Form 8949 Code H

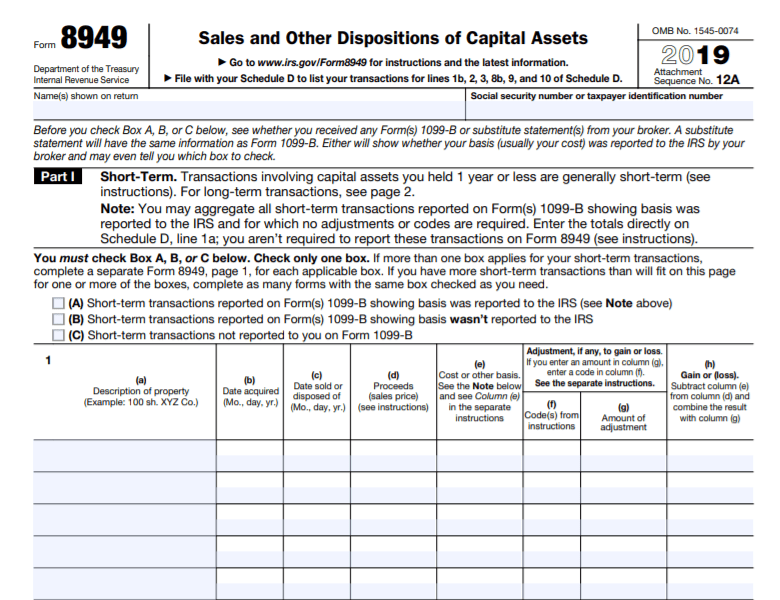

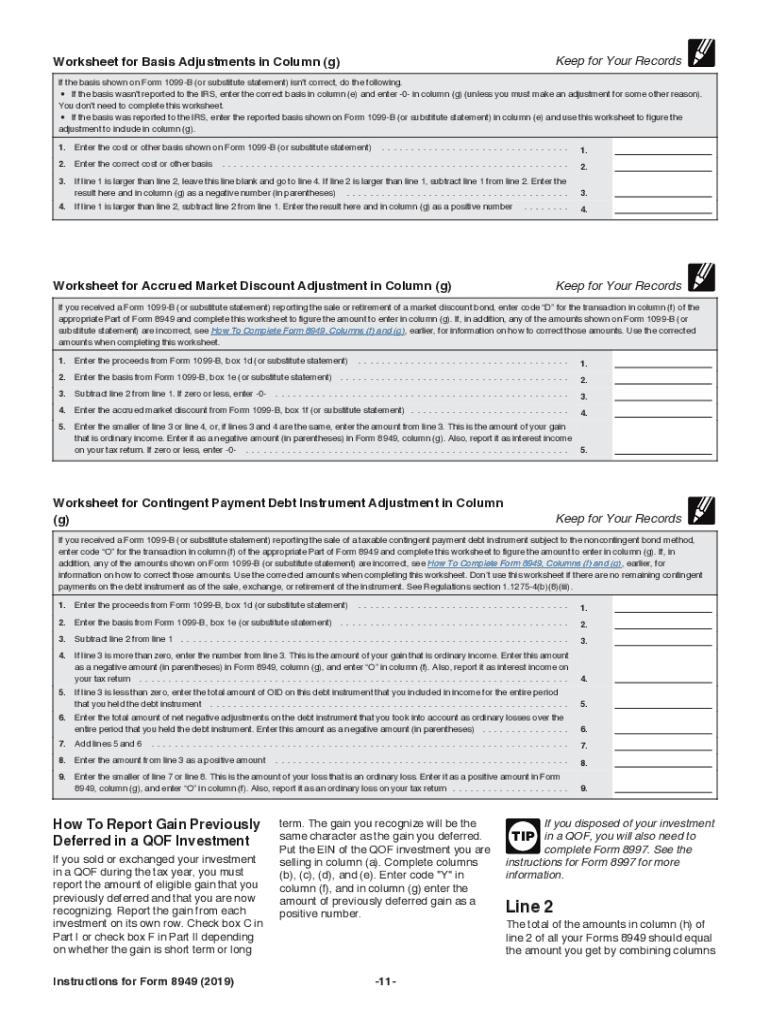

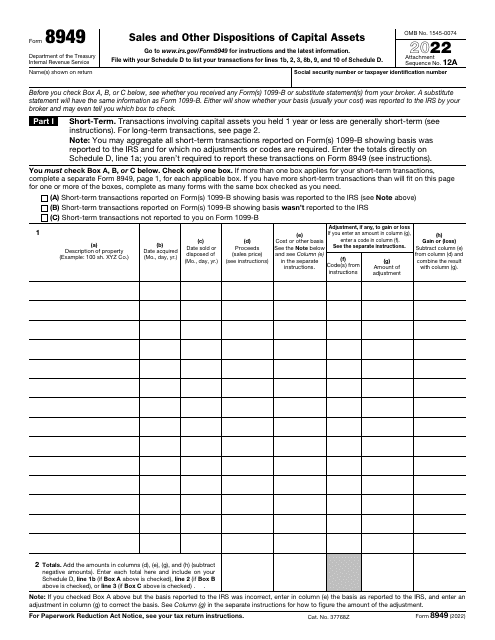

Form 8949 Code H - The adjustment amount will also be listed on form 8949 and will transfer. Report the sale or exchange. Web use form 8949 to report sales and exchanges of capital assets. This article will help you generate form 8949, column (f) for various codes in intuit lacerte. Get ready for tax season deadlines by completing any required tax forms today. The same information should be entered in part ii for any long. Web solved•by intuit•239•updated 1 year ago. Ad download or email irs 8949 & more fillable forms, register and subscribe now! Add the amounts in columns (d), (e), (g), and (h) (subtract negative. Web exclude some/all of the gain from the sale of your main home h nondeductible loss other than a wash sale* see tab r, glossary and l index, for the definition of wash sale. This article will help you generate form 8949, column (f) for various codes in intuit lacerte. Form 8949, column (f) reports. Web use form 8949 to report sales and exchanges of capital assets. Add the amounts in columns (d), (e), (g), and (h) (subtract negative. Web column (f)—code in order to explain any adjustment to gain or (loss) in column. Get ready for tax season deadlines by completing any required tax forms today. Web these adjustment codes will be included on form 8949, which will print along with schedule d. Web support form 8949 adjustment codes (1040) form 8949 adjustment codes are reported in column (f). Web use form 8949 to report sales and exchanges of capital assets. See how. The adjustment amount will also be listed on form 8949 and will transfer. Add the amounts in columns (d), (e), (g), and (h) (subtract negative. Web use form 8949 to report sales and exchanges of capital assets. Web use form 8949 to report sales and exchanges of capital assets. Then enter the amount of excluded (nontaxable) gain as a negative. The same information should be entered in part ii for any long. Web column (f)—code in order to explain any adjustment to gain or (loss) in column (g), enter the appropriate code(s) in column (f). Report the sale or exchange on form 8949 as you would if you were not taking the exclusion. Web support form 8949 adjustment codes (1040). Web exclude some/all of the gain from the sale of your main home h nondeductible loss other than a wash sale* see tab r, glossary and l index, for the definition of wash sale. Add the amounts in columns (d), (e), (g), and (h) (subtract negative. Form 8949, column (f) reports. Web for the main home sale exclusion, the code. Web file form 8949 with the schedule d for the return you are filing. Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the. Web use form 8949 to report sales and exchanges of capital assets. Web solved•by intuit•239•updated 1 year ago. Ad download or email. Add the amounts in columns (d), (e), (g), and (h) (subtract negative. Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the. Form 8949, column (f) reports. Web for the main home sale exclusion, the code is h. Ad download or email irs 8949 & more. Report the sale or exchange on form 8949 as you would if you were not taking the. See how to complete form 8949, columns (f). Get ready for tax season deadlines by completing any required tax forms today. Web for the main home sale exclusion, the code is h. Web form 8949 (sales and other dispositions of capital assets) records. Web overview of form 8949: Web solved•by intuit•239•updated 1 year ago. Add the amounts in columns (d), (e), (g), and (h) (subtract negative. Web form 8949 department of the treasury internal revenue service sales and other dispositions of capital assets go to www.irs.gov/form8949 for instructions and the. Report the sale or exchange on form 8949 as you would if you. Web solved•by intuit•239•updated 1 year ago. Ad download or email irs 8949 & more fillable forms, register and subscribe now! Web form 8949 (sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges. Web gain or loss on line 2, total the amounts for proceeds, cost or other basis, adjustments (if any). Web to include a code h for the sale of home on schedule d, form 8949, column (f) code (s), do the following: Ad download or email irs 8949 & more fillable forms, try for free now! Report the sale or exchange on form 8949 as you would if you were not taking the exclusion. Web (h) gain or (loss) subtract column (e) from column (d) and combine the result with column (g). Web exclude some/all of the gain from the sale of your main home h nondeductible loss other than a wash sale* see tab r, glossary and l index, for the definition of wash sale. Web form 8949 (sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges. Web these adjustment codes will be included on form 8949, which will print along with schedule d. The same information should be entered in part ii for any long. See how to complete form 8949, columns (f). Web column (f)—code in order to explain any adjustment to gain or (loss) in column (g), enter the appropriate code(s) in column (f). Web for the main home sale exclusion, the code is h. Get ready for tax season deadlines by completing any required tax forms today. Form 8949, column (f) reports. Web solved•by intuit•239•updated 1 year ago. Web use form 8949 to report sales and exchanges of capital assets. Report the sale or exchange. Report the sale or exchange on form 8949 as you would if you weren't. Web overview of form 8949: Web gain or loss on line 2, total the amounts for proceeds, cost or other basis, adjustments (if any) and gain or loss. Then enter the amount of excluded (nontaxable) gain as a negative number.Irs Form 8949 Printable Printable Forms Free Online

Online IRS Instructions 8949 2018 2019 Fillable and Editable PDF

Form 8949 Instructions 2020 2021 Fillable and Editable PDF Template

How To Fill Out Crypto Tax Form 8949 in HR Block Tax Software (2021

Fillable Irs Form 8949 Printable Forms Free Online

What is the IRS Form 8949 and Do You Need It? The Handy Tax Guy

Form 8949 Fillable Printable Forms Free Online

Form 8949 Example Filled Out Fill Out and Sign Printable PDF Template

IRS Form 8949 Download Fillable PDF or Fill Online Sales and Other

IRS Form 8949 instructions.

Related Post: