Maryland Tax Extension Form 502E

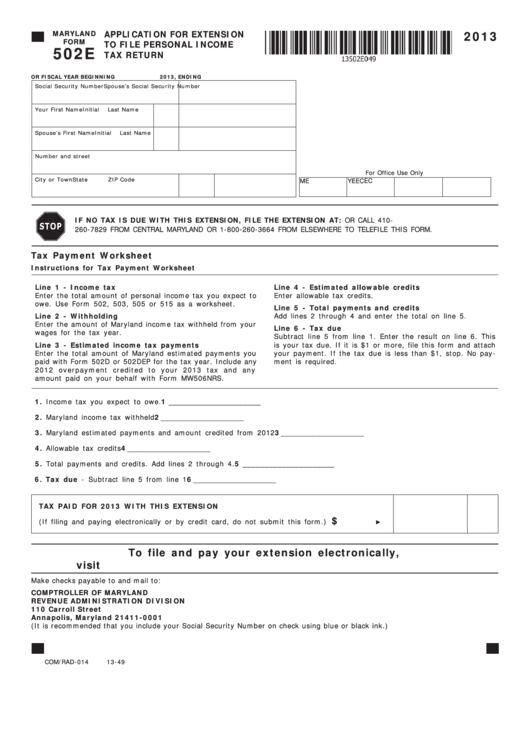

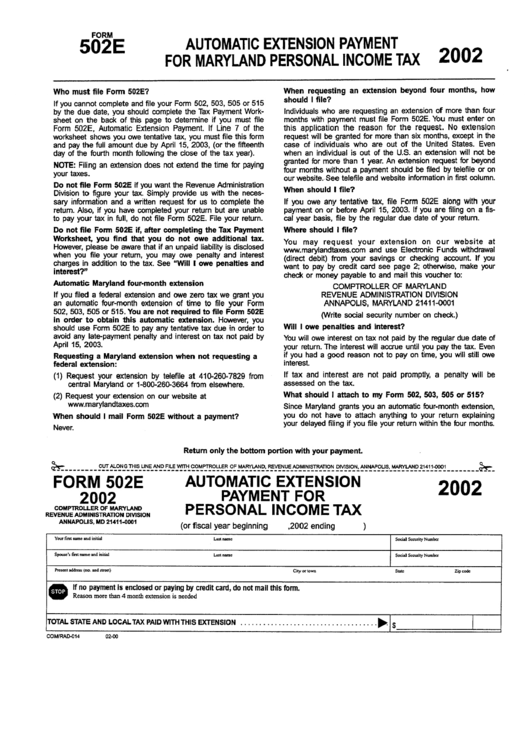

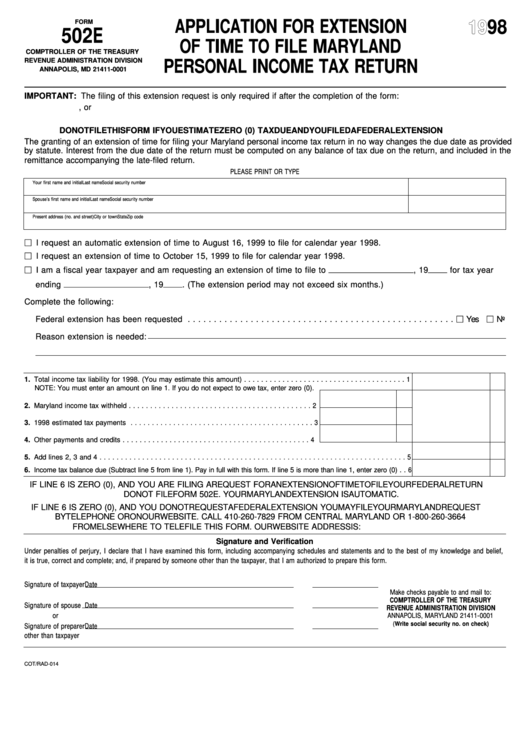

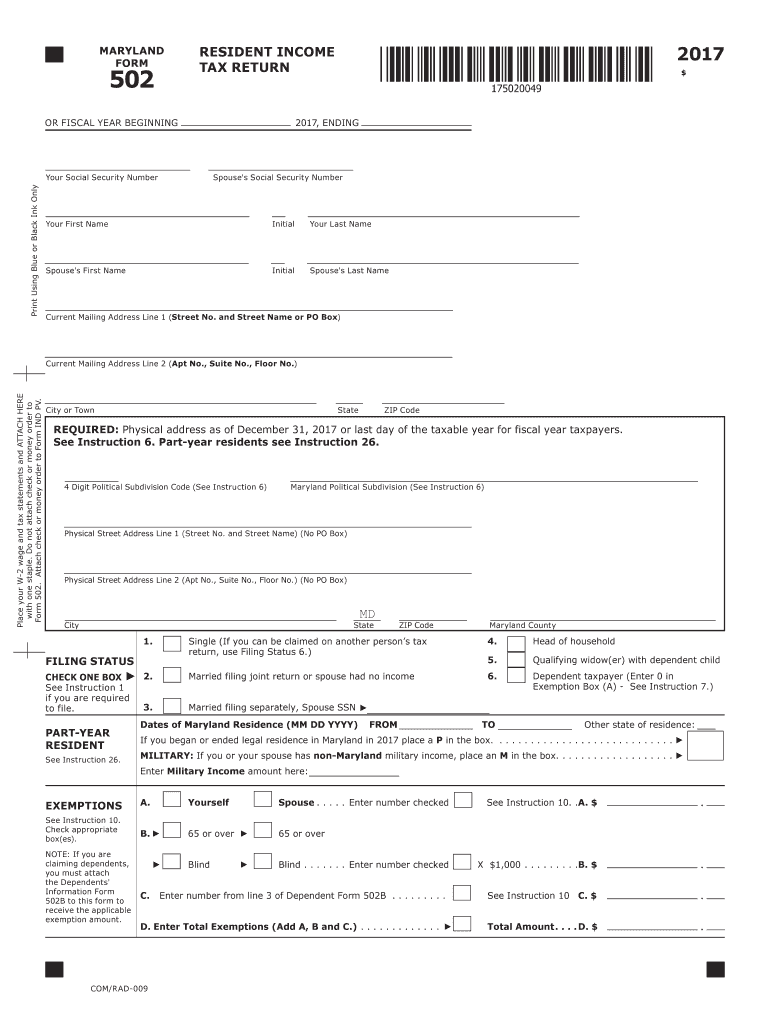

Maryland Tax Extension Form 502E - Web we last updated maryland form 502e in march 2021 from the maryland comptroller of maryland. If no tax is due with this. Maryland amended income tax return form 502x revised 9/99. This form is for income earned in tax year 2022, with tax returns due in april. Easily sign the form with your finger. Request for copy of tax form*. Web form 502e—application for extension to file for personal income tax form 502h*—heritage structure rehabilitation tax credit. If the request for an. First time filer or change in filing status. Web on the other hand, if you have a maryland tax balance, you can make an extension payment with form 502e (application for extension to file personal income tax. Filing this form extends the time to file your return, but does not extend the time to pay your taxes. Send filled & signed form or save. Application for extension to file personal income tax return. Web city state md zip code + 4 maryland county. Maryland has a state income tax that ranges between 2% and 5.75% , which. Maryland amended income tax return form 502x revised 9/99. Web form 502e—application for extension to file for personal income tax form 502h*—heritage structure rehabilitation tax credit. Request for copy of tax form*. If no tax is due with this. This form is for income earned in tax year 2022, with tax returns due in april. Ad signnow.com has been visited by 100k+ users in the past month Extension to file amend return contact taxpayer. Get ready for tax season deadlines by completing any required tax forms today. Maryland has a state income tax that ranges between 2% and 5.75% , which is administered by the maryland comptroller of maryland. Payment of the expected tax due. Payment of the expected tax due is required with form pv. Web you can make an extension payment with form 502e (application for extension to file personal income tax return). Easily sign the form with your finger. Complete, edit or print tax forms instantly. Application for extension to file personal income tax return. Web extension to file personal income tax return maryland form 502e 2017 if no tax is due with this extension, file the extension. Extension to file amend return contact taxpayer. Web you can make an extension payment with form 502e (application for extension to file personal income tax return). Payment of the expected tax due is required with form pv.. Web maryland resident income tax return: This form is for income earned in tax year 2022, with tax returns due in april. Form to be used when claiming dependents. If the request for an. Maryland has a state income tax that ranges between 2% and 5.75% , which is administered by the maryland comptroller of maryland. Follow the instructions on form pv to request an automatic extension on filing your return. Payment with nonresident return (505). First time filer or change in filing status. Open form follow the instructions. Who must file form 502e? Request for copy of tax form*. Ad signnow.com has been visited by 100k+ users in the past month Printable maryland income tax form 502e. Web extension to file personal income tax return maryland form 502e 2017 if no tax is due with this extension, file the extension. Maryland amended income tax return form 502x revised 9/99. Web estimated tax payments and payment made with an extension request, form 502e. If no tax is due with this. Maryland has a state income tax that ranges between 2% and 5.75% , which is administered by the maryland comptroller of maryland. Payment of the expected tax due is required with form pv. Web extension to file personal income tax. Open form follow the instructions. Web city state md zip code + 4 maryland county. Form 402e is also used to pay the tax balance due for your maryland extension. Get ready for tax season deadlines by completing any required tax forms today. Form to be used when claiming dependents. Payment with nonresident return (505). Filing this form extends the time to file your return, but does not extend the time to pay your taxes. Get ready for tax season deadlines by completing any required tax forms today. If no tax is due with this. (1) expects to owe no tax. Maryland amended income tax return form 502x revised 9/99. Web you can make an extension payment with form 502e (application for extension to file personal income tax return). Web city state md zip code + 4 maryland county. Payment of the expected tax due is required with form pv. Ad signnow.com has been visited by 100k+ users in the past month Web extension to file personal income tax return maryland form 502e 2017 if no tax is due with this extension, file the extension. The individual must request the extension by filing form 502e and, if a tax is due, making payment by direct debit, credit card, check, or money order. Open form follow the instructions. Maryland application for extension to file personal income tax return. If no tax is due with this. Application for extension to file personal income tax return. Request for copy of tax form*. Send filled & signed form or save. Extension to file amend return contact taxpayer. This form is for income earned in tax year 2022, with tax returns due in april.Tax Forms Maryland Tax Forms

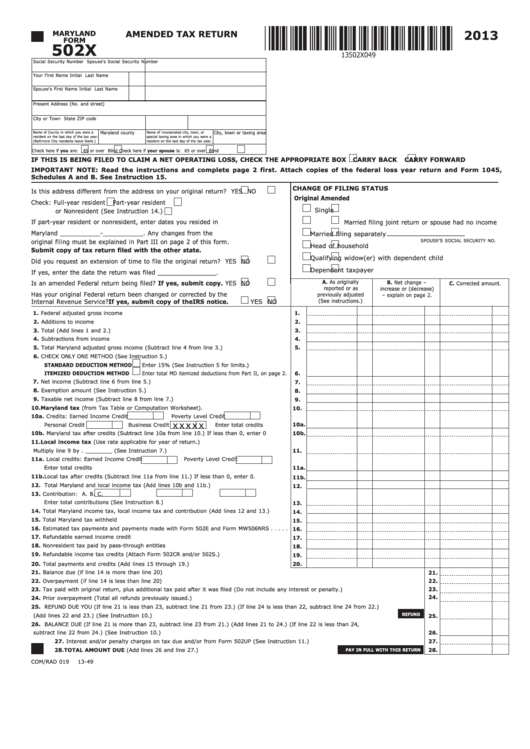

Fillable Maryland Form 502x Amended Tax Return 2013 printable pdf

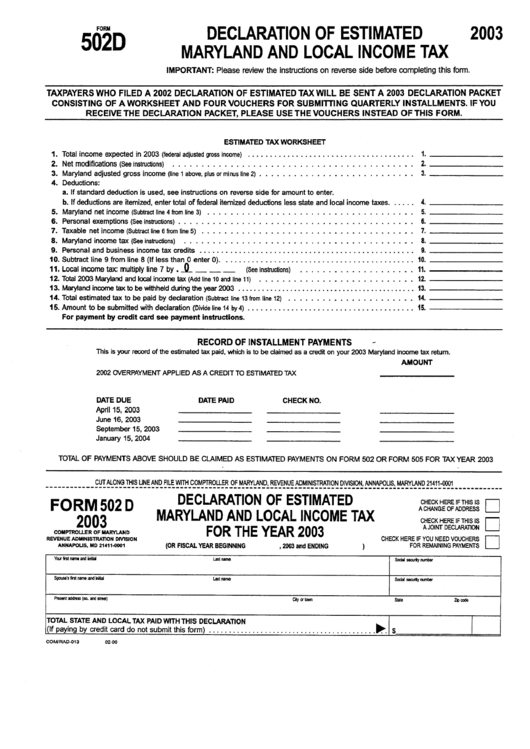

Form 502d Declaration Of Estimated Maryland And Lockal Tax

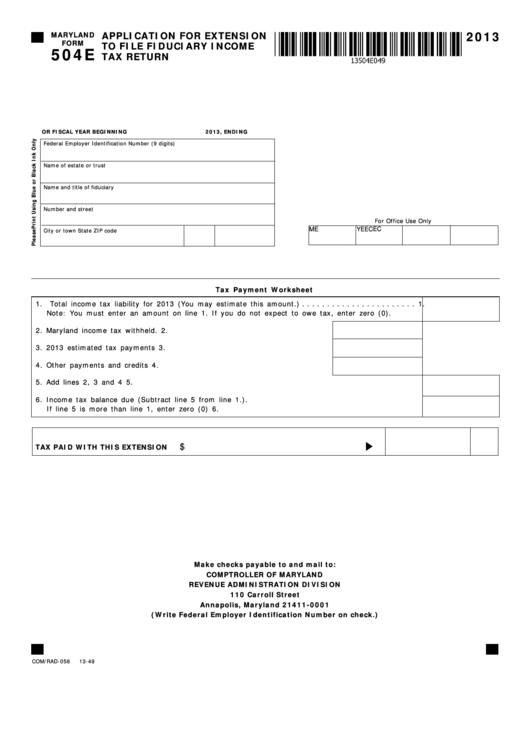

Fillable Maryland Form 504e Application For Extension To File

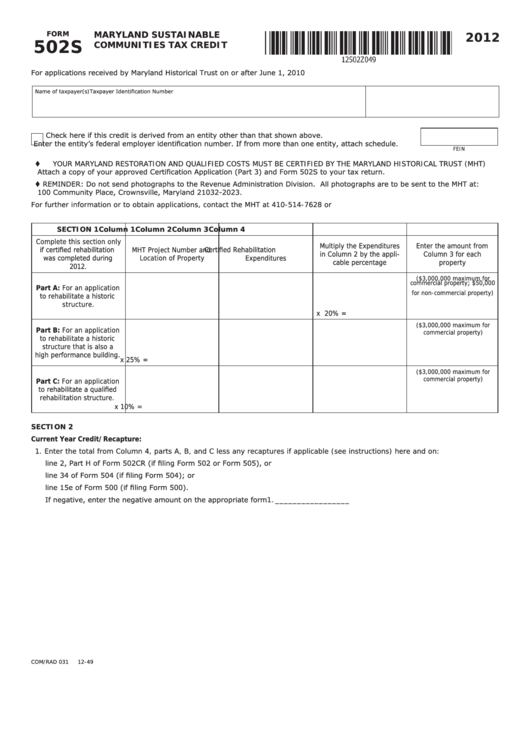

Top 43 Maryland Form 502 Templates free to download in PDF format

Fillable Maryland Form 502e Application For Extension To File

Tax Extension Form Printable Printable Forms Free Online

Form 502e Automatic Extension Payment For Maryland Personal

Fillable Form 502 E Application For Extension Of Time To File

Maryland State Tax Form 502 Fill Out and Sign Printable PDF Template

Related Post: