Energy Efficient Home Improvement Credit Form

Energy Efficient Home Improvement Credit Form - A taxpayer can claim the credit only for qualifying expenditures incurred for an existing home or for an. Information about form 5695, residential energy credits, including recent updates, related forms and. Apply & get fast pre approval! O insulation materials or systems and air sealing materials. High quality entry doors available in vinyl & aluminum frame materials. Energy reviews can lead to increased efficiency & lower costs. The residential clean energy credit, and; Top lenders reviewed by industry experts! Web page last reviewed or updated: $150 on qualified natural gas,. Energy reviews can lead to increased efficiency & lower costs. Web if you checked the “yes” box, you can only claim the energy efficient home improvement credit for qualifying improvements that were not related to the construction of the. Web electrification, and clean energy improvements, including those covered under the home efficiency. Top lenders reviewed by industry experts! Use previous. As amended by the ira, the energy efficient home improvement credit. The residential clean energy credit, and. The residential energy credits are: The energy efficient home improvement credit. With your home energy audit as your roadmap, you can make improvements such as upgrading windows, doors, and. The residential clean energy credit, and; The internal revenue service (irs) will allow you to take a federal tax credit of up to $3,200 if you have made any. Top lenders reviewed by industry experts! Information about form 5695, residential energy credits, including recent updates, related forms and. Web doors, windows, and insulation. Use previous versions of form 5695. The residential clean energy credit, and. The internal revenue service (irs) will allow you to take a federal tax credit of up to $3,200 if you have made any. High quality entry doors available in vinyl & aluminum frame materials. Also use form 5695 to take any residential. A taxpayer can claim the credit only for qualifying expenditures incurred for an existing home or for an. Web page last reviewed or updated: Information about form 5695, residential energy credits, including recent updates, related forms and. Top lenders reviewed by industry experts! Web electrification, and clean energy improvements, including those covered under the home efficiency. Web energy efficient home improvement credit. The residential energy credits are: In 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency improvements and (2) the amount of the. Also, when you claim the credit, make sure to reference the manufacturer’s certification. The energy efficient home improvement credit. Apply & get fast pre approval! O insulation materials or systems and air sealing materials. Web if you checked the “yes” box, you can only claim the energy efficient home improvement credit for qualifying improvements that were not related to the construction of the. Web doors, windows, and insulation. Web tax credits for homeowners. Web energy efficient home improvement credit. Web use form 5695 to figure and take your residential energy credits. These expenses may qualify if they meet requirements detailed on. Also, when you claim the credit, make sure to reference the manufacturer’s certification. $50 on advanced primary air circulating fan. Web under the energy efficient home improvement credit: Web get details on the energy efficient home improvement credit. Also use form 5695 to take any residential. Web this means you can claim a maximum total yearly energy efficient home improvement credit amount up to $3,200. Information about form 8908, energy efficient home credit, including recent updates, related forms, and. Web tax credits for homeowners. Top lenders reviewed by industry experts! The residential clean energy credit, and; Web use form 5695 to figure and take your residential energy credits. These expenses may qualify if they meet requirements detailed on. Also use form 5695 to take any residential. Web the residential energy credits are: Web the nonbusiness energy tax credit can be claimed on your 2022 taxes via form 5695. A taxpayer can claim the credit only for qualifying expenditures incurred for an existing home or for an. Web energy efficient home improvement credit. Top lenders reviewed by industry experts! High quality entry doors available in vinyl & aluminum frame materials. Web through december 31, 2022, the energy efficient home improvement credit is a $500 lifetime credit. With your home energy audit as your roadmap, you can make improvements such as upgrading windows, doors, and. Energy reviews can lead to increased efficiency & lower costs. Ad durable & energy efficient entry doors for your home. Ad find the best home equity line of credit rates. Web page last reviewed or updated: The residential clean energy credit, and. Web doors, windows, and insulation. O insulation materials or systems and air sealing materials. High quality entry doors available in vinyl & aluminum frame materials. Web tax credits for homeowners. Ad learn how you can reduce energy consumption & energy costs. Use previous versions of form 5695.Energy Efficient Home Improvement Tax Credit 2018 Home Improvement

Infographic How to Make Your Home More Energy Efficient GenStone

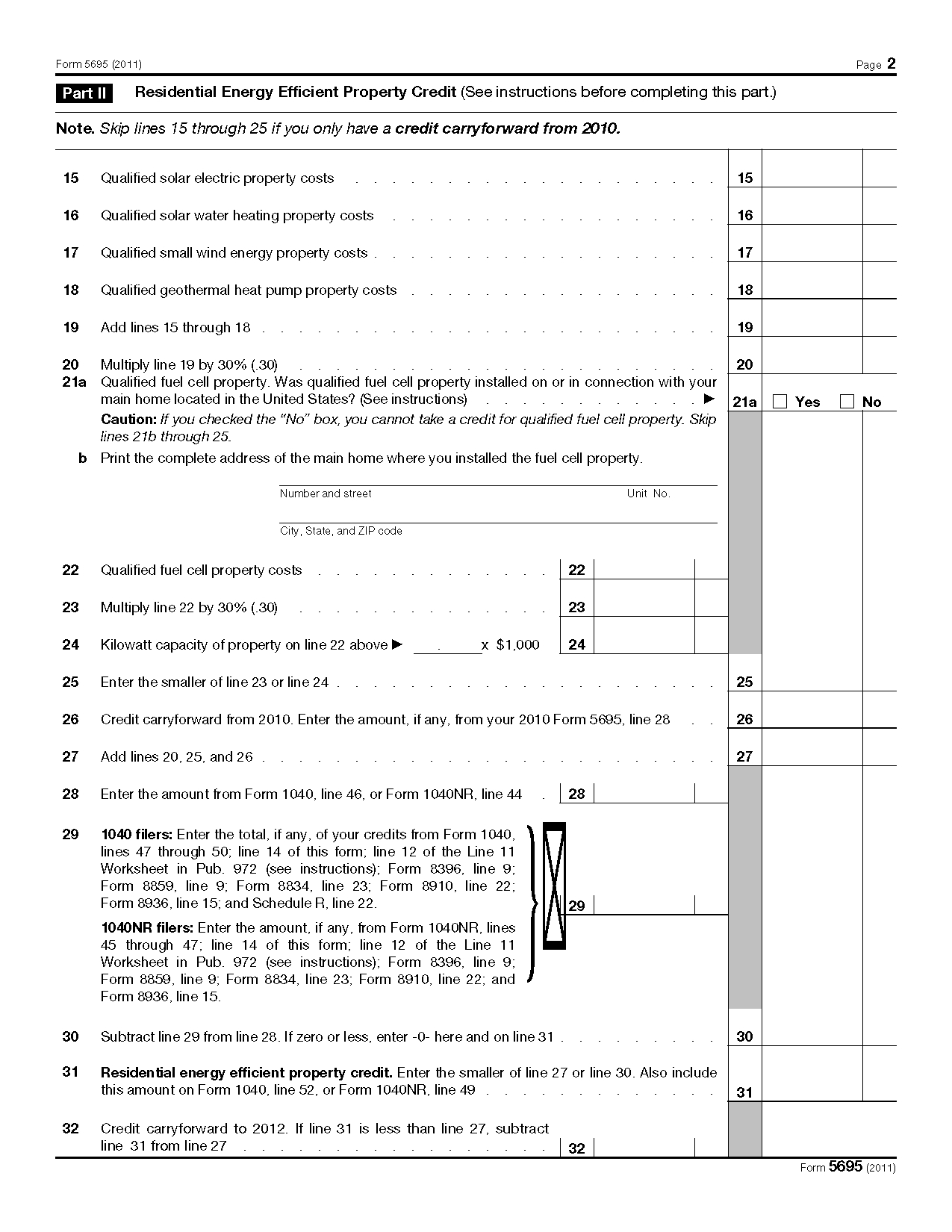

Form 5695 Residential Energy Credits —

Energy Efficient Home Improvement Credits in 2023 SVA

Nonbusiness Energy Credit Form Armando Friend's Template

Completed Form 5695 Residential Energy Credit Capital City Solar

ITC solar tax credit NATiVE

IRS Form 5695 Instructions Residential Energy Credits

Energy Efficient Home Improvement Credit Calculator 2023

EnergyEfficient Tax Credits A Guide to U.S. Tax Incentives for Green

Related Post: