Form 3115 Instructions

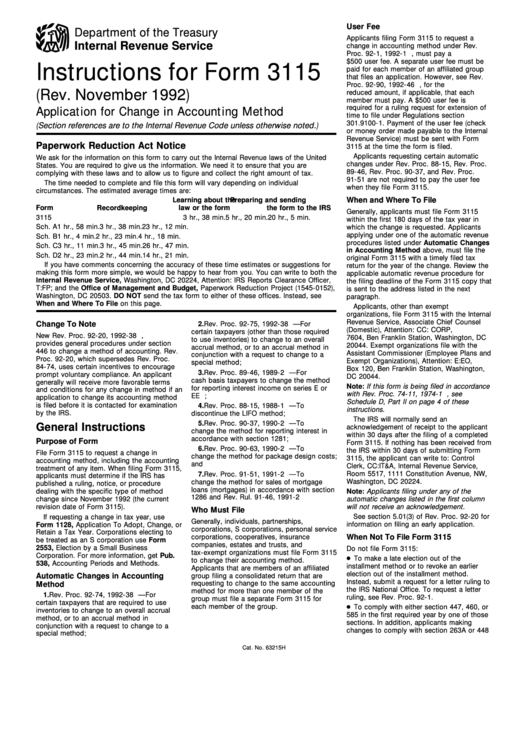

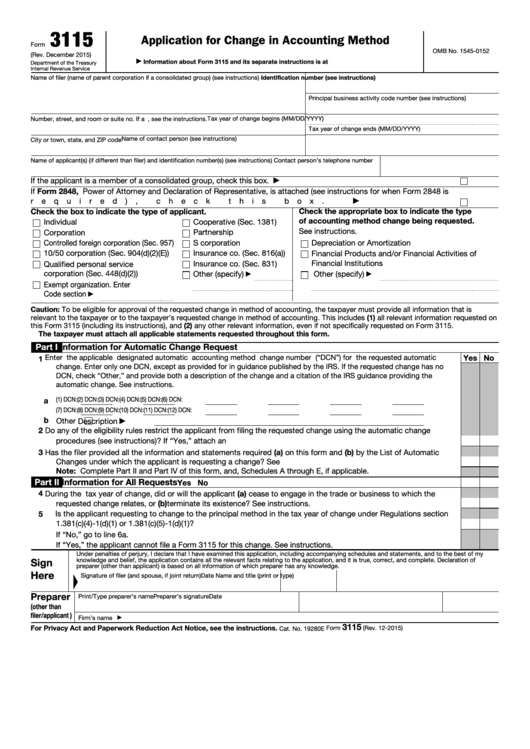

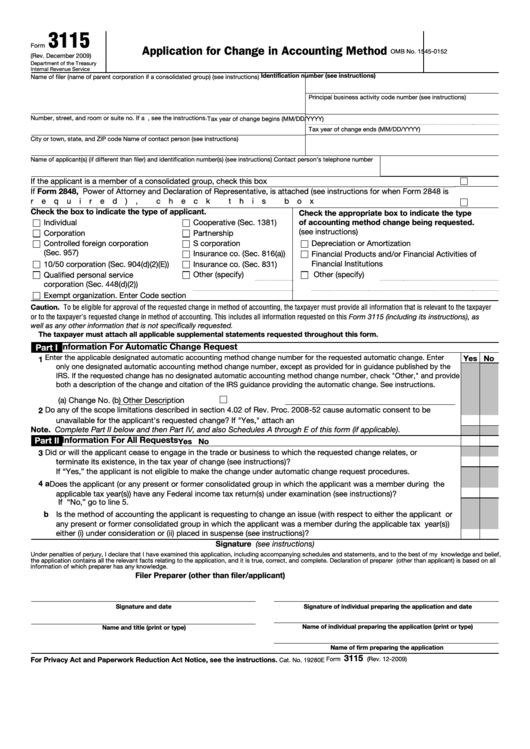

Form 3115 Instructions - In general, you must file a current form 3115 to request a change in either an overall accounting method or the accounting treatment of any item. Form 3115 is a quick way for businesses to make changes to accounting methods. Web per the form 3115 instructions,for an automatic change request, the filer must send a signed and dated copy of the form 3115 to the irs national office and/or. Make your online forms stand out. Choose from thousands of customizable form templates. Web on line 1, enter the amount from form 8615, line 8. December 2022) department of the treasury internal revenue service. Web generating form 3115 in lacerte. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. However, taxpayers are usually hindered by the five. Web this form 3115 (including its instructions), and (2) any other relevant information, even if not specifically requested on form 3115. Web completing form 3115 (application for change in accounting method) page 1. Web attach the original form 3115 to filer's timely filed (including extensions) federal income tax return for the year of change. In general, you must file a. The taxpayer must attach all applicable. The taxpayer may convert any form. File a copy of the signed form 3115. However, taxpayers are usually hindered by the five. Automatic consent is granted for changes that have an. Web to obtain the irs's consent, taxpayers file form 3115, application for change in accounting method. Web the irs today informed taxpayers and practitioners that it has revised form 3115, application for change in accounting method, and its instructions. If you select the individual check box,. The taxpayer must attach all applicable. On line 2, enter the qualified dividends included. Web on line 1, enter the amount from form 8615, line 8. On line 2, enter the qualified dividends included on form 8615, line 8. We estimate that it will take 1 hour to read the instructions, gather the facts, and answer the questions. The taxpayer may convert any form. Web this form 3115 (including its instructions), and (2) any. Web on line 1, enter the amount from form 8615, line 8. Make your online forms stand out. Automatic consent is granted for changes that have an. Even when the irs's consent is not required, taxpayers. File a copy of the signed form 3115. Even when the irs's consent is not required, taxpayers. Attach the original form 3115 to the filer's timely filed. Web form 3115 is used to request this consent. Web on line 1, enter the amount from form 8615, line 8. Web per the form 3115 instructions,for an automatic change request, the filer must send a signed and dated copy of. For tax years beginning on or after january 1, 2014, taxpayers must comply with the finalized. Ad get access to 500+ legal templates print & download, start for free! Web generating form 3115 in lacerte. Form 3115 is a quick way for businesses to make changes to accounting methods. Web form 3115, otherwise known as the application for change in. Change in accounting method, and its instructions. Web this form 3115 (including its instructions), and (2) any other relevant information, even if not specifically requested on form 3115. Make your online forms stand out. Solved • by intuit • 31 • updated 5 days ago. Web on line 1, enter the amount from form 8615, line 8. Web to obtain the irs's consent, taxpayers file form 3115, application for change in accounting method. However, taxpayers are usually hindered by the five. Web completing form 3115 (application for change in accounting method) page 1. The internal revenue service (irs) has revised form 3115, application for. Web form 3115 is used to request this consent. Attach the original form 3115 to the filer's timely filed. (see the earlier discussion for form 8615, line 8.) on line. Solved • by intuit • 31 • updated 5 days ago. Web completing form 3115 (application for change in accounting method) page 1. You must indicate this form either business or individual. Web to obtain the irs's consent, taxpayers file form 3115, application for change in accounting method. Attach the original form 3115 to the filer's timely filed. For tax years beginning on or after january 1, 2014, taxpayers must comply with the finalized. We estimate that it will take 1 hour to read the instructions, gather the facts, and answer the questions. Automatic consent is granted for changes that have an. Web information about form 3115, application for change in accounting method, including recent updates, related forms and instructions on how to file. Solved • by intuit • 31 • updated 5 days ago. Web generating form 3115 in lacerte. On line 2, enter the qualified dividends included on form 8615, line 8. Make your online forms stand out. Web this form 3115 (including its instructions), and (2) any other relevant information, even if not specifically requested on form 3115. Web form 3115, otherwise known as the application for change in accounting method, allows business owners to switch accounting methods. Change in accounting method, and its instructions. Print & download start for free Even when the irs's consent is not required, taxpayers. The internal revenue service (irs) has revised form 3115, application for. If you select the individual check box,. Web per the form 3115 instructions,for an automatic change request, the filer must send a signed and dated copy of the form 3115 to the irs national office and/or. Web form 3115 is used to request this consent. The taxpayer must attach all applicable.Download Instructions for IRS Form 3115 Application for Change in

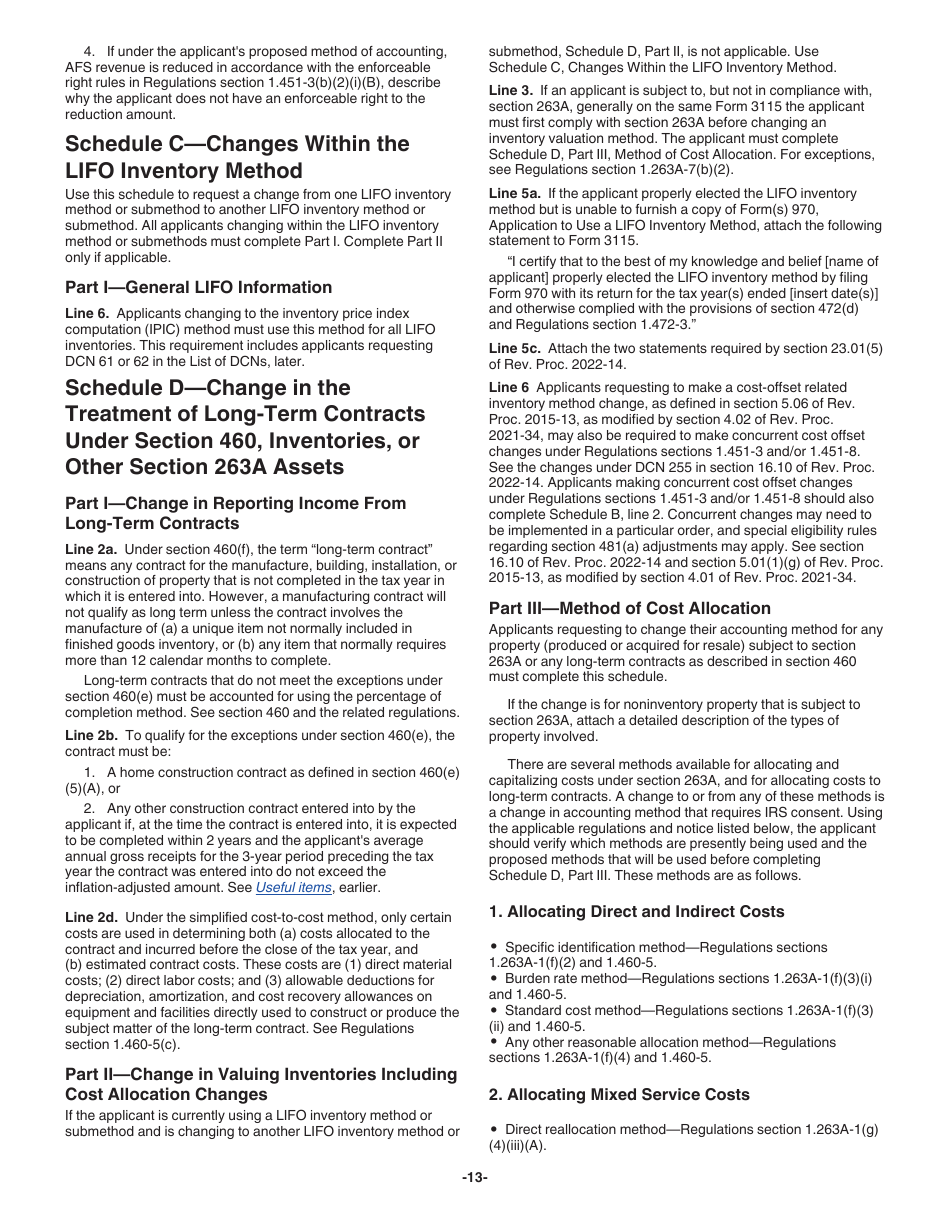

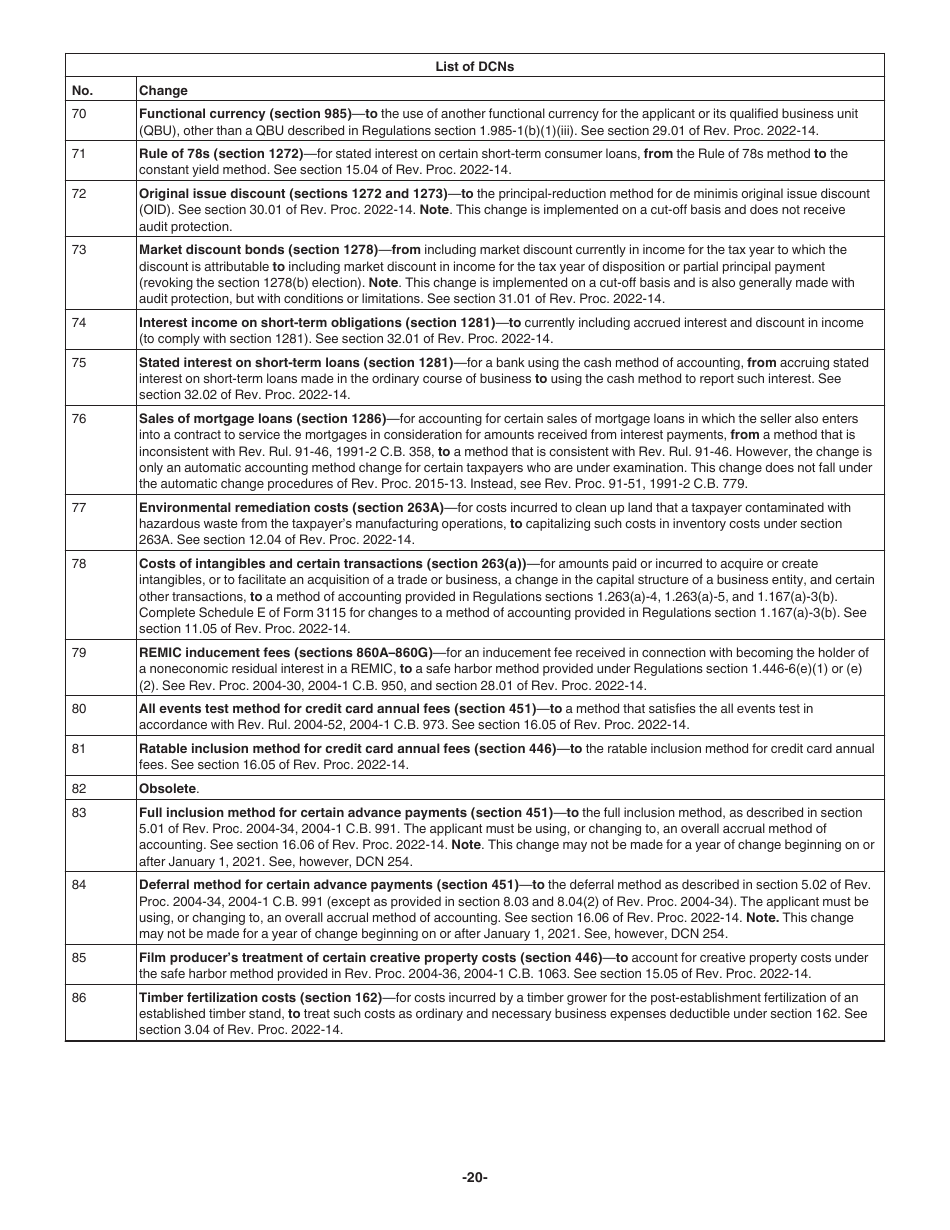

Instructions For Form 3115 printable pdf download

Form 3115 Application for Change in Accounting Method(2015) Free Download

Download Instructions for IRS Form 3115 Application for Change in

Form 3115 Depreciation Guru

Download Instructions for IRS Form 3115 Application for Change in

Fillable Form 3115 Application For Change In Accounting Method

Form 3115 Application for Change in Accounting Method(2015) Free Download

Fillable Form 3115 Application For Change In Accounting Method

Automatic Change to Cash Method of Accounting for Tax

Related Post: