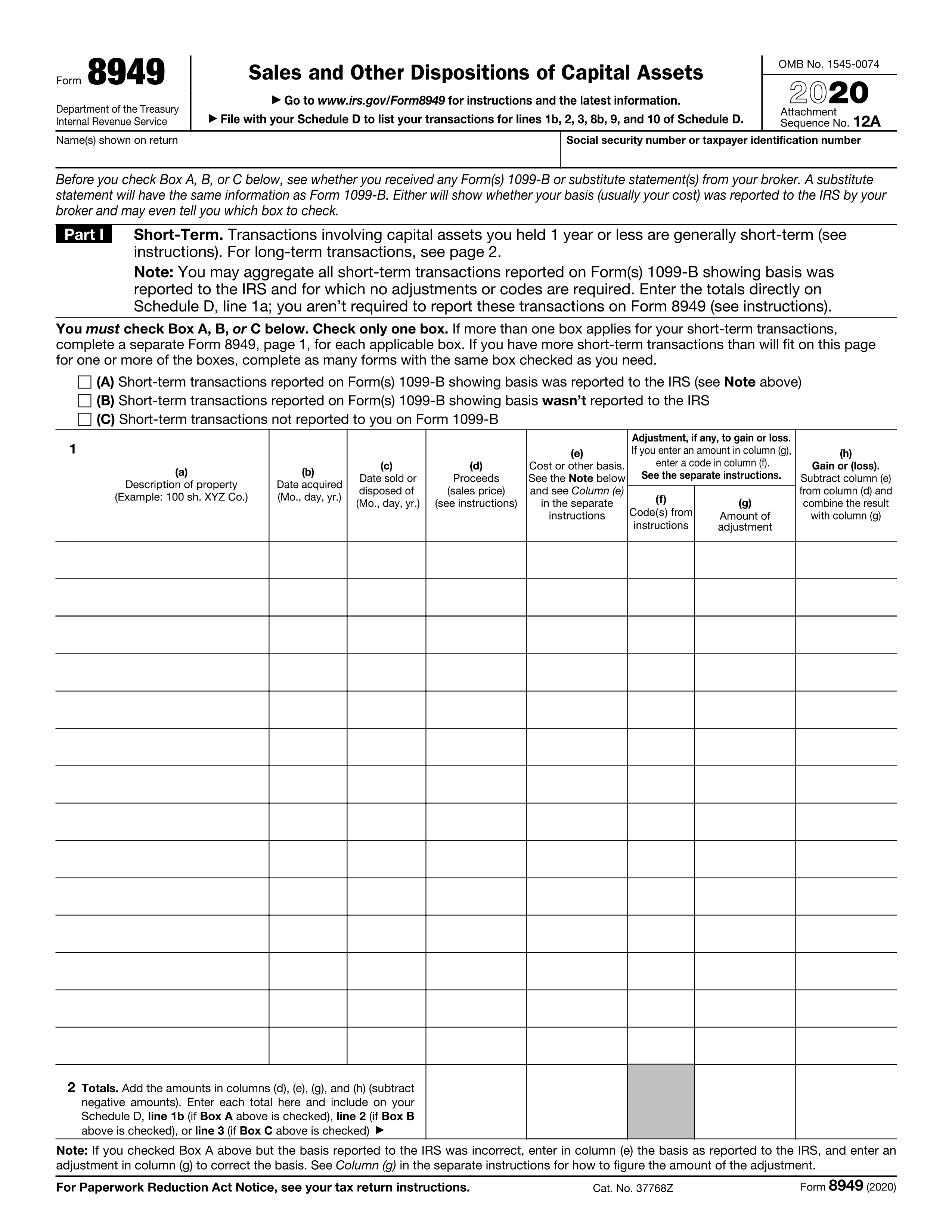

IRS Form 8949.

IRS Form 8997 2019 Fill Out, Sign Online and Download Fillable PDF

Form 539L Real Estate Withholding Computation Of Estimated Gain Or

IRS Form 8997 Download Fillable PDF or Fill Online Initial and Annual

Affidavit Of Seller's Gain Fill and Sign Printable Template Online

Form 1120S K 1 Instructions 2016 2018 Codes Line 17 —

Related Post: