Etrade Form 3922

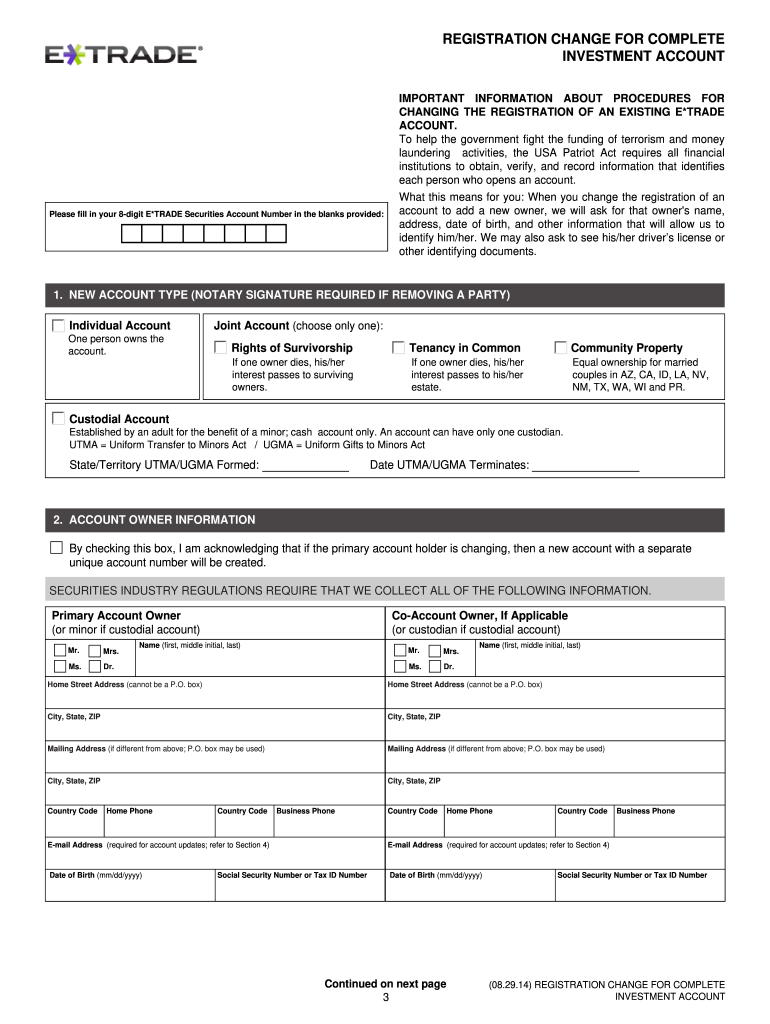

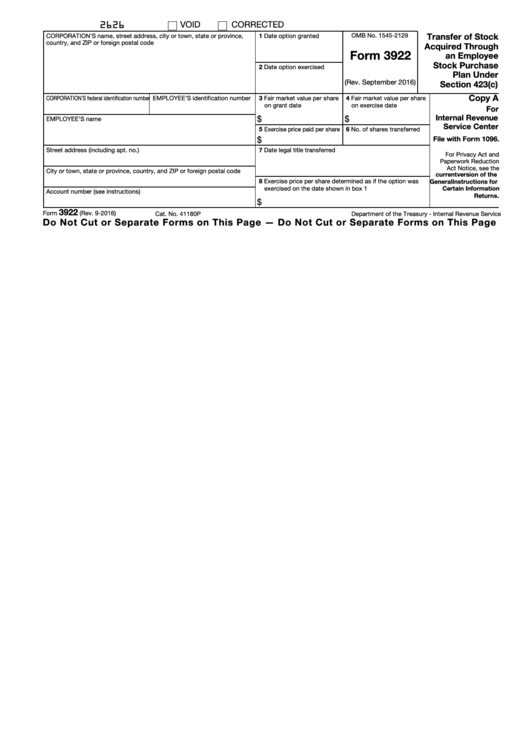

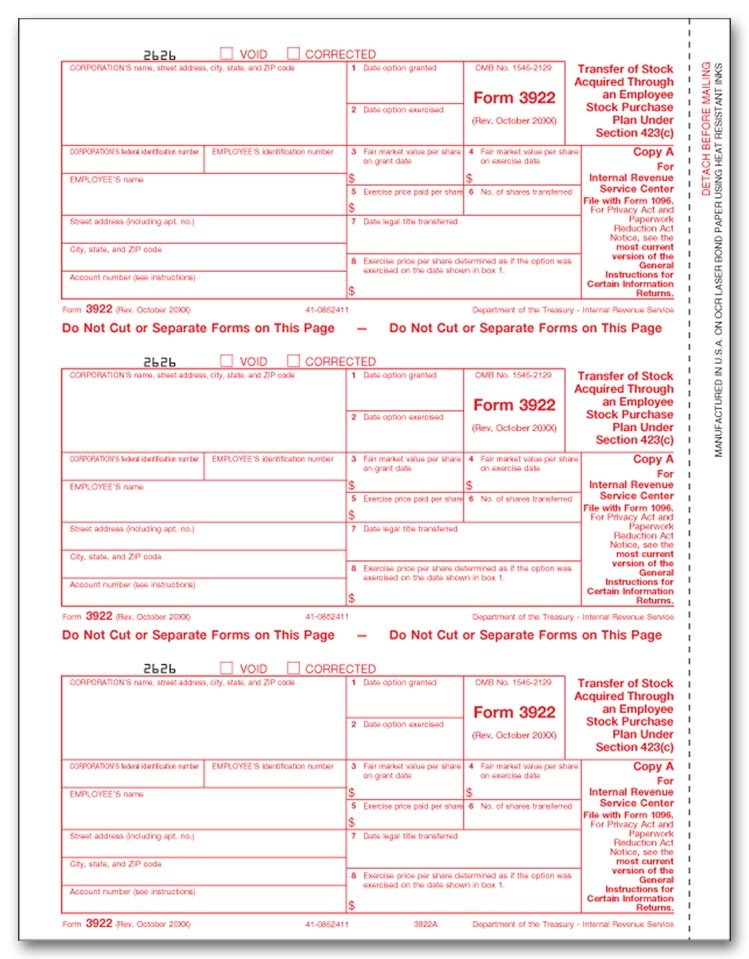

Etrade Form 3922 - Ad we’re all about helping you get more from your money. In the screen you posted. Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), including recent updates, related forms, and instructions on how to file. Web 1 best answer. That is, following the procedures that you. Your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), if you purchased espp stock. Web an espp is a schedule that enable you to set off cash from your paycheck which is than used to purchase shares of your company’s stock, often at a discount. As a reminder, fidelity does not provide tax advice. Web since you've already received the form from your employer and are simply looking for a pdf version, let's cut to the chase with a link to the form from the irs website. Web form 3921 is required when an employee (or former employee) exercises an iso, and form 3922 is required when a corporation records a transfer of legal title of shares acquired under an espp (including to a broker or other financial institution) when either. Web i finally found the form 3922 from 2018 which had the info about this sale. Web form 3921 is required when an employee (or former employee) exercises an iso, and form 3922 is required when a corporation records a transfer of legal title of shares acquired under an espp (including to a broker or other financial institution) when either.. The portfolios, watchlists, gains & losses, and estimated income webpages on etrade.com are provided as tools to assist. Web 1 best answer. Kindly guide me on how to enter that in tt: In the screen you posted. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), if you purchased espp stock. In the screen you posted. The portfolios, watchlists, gains & losses, and estimated income webpages on etrade.com are provided as tools to assist. Web an espp is a schedule that enable you to set off. In general for turbotax, you must enter the 1099b as it appears and make the adjustments elsewhere. The form includes the information needed to figure a person's compensation income, basis, and qualifying holding period in the espp shares, but not the selling price for the shares. Web i used deluxe, but 2020 was more straight forward than ever, asking directly. If you did not sell any shares this year you don't need to enter this form. Web when would you need to file a 3922? Web informational with form 3922, transfer of stock acquired through somebody employee stock purchase plan under section 423(c), including actual updates, family forms, and operating on how in file. 1) should i update the total. Kindly guide me on how to enter that in tt: Check out the tax center here to find relevant tax documents and other resources. Web form 3921 is required when an employee (or former employee) exercises an iso, and form 3922 is required when a corporation records a transfer of legal title of shares acquired under an espp (including to. Web generally, form 3922 is issued for informational purposes only unless stock acquired through an employee stock purchase plan under section 423 (c) is sold or otherwise disposed of. Corporations file form 3922 for each transfer of. Check out the tax center here to find relevant tax documents and other resources. That is, following the procedures that you. Web download. As a reminder, fidelity does not provide tax advice. Web informational with form 3922, transfer of stock acquired through somebody employee stock purchase plan under section 423(c), including actual updates, family forms, and operating on how in file. If you did not sell any shares this year you don't need to enter this form. Web form 3922, transfer of stock. Corporations file form 3922 for each transfer of stock obtained. If your corporation transfers the legal title of a share of stock, and the option is exercised under an employee stock purchase plan, you must file form 3922 for each transfer. In general for turbotax, you must enter the 1099b as it appears and make the adjustments elsewhere. Web when. Web an espp is a program that enabled you to set aside money upon my paycheck that is than used to purchase shares of your company’s stock, often at a discount. Web i finally found the form 3922 from 2018 which had the info about this sale. Web informational with form 3922, transfer of stock acquired through somebody employee stock. Web an espp is a schedule that enable you to set off cash from your paycheck which is than used to purchase shares of your company’s stock, often at a discount. Your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), if you purchased espp stock. If you did not sell any shares this year you don't need to enter this form. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. That is, following the procedures that you. Web form 3921 is required when an employee (or former employee) exercises an iso, and form 3922 is required when a corporation records a transfer of legal title of shares acquired under an espp (including to a broker or other financial institution) when either. I see the following options: There are many exceptions for filing a 3922, including. Access our wide suite of tools. 1) should i update the total cost basis (sum off all 1e) with the adjusted cost. Web 1 best answer. In general for turbotax, you must enter the 1099b as it appears and make the adjustments elsewhere. Web irs form 3922. Web informational with form 3922, transfer of stock acquired through somebody employee stock purchase plan under section 423(c), including actual updates, family forms, and operating on how in file. Web when would you need to file a 3922? Web information about form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), including recent updates, related forms, and instructions on how to file. The form includes the information needed to figure a person's compensation income, basis, and qualifying holding period in the espp shares, but not the selling price for the shares. Get ready for tax season deadlines by completing any required tax forms today. Open an account & let's get started. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 433 • updated 1 year ago.Etrade registration change form Fill out & sign online DocHub

IRS Form 3922

What Is IRS Form 3922?

IRS Form 3922 Software 289 eFile 3922 Software

Etrade Tax Form 2023 Printable Forms Free Online

File IRS Form 3922 Online EFile Form 3922 for 2022

Top 6 Form 3922 Templates free to download in PDF format

3922 Laser Tax Forms, Copy A

3922 2020 Public Documents 1099 Pro Wiki

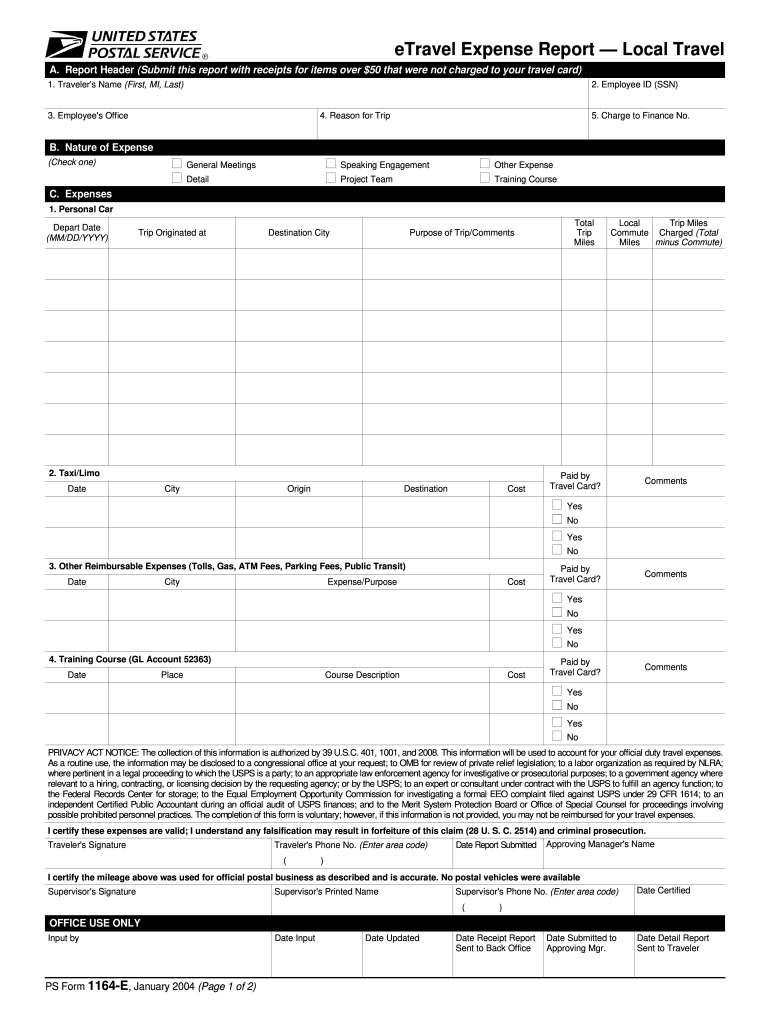

Usps Claim Form Printable Printable Form, Templates and Letter

Related Post: