Form 8840 是什么

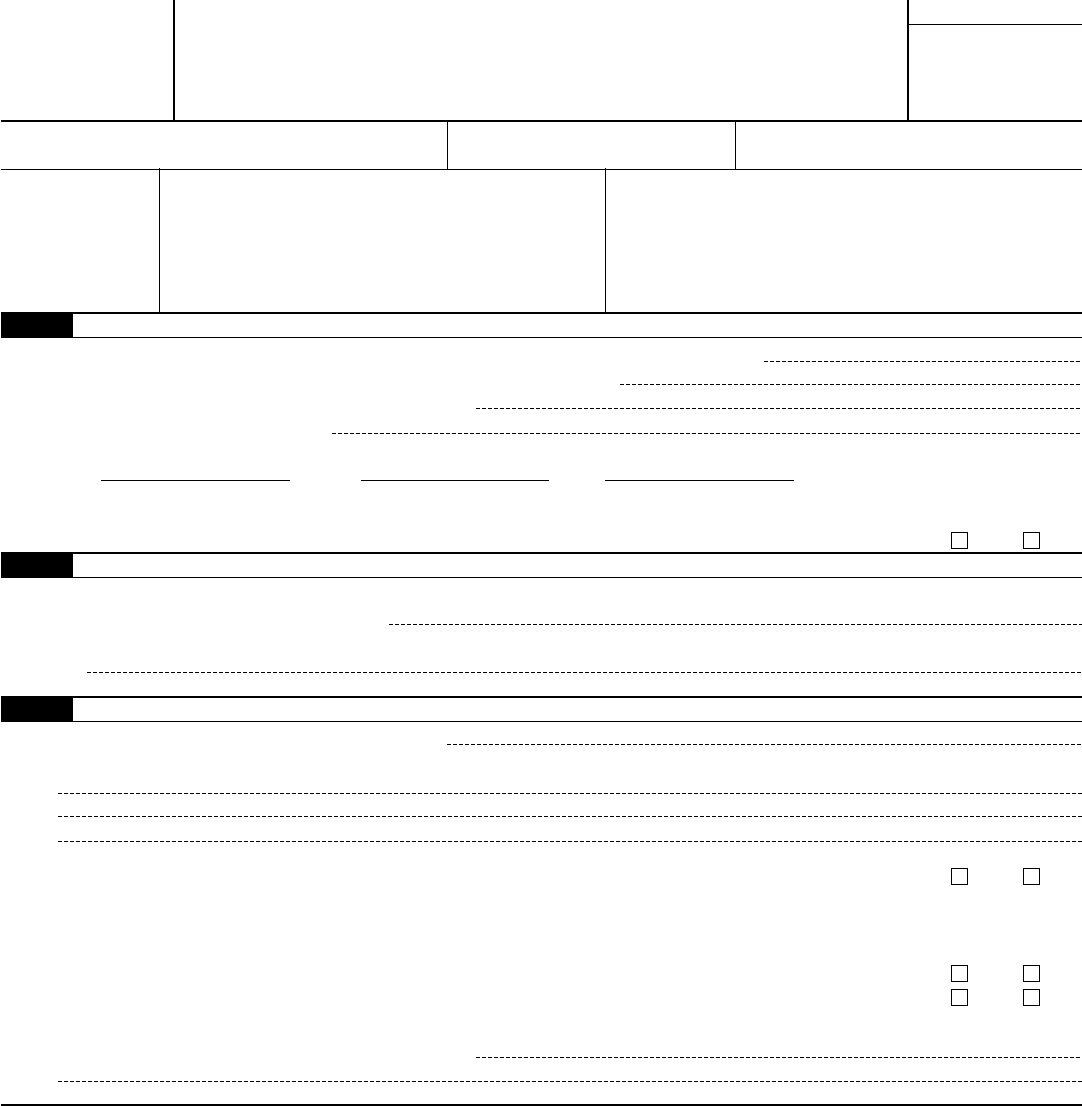

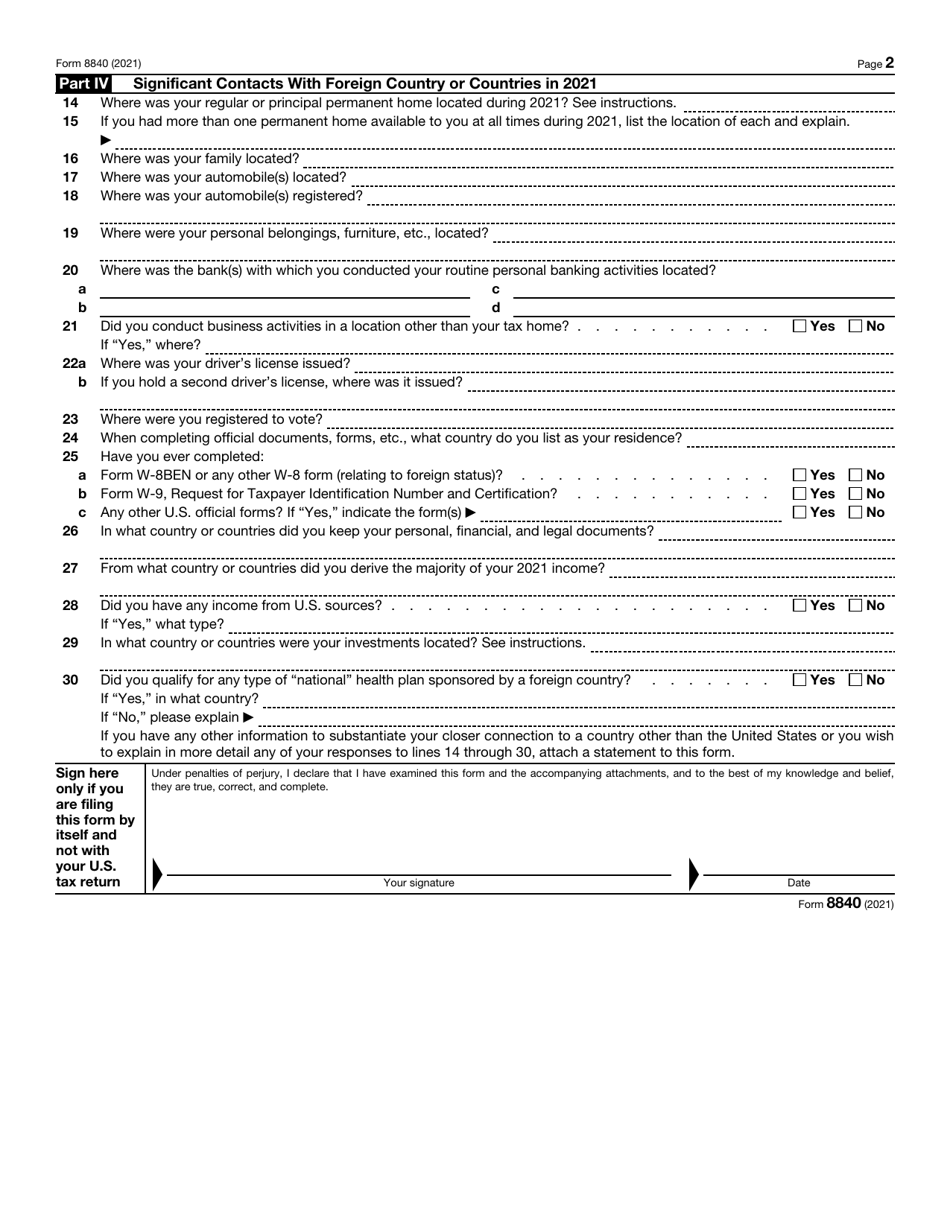

Form 8840 是什么 - Web 如果你是non resident, 现在据说不用file 8833也可以claim tax treaty, 只要你在1040 nr 最后一页item l指明你用的是哪个tax treaty (前两年form 1040 nr大改过一次,. 2 part iv significant contacts with foreign country or countries in 2019 14. Web who should file form 8840? Should assess whether they should be filing form 8840. Web 这个8843表的全名是:个人免除和个人健康状况声明 (statement for exempt individuals and individuals with a medical condition)。. Department of the treasury internal revenue service. Web form 8840 and the cra. Try it for free now! 8840 (2019) form 8840 (2019) page. When a person is neither a u.s. Should assess whether they should be filing form 8840. The form 8840 is an international tax form that is used as an irs exception to the substantial presence test. Closer connection exception statement for aliens. Web information about form 8840, closer connection exception statement for aliens, including recent updates, related forms, and instructions on how to file. However, since you. Closer connection exception statement for aliens. When a person is neither a u.s. Complete, edit or print tax forms instantly. Where was your regular or. Web 如果你是non resident, 现在据说不用file 8833也可以claim tax treaty, 只要你在1040 nr 最后一页item l指明你用的是哪个tax treaty (前两年form 1040 nr大改过一次,. Web 这篇文章,我们主要讲如何申报“海外金融账户(fbar)”和“海外金融资产(form 8938)”;另外两篇文章,我们将详解如何申报“海外股权(form 5471)”和“境外信托及赠与(form 3520)”。 The form 8840 is an international tax form that is used as an irs exception to the substantial presence test. 正式名称为外籍劳工移民申请(immigrant petition for alien worker),是美国雇主向美国公民及移民服务局提交的一种文件, 该文件旨在为其外籍. The 8840 closer connection example may help alleviate u.s. Web form 8840 and the cra. Unlike other irs forms, form 8840 is simple and lesser complicated to file. The 8840 closer connection example may help alleviate u.s. Web 这个8843表的全名是:个人免除和个人健康状况声明 (statement for exempt individuals and individuals with a medical condition)。. Web 这篇文章,我们主要讲如何申报“海外金融账户(fbar)”和“海外金融资产(form 8938)”;另外两篇文章,我们将详解如何申报“海外股权(form 5471)”和“境外信托及赠与(form 3520)”。 2 part iv significant contacts with foreign country or countries in 2019 14. Web 如果你是non resident, 现在据说不用file 8833也可以claim tax treaty, 只要你在1040 nr 最后一页item l指明你用的是哪个tax treaty (前两年form 1040 nr大改过一次,. The form 8840 is an international tax form that is used as an irs exception to the substantial presence test. Web instructions for how to fill irs form 8840. 8840 (2019) form 8840 (2019) page. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. When a person is neither a u.s. Canadian snowbirds and those who spend a fair amount of time in the u.s. 正式名称为外籍劳工移民申请(immigrant petition for alien worker),是美国雇主向美国公民及移民服务局提交的一种文件, 该文件旨在为其外籍. When a person is neither a u.s. Where was your regular or. Web 这篇文章,我们主要讲如何申报“海外金融账户(fbar)”和“海外金融资产(form 8938)”;另外两篇文章,我们将详解如何申报“海外股权(form 5471)”和“境外信托及赠与(form 3520)”。 Should assess whether they should be filing form 8840. The form 8840 is an international tax form that is used as an irs exception to the substantial presence test. Complete, edit or print tax forms instantly. Canadian snowbirds and those who spend a fair amount of time in the u.s. 2 part iv significant contacts with foreign country or countries in 2019 14. Where was your regular or. Try it for free now! However, since you are new to it, you. 8840 (2019) form 8840 (2019) page. Canadian snowbirds and those who spend a fair amount of time in the u.s. Complete, edit or print tax forms instantly. Web 这个8843表的全名是:个人免除和个人健康状况声明 (statement for exempt individuals and individuals with a medical condition)。. The 8840 closer connection example may help alleviate u.s. Complete, edit or print tax forms instantly. 正式名称为外籍劳工移民申请(immigrant petition for alien worker),是美国雇主向美国公民及移民服务局提交的一种文件, 该文件旨在为其外籍. Web 如果你是non resident, 现在据说不用file 8833也可以claim tax treaty, 只要你在1040 nr 最后一页item l指明你用的是哪个tax treaty (前两年form 1040 nr大改过一次,. The form 8840 is an international tax form that is used as an irs exception to the substantial presence test. 2 part iv significant contacts with foreign country or countries in 2019. Canadian snowbirds and those who spend a fair amount of time in the u.s. Should assess whether they should be filing form 8840. When a person is neither a u.s. Complete, edit or print tax forms instantly. Unlike other irs forms, form 8840 is simple and lesser complicated to file. Upload, modify or create forms. Where was your regular or. Web • 183 days during the period 2022, 2021, and 2020, counting all the days of physical presence in 2022 but only 1/3 the number of days of presence in 2021 However, filing form 8840 with the irs. 8840 (2019) form 8840 (2019) page. Web 这个8843表的全名是:个人免除和个人健康状况声明 (statement for exempt individuals and individuals with a medical condition)。. Web who should file form 8840? However, since you are new to it, you. When a person is neither a u.s. Web instructions for how to fill irs form 8840. Department of the treasury internal revenue service. Web 这篇文章,我们主要讲如何申报“海外金融账户(fbar)”和“海外金融资产(form 8938)”;另外两篇文章,我们将详解如何申报“海外股权(form 5471)”和“境外信托及赠与(form 3520)”。 The 8840 closer connection example may help alleviate u.s. Web 根据美国国税局规定,凡是持有 f (学生)、j (公费)、m (观光) 签证的外籍学生,或是持 j (访问)、q (交换) 的外籍学者,不论是否有工作或收入,只要是暂时居留在美国,都必须向国税局递交一份个人数据说明书 (form 8843),并申报联邦税表1040 nr (u. Tax issues if a foreign national qualifies as a resident for tax purpose using.IRS Form 8840 Download Fillable PDF or Fill Online Closer Connection

Guide Tax Form 8840 by accounting advice on Dribbble

Fillable Online 2003 Form 8840. Closer Connection Exception Statement

Form 8840 Closer Connection Exception Statement for Aliens (2015

2020 Form IRS 8843 Fill Online, Printable, Fillable, Blank pdfFiller

2017 Form 8840 Edit, Fill, Sign Online Handypdf

IRS Form 8840 Download Fillable PDF or Fill Online Closer Connection

Form 8840 year 2023 Fill online, Printable, Fillable Blank

2023 Irs Gov Forms Fillable Printable Pdf And Forms Handypdf CLOUD

Why Is IRS Tax Form 8840 Important for Canadian Snowbirds?

Related Post: