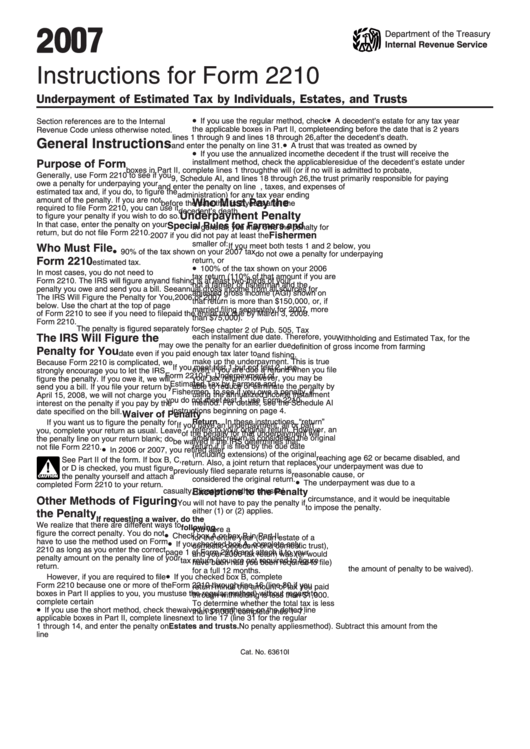

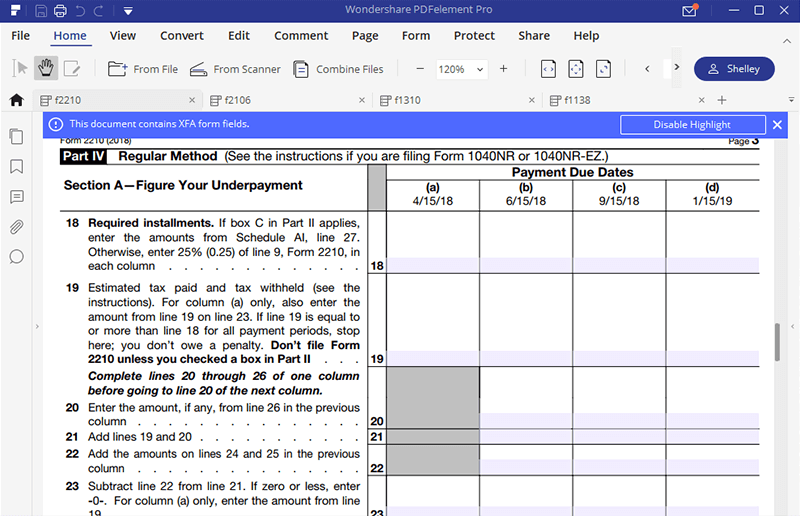

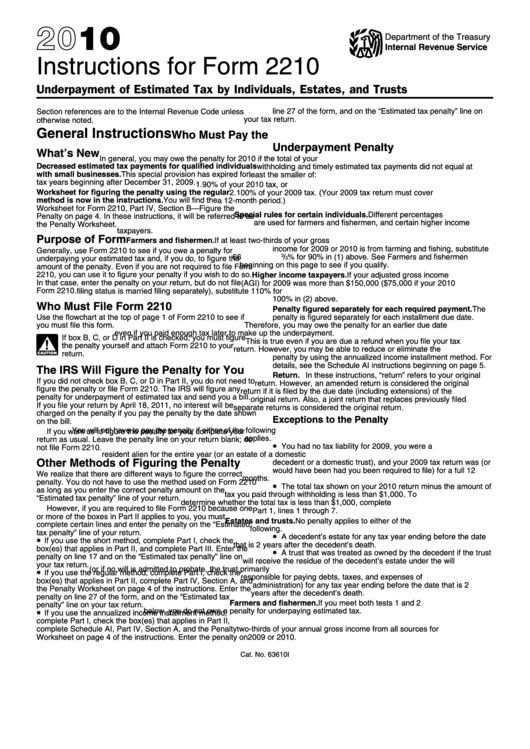

Instructions Form 2210

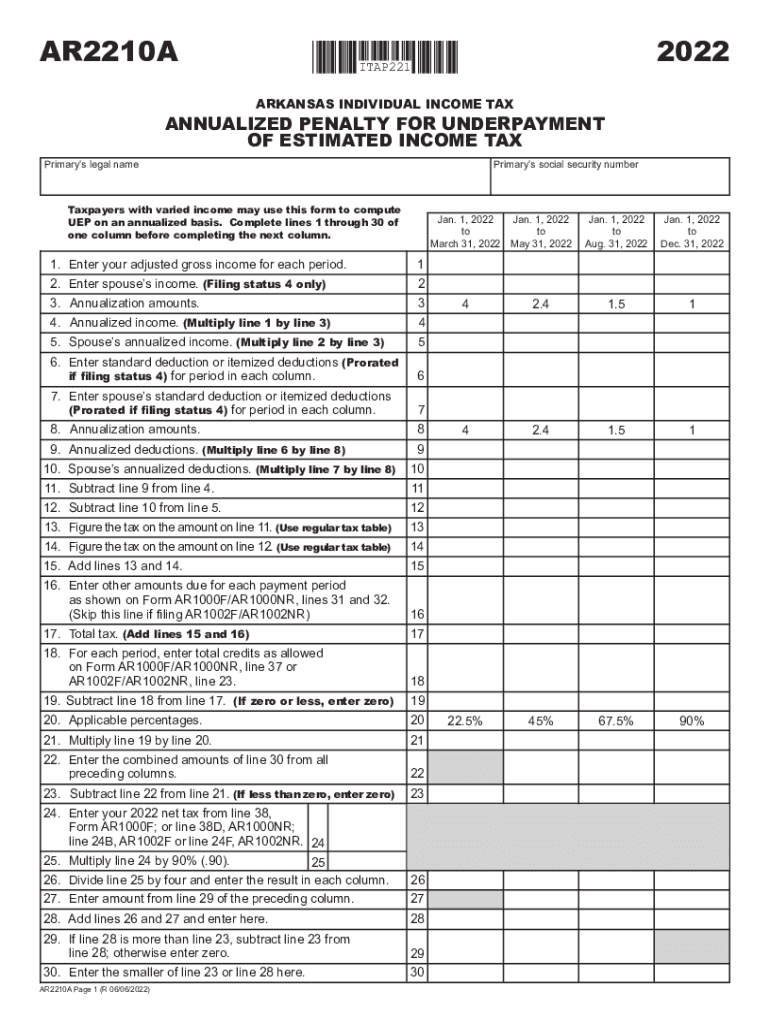

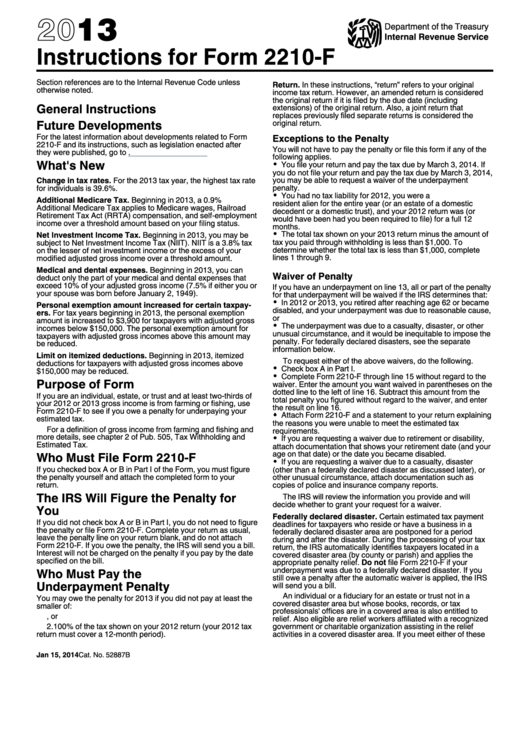

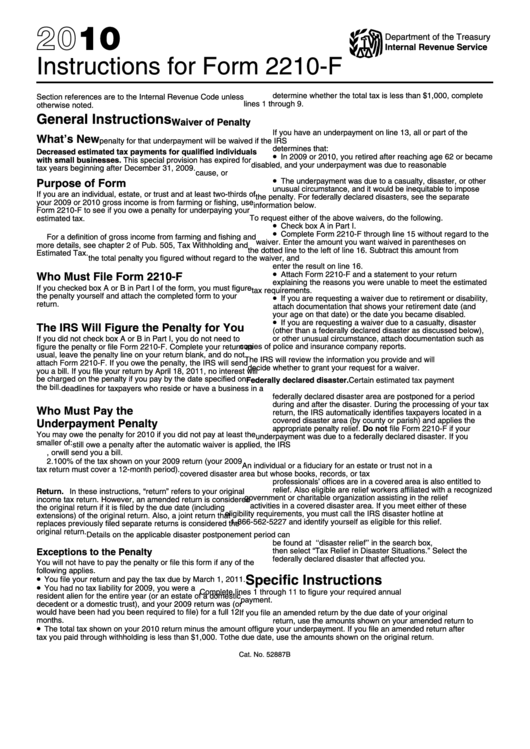

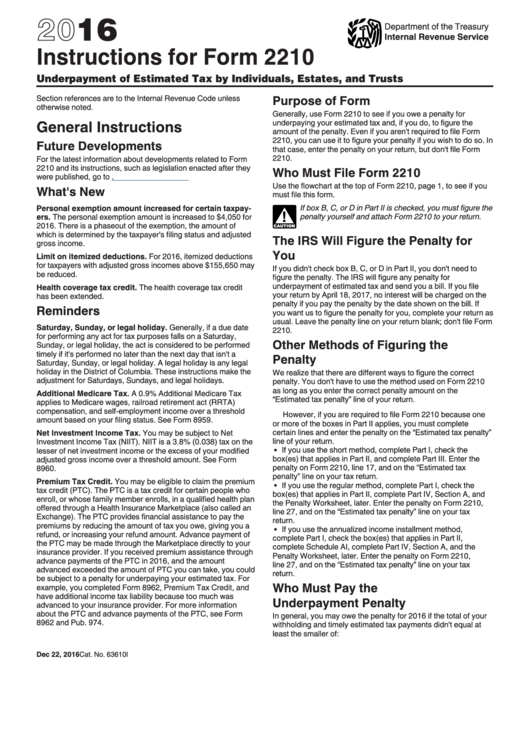

Instructions Form 2210 - Solved•by turbotax•2479•updated january 13, 2023. Web form 2210 department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts omb no. Web instructions for form 2210 schedule ai tells you exactly what to do. Upload, modify or create forms. Do not file form 2210 (but if box. Web tax form 2210 instructions. You must file page 1 of form 2210, but you aren’t required to figure your penalty (unless box b, c, or d applies). Department of the treasury internal revenue service. Underpayment of estimated tax by individuals, estates, and trusts. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. A tax agent will answer in minutes! Web form 2210 department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts omb no. You do not owe a penalty. Web the irs will generally figure your penalty for you and you should not file form 2210. This penalty is different from the penalty for. A tax agent will answer in minutes! It just says to add up the deductions for each period. How do i add form 2210? Underpayment of estimated tax by individuals, estates, and trusts. You must file page 1 of form 2210, but you aren’t required to figure your penalty (unless box b, c, or d applies). Certain estimated tax payment deadlines for taxpayers who reside or have a business in. Upload, modify or create forms. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the. Irs form 2210(underpayment of estimated. Do not file form 2210. Web the irs will generally figure your penalty for you and you should not file form 2210. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Web form 2210 is used to calculate a penalty when the taxpayer has underpaid on their. The form doesn't always have to be. You do not owe a penalty. Web form 2210 department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts omb no. Upload, modify or create forms. A tax agent will answer in minutes! Citizen or resident alien for the entire year (or an estate of a. Web to complete form 2210, you must enter your prior year tax which is found on line 24 of your prior year 1040 and check any corresponding boxes if they relate to your situation. Web purpose of form use form 2210 to see if you owe a. There are some situations in which you must file form 2210, such as to. Ask a tax professional anything right now. Do not file form 2210. Irs form 2210(underpayment of estimated. The form doesn't always have to be. Web tax form 2210 instructions. The irs will generally figure your penalty for you and you should not. Web for those yet to file, the irs urges every eligible taxpayer to claim the waiver on their return; Irs form 2210(underpayment of estimated. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for. The irs tax form for underpayment of estimated tax by individuals, estates, and trusts is lengthy and complicated. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. A tax agent will answer in minutes! Web form 2210 is used to determine how much you owe in underpayment penalties on your. February 14, 2023 12:48 pm. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Ad access irs tax forms. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. You can, however, use form 2210. It just says to add up the deductions for each period. The irs tax form for underpayment of estimated tax by individuals, estates, and trusts is lengthy and complicated. February 14, 2023 12:48 pm. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Underpayment of estimated tax by individuals, estates, and trusts. In order to make schedule ai available, part ii of form 2210 underpayment of estimated tax by. Do not file form 2210. In part ii applies, you must file. Web to complete form 2210, you must enter your prior year tax which is found on line 24 of your prior year 1040 and check any corresponding boxes if they relate to your situation. Web the irs will generally figure your penalty for you and you should not file form 2210. Ad forms, deductions, tax filing and more. You must file page 1 of form 2210, but you aren’t required to figure your penalty (unless box b, c, or d applies). You do not owe a penalty. Web irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to file to determine if they owe a penalty. Ask a tax professional anything right now. Questions answered every 9 seconds. Web instructions for form 2210 schedule ai tells you exactly what to do. Web form 2210 department of the treasury internal revenue service underpayment of estimated tax by individuals, estates, and trusts omb no. Web for the latest information about developments related to form 2210 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2210. Department of the treasury internal revenue service.Instructions For Form 2210 Underpayment Of Estimated Tax By

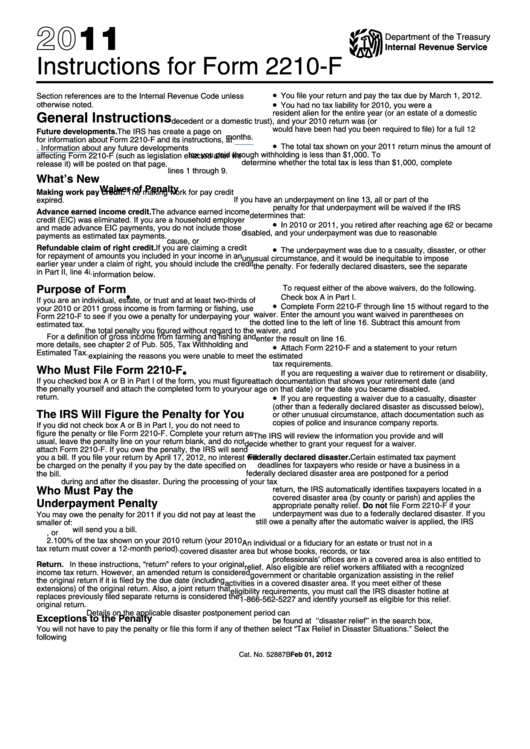

Instructions For Form 2210F Underpayment Of Estimated Tax By Farmers

Fillable Online Instructions for Form 2210 (2021) Internal Revenue

Remplir le formulaire 2210 de l'IRS avec le meilleur remplisseur

Instructions For Form 2210 Underpayment Of Estimated Tax By

Instructions For Form 2210 Underpayment Of Estimated Tax By

Instructions for Form 2210 (2022)Internal Revenue Service Fill out

Instructions For Form 2210F Underpayment Of Estimated Tax By Farmers

Instructions For Form 2210F Underpayment Of Estimated Tax By Farmers

Instructions For Form 2210 Underpayment Of Estimated Tax By

Related Post: