Form 4835 Vs Schedule F

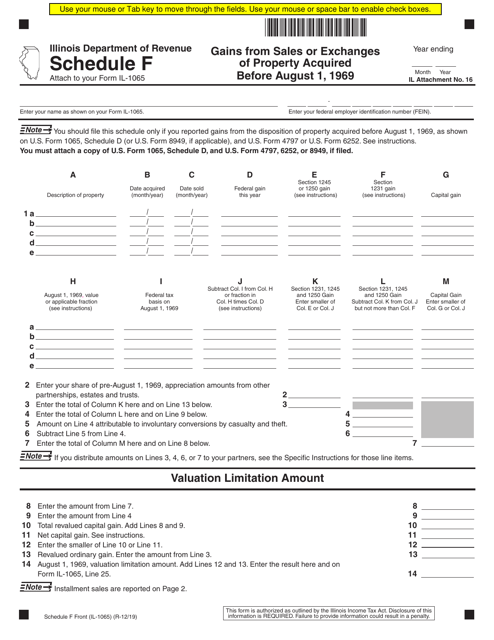

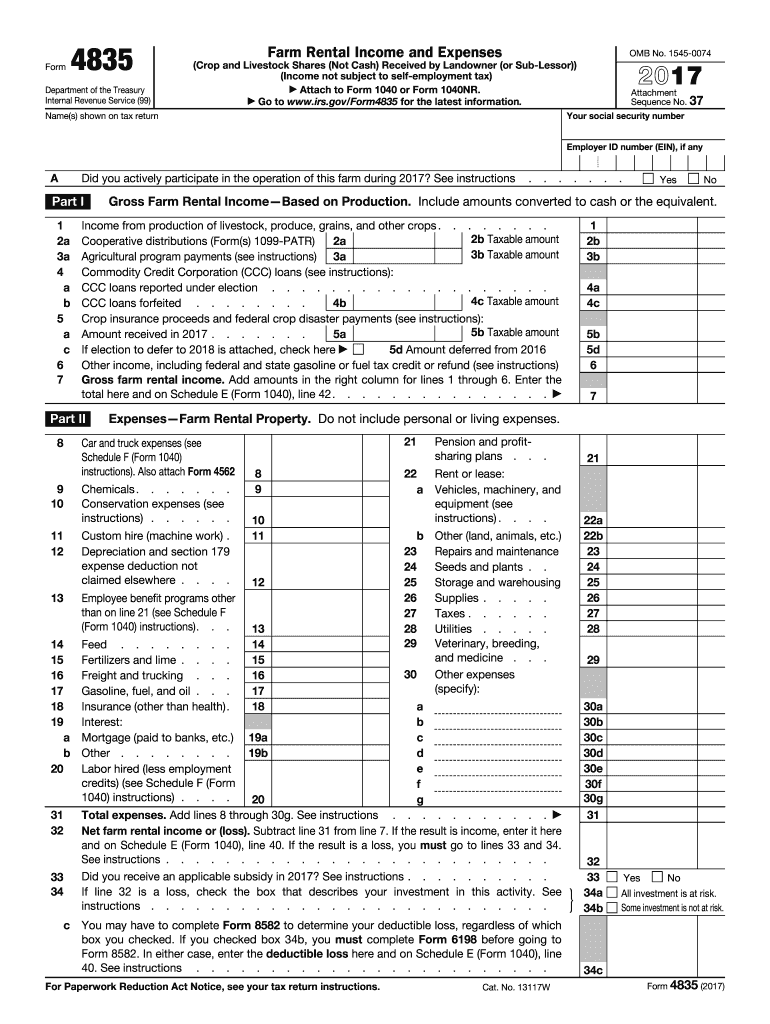

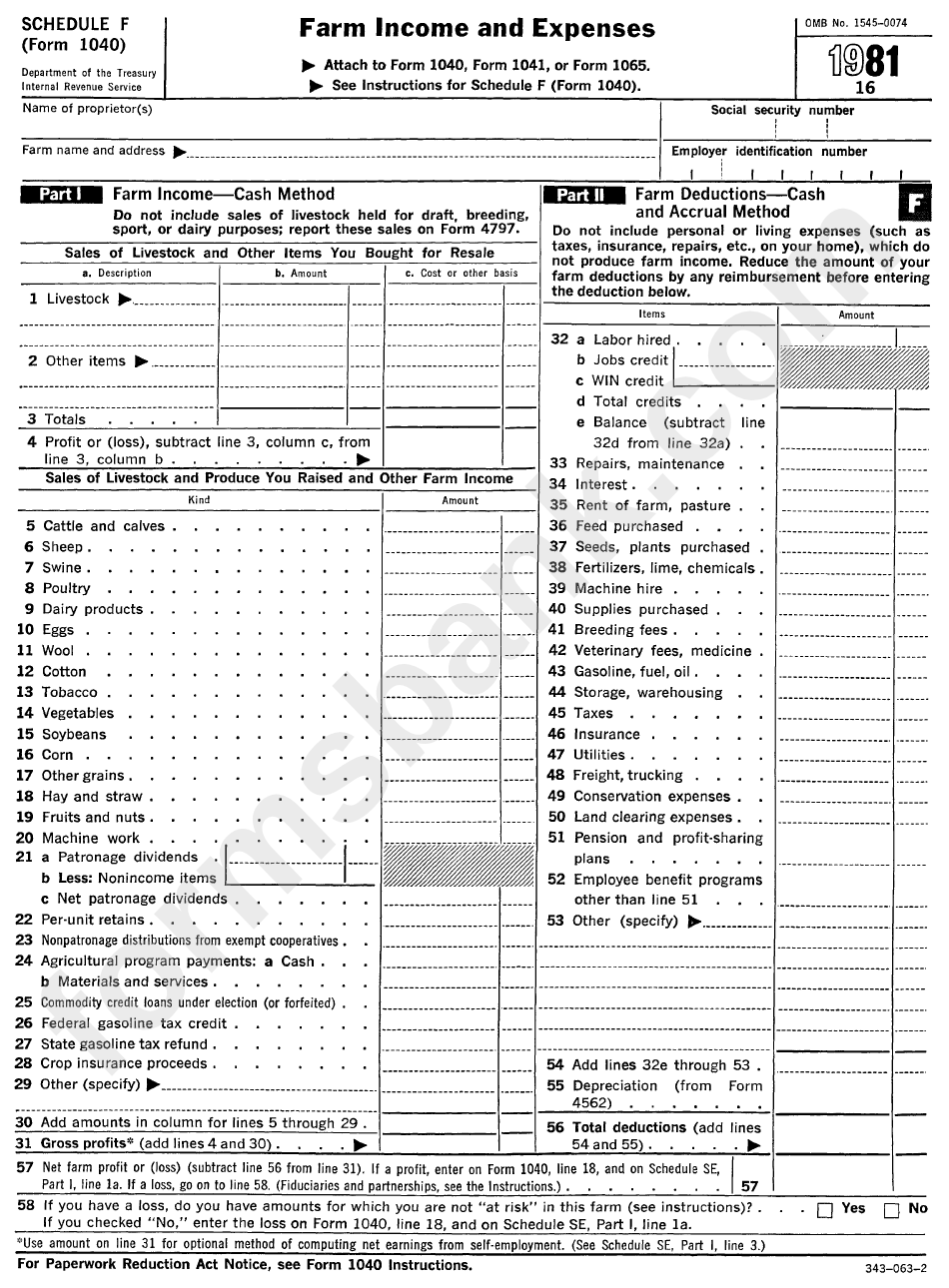

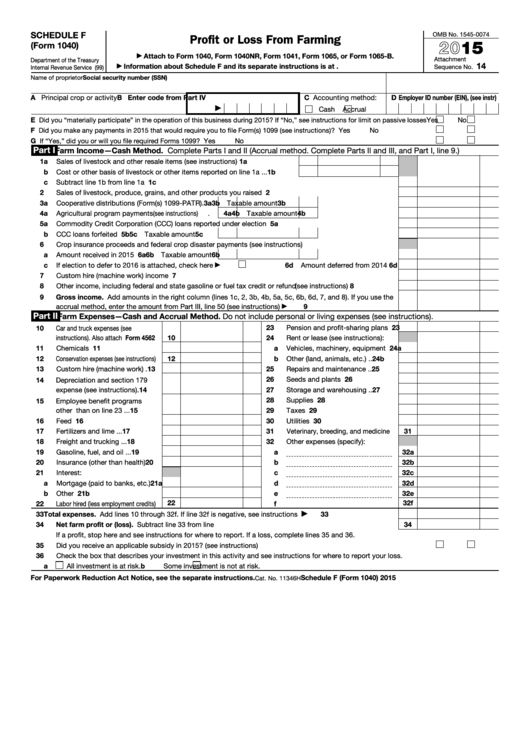

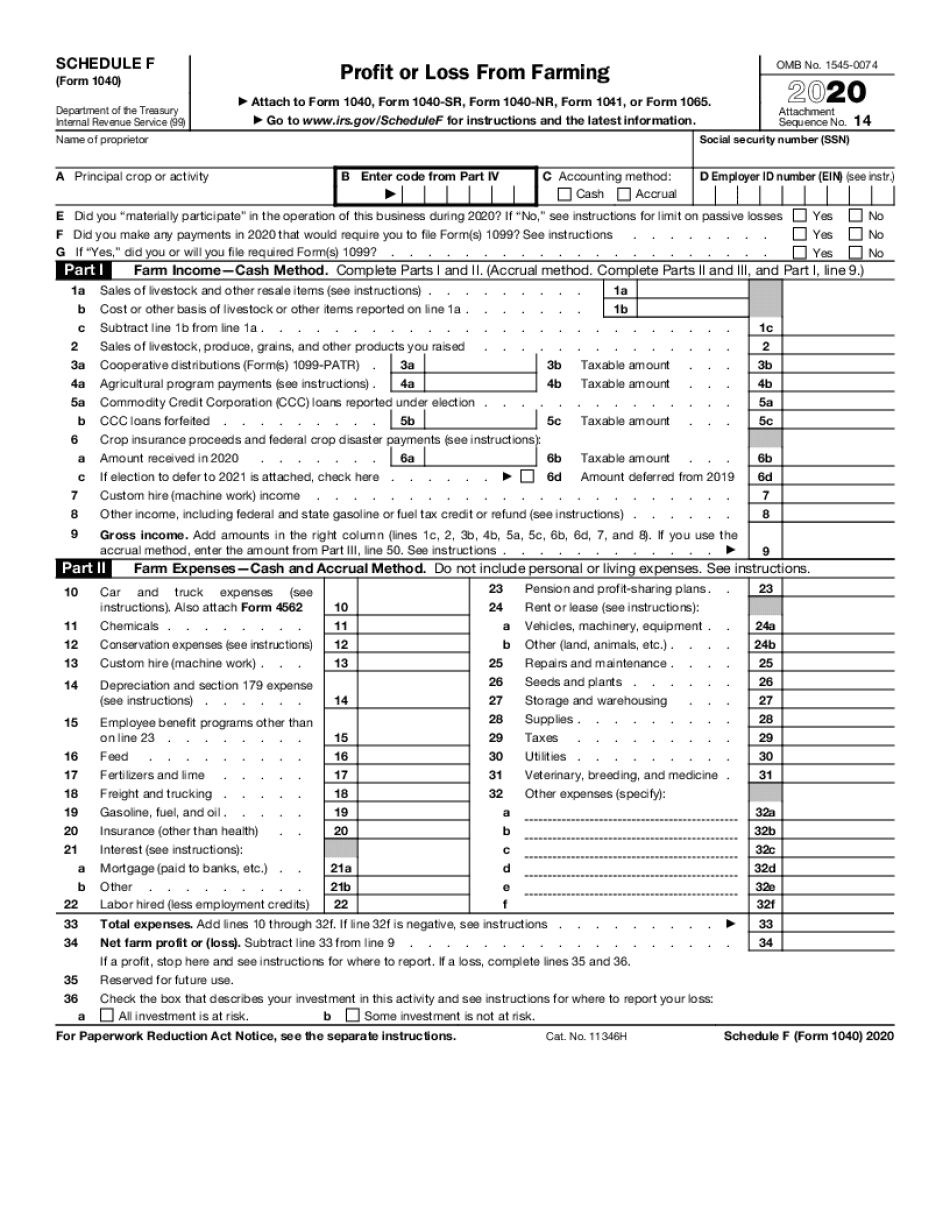

Form 4835 Vs Schedule F - Form 4835 to report rental income based on crop or livestock shares. Ad edit, sign and print tax forms on any device with signnow. • tenant—instead use schedule f (form 1040) to report farm income and expenses; This is an irs form that allows landowners to report out on rental income they receive from renting their land out. Do not use form 4835 if you were a/an: Much interest you are allowed to. Web how do i enter preproductive expenses for schedule f/form 4835? Web do not use form 4835 if you were a/an: Report farming income on schedule f farmers who are sole proprietors must file schedule f by william perez updated on. Web the “annual rental payments” are not rentals from real estate and should not be reported on form 4835, farm rental income and expenses, or schedule e,. Web do not use form 4835 if you were a/an: Get ready for tax season deadlines by completing any required tax forms today. Web if an individual’s business income is not derived from farming, it will generally be reported instead of irs form 1040, schedule c, profit and loss from business. Your farming activity may subject you to state and.. • tenant—instead use schedule f (form 1040) to report farm income and expenses; Farm rental income and expenses: Web also, use this form to report sales of livestock held for draft, breeding, sport, or dairy purposes. Web the “annual rental payments” are not rentals from real estate and should not be reported on form 4835, farm rental income and expenses,. Do not use form 4835 if you were a/an: Much interest you are allowed to. Web if you figure it using schedule j (form 1040). Web taxable income farm income: Tenant—instead use schedule f (form 1040) to report farm income and expenses; Web form 4835 is only used when you receive rental income from a farm in the form of a percentage of the crops raised on that farm, otherwise known as share crop. Report farming income on schedule f farmers who are sole proprietors must file schedule f by william perez updated on. Tenant—instead use schedule f (form 1040) to report. Much interest you are allowed to. • tenant—instead use schedule f (form 1040) to report farm income and expenses; Web if you figure it using schedule j (form 1040). Open screen 19, farm income (sch. Your farming activity may subject you to state and. Web taxable income farm income: Farm rental income and expenses: Do not use form 4835 if you were a/an: Much interest you are allowed to. Web also, use this form to report sales of livestock held for draft, breeding, sport, or dairy purposes. Do not use form 4835 if you were a/an: Web if an individual’s business income is not derived from farming, it will generally be reported instead of irs form 1040, schedule c, profit and loss from business. Get ready for tax season deadlines by completing any required tax forms today. Ad edit, sign and print tax forms on any device. Specific instructions employer id number (ein). Web also, use this form to report sales of livestock held for draft, breeding, sport, or dairy purposes. Web about form 4835, farm rental income and expenses. Web do not use form 4835 if you were a/an: Web if you figure it using schedule j (form 1040). Web how do i enter preproductive expenses for schedule f/form 4835? Ad edit, sign and print tax forms on any device with signnow. Web if you’re a farmer making supplemental income by leasing some of your real estate to a farm tenant, you might be tempted to report this as farm income on schedule. Open screen 19, farm income (sch.. Do not use form 4835 if you were a/an: Ad edit, sign and print tax forms on any device with signnow. Web form 4835 is only used when you receive rental income from a farm in the form of a percentage of the crops raised on that farm, otherwise known as share crop. • tenant—instead use schedule f (form 1040). Much interest you are allowed to. Web also, use this form to report sales of livestock held for draft, breeding, sport, or dairy purposes. Farm rental income and expenses: Report farming income on schedule f farmers who are sole proprietors must file schedule f by william perez updated on. Web if you figure it using schedule j (form 1040). Web information about schedule f (form 1040), profit or loss from farming, including recent updates, related forms, and instructions on how to file. Web use schedule f (form 1040) to report farm income and expenses. Web about form 4835, farm rental income and expenses. Web form 4835 is only used when you receive rental income from a farm in the form of a percentage of the crops raised on that farm, otherwise known as share crop. Ad edit, sign and print tax forms on any device with signnow. Web schedule f (form 1040), profit or loss from farming, and pub. Web do not use form 4835 if you were a/an: This is an irs form that allows landowners to report out on rental income they receive from renting their land out. • tenant—instead use schedule f (form 1040) to report farm income and expenses; Web do not use form 4835 if you were a/an: If the taxpayer has more than one schedule f,. Open screen 19, farm income (sch. Web the “annual rental payments” are not rentals from real estate and should not be reported on form 4835, farm rental income and expenses, or schedule e,. Tenant—instead use schedule f (form 1040) to report farm income and expenses; • tenant—instead use schedule f (form 1040) to report farm income and expenses;Form IL1065 Schedule F 2019 Fill Out, Sign Online and Download

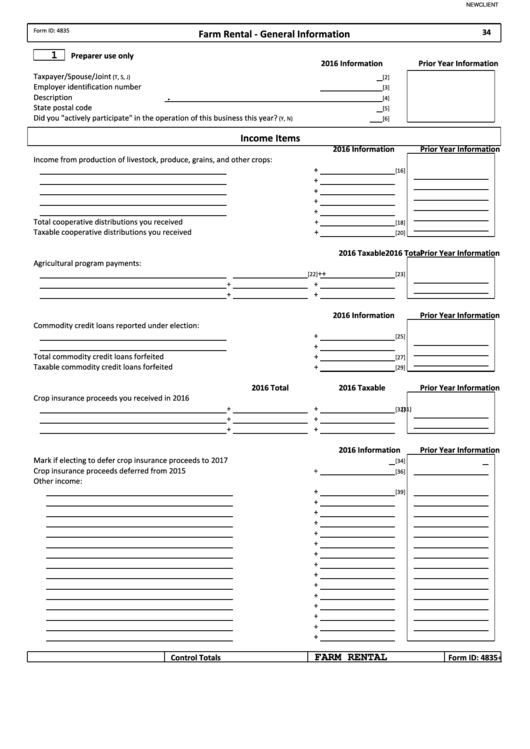

Form 4835 Fill Out and Sign Printable PDF Template signNow

Schedule F (Form 1040) Farm Tax Expenses 1981 printable pdf

Form 4835 Farm Rental and Expenses (2015) Free Download

Fillable Schedule F (Form 1040) Profit Or Loss From Farming 2015

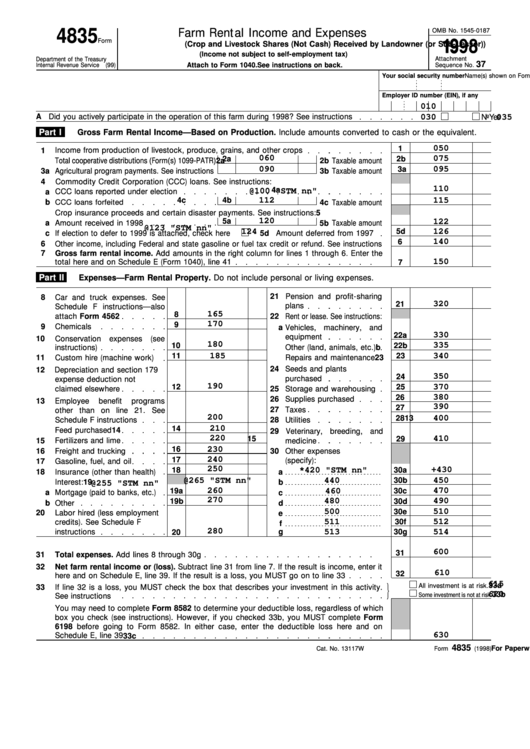

Fillable Form 4835 Farm Rental And Expenses 1998 printable

Top 13 Form 4835 Templates free to download in PDF format

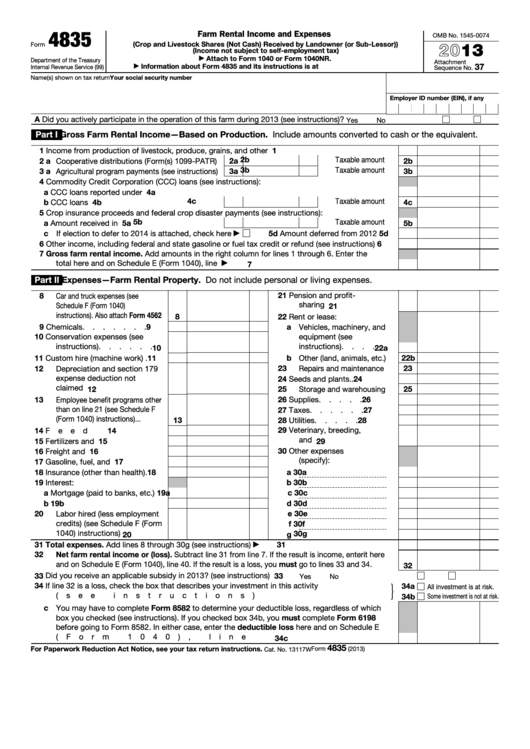

Fillable Form 4835 Farm Rental And Expenses 2013 printable

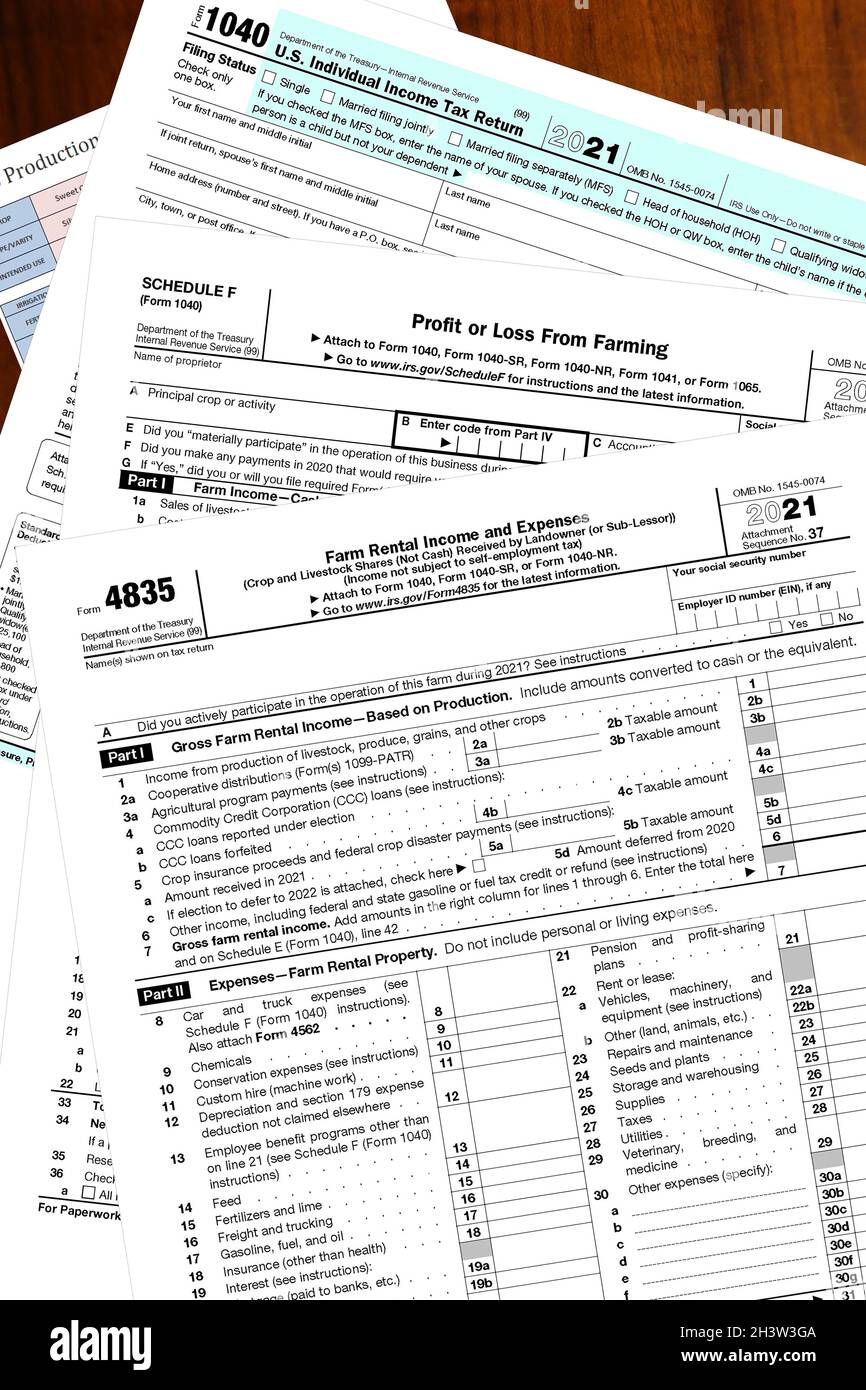

Form 4835 High Resolution Stock Photography and Images Alamy

The Fastest Way To Convert PDF To Fillable Schedule F Form 1040

Related Post: