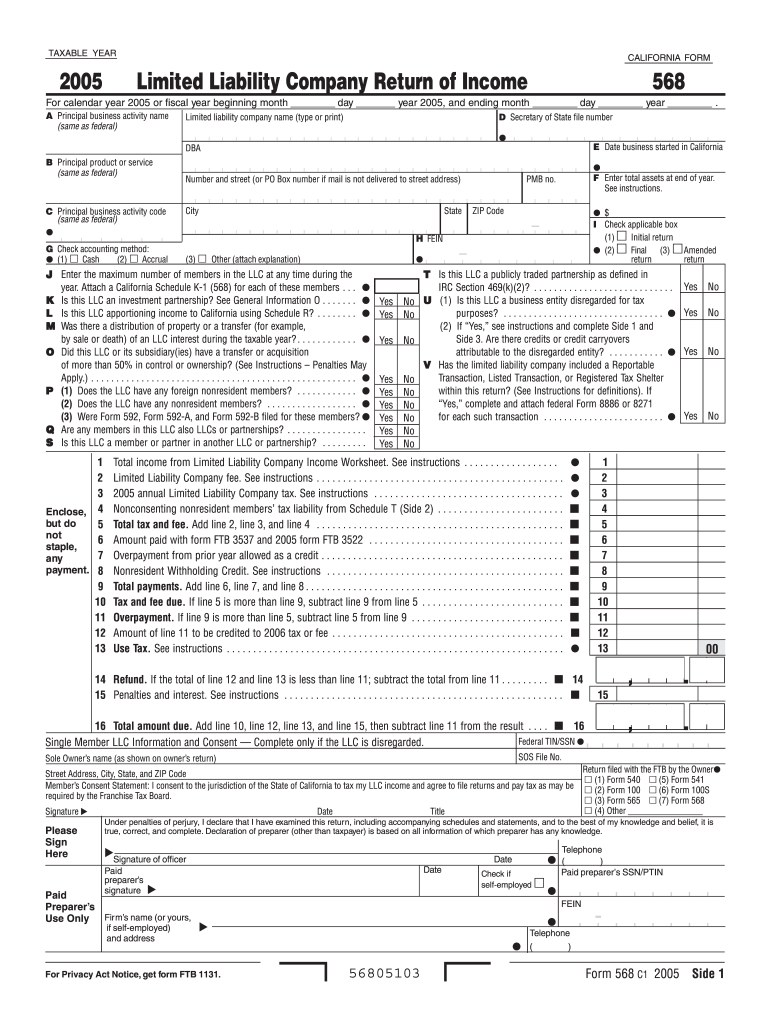

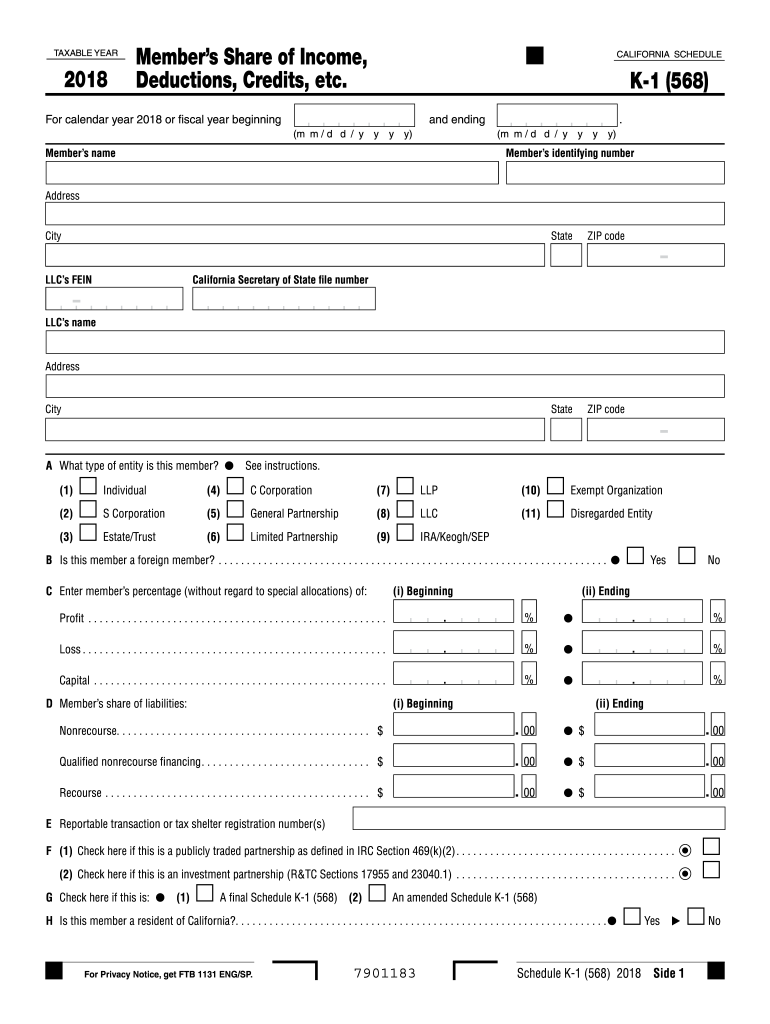

Ca Form 568 Due Date

Ca Form 568 Due Date - Limited liability companies are automatically assessed an $800 tax. Solved • by turbotax • 336 • updated january 13, 2023 form 568. Web the irs said monday that californians in 55 of the state's 58 counties would not have to pay their 2022 taxes or 2023 estimated taxes until nov. E check accounting method f date business started in ca. If your llc files on an extension, refer to payment for automatic extension for llcs. Web 2022 partnership and llc income tax returns due and tax due (for calendar year filers). 16, 2023, to file and pay their 2022 state taxes to avoid penalties. 568 form (pdf) | 568 booklet; Common questions about individual ca llc income worksheet (form 568) solved • by intuit • 7 • updated february 10, 2023. This amount needs to be prepaid and filed with form 3522. Although the individual's due date was postponed to may 17, 2021, an smllc that was owned by an individual still had the original due date of april 15, 2021, to file a form 568. Ad uslegalforms.com has been visited by 100k+ users in the past month For example, an s corporation's 2022 tax return due date is: For example, the. Web due date for california state tax returns and payments moved to november 16, 2023. Llcs will use form ftb 3536 to pay by the due date of the llc’s return, any amount of. This amount needs to be prepaid and filed with form 3522. Although the individual's due date was postponed to may 17, 2021, an smllc that was. Enter total assets at end of year. Web due date for california state tax returns and payments moved to november 16, 2023. Llcs will use form ftb 3536 to pay by the due date of the llc’s return, any amount of. If the due date falls on a saturday,. Web how do i know if i should file california form. There is a difference between how california treats businesses vs federal. Web the same as the federal income tax returns, the limited liability companies are required to file form 568 by april 15. Web the form is typically due on the 15th day of the 4th month after the closure of the llc's tax year. If your llc files on. Date business started in ca (m m / d d / y y y y) g. The california llc tax due date is the deadline by which california llcs must submit their tax returns and typically falls on or before the 15th day. Web 2022 partnership and llc income tax returns due and tax due (for calendar year filers). Limited. Web 2022 partnership and llc income tax returns due and tax due (for calendar year filers). Web limited liability company (form 568 original, including next year's llc tax and next year's llc fee; Web the llc fee remains due and payable by the due date of the llc's return. Web the annual tax payment date is the fifteenth day of. Date business started in ca (m m / d d / y y y y) g. Web file limited liability company return of income (form 568) by the original return due date. This amount needs to be prepaid and filed with form 3522. Web do not mail the $800 annual tax with form 568. • form 199, california exempt organization. Web form 568 2018 side 1 taxable year 2018 limited liability company return of income. Add line 15, line 16, line 18, and line. Although the individual's due date was postponed to may 17, 2021, an smllc that was owned by an individual still had the original due date of april 15, 2021, to file a form 568. Web the. Web do not mail the $800 annual tax with form 568. Web remote sellers have economic nexus if, in the preceding or current calendar year, the total combined sales of products and services into california exceed $500,000. Ad uslegalforms.com has been visited by 100k+ users in the past month • form 199, california exempt organization annual information return for. Web. 568 form (pdf) | 568 booklet; Web 2022 partnership and llc income tax returns due and tax due (for calendar year filers). Limited liability companies are automatically assessed an $800 tax. If the due date falls on a saturday,. Web how do i know if i should file california form 568, llc return of income for this year? Although the individual's due date was postponed to may 17, 2021, an smllc that was owned by an individual still had the original due date of april 15, 2021, to file a form 568. When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day. Web how do i know if i should file california form 568, llc return of income for this year? Date business started in ca (m m / d d / y y y y) g. Web the same as the federal income tax returns, the limited liability companies are required to file form 568 by april 15. Get ready for tax season deadlines by completing any required tax forms today. Llcs will use form ftb 3536 to pay by the due date of the llc’s return, any amount of. If your llc files on an extension, refer to payment for automatic extension for llcs. The california llc tax due date is the deadline by which california llcs must submit their tax returns and typically falls on or before the 15th day. Web 2022 partnership and llc income tax returns due and tax due (for calendar year filers). Web the annual tax payment date is the fifteenth day of the fourth month of the taxable year. Ad uslegalforms.com has been visited by 100k+ users in the past month Web our due dates apply to both calendar and fiscal tax years. E check accounting method f date business started in ca. Web this tax amounts to $800 for every type of entity and is due on april 15 every year. Limited liability companies are automatically assessed an $800 tax. Web the llc fee remains due and payable by the due date of the llc's return. Web due date for california state tax returns and payments moved to november 16, 2023. Web remote sellers have economic nexus if, in the preceding or current calendar year, the total combined sales of products and services into california exceed $500,000. Enter total assets at end of year.How to Fill Out Form 568 Simplified tax reporting airSlate

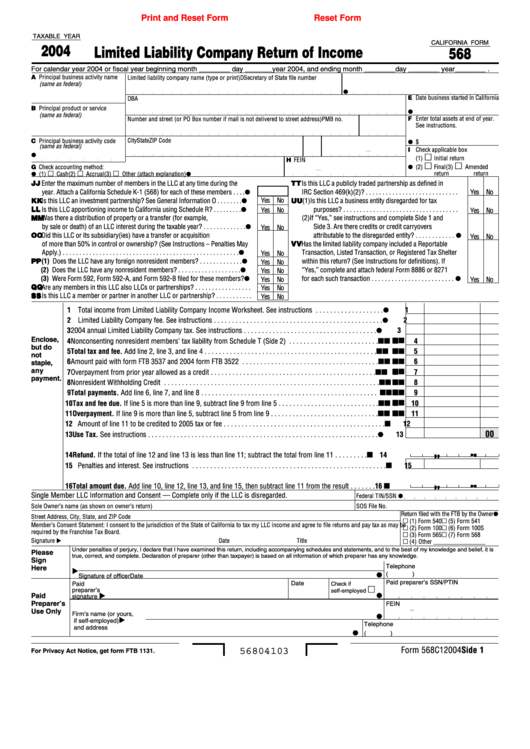

Ca Form 568 Fillable Printable Forms Free Online

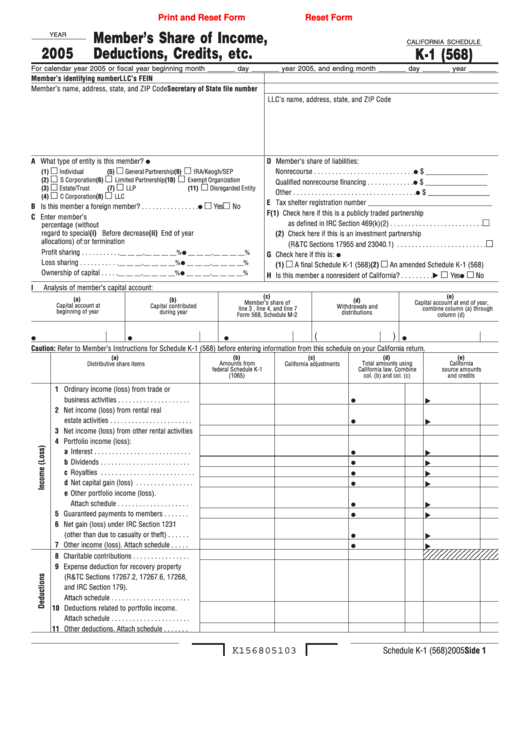

Fillable California Schedule K1 (568) Member'S Share Of

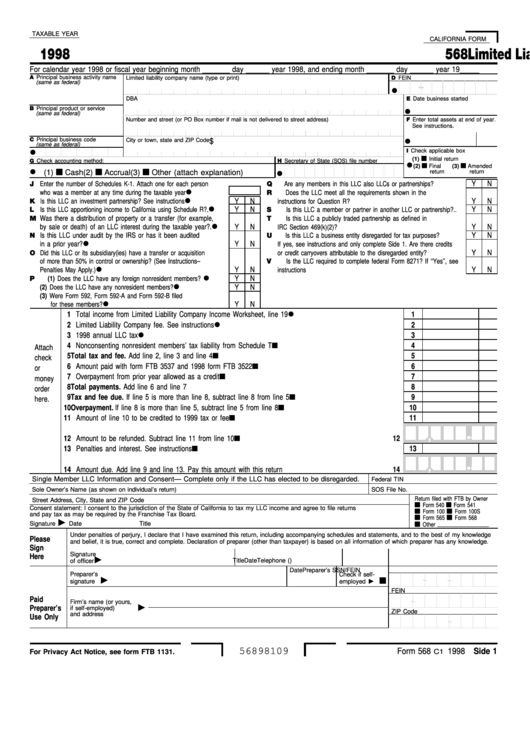

Fillable Ca 568 Form Printable Forms Free Online

CA Form 568 Due Dates 2023 State And Local Taxes Zrivo

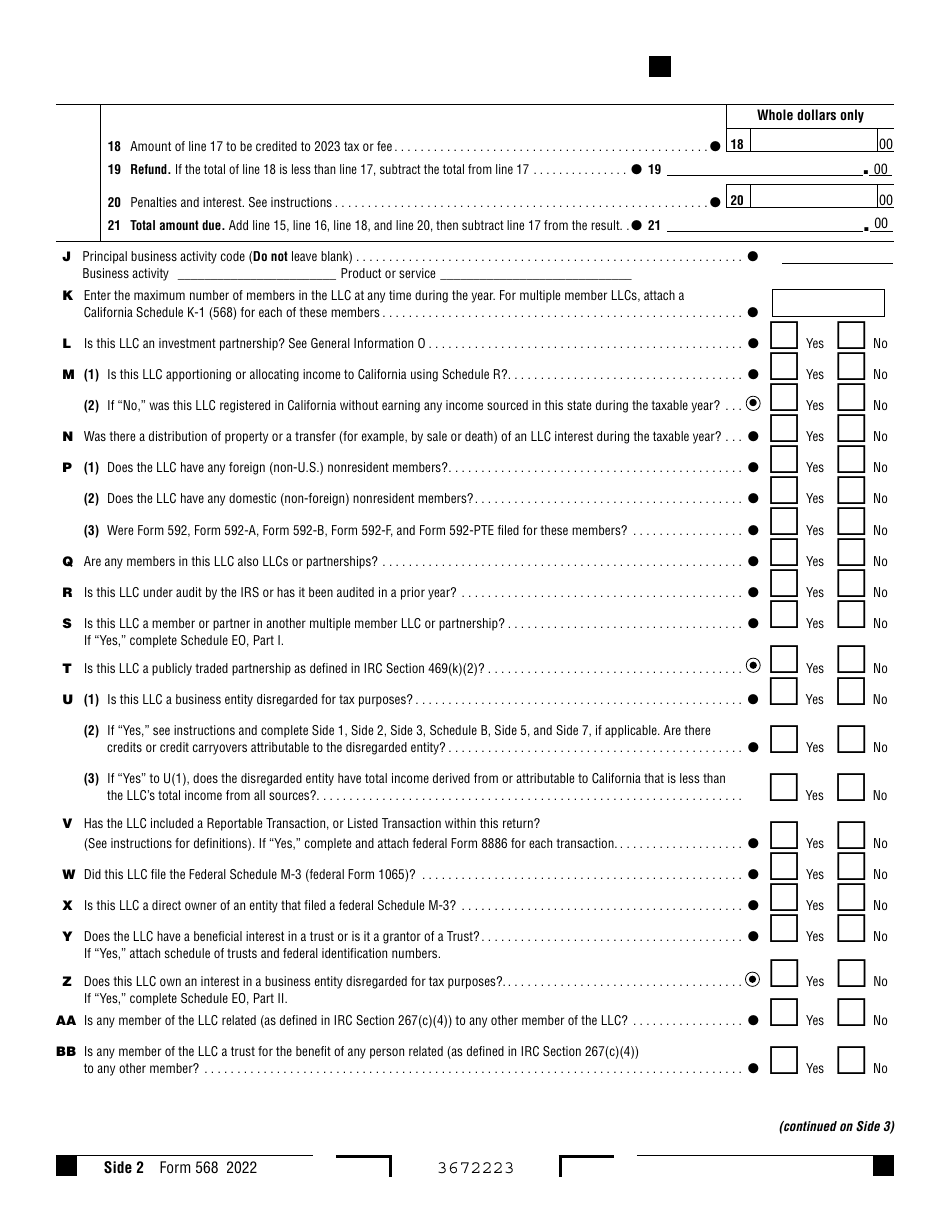

Form 568 Download Fillable PDF or Fill Online Limited Liability Company

Form 568 Download Fillable PDF or Fill Online Limited Liability Company

Fillable Online ftb ca 2005 Limited Liability Company Return of

California k 1 instructions Fill out & sign online DocHub

Notice of Unavailability for Annual Form Updates DocHub

Related Post: