Form 2210 Waiver Explanation Statement Examples

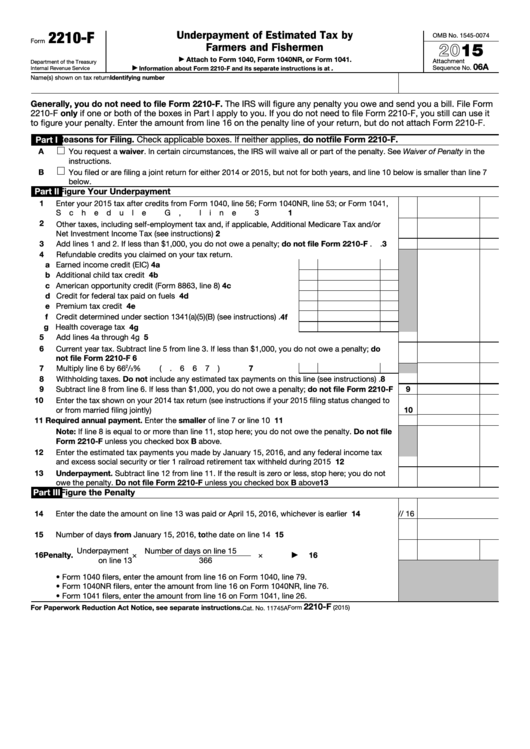

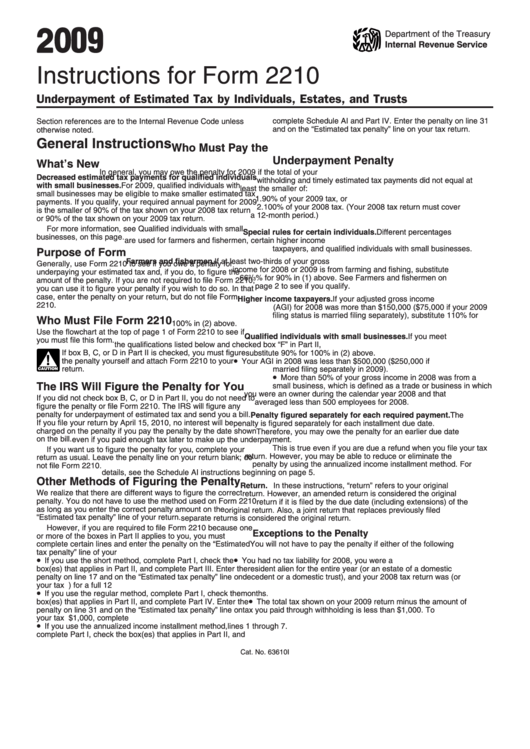

Form 2210 Waiver Explanation Statement Examples - Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Web under from 2210, part ii, i have box a checked with the notation 85% waiver. Web attach form 2210 and a statement to your return explaining the reasons you were unable to meet the estimated tax requirements and the time period for which you are requesting a waiver. My return was rejected with this explanation if a penalty is present and a full or. Is line 4 or line 7 less than $1,000? 90% of their tax for. Web see waiver of penalty in instructions for form 2210 pdf. You must check this box and file page 1 of form 2210, but you aren’t required to figure your. Web for example, the estimated tax penalty is generally not “abatable” by the taxpayers. Complete lines 1 through 7 below. Short method (found on page 2 of the form). The form doesn't always have to be. Web under from 2210, part ii, i have box a checked with the notation 85% waiver. Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the estimated tax. Use form 2210 to determine the amount of. You must check this box and file page 1 of form 2210, but you aren’t required to figure your. You had most of your income tax withheld early in the year instead of spreading it equally through the. Complete lines 1 through 7 below. Web turbotax provides an entry field for an explanation to be included in your tax return. Waiver (see instructions) of your entire penalty. Web see waiver of penalty in instructions for form 2210 pdf. Web under from 2210, part ii, i have box a checked with the notation 85% waiver. This penalty is different from the penalty for. My return was rejected with this explanation if a penalty is present and a full or. Web regard to the waiver, and enter the result on line 19. Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the estimated tax. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a. My return was rejected with this explanation if. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. Web dispute a penalty if you don’t qualify for penalty removal or. Web taxpayer has been a real estate agent for only 2 years.is it okay to use the following explanation for the. My return was rejected with this explanation if a penalty is present and a full or. Web taxpayer has been a real estate agent for only 2 years.is it okay to use the following explanation for the request of waiver on penalty for form 2210? Web attach form 2210 and a statement to your return explaining the reasons you were. Web the taxpayer may owe an underpayment tax penalty if their total withholding and timely estimated tax payments were less than the smaller of: Web see waiver of penalty in instructions for form 2210 pdf. Web turbotax provides an entry field for an explanation to be included in your tax return as to why you qualify for a waiver of. For 2022, most counties in. Web for example, the estimated tax penalty is generally not “abatable” by the taxpayers. Web turbotax provides an entry field for an explanation to be included in your tax return as to why you qualify for a waiver of the penalty. Web regard to the waiver, and enter the result on line 19. Use form. You must check this box and file page 1 of form 2210, but you aren’t required to figure your. For 2022, most counties in. Complete lines 1 through 7 below. Web regard to the waiver, and enter the result on line 19. My return was rejected with this explanation if a penalty is present and a full or. Web form 2210 present three methods on how to compute tax underpayment penalty: This penalty is different from the penalty for. Web 06 name(s) shown on tax return identifying number do you have to file form 2210? Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the estimated tax. Web taxpayer has. Web form 2210 is used by individuals (as well as estates and trusts) to determine if a penalty is owed for the underpayment of income taxes due. The form doesn't always have to be. You must check this box and file page 1 of form 2210, but you aren’t required to figure your. Web the taxpayer may owe an underpayment tax penalty if their total withholding and timely estimated tax payments were less than the smaller of: Web form 2210 is used to calculate a penalty when the taxpayer has underpaid on their estimated taxes (quarterly es vouchers). 90% of their tax for. Web taxpayer has been a real estate agent for only 2 years.is it okay to use the following explanation for the request of waiver on penalty for form 2210? Web see waiver of penalty in instructions for form 2210 pdf. Waiver (see instructions) of your entire penalty. Complete lines 1 through 7 below. Rather, taxpayers can request an exclusion from the penalty when filing their. Is line 4 or line 7 less than $1,000? My return was rejected with this explanation if a penalty is present and a full or. Web turbotax provides an entry field for an explanation to be included in your tax return as to why you qualify for a waiver of the penalty. Web 06 name(s) shown on tax return identifying number do you have to file form 2210? This method is applicable if the. Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the estimated tax. Web regard to the waiver, and enter the result on line 19. Use form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a. For 2022, most counties in.Fillable Form 2210F Underpayment Of Estimated Tax By Farmers And

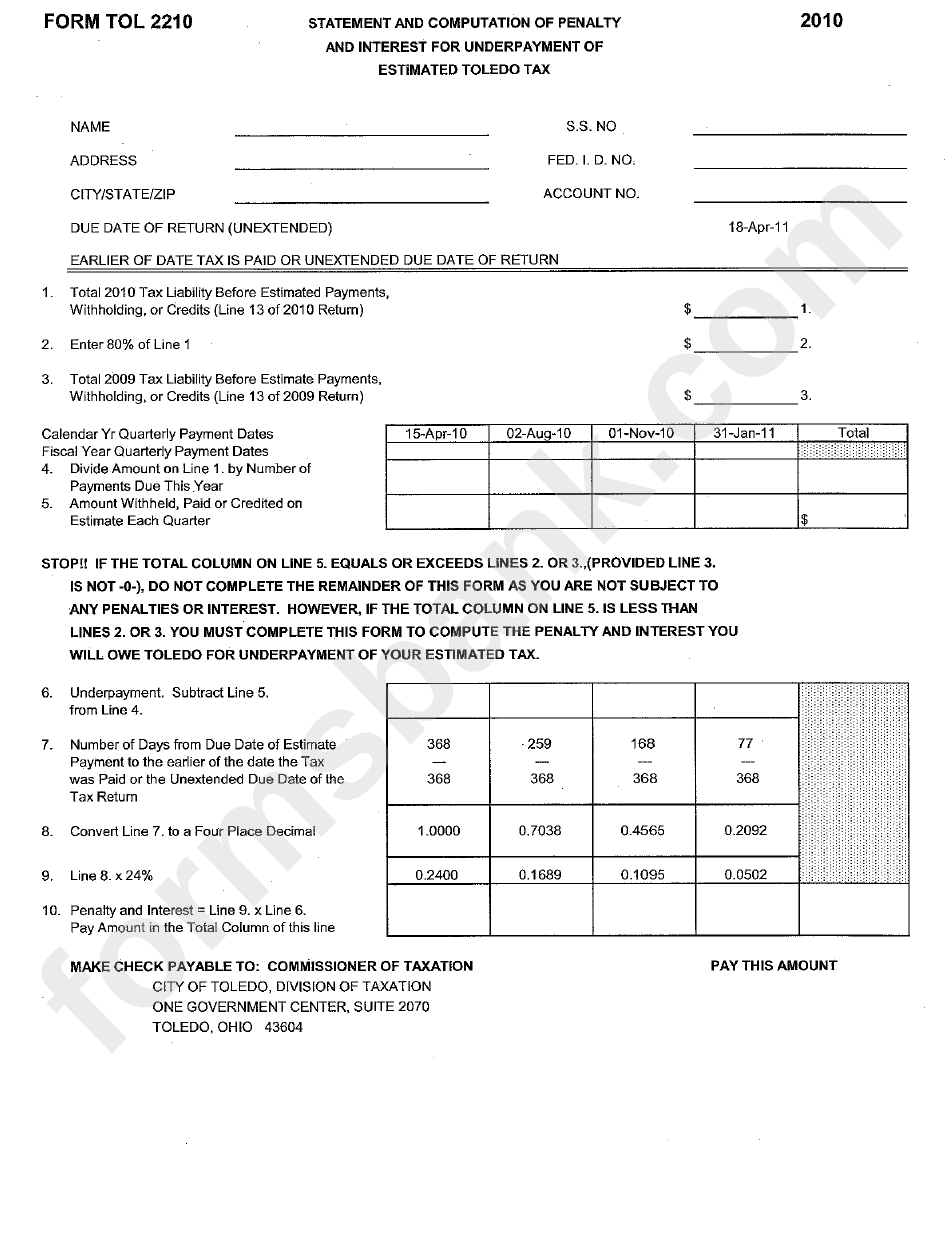

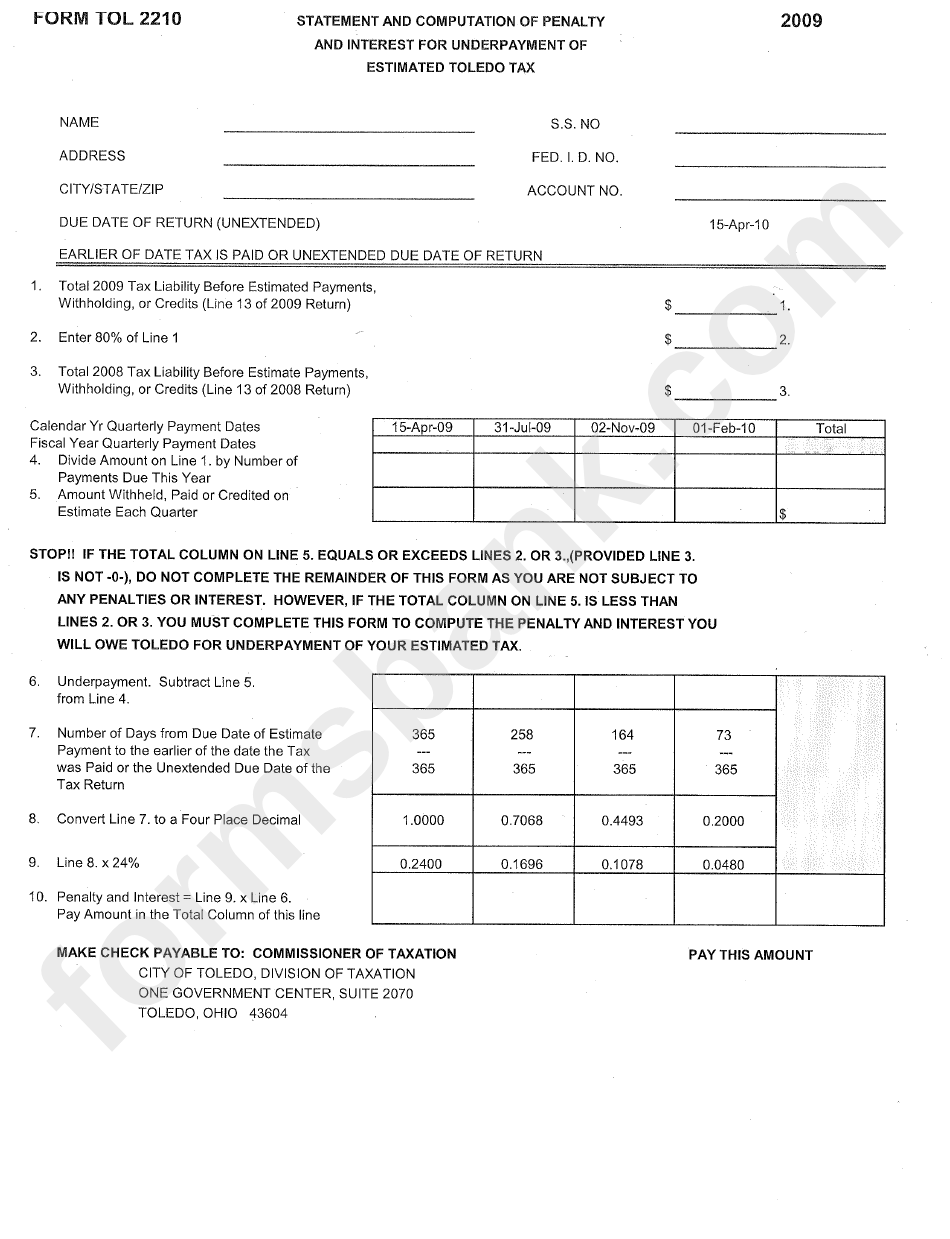

Form Tol 2210 Statement And Computation Of Penalty And Interest For

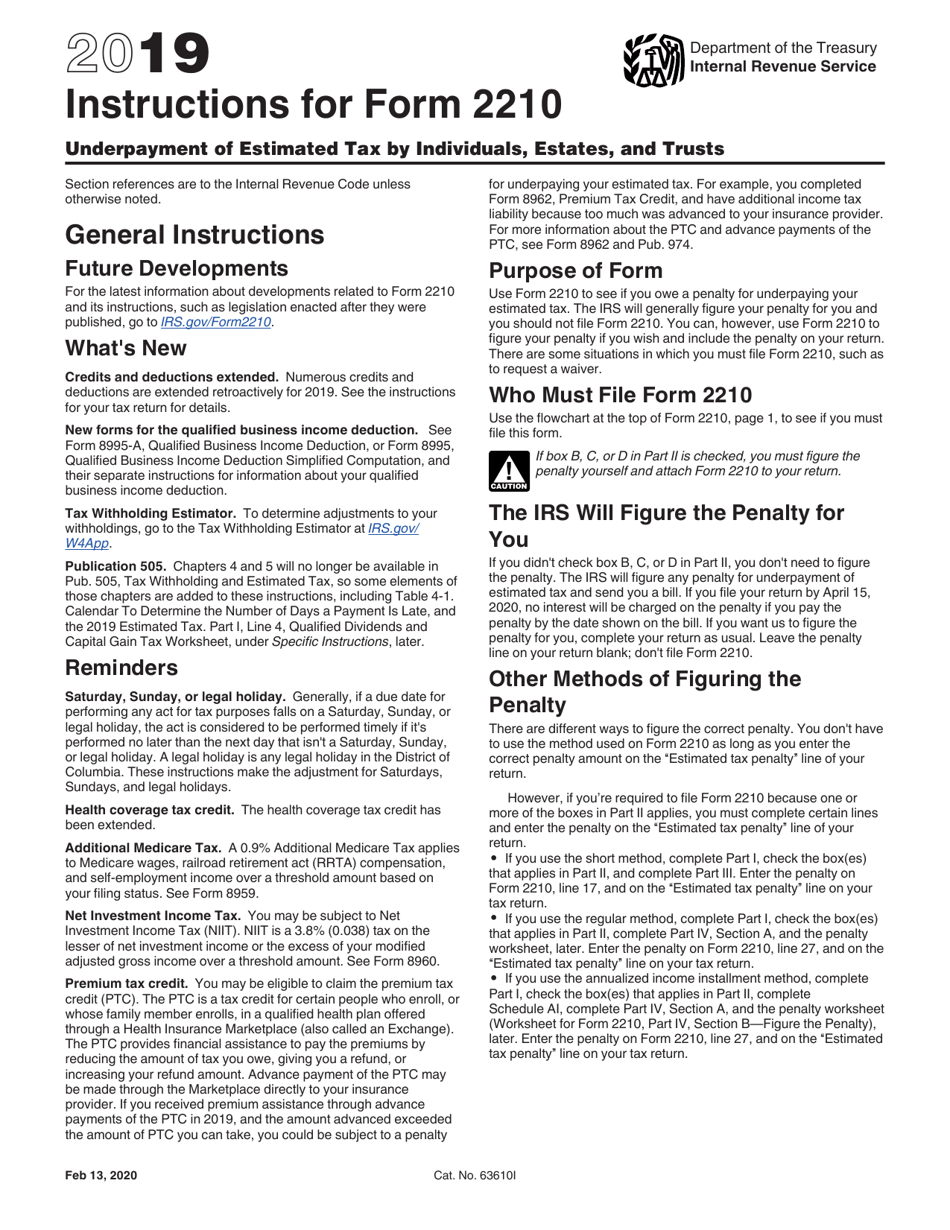

Download Instructions for IRS Form 2210 Underpayment of Estimated Tax

Ssurvivor Irs Form 2210 Ai Instructions

Instructions For Form 2210 Underpayment Of Estimated Tax By

Form 2210 Fill and Sign Printable Template Online US Legal Forms

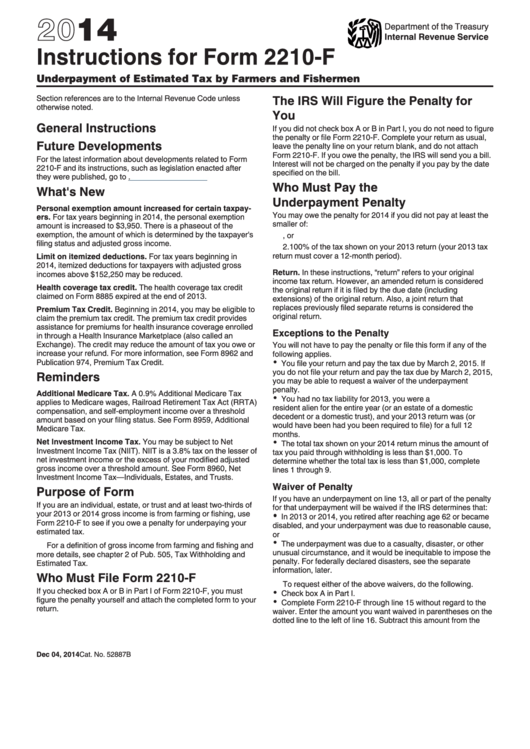

Instructions For Form 2210F Underpayment Of Estimated Tax By Farmers

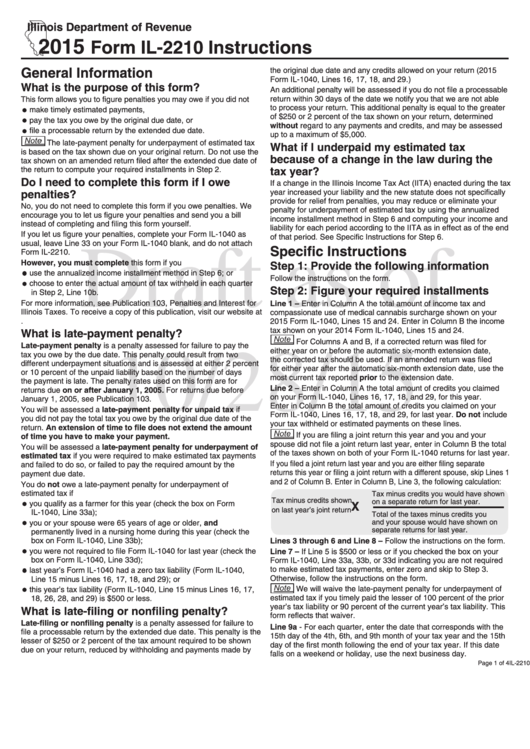

Form Il2210 Instructions Draft 2015 printable pdf download

Form Tol 2210 Statement And Computation Of Penalty And Interest

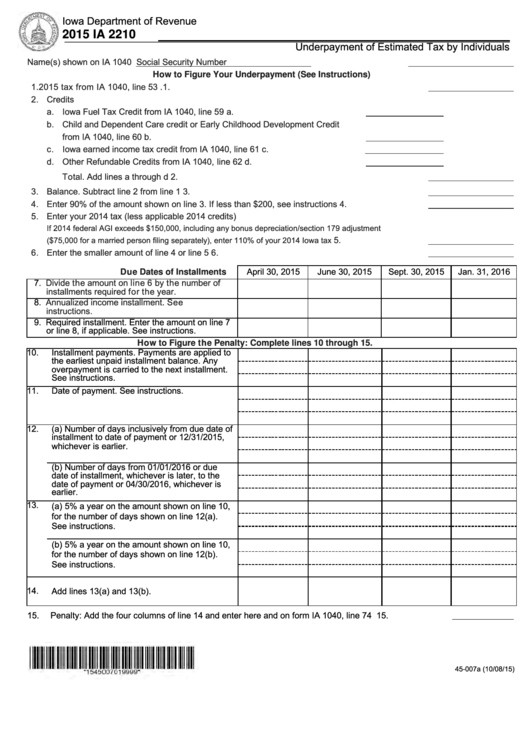

Fillable Form Ia 2210 Underpayment Of Estimated Tax By Individuals

Related Post: