Ca State Withholding Form

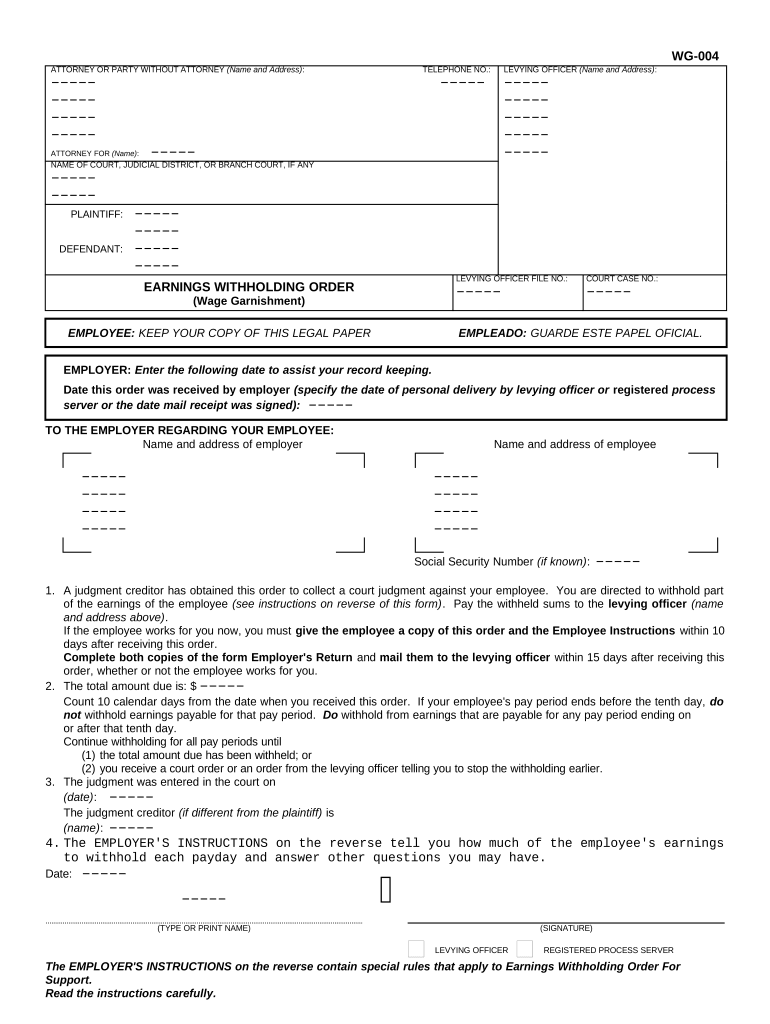

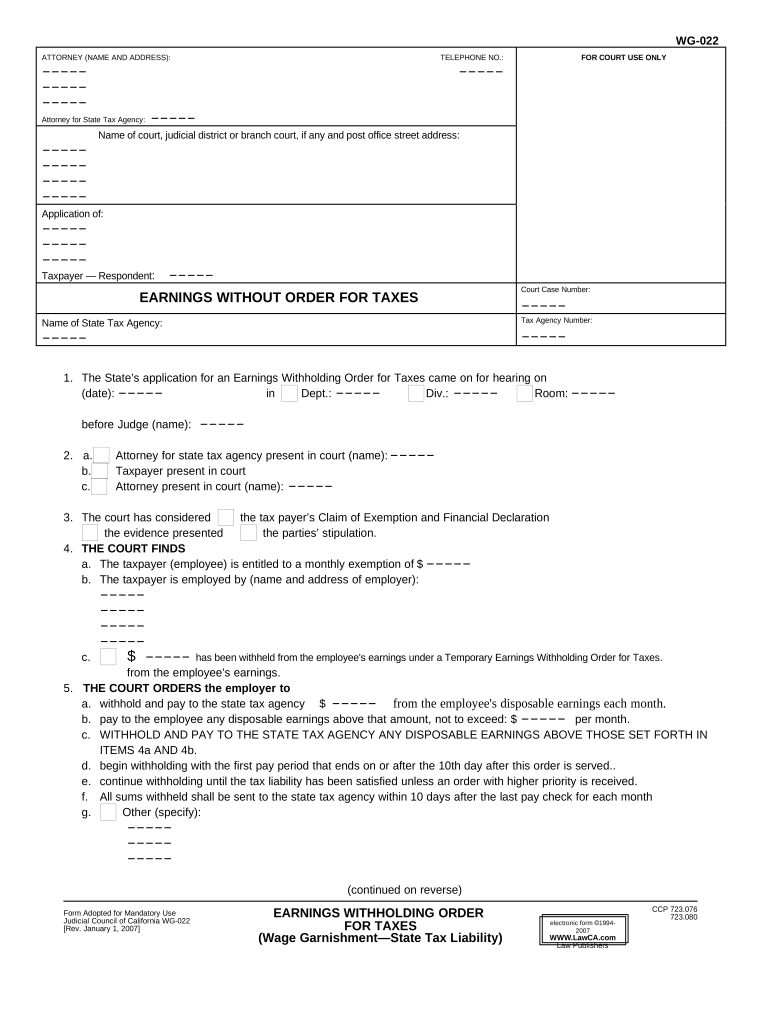

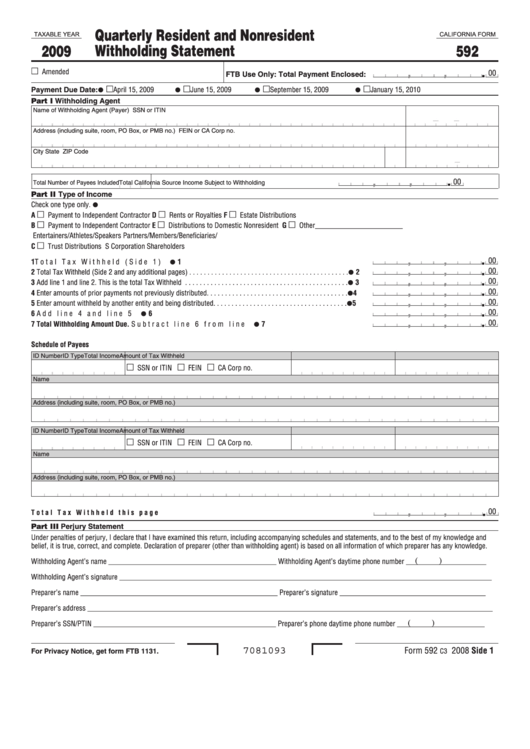

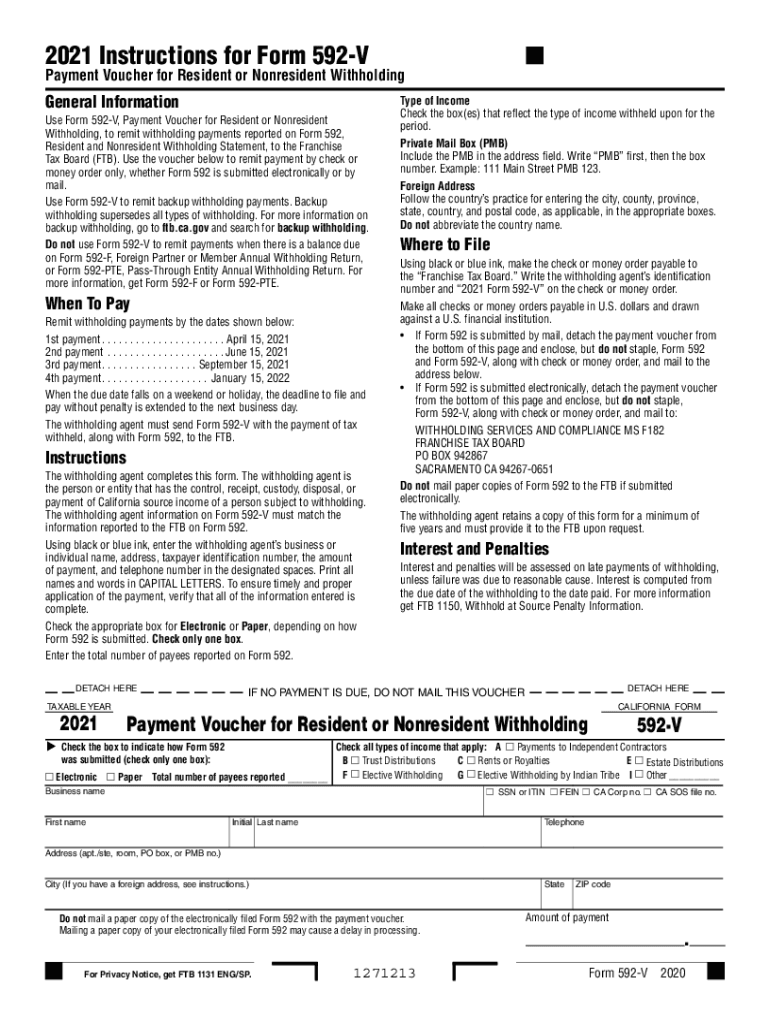

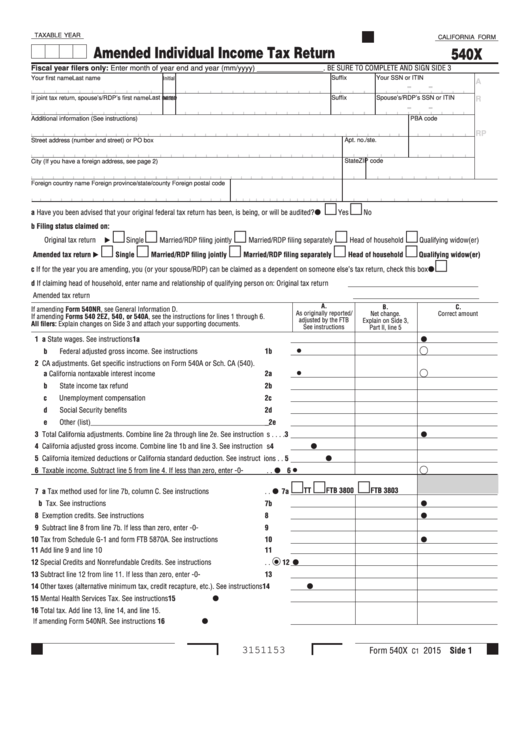

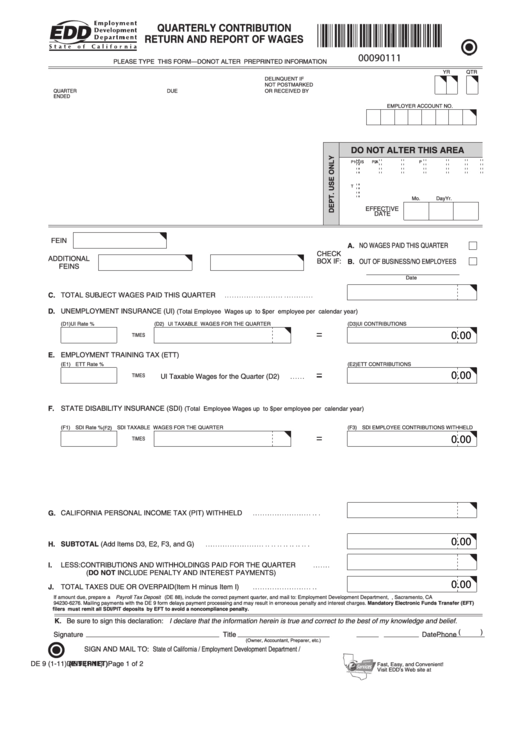

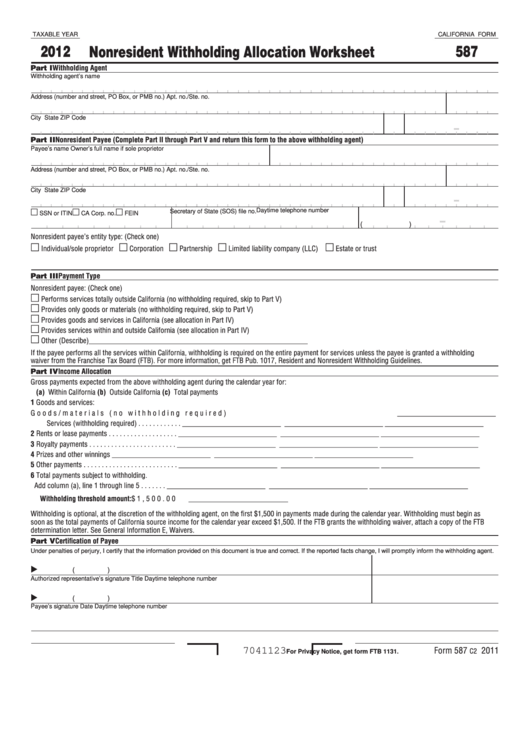

Ca State Withholding Form - For state withholding, use the worksheets on this form. Web california extends due date for california state tax returns. Web payroll tax deposit (de 88) is used to report and pay unemployment insurance (ui), employment training tax (ett), state disability insurance (sdi) withholding, and. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Web for state withholding, use the worksheets on this form, and for federal withholding use the internal revenue service (irs) publication 919 or federal withholding calculations. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. (check one) gross payments expected from the withholding agent during the calendar year for: Web simplified income, payroll, sales and use tax information for you and your business The de 4p allows you to: Form 590 does not apply to payments of backup withholding. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. Form 590 does not apply to payments of backup withholding. Irs further postpones tax deadlines for most california. Web up to 10% cash back california form de 4, employee's withholding allowance certificate to know how much state income tax to withhold from your. Web california provides two methods for determining the amount of wages and salaries to be withheld for state pit: (1) claim a different number of. Web the withholding agent keeps this form with their records. Web up to 10% cash back california form de 4, employee's withholding allowance certificate to know how much state income tax to withhold from your. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. For state withholding, use the worksheets on this form. Web up to 10% cash back california form de 4, employee's withholding allowance certificate to know how much state income tax to withhold from your new employee's. Web compare the state income tax withheld with your estimated total annual tax. Irs further postpones tax deadlines for most california. California, massachusetts and new york. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592. If there is ca withholding reported on the. The form helps your employer. Web up to 10% cash back california form de 4, employee's withholding allowance certificate to know how much state income tax to withhold from your new employee's wages only limited. Web get forms, instructions, and publications. Form 592 includes a schedule of payees section, on. Web for state withholding, use the worksheets on this form, and for federal withholding use the internal revenue service (irs) publication 919 or federal withholding calculations. Employee's withholding certificate form 941; Web compare the state income tax withheld with your estimated total annual tax. For state withholding, use the worksheets on this form. (1) claim a different number of. Web get forms, instructions, and publications. Web compare the state income tax withheld with your estimated total annual tax. Web simplified income, payroll, sales and use tax information for you and your business California, massachusetts and new york. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Web simplified income, payroll, sales and use tax information for you and your business Web california extends due date for california state tax returns. Employee's withholding certificate form 941; Web california provides two methods for determining the amount of wages and salaries to be withheld for state pit: (check one) gross payments expected from the withholding agent during the calendar. Web filling out the california withholding form de 4 is an important step to ensure accurate tax withholding from your wages or salary in california. Web california extends due date for california state tax returns. Web get forms, instructions, and publications. Web up to 10% cash back california form de 4, employee's withholding allowance certificate to know how much state. Web california extends due date for california state tax returns. Web the california income tax withholding form, also known as the de 4, is used to calculate the amount of taxes that should be withheld from an employee’s. Web simplified income, payroll, sales and use tax information for you and your business Web use form 590, withholding exemption certificate, to. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. (1) claim a different number of. Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. California, massachusetts and new york. Web for state withholding, use the worksheets on this form, and for federal withholding use the internal revenue service (irs) publication 919 or federal withholding calculations. Web payroll tax deposit (de 88) is used to report and pay unemployment insurance (ui), employment training tax (ett), state disability insurance (sdi) withholding, and. Web compare the state income tax withheld with your estimated total annual tax. Web the california income tax withholding form, also known as the de 4, is used to calculate the amount of taxes that should be withheld from an employee’s. Web simplified income, payroll, sales and use tax information for you and your business Irs further postpones tax deadlines for most california. For state withholding, use the worksheets on this form. Tax withheld on california source income is reported to the franchise tax board (ftb) using form 592, resident and nonresident withholding statement. (check one) gross payments expected from the withholding agent during the calendar year for: Web california extends due date for california state tax returns. Web the withholding agent keeps this form with their records. Web simplified income, payroll, sales and use tax information for you and your business If there is ca withholding reported on the. The form helps your employer. Form 592 includes a schedule of payees section, on. Web compare the state income tax withheld with your estimated total annual tax.Ca Withholding Form Fill Out and Sign Printable PDF Template signNow

ca withholding Doc Template pdfFiller

California State Withholding Fillable Form

Ca De 4 Printable Form California Employee's Withholding Allowance

California State Withholding Allowances Form

1+ California State Tax Withholding Forms Free Download

State Tax Withholding Form California

Ftb 589 Fill out & sign online DocHub

California State Withholding Form Employees

Fillable California Form 587 Nonresident Withholding Allocation

Related Post: