Form 1120-F

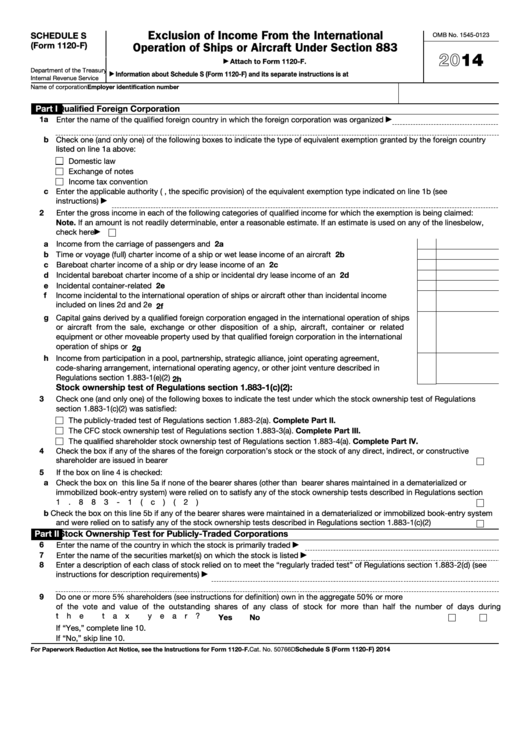

Form 1120-F - Income tax return of a foreign corporation. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Who must use this form? Web 1a enter the name of the qualified foreign country in which the foreign corporation was organized check one (and only one) of the following boxes to indicate the type of. Ad easy guidance & tools for c corporation tax returns. Web form 5472 + 1120 filing requirement exists, regardless of u.s. Income tax return of a foreign corporation for calendar year 2022, or tax year beginning, 2022, and. Effective 01/23 page 1 of 6. Our experts will explain how to. Trade or business” concept is used in many different provisions of the code and. Try it for free now! Web form 1120 department of the treasury internal revenue service u.s. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to. Income tax return of a foreign corporation. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! This form is to be used by a foreign corporation that has income that is. Ad easy guidance & tools for c corporation tax returns. Disregarded entities may have no income. Form 1120 f is known as foreign corporation income tax return that is used mostly by corporates to file tax forms that require complex details such as. Income tax. Income tax liability of a foreign corporation. Web 1a enter the name of the qualified foreign country in which the foreign corporation was organized check one (and only one) of the following boxes to indicate the type of. Disregarded entities may have no income. Income tax return of a foreign corporation, including recent updates, related forms and instructions on how. Income tax liability of a foreign corporation. Income tax return of a foreign corporation for calendar year 2022, or tax year beginning, 2022, and. Web form 1120 department of the treasury internal revenue service u.s. Web form 5472 + 1120 filing requirement exists, regardless of u.s. Form 1120 f is known as foreign corporation income tax return that is used. Income tax return of a foreign corporation for calendar year 2022, or tax year beginning, 2022, and. Income tax return of a foreign corporation. Web 1a enter the name of the qualified foreign country in which the foreign corporation was organized check one (and only one) of the following boxes to indicate the type of. Upload, modify or create forms.. Effective 01/23 page 1 of 6. Income tax liability of a foreign corporation. Our experts will explain how to. Web 1a enter the name of the qualified foreign country in which the foreign corporation was organized check one (and only one) of the following boxes to indicate the type of. Web form 5472 + 1120 filing requirement exists, regardless of. Our experts will explain how to. Disregarded entities may have no income. Income tax return of a foreign corporation, including recent updates, related forms and instructions on how to file. Income tax return of a foreign corporation. Income tax return of a foreign corporation for calendar year 2022, or tax year beginning, 2022, and. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to. Disregarded entities may have no income. Income tax return of a foreign corporation. Income tax liability of a foreign corporation. Try it for free now! Web form 5472 + 1120 filing requirement exists, regardless of u.s. Income tax return of a foreign corporation, including recent updates, related forms and instructions on how to file. Income tax return of a foreign corporation. Disregarded entities may have no income. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Income tax liability of a foreign corporation. Upload, modify or create forms. Effective 01/23 page 1 of 6. Web form 1120 department of the treasury internal revenue service u.s. This form is to be used by a foreign corporation that has income that is. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to. Income tax return of a foreign corporation for calendar year 2022, or tax year beginning, 2022, and. Ad easy guidance & tools for c corporation tax returns. Upload, modify or create forms. Web 1a enter the name of the qualified foreign country in which the foreign corporation was organized check one (and only one) of the following boxes to indicate the type of. Who must use this form? Income tax return of a foreign corporation. Income tax return of a foreign corporation, including recent updates, related forms and instructions on how to file. Web form 5472 + 1120 filing requirement exists, regardless of u.s. Form 1120 f is known as foreign corporation income tax return that is used mostly by corporates to file tax forms that require complex details such as. Our experts will explain how to. Income tax return of a foreign corporation. Income tax liability of a foreign corporation. Taxact® business 1120 (2022 online edition) is the easiest way to file a 1120! Try it for free now! Web form 1120 department of the treasury internal revenue service u.s. Income tax liability of a foreign corporation. Trade or business” concept is used in many different provisions of the code and. This form is to be used by a foreign corporation that has income that is. Effective 01/23 page 1 of 6.Fillable Schedule S (Form 1120F) Exclusion Of From The

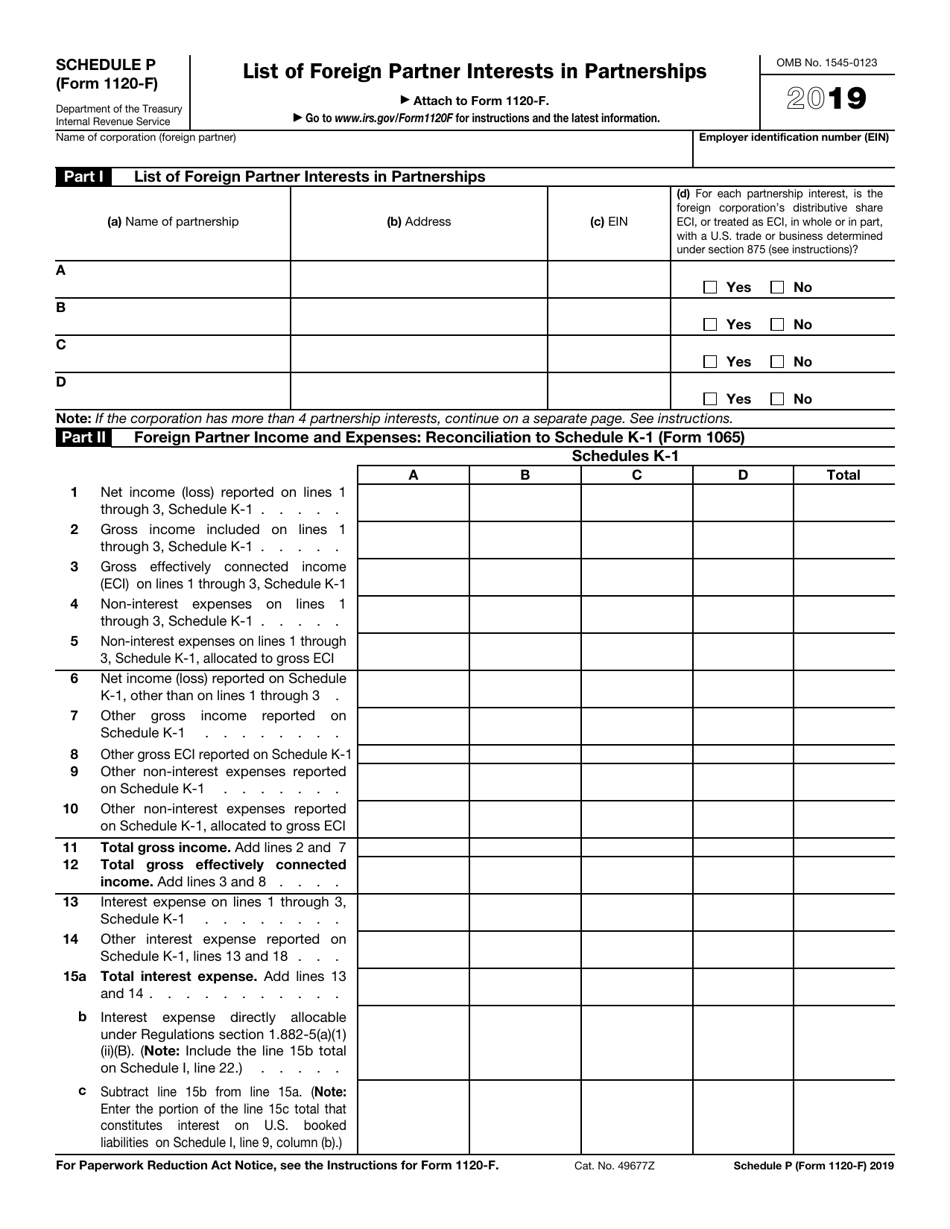

IRS Form 1120F Schedule P Download Fillable PDF or Fill Online List of

Form 1120F (Schedule I) Interest Expense Allocation (2014) Free Download

Form 1120F U.S. Tax Return of a Foreign Corporation (2014

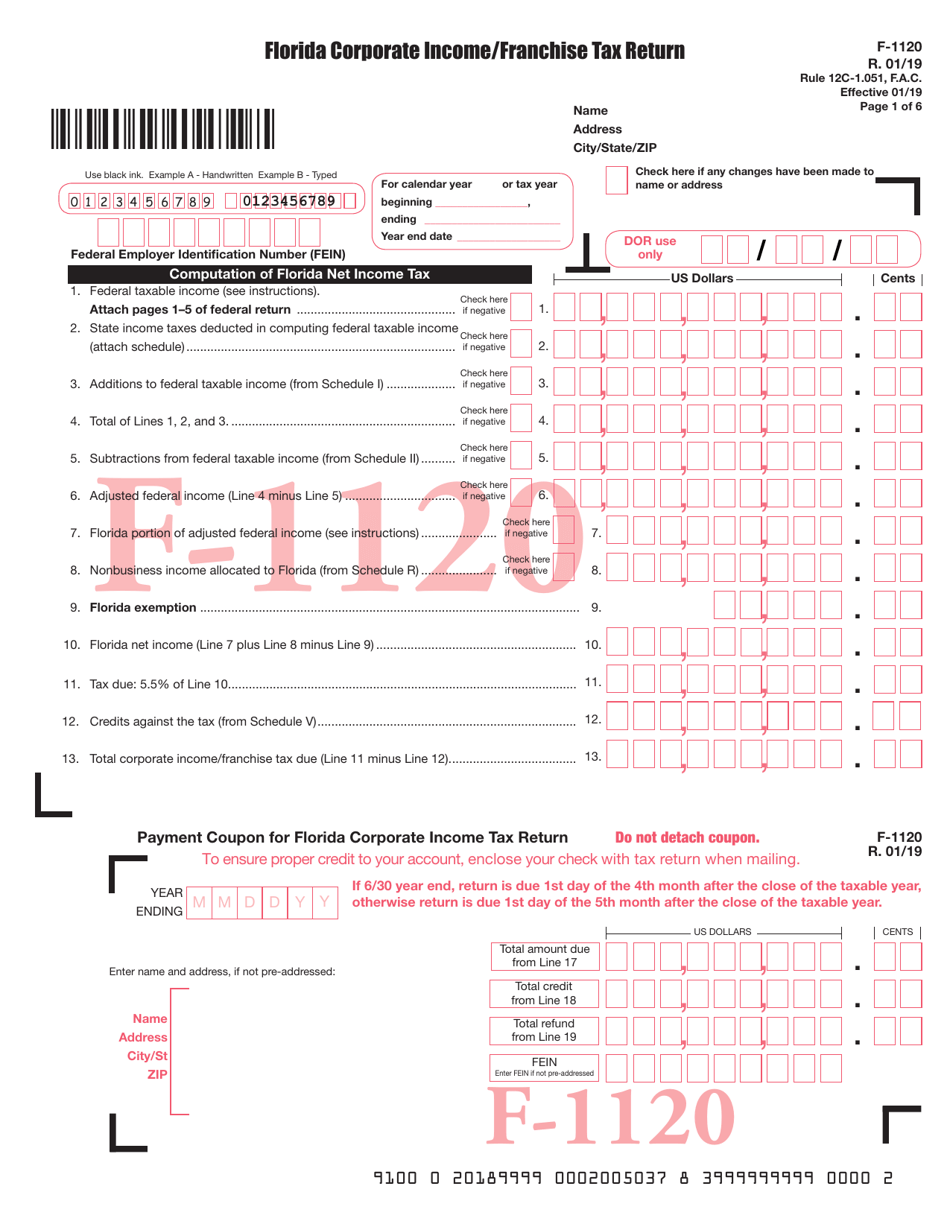

Form F1120 Fill Out, Sign Online and Download Printable PDF, Florida

Form 1120F (Schedule H) Deductions Allocated to Effectively

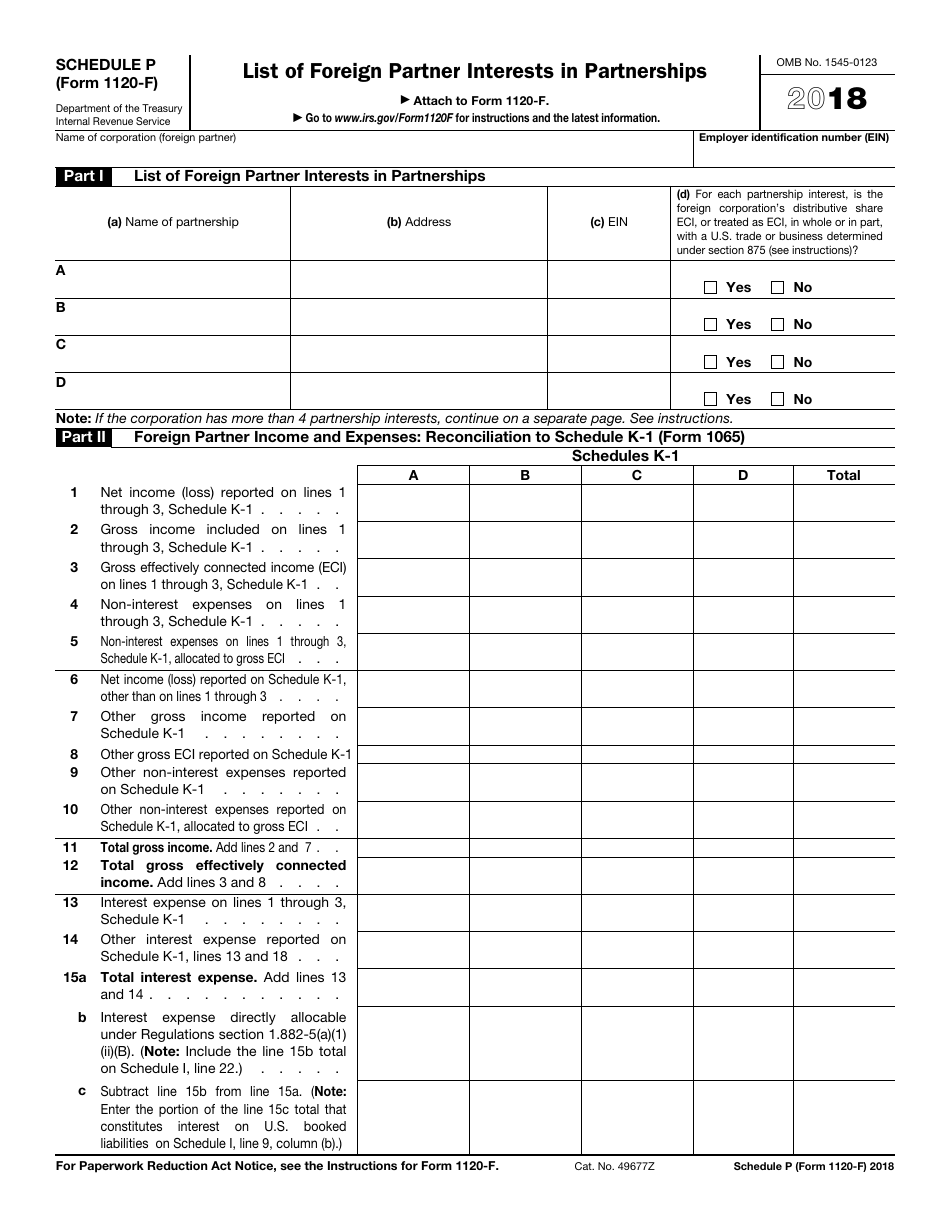

IRS Form 1120F Schedule P Download Fillable PDF or Fill Online List of

IRS 1120F Form Tax Templates Online to Fill in PDF

Form 1120F U.S. Tax Return of a Foreign Corporation (2014

Form 1120F U.S. Tax Return of a Foreign Corporation (2014

Related Post: