Form 1116 Instructions

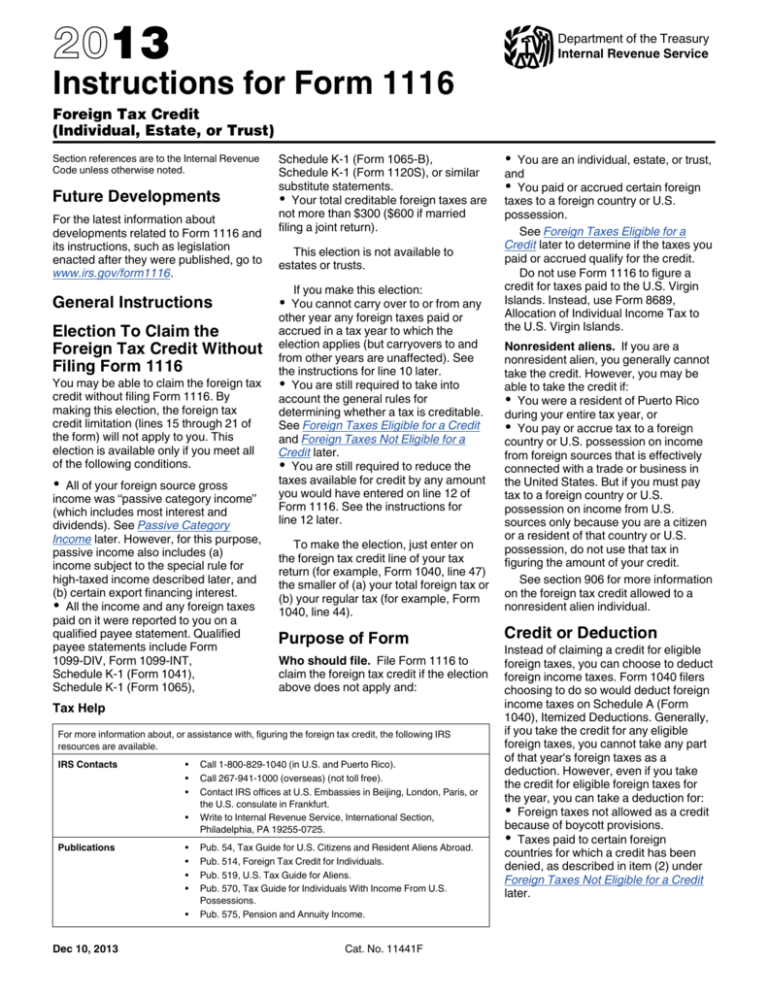

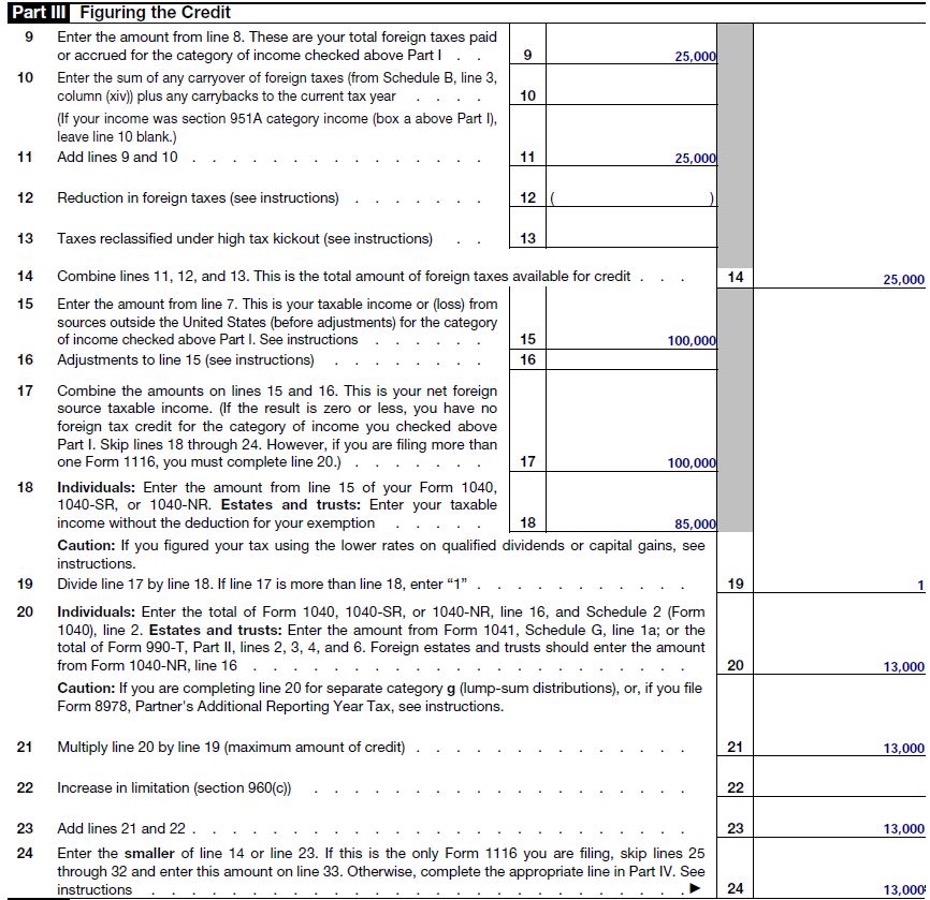

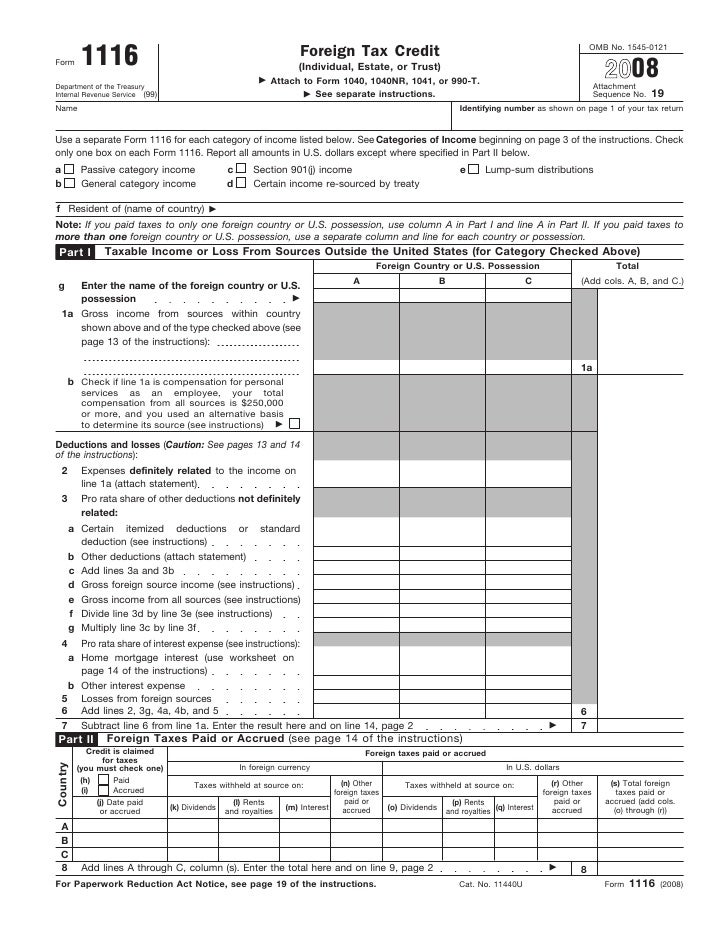

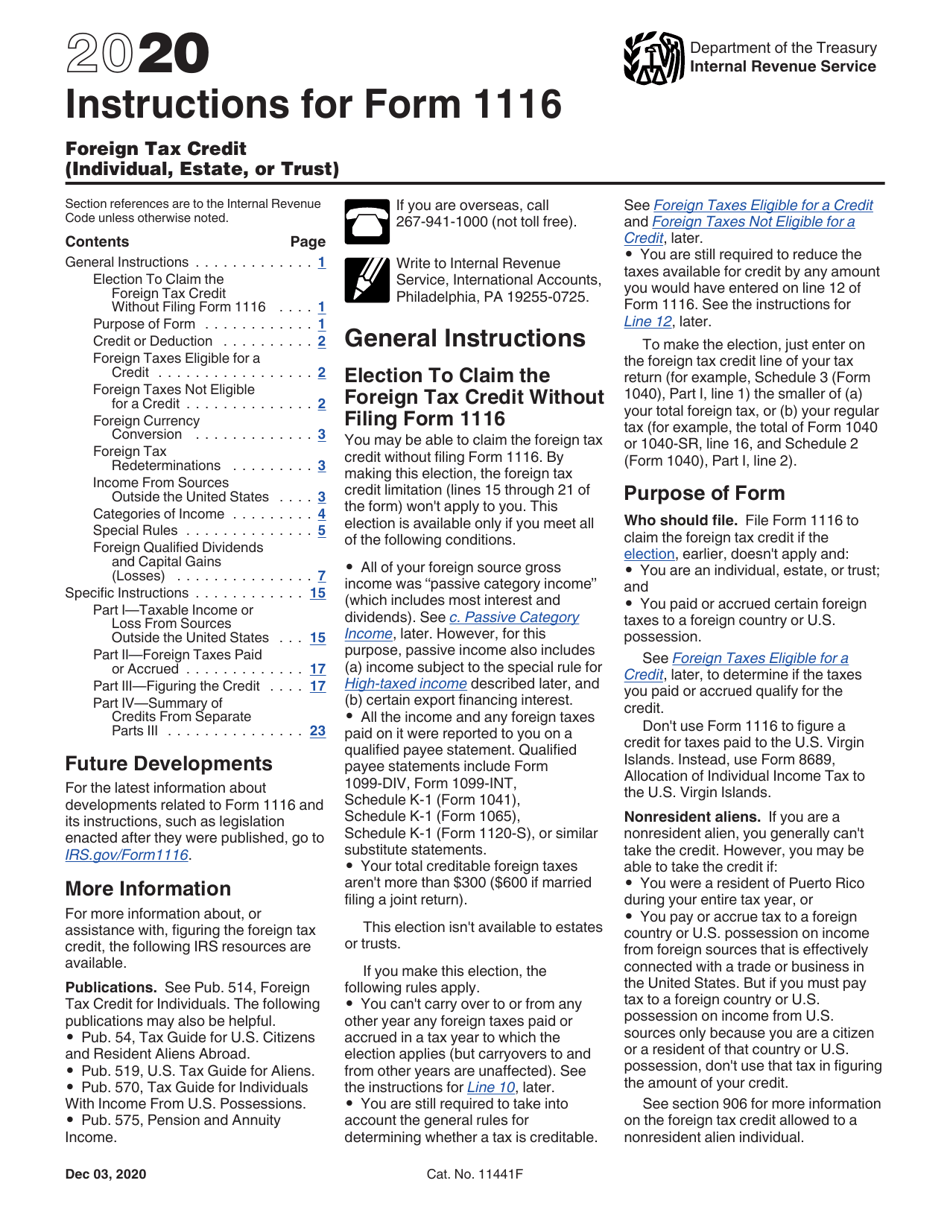

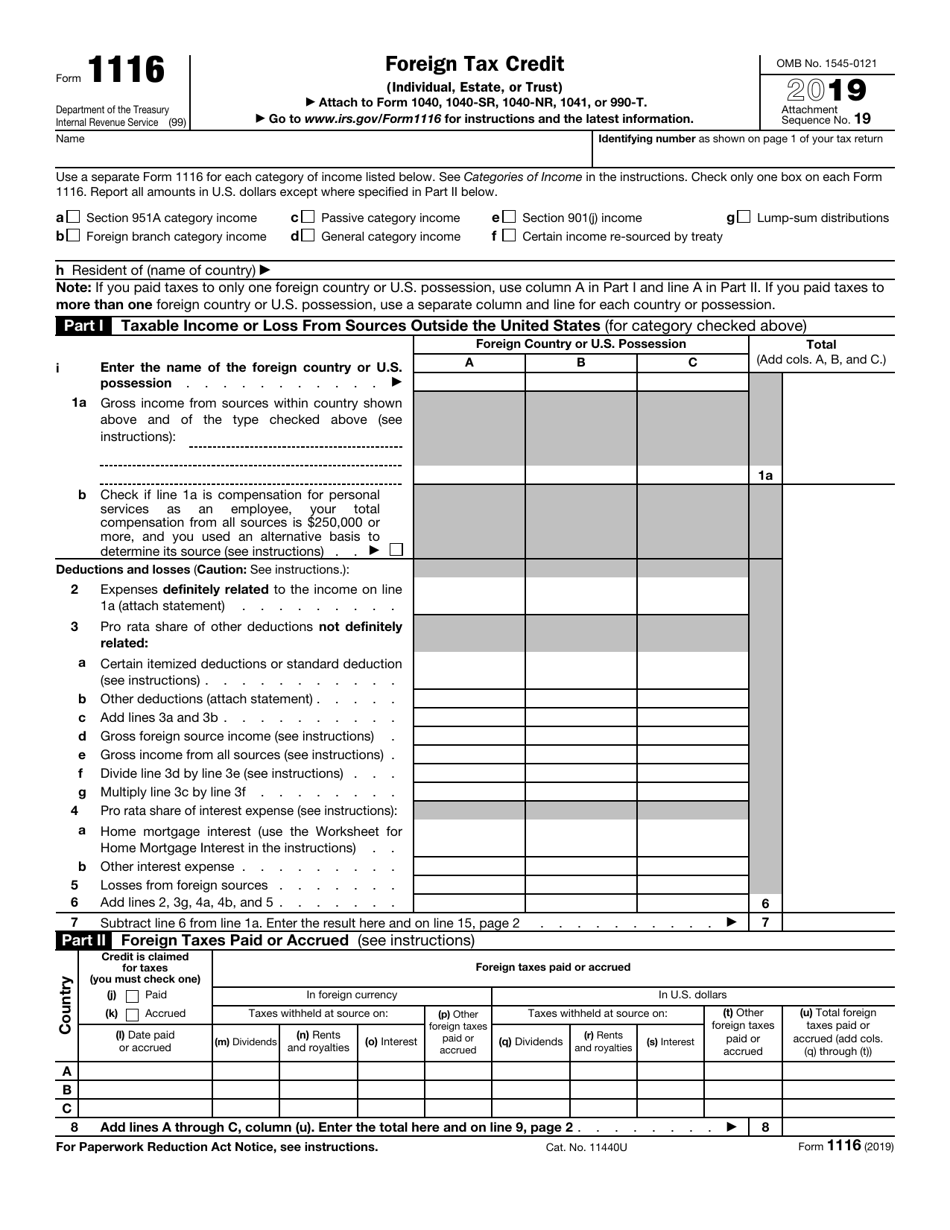

Form 1116 Instructions - Web form 1116 instructions. As shown on page 1 of your tax return. There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. Calculate and report the foreign tax. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Foreign taxes eligible for a credit. Taxpayers are therefore reporting running. Web use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years. Enter “1099 taxes” in part ii, column (j),. To make the election, just enter on the foreign tax credit line of your tax return (for example, schedule 3 (form 1040), part i,. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Web determine which taxes and types of foreign income are eligible for the foreign tax credit. Web the schedule b for form 1116 will generate automatically when required. To make the election, just enter on the foreign tax. Taxable income or loss from sources outside the united states. Web determine which taxes and types of foreign income are eligible for the foreign tax credit. In a nutshell, the high tax passive income on page one, line 1a is backed out of the passive. Foreign taxes eligible for a credit. Foreign taxes not eligible for a. Election to claim the foreign tax credit without filing form 1116. Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs. To make the election, just enter on the foreign tax credit line of your tax return (for example, schedule 3 (form 1040),. Web form 1116 instructions. Web for instructions and the latest information. Enter “1099 taxes” in part ii, column (j),. Web determine which taxes and types of foreign income are eligible for the foreign tax credit. See schedule c (form 1116) and its. In a nutshell, the high tax passive income on page one, line 1a is backed out of the passive. Taxpayers are therefore reporting running. Election to claim the foreign tax credit without filing form 1116. To open the schedule b for form 1116: Election to claim the foreign tax credit without filing form 1116. Election to claim the foreign tax credit without filing form 1116. Press f6 to bring up open forms. Here’s a simplified overview of. Web you can use the $100 of unused foreign tax credits to reduce your tax bill on the prior and subsequent returns, leaving $25 of excess limit to be used in the future. Foreign taxes eligible for. Election to claim the foreign tax credit without filing form 1116. Accurately compute the credit using form 1116. See schedule c (form 1116) and its instructions, and foreign tax redeterminations, later, for more information. Enter “1099 taxes” in part ii, column (j),. Web per irs instructions for form 1116 foreign tax credit (individual, estate, or trust), page 1: Taxable income or loss from sources outside the united states. Calculate and report the foreign tax. Foreign taxes not eligible for a. See schedule c (form 1116) and its instructions, and foreign tax redeterminations, later, for more information. See the instructions for line 12, later. There is a new schedule c (form 1116) which is used to report foreign tax redeterminations that occurred in the. See the instructions for line 12, later. Web in this article, we’ll walk you through the instructions for filling out form 1116. Foreign taxes eligible for a credit. Web use schedule c (form 1116) to report foreign tax redeterminations that. Web you can use the $100 of unused foreign tax credits to reduce your tax bill on the prior and subsequent returns, leaving $25 of excess limit to be used in the future. To make the election, just enter on the foreign tax credit line of your tax return (for example, schedule 3 (form 1040), part i,. See schedule c. Foreign taxes not eligible for a. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Go to www.irs.gov/form1116 for instructions and the latest information. To open the schedule b for form 1116: Press f6 to bring up open forms. Taxable income or loss from sources outside the united states. Election to claim the foreign tax credit without filing form 1116. Web use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years. Use form 2555 to claim the. Web the schedule b for form 1116 will generate automatically when required. As shown on page 1 of your tax return. Here’s a simplified overview of. Enter “1099 taxes” in part ii, column (j),. Form 1116 can be complex, and it’s crucial to follow the instructions provided by the irs carefully. Web you can use the $100 of unused foreign tax credits to reduce your tax bill on the prior and subsequent returns, leaving $25 of excess limit to be used in the future. Web per irs instructions for form 1116 foreign tax credit (individual, estate, or trust), page 1: See schedule c (form 1116) and its instructions, and foreign tax redeterminations, later, for more information. Taxpayers are therefore reporting running. Foreign taxes eligible for a credit. Election to claim the foreign tax credit without filing form 1116.Instructions for Form 1116

USCs and LPRs Living Outside the U.S. Key Tax and BSA Forms « Tax

Form 1116 part 1 instructions

Foreign Tax Credit Form 1116 Instructions

Form 1116Foreign Tax Credit

Download Instructions for IRS Form 1116 Foreign Tax Credit (Individual

Instructions for Form 1116

Foreign Tax Credit & IRS Form 1116 Explained Greenback Expat Taxes

IRS Form 1116 Download Fillable PDF or Fill Online Foreign Tax Credit

Foreign Tax Credit Form 1116 and how to file it (example for US expats)

Related Post: