Form 6252 Turbotax

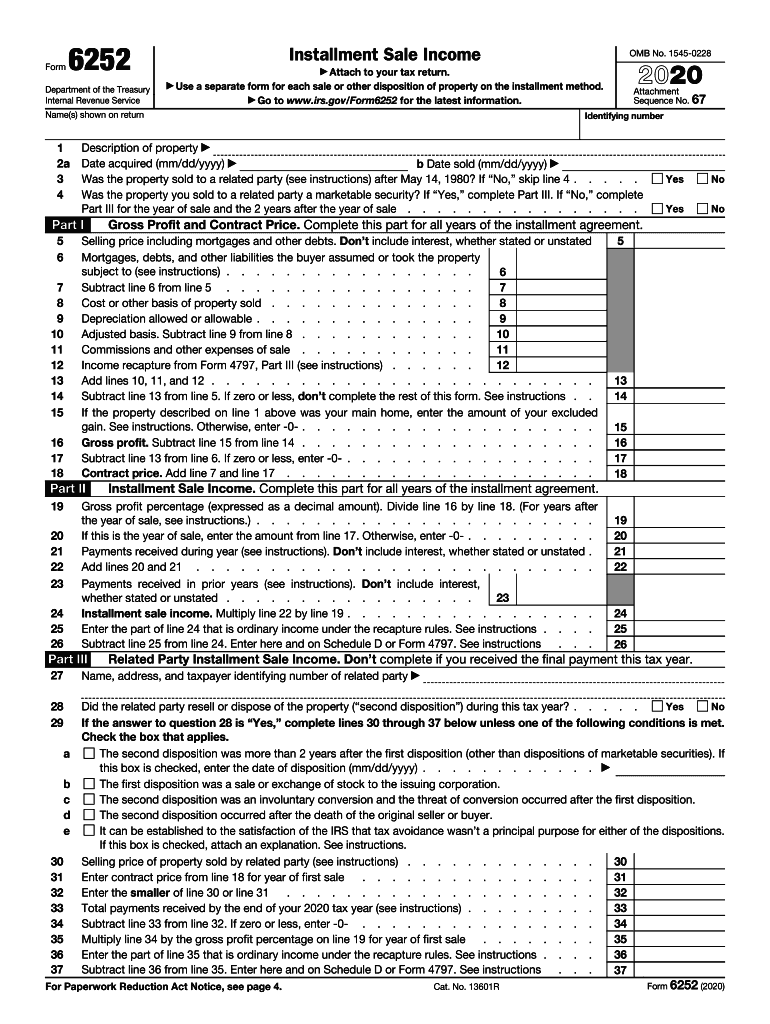

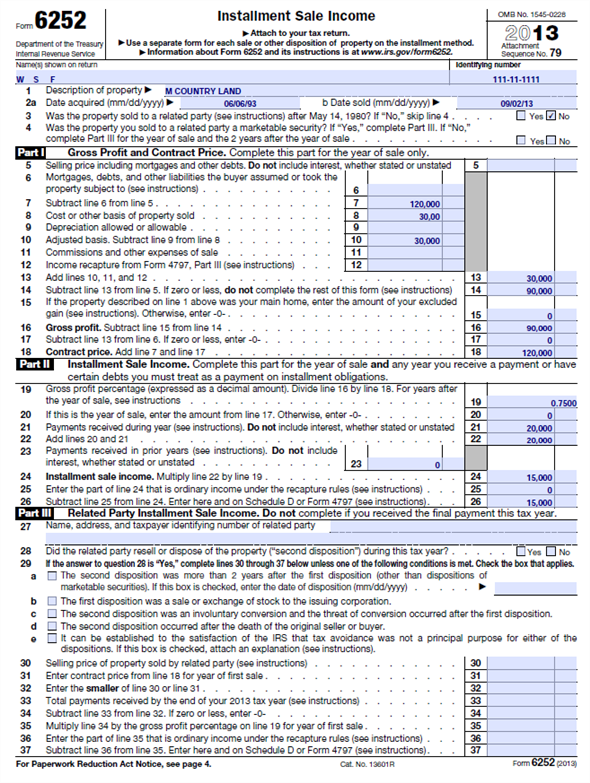

Form 6252 Turbotax - Web irs form 6252 installment sale income is used to report income from an installment sale on the installment method. Web the tax code does give you the option of treating an installment sale like a regular sale—that is, reporting the entire gain in the year of the sale, even though you. Easily sort by irs forms to find the product that best fits your tax. Pay the lowest amount of taxes possible with strategic planning and preparation Use a separate form for each sale or other disposition of property on the. Ad download or email form 6252 & more fillable forms, register and subscribe now! Any installment sale income for current year (form 6252, line 26), which will be included with the amount on schedule 1. If you sold property to a related party during the year, also complete part iii. Web up to 10% cash back installment sales are reported on irs form 6252, installment sale income. Get ready for tax season deadlines by completing any required tax forms today. Irs form 6252 reports the profits from selling a personal or business asset through an installment plan. Web complete part i, lines 1 through 4, and part ii. Use this form to report income from an installment sale on the installment method. Beginning in tax year 2019,. Web about form 6252, installment sale income. Any installment sale income for current year (form 6252, line 26), which will be included with the amount on schedule 1. Pay the lowest amount of taxes possible with strategic planning and preparation Or form 6252, installment sale income, whichever applies. Taxpayers should only file this form if they. Generally, an installment sale is a. Web total gross profit from sale (form 6252, line 16), and; Get ready for tax season deadlines by completing any required tax forms today. Web the tax code does give you the option of treating an installment sale like a regular sale—that is, reporting the entire gain in the year of the sale, even though you. Generally, an installment sale. Form 4797, sales of business property; Generally, an installment sale is a. Generally, an installment sale is a disposition. Web to include form 6252 for an installment sale in turbotax busness please follow these steps: Web if you are selling assets using the installment sale method, you may need to report the transaction on irs form 6252 for each year. Web irs tax form 6252 is a form that you must use to report income you've acquired from selling something for a price higher than what you originally paid for the item. Web complete part i, lines 1 through 4, and part ii. Web to include form 6252 for an installment sale in turbotax busness please follow these steps: Web. Web how to generate form 6252 for a current year installment sale in lacerte if form 6252 doesn't generate after completing the entries, look for the following. Generally, an installment sale is a disposition. Form 4797, sales of business property; Web department of the treasury internal revenue service installment sale income attach to your tax return. Easily sort by irs. Web if you are selling assets using the installment sale method, you may need to report the transaction on irs form 6252 for each year in which you receive an. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Generally, an installment sale is a. Taxpayers should only file this form. Use this form to report income from an installment sale on the installment method. Pay the lowest amount of taxes possible with strategic planning and preparation A separate form should be filed for each asset you sell using this method. Web up to 10% cash back installment sales are reported on irs form 6252, installment sale income. Web how to. If you sold property to a related party during the year, also complete part iii. Web if you are selling assets using the installment sale method, you may need to report the transaction on irs form 6252 for each year in which you receive an. Easily sort by irs forms to find the product that best fits your tax. Common. Web how to generate form 6252 for a current year installment sale in lacerte if form 6252 doesn't generate after completing the entries, look for the following. Complete form 6252 for each year of the installment. Web go to the section tab sale of asset 4797, 6252. Use a separate form for each sale or other disposition of property on. Web if you are selling assets using the installment sale method, you may need to report the transaction on irs form 6252 for each year in which you receive an. Web total gross profit from sale (form 6252, line 16), and; Web to include form 6252 for an installment sale in turbotax busness please follow these steps: Web report any recognized gains on your schedule d; Common questions about form 6252 in proseries. Or form 6252, installment sale income, whichever applies. Form 4797, sales of business property; Solved•by intuit•8•updated 1 year ago. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Use this form to report income from an installment sale on the installment method. Scroll down to the section current year installment sale (6252) and enter any other information that applies to the installment. Pay the lowest amount of taxes possible with strategic planning and preparation Web department of the treasury internal revenue service installment sale income attach to your tax return. Any installment sale income for current year (form 6252, line 26), which will be included with the amount on schedule 1. Web complete part i, lines 1 through 4, and part ii. Get ready for tax season deadlines by completing any required tax forms today. Complete form 6252 for each year of the installment. Generally, an installment sale is a. A separate form should be filed for each asset you sell using this method. Ad download or email form 6252 & more fillable forms, register and subscribe now!Form 6252 Fill Out and Sign Printable PDF Template signNow

Southwestern Federal Taxation 2015 38th Edition Textbook Solutions

How to file the *new* Form 1099NEC for independent contractors using

What is a W2 Form? TurboTax Tax Tips & Videos

When a property is sold for a gain, the investor may end up with a

1095 C Form Turbotax Form Resume Examples EQBD32okXn

What is a Schedule K1 Tax Form? TurboTax Tax Tips & Videos Fill

Form 6252 Installment Sale (2015) Free Download

IRS Form 6252 Reporting Installment Sales on Your Form 1040

turbotax nol carryback Fill Online, Printable, Fillable Blank form

Related Post: