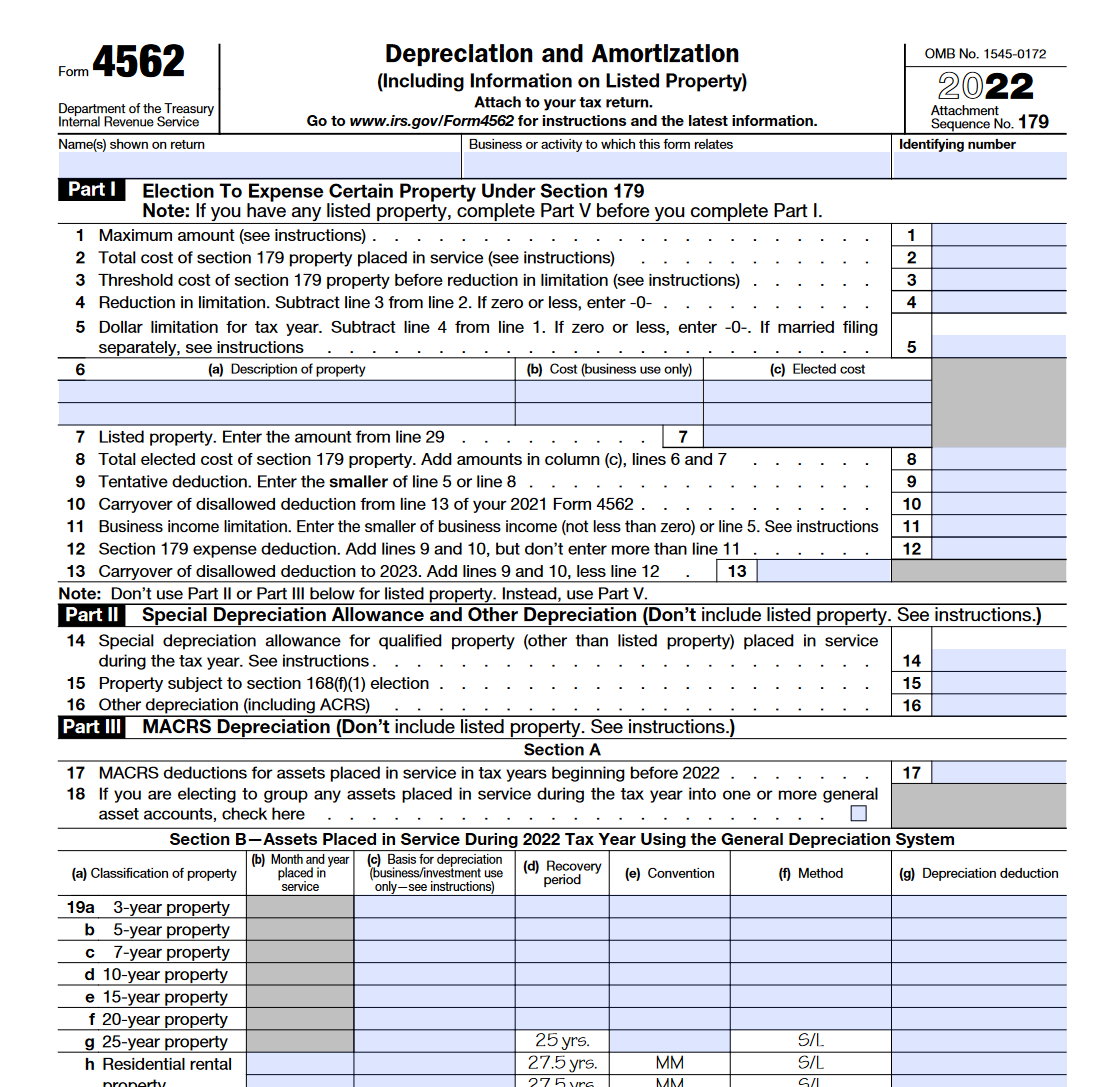

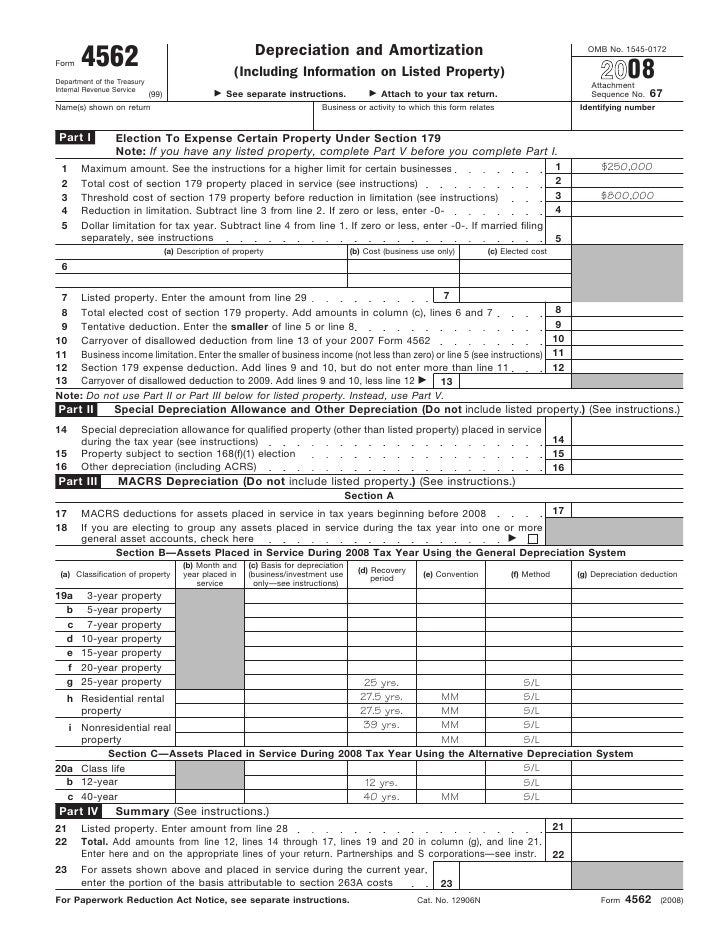

Form 4562 Depreciation And Amortization

Form 4562 Depreciation And Amortization - Web purpose of form use form 4562 to: Learn what assets should be included on form 4562, as. Depreciation and amortization is the name of this form, but it has additional uses beyond those two ways to claim expenses. To complete form 4562, you'll need to know the cost. Web form 4562, depreciation and amortization (including information on listed property), is generally completed in taxslayer pro via the depreciation module. Web when you file form 4562 each year, you can receive an annual tax benefit for depreciation and amortization even if you cannot deduct the entire cost of any. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. This report is sorted by balancing segment, fiscal year added,. Such items as the costs of starting a expenses for business use of your home • the original. Web you can amortize business for purposes of deducting form 4562 filed with either: Web use form 4562 to figure your deduction for depreciation and amortization. Irs form 4562is used to calculate and claim deductions for depreciation and amortization. Web purpose of form use form 4562 to: Web form 4562, depreciation and amortization (including information on listed property), is generally completed in taxslayer pro via the depreciation module. Some intangible assets such as trademarks. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Attach form 4562 to your tax return for the current tax year if you are claiming any of the following. Such items as the costs. Web open screen 22, depreciation (4562). In the show assets for list, click the form that relates to the amortization expense.; Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. • claim your deduction for depreciation and amortization, • make the election under section 179 to expense certain property, and. Web section 179 reduction. Web use form 4562 to figure your deduction for depreciation and amortization. In line 2 > macrs convention; Web however, you can deduct a portion of your costs each year by claiming a depreciation deduction and reporting it on irs form 4562, depreciation and. Web solved•by turbotax•1641•updated january 13, 2023. Web when you file form 4562 each year, you can receive an annual tax benefit for depreciation and amortization even if you cannot deduct the entire cost of any. Web section 179 reduction. Web irs form 4562: Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web irs form 4562. Web purpose of form use form 4562 to: Web open screen 22, depreciation (4562). Web irs form 4562 amortization and depreciation is the form companies must file to deduct a part or the entire value of assets and property they use in their trade or. I have entered data in screen 4562, but the. Form 4562 is used to claim. Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the. Web form 4562, depreciation and amortization (including information on listed property), is generally completed in taxslayer pro via the depreciation module. Web open screen 22, depreciation (4562). Web go to federal > depreciation overrides and depletion options; Such items as the costs of. Such items as the costs of starting a expenses for business use of your home • the original. • claim your deduction for depreciation and amortization, • make the election under section 179 to expense certain property, and •. Lists asset depreciation amounts for the specified fiscal year. Web irs form 4562: Attach form 4562 to your tax return for. Such items as the costs of starting a expenses for business use of your home • the original. Web you can amortize business for purposes of deducting form 4562 filed with either: In line 2 > macrs convention; Lists asset depreciation amounts for the specified fiscal year. I have entered data in screen 4562, but the. Such items as the costs of starting a expenses for business use of your home • the original. Web solved•by turbotax•1641•updated january 13, 2023. Web however, you can deduct a portion of your costs each year by claiming a depreciation deduction and reporting it on irs form 4562, depreciation and. Attach form 4562 to your tax return for the current. Web form 4562 is a comprehensive document containing multiple sections that help taxpayers report their business assets’ annual depreciation and amortization. Such items as the costs of starting a expenses for business use of your home • the original. Web use form 4562 to figure your deduction for depreciation and amortization. Web however, you can deduct a portion of your costs each year by claiming a depreciation deduction and reporting it on irs form 4562, depreciation and. Web federal depreciation and amortization (including information on listed property) form 4562 pdf. Web irs form 4562: Web go to federal > depreciation overrides and depletion options; Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web you can amortize business for purposes of deducting form 4562 filed with either: • claim your deduction for depreciation and amortization, • make the election under section 179 to expense certain property, and •. I have entered data in screen 4562, but the. This report is sorted by balancing segment, fiscal year added,. Web form 4562, depreciation and amortization (including information on listed property), is generally completed in taxslayer pro via the depreciation module. Attach form 4562 to your tax return for the current tax year if you are claiming any of the following. In the asset list, click add.; Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. To complete form 4562, you'll need to know the cost. Web when you file form 4562 each year, you can receive an annual tax benefit for depreciation and amortization even if you cannot deduct the entire cost of any. Web purpose of form use form 4562 to: Learn what assets should be included on form 4562, as.IRS Form 4562. Depreciation and Amortization Forms Docs 2023

Form 4562 Depreciation And Amortization Worksheet

Form 4562Depreciation and Amortization

2020 Form 4562 Depreciation and Amortization7 YouTube

Form 4562 Depreciation and Amortization YouTube

IRS Form 4562 walkthrough (Depreciation and Amortization) YouTube

Download Instructions for IRS Form 4562 Depreciation and Amortization

About Form 4562, Depreciation and Amortization IRS tax forms

Form 4562 Depreciation and Amortization DocumentsHelper

Learn How to Fill the Form 4562 Depreciation and Amortization YouTube

Related Post: