Form 500 Tax Return

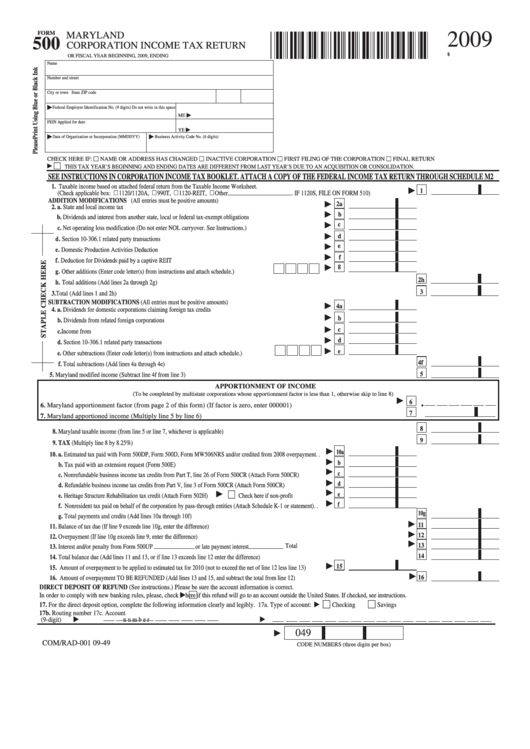

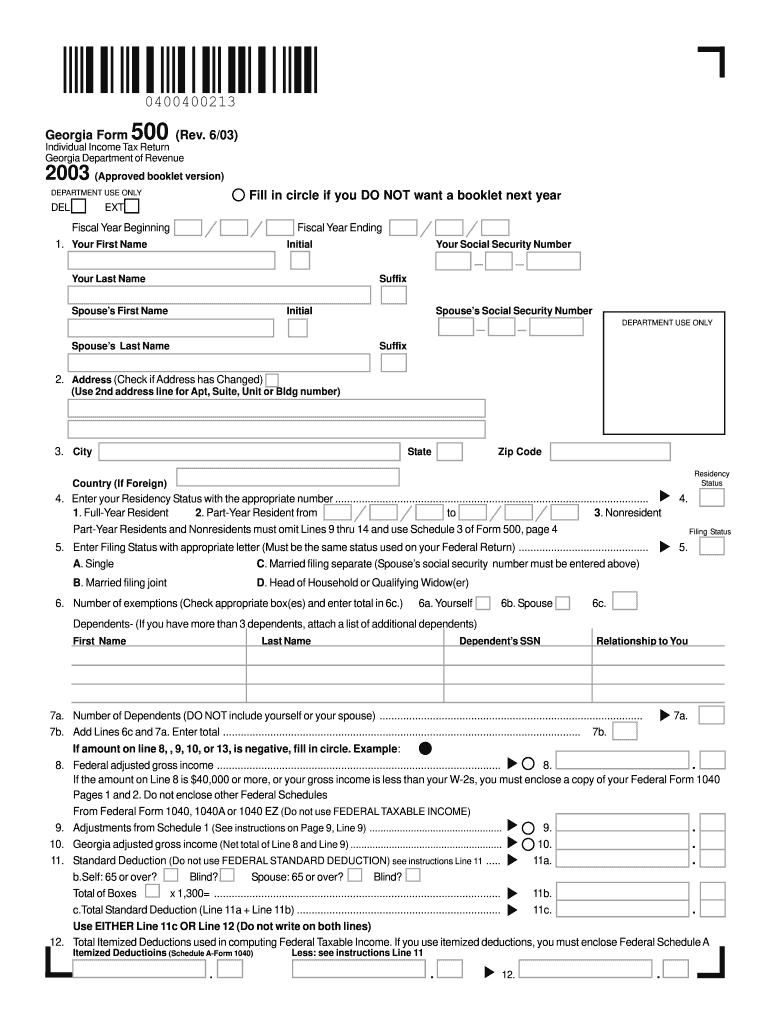

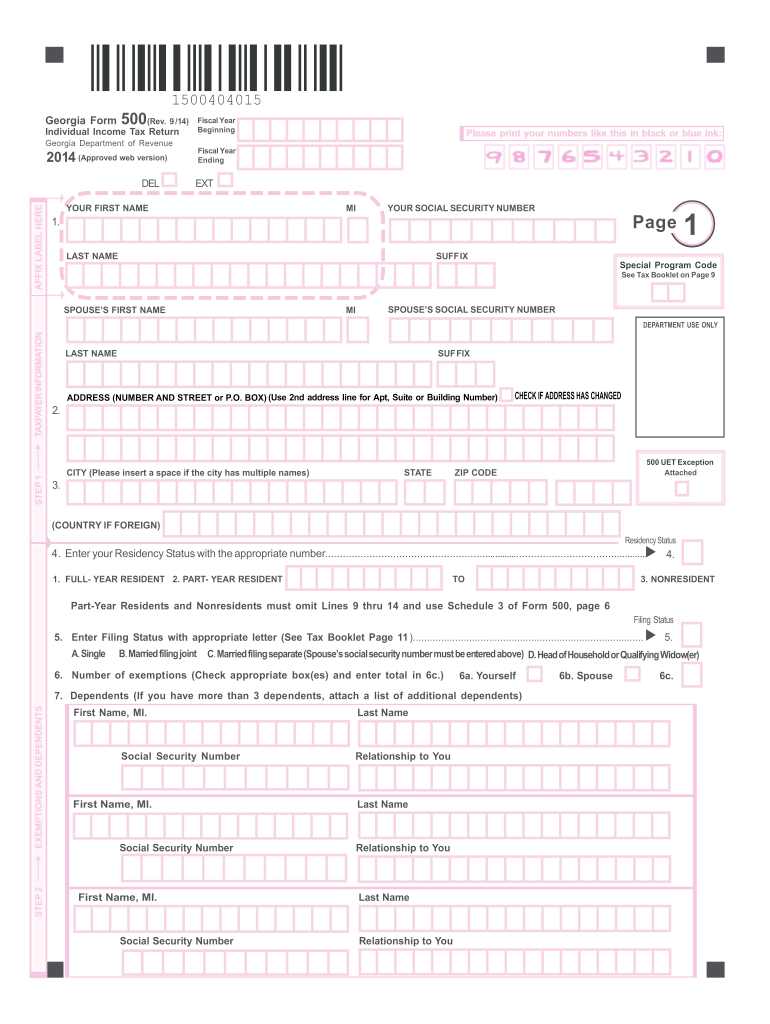

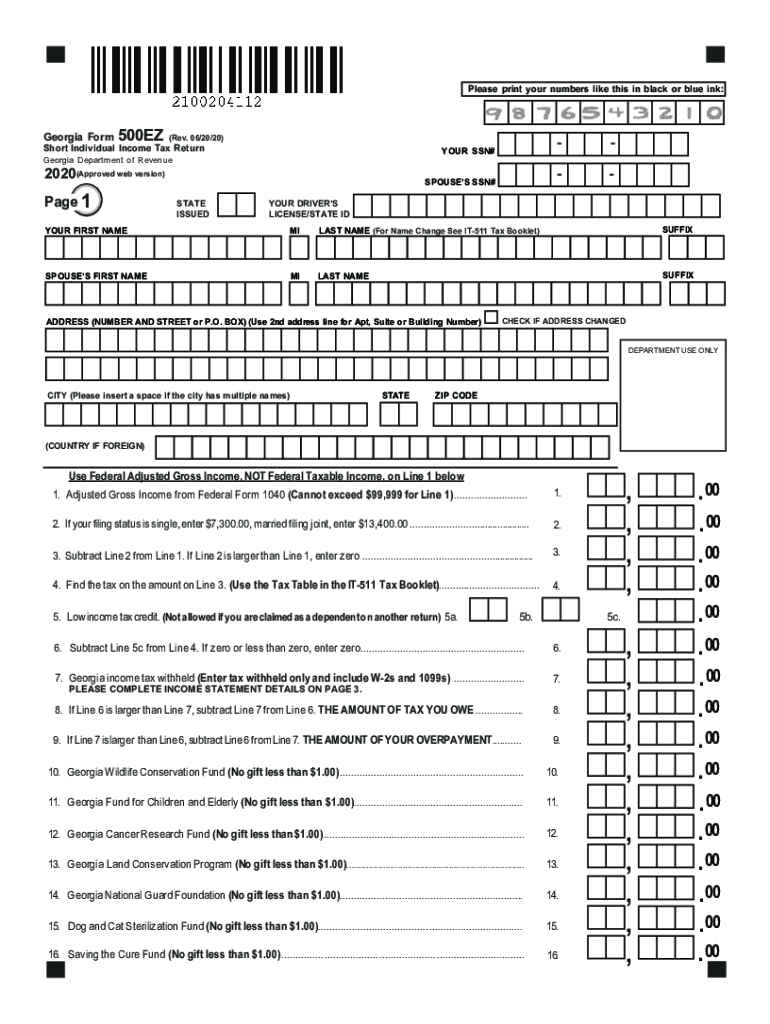

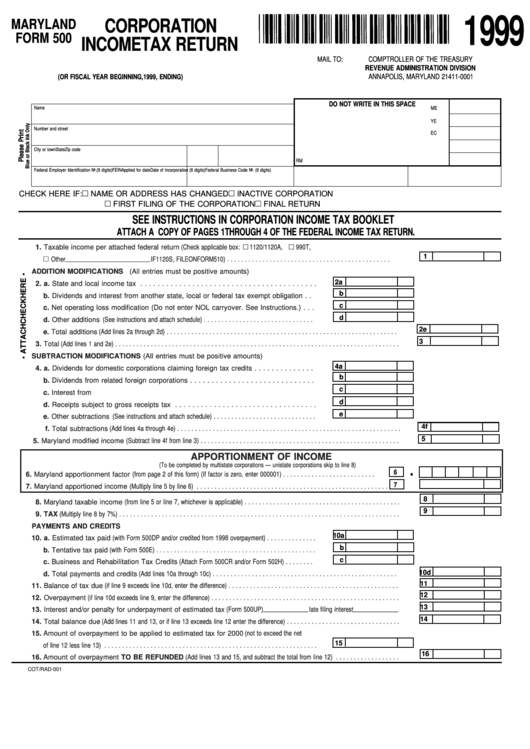

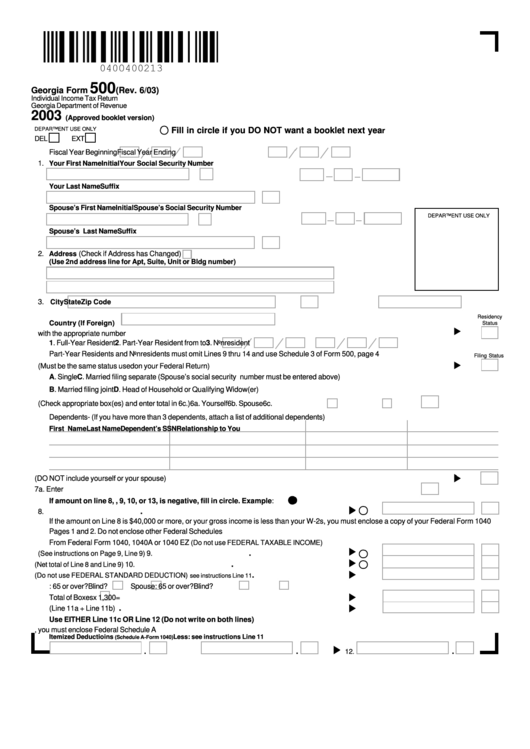

Form 500 Tax Return - Web annual income tax return all corporations can file their annual income tax return (form 500) and pay any tax due using approved software products. (1) the first return filed for the. Web form 500 is the general income tax return form for all georgia residents. Print blank form > georgia department of revenue. This form is for income earned. 08/02/21) amended individual income tax return georgia department of revenue use this form for the 2021 tax year only. Access irs forms, instructions and publications in electronic. Person holding an interest in specified foreign financial assets with an aggregate value exceeding $50,000 at the end of the tax year or $75,000. Web forms in tax booklet: Completing the form online is not suitable for tablets and phones (mobile. Web georgia form 500 (rev. Used to compute a corporation’s income tax liability and to determine the amount of tax due or the amount of the refund. Page last reviewed or updated: Person holding an interest in specified foreign financial assets with an aggregate value exceeding $50,000 at the end of the tax year or $75,000. For the calendar plan. Web generally, any u.s. Completing the form online is not suitable for tablets and phones (mobile. Page last reviewed or updated: Web forms in tax booklet: Web tax & accounting home. To successfully complete the form, you must. Web forms in tax booklet: Web georgia form 500 (rev. Used to compute a corporation’s income tax liability and to determine the amount of tax due or the amount of the refund. Web annual income tax return all corporations can file their annual income tax return (form 500) and pay any tax due. Used to compute a corporation’s income tax liability and to determine the amount of tax due or the amount of the refund. Web official use only 4 if the name and/or ein of the plan sponsor has changed since the last return/report filed for this plan, enter the name, ein and the plan number from the last. For the calendar. 06/20/20) individual income tax return georgia department of revenue 2020(approved web vers ion) pag e 1 fiscal year beginning state issued. To successfully complete the form, you must. Your social security number gross income is less than your you must. Web form 500 is the general income tax return form for all georgia residents. Web georgia form 500 (rev. Web annual income tax return all corporations can file their annual income tax return (form 500) and pay any tax due using approved software products. Person holding an interest in specified foreign financial assets with an aggregate value exceeding $50,000 at the end of the tax year or $75,000. 06/20/20) individual income tax return georgia department of revenue 2020(approved web. Web form 500 is the general income tax return form for all georgia residents. Access irs forms, instructions and publications in electronic. Web annual income tax return all corporations can file their annual income tax return (form 500) and pay any tax due using approved software products. Used to compute a corporation’s income tax liability and to determine the amount. To successfully complete the form, you must. Web tax & accounting home. Georgia department of revenue saving the cure fund (no gift of less than $1.00). Web annual income tax return all corporations can file their annual income tax return (form 500) and pay any tax due using approved software products. Web georgia form 500 (rev. This form is for income earned. Web forms in tax booklet: Page last reviewed or updated: Access irs forms, instructions and publications in electronic. Dependents (if you have more. For the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and endinga. Web annual return identification information. Enter the number from line 6c. Web annual income tax return all corporations can file their annual income tax return (form 500) and pay any tax due using approved software products. Individual income tax instruction booklet. (1) the first return filed for the. Web annual return identification information. Web official use only 4 if the name and/or ein of the plan sponsor has changed since the last return/report filed for this plan, enter the name, ein and the plan number from the last. Contains 500 and 500ez forms and general instructions. Web find georgia form 500 instructions at esmart tax today. Print blank form > georgia department of revenue. Completing the form online is not suitable for tablets and phones (mobile. Web more about the georgia form 500 tax return we last updated georgia form 500 in january 2023 from the georgia department of revenue. Access irs forms, instructions and publications in electronic. For the calendar plan year 2022 or fiscal plan year beginning (mm/dd/yyyy) and endinga. Used to compute a corporation’s income tax liability and to determine the amount of tax due or the amount of the refund. Web forms, instructions and publications search. This form is for income earned. Form 500 requires you to list multiple forms of income, such as wages, interest, or alimony. Web generally, any u.s. Dependents (if you have more. Person holding an interest in specified foreign financial assets with an aggregate value exceeding $50,000 at the end of the tax year or $75,000. Web ga tax withheld georgia form500 individual income tax return georgia department of revenue 2020 14a. 06/20/20) individual income tax return georgia department of revenue 2020(approved web vers ion) pag e 1 fiscal year beginning state issued. Enter the number from line 6c.Fillable Form 500 Maryland Corporation Tax Return 2009

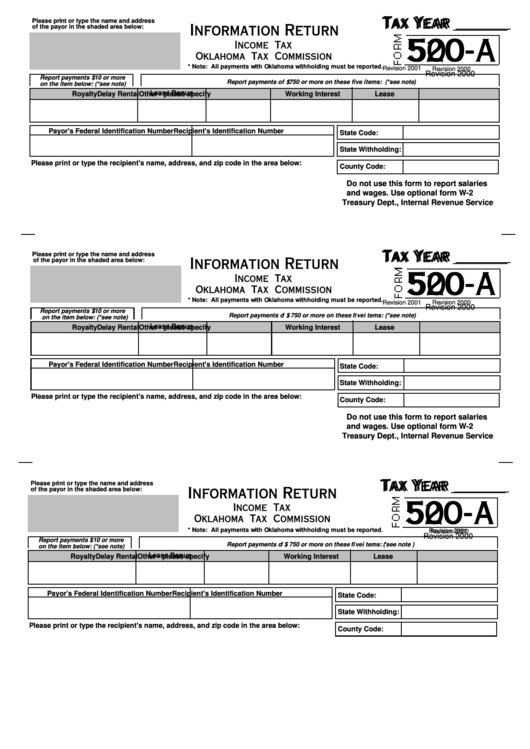

Form 500A Tax Information Return printable pdf download

Form 500 (Rev. 6/03) . . . . . Fill in circle if you

GA Form 500 Individual Tax Return Fill Out and Sign Printable

State Tax Form Fill Out and Sign Printable PDF

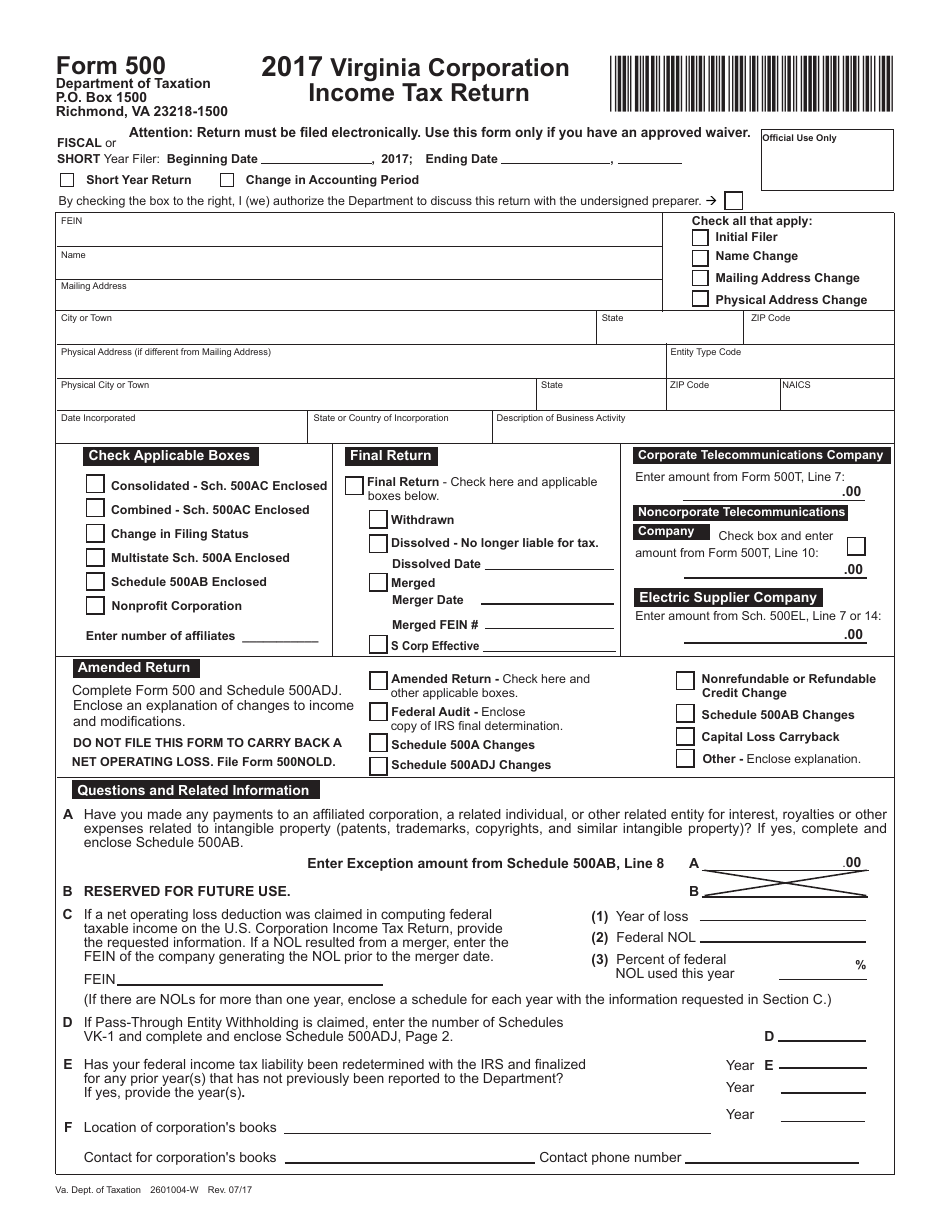

Form 500 Download Fillable PDF or Fill Online Virginia Corporation

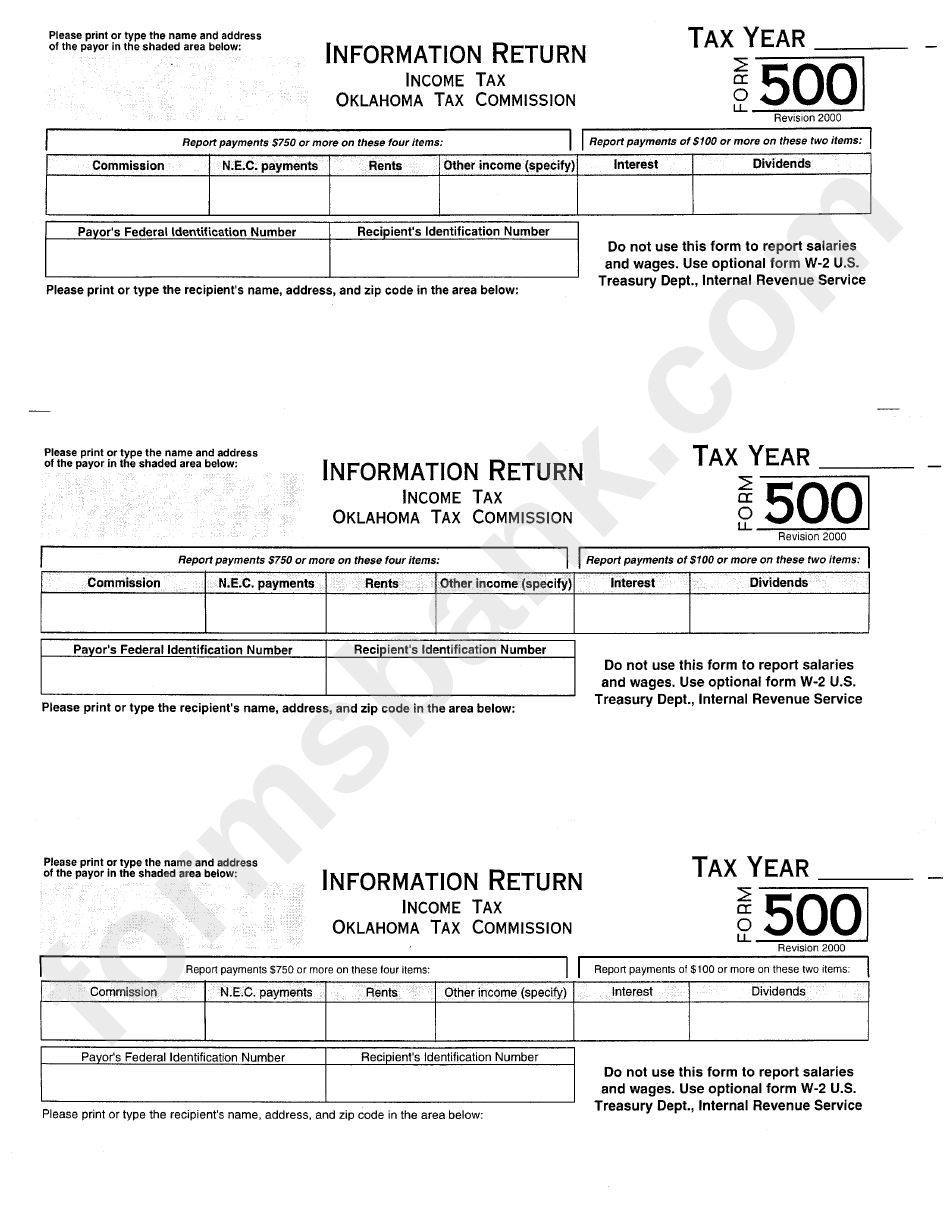

Form 500 Information Return Tax Oklahoma Tax Commission

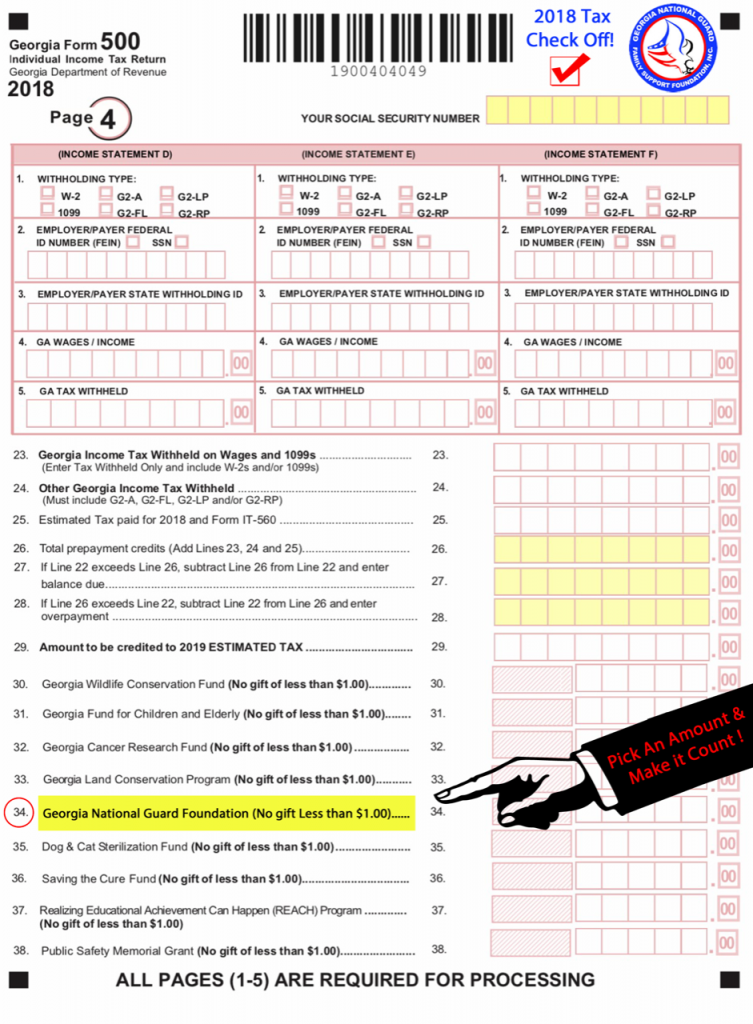

Pick an Amount & Make it Count on GA Form 500 Individual Tax Return

Maryland Form 500 Corporation Tax Return 1999 printable pdf

Form 500 Individual Tax Return 2003 printable pdf

Related Post: