Form 480.6 A

Form 480.6 A - Bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. Ad create legal forms instantly. Upon the hearing, if it appears after consideration of all objections. Addition or elimination of certain areas. If you receive these forms, it is. Web as established by the puerto rico internal revenue code of 2011, as amended (code), must file this form. Web 19 rows created by jonathan cunanan, last modified on feb 10, 2020. Every person required to deduct and withhold any tax under section 1062.03 of the puerto rico. Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services rendered or to individuals for any of the. Web form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. Ad create legal forms instantly. Addition or elimination of certain areas. Indicate if the entity was granted an exemption under the. El formulario 480.6 ec solo se puede radicar por medios electrónicos a través de uno de los programas certificados por el departamento (“programas. The preparation of form 480.6a will be required when the payment not subject to withholding is. Web as established by the puerto rico internal revenue code of 2011, as amended (code), must file this form. 1 480.20(ec) 2 480.10(sc) 3 480.20(u) m. Web 19 rows created by jonathan cunanan, last modified on feb 10, 2020. Bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. Web aii. Web as established by the puerto rico internal revenue code of 2011, as amended (code), must file this form. Indicate if the entity was granted an exemption under the. Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services rendered or to individuals for any of the. Ad create legal. Web forms 480.6a and 480.6d. Web form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. Web select the form with respect to which this informative return is prepared: Ad create legal forms instantly. Where do i report form 480.6 c? Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services rendered or to individuals for any of the. Ad create legal forms instantly. Gobierno de puerto rico government of puerto rico departamento de hacienda. Web reverse of da form 2406, apr 1993. Every person required to deduct and withhold any. 1 480.20(ec) 2 480.10(sc) 3 480.20(u) m. Instantly find & download legal forms drafted by attorneys for your state. Bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. Web as established by the puerto rico internal revenue code of 2011, as amended (code), must file this form. Indicate if the. Form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services rendered or to individuals for any of the. Upon the hearing, if it appears after consideration of all. Web select the form with respect to which this informative return is prepared: Web as established by the puerto rico internal revenue code of 2011, as amended (code), must file this form. Web reverse of da form 2406, apr 1993. Form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject. Addition or elimination of certain areas. Upon the hearing, if it appears after consideration of all objections. Gobierno de puerto rico government of puerto rico departamento de hacienda. Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services rendered or to individuals for any of the. Web 19 rows created. Web what is irs form 480.6a? Indicate if the entity was granted an exemption under the. Upon the hearing, if it appears after consideration of all objections. Web reverse of da form 2406, apr 1993. The preparation of form 480.6a will be required when the payment not subject to withholding is $500 or more. Gobierno de puerto rico government of puerto rico departamento de hacienda. Ad create legal forms instantly. Web 19 rows created by jonathan cunanan, last modified on feb 10, 2020. Bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. Web forms 480.6a and 480.6d. El formulario 480.6 ec solo se puede radicar por medios electrónicos a través de uno de los programas certificados por el departamento (“programas. Indicate if the entity was granted an exemption under the. Web reverse of da form 2406, apr 1993. 1 480.20(ec) 2 480.10(sc) 3 480.20(u) m. Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services rendered or to individuals for any of the. Form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. Addition or elimination of certain areas. Instantly find & download legal forms drafted by attorneys for your state. Where do i report form 480.6 c? Every person required to deduct and withhold any tax under section 1062.03 of the puerto rico. The preparation of form 480.6a will be required when the payment not subject to withholding is $500 or more. Web as established by the puerto rico internal revenue code of 2011, as amended (code), must file this form. Web select the form with respect to which this informative return is prepared: Web what is irs form 480.6a? Web form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding.20192023 PR Form 480.20(U) Fill Online, Printable, Fillable, Blank

480 7a 2018 Fill Online, Printable, Fillable, Blank pdfFiller

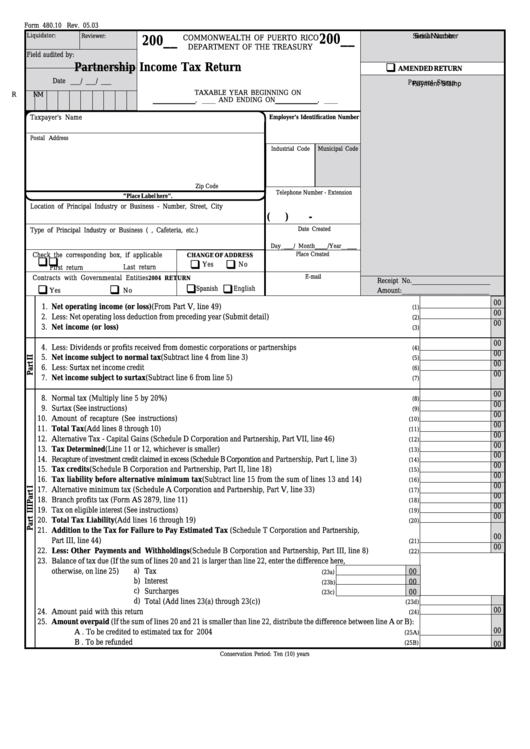

Form 480.10 Partnership Tax Return printable pdf download

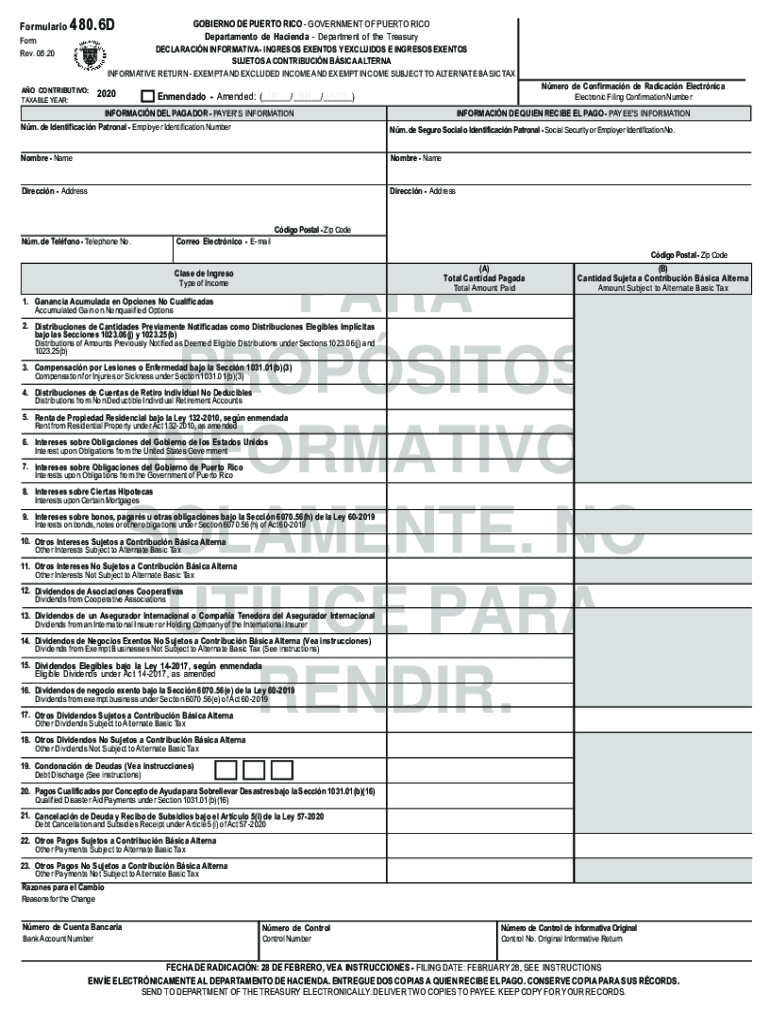

Form 480 6d puerto rico Fill out & sign online DocHub

480.6A 2019 Public Documents 1099 Pro Wiki

2007 Form PR 480.6DFill Online, Printable, Fillable, Blank pdfFiller

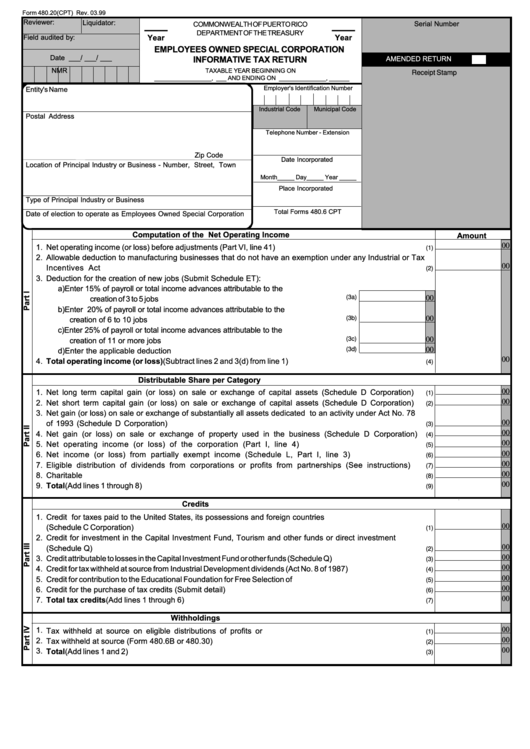

Form 480.20(Cpt) Employees Owned Special Corporation Informative Tax

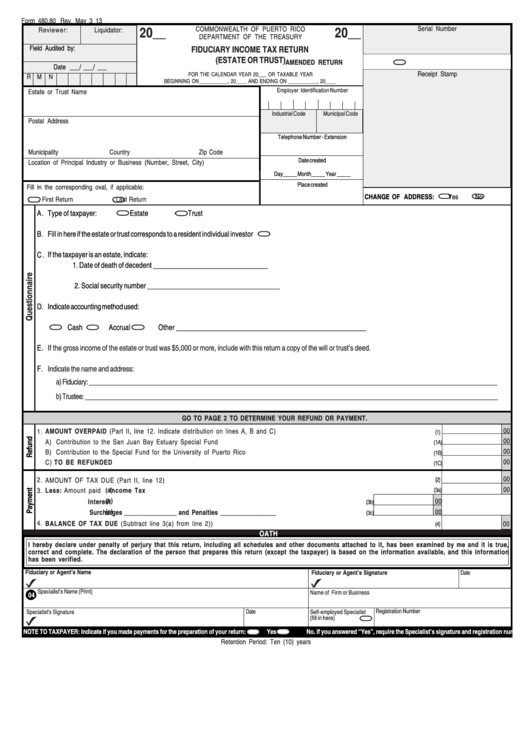

Form 480.80 Fiduciary Tax Return (Estate Or Trust) 2013

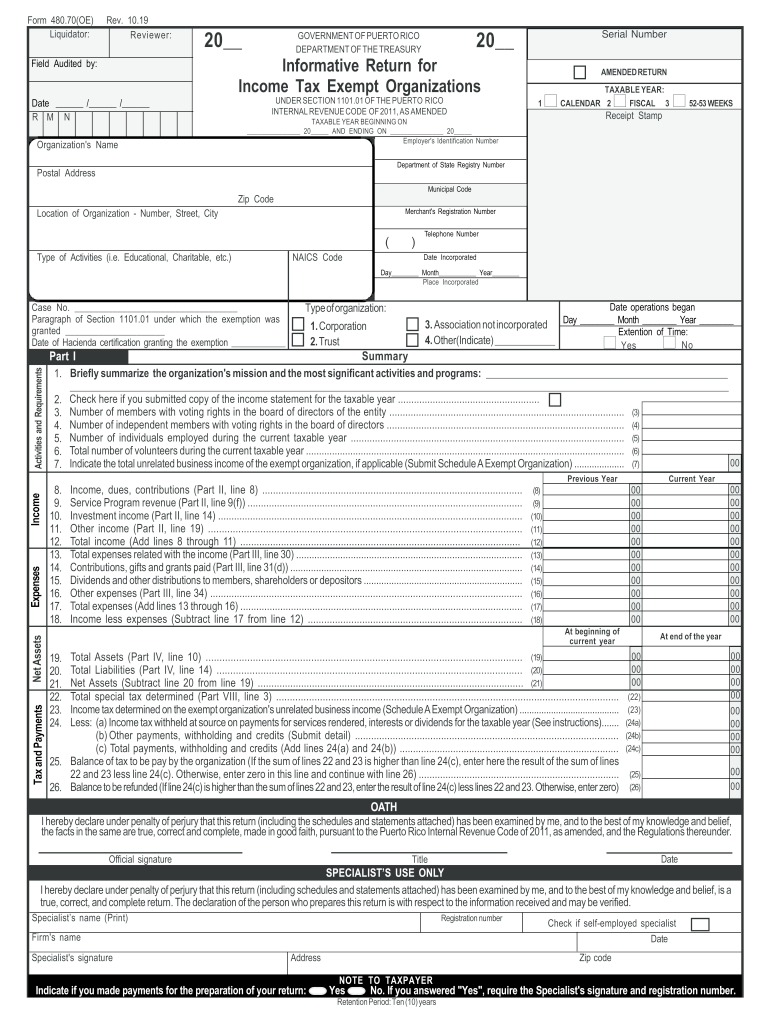

20192023 Form PR 480.70(OE)Fill Online, Printable, Fillable, Blank

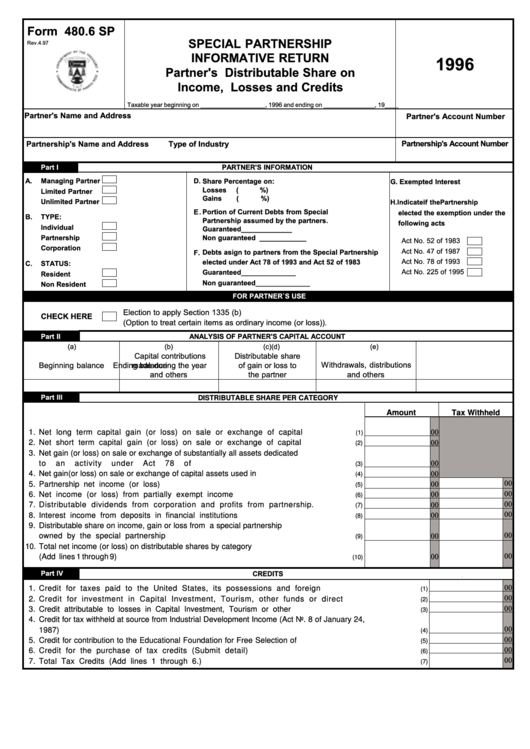

Form 480.6 Sp Partner'S Distributable Share On Losses And

Related Post: