Form 3922 Turbotax

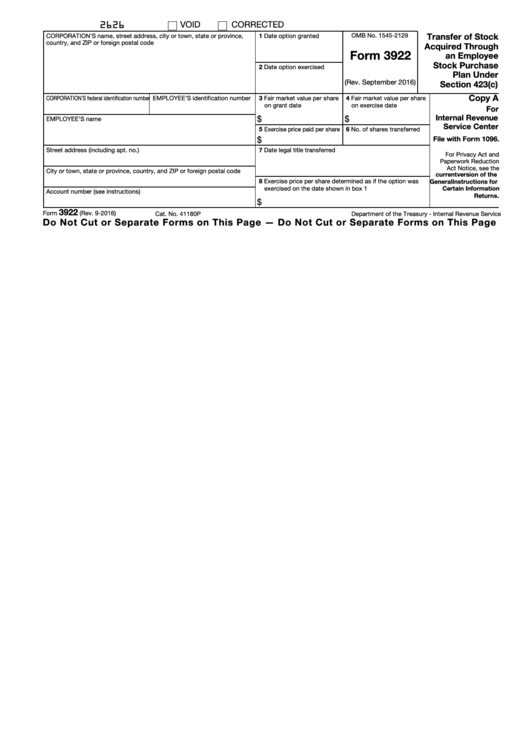

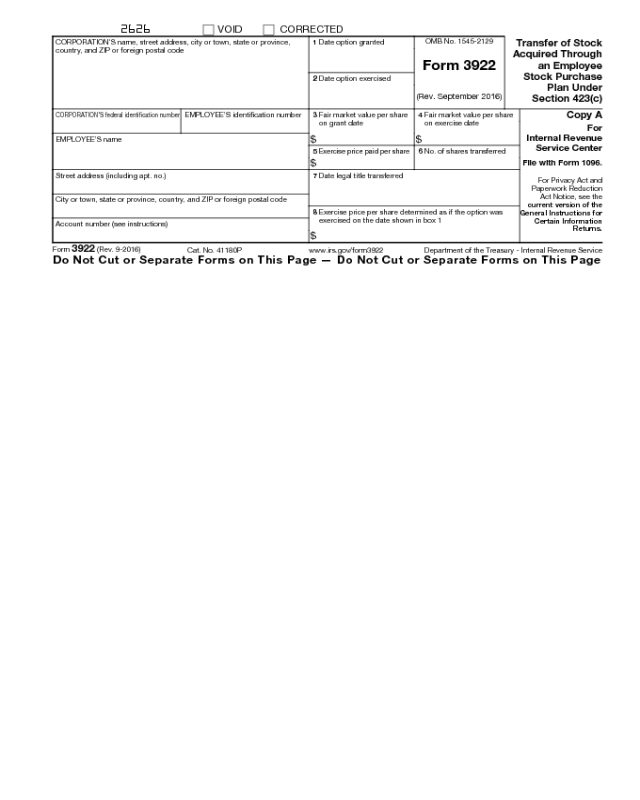

Form 3922 Turbotax - What is the purpose of irs form 3922? Ad save time and money with professional tax planning & preparation services. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Set up an irs payment plan. Click on take me to my return. Your employer will send you form 3922,. Irs form 3922 is an informational form issued by companies to employees who have participated in the employee stock purchase. Web form 3922 is an informational statement and would not be entered into the tax return. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Keep the form for your records because you’ll need the information when you sell, assign, or. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Ad tax preparation services ordered online in less than 10 minutes. Web who must file. Click on take me to my return. You will need the information reported on form 3922 to determine stock basis. What is irs form 3922? Web irs form 3922 is for informational purposes only and isn't entered into your return. Web 1 best answer irenes intuit alumni if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. Web form 3922 transfer of stock acquired through an employee stock purchase plan under. Keep the form for your records because you’ll need the information when you sell, assign, or. Your employer will send you form 3922,. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web instructions for forms 3921 and 3922 (rev. What is the purpose of irs form. Web form 3922 is an informational statement and would not be entered into the tax return. Ad tax preparation services ordered online in less than 10 minutes. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and is not entered into your. Solved•by turbotax•16130•updated march 13,. Click on take me to my return. Web you should have received form 3922 when you exercised your stock options. Sign in or open turbotax. Web 1 best answer irenes intuit alumni if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. Instructions for forms 3921 and 3922, exercise of an. Web who must file. Ad save time and money with professional tax planning & preparation services. Web instructions for forms 3921 and 3922 (rev. What is irs form 3922? Form 3922 is an irs tax form used by corporations to report the transfer of stock options acquired by employees under the. Irs form 3922 is an informational form issued by companies to employees who have participated in the employee stock purchase. Pay the lowest amount of taxes possible with strategic planning and preparation Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and is not entered into. Web what is irs form 3922? Ad tax preparation services ordered online in less than 10 minutes. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option. Pay the lowest amount of taxes possible with strategic planning and preparation Web instructions for forms 3921 and. Web espp form 3922 box 8 united states (english) united states (spanish) canada (english) canada (french) full service for personal taxes tax refund calculator. Web generally, form 3922 is issued for informational purposes only unless stock acquired through an employee stock purchase plan under section 423(c) is sold or otherwise. Transfer of stock acquired through an employee stock purchase plan. Form 3922 is an irs tax form used by corporations to report the transfer of stock options acquired by employees under the. Sign in or open turbotax. Web irs form 3922 is for informational purposes only and isn't entered into your return. Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is. Click on take me to my return. Solved•by turbotax•16130•updated march 13, 2023. Web form 3922 is an informational statement and would not be entered into the tax return. Form 3922 is an irs tax form used by corporations to report the transfer of stock options acquired by employees under the. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. You will need the information reported on form 3922 to determine stock basis. Keep the form for your records because you’ll need the information when you sell, assign, or. Web 1 best answer irenes intuit alumni if you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee. Web irs form 3922 is for informational purposes only and isn't entered into your return. Web who must file. Sign in or open turbotax. Transfer of stock acquired through an employee stock purchase plan under section 423(c) copy a. Set up an irs payment plan. Web instructions for forms 3921 and 3922 (rev. Web what is irs form 3922? Where do i enter form 3922? Your employer will send you form 3922,. Pay the lowest amount of taxes possible with strategic planning and preparation Ad tax preparation services ordered online in less than 10 minutes. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and is not entered into your.Top 6 Form 3922 Templates free to download in PDF format

Form 3922 Edit, Fill, Sign Online Handypdf

Form 3922 Transfer of Stock Acquired Through An Employee Stock

3922 Forms, Employee Stock Purchase, Employee Copy B DiscountTaxForms

Laser Tax Form 3922 Copy A Free Shipping

3922 2020 Public Documents 1099 Pro Wiki

IRS Form 3922 Software 289 eFile 3922 Software

File IRS Form 3922 Online EFile Form 3922 for 2022

IRS Form 3922 Instructions 2022 How to Fill out Form 3922

IRS Form 3922

Related Post: