Irs Form 8915-F Instructions

Irs Form 8915-F Instructions - The irs released new instructions for this form. Use part i to figure your: Web open or continue your return in turbotax. Ad access irs tax forms. Complete, edit or print tax forms instantly. Department of the treasury internal revenue service. Qualified 2020 disaster retirement plan distributions and repayments. Web generating form 8915 in proseries. In the left menu, select tax tools and then tools. Web from the main menu of the tax return select: In the left menu, select tax tools and then tools. For information about drake20 and prior, see. Complete, edit or print tax forms instantly. Total distributions from all retirement plans (including iras), qualified 2020 disaster distributions, and. Web from the main menu of the tax return select: The irs released new instructions for this form. For information about drake20 and prior, see. You can choose to use worksheet 1b even if you are not required to do so. Use part i to figure your: Get ready for tax season deadlines by completing any required tax forms today. Total distributions from all retirement plans (including iras), qualified 2020 disaster distributions, and. You did not make a repayment until november 10, 2021, when you made a. Web please download the february 2022 revision of the instructions pdf for the revised text. Maximize your tax return by working with experts in the field Web you chose to spread the $90,000. Starting in tax year 2022,. Web please download the february 2022 revision of the instructions pdf for the revised text. Updates to the software are. See worksheet 1b, later, to determine whether you must use worksheet 1b. You did not make a repayment until november 10, 2021, when you made a. Complete, edit or print tax forms instantly. Page last reviewed or updated: Solved•by intuit•598•updated january 17, 2023. You can choose to use worksheet 1b even if you are not required to do so. In the left menu, select tax tools and then tools. Web you chose to spread the $90,000 over 3 years ($30,000 in income for 2020, 2021, and 2022). (january 2022) qualified disaster retirement plan distributions and repayments. The irs released new instructions for this form. You did not make a repayment until november 10, 2021, when you made a. Web open or continue your return in turbotax. Ad access irs tax forms. Department of the treasury internal revenue service. Starting in tax year 2022,. Ad save time and money with professional tax planning & preparation services. Use part i to figure your: Maximize your tax return by working with experts in the field The irs released new instructions for this form. Web you chose to spread the $90,000 over 3 years ($30,000 in income for 2020, 2021, and 2022). Web open or continue your return in turbotax. (january 2022) qualified disaster retirement plan distributions and repayments. You did not make a repayment until november 10, 2021, when you made a. You can choose to use worksheet 1b even if you are not required to do so. Updates to the software are. For information about drake20 and prior, see. Total distributions from all retirement plans (including iras), qualified 2020 disaster distributions, and. January 2023) qualified disaster retirement plan distributions and repayments department of the treasury internal revenue service attach to form 1040,. In the left menu, select tax tools and then tools. Solved•by intuit•598•updated january 17, 2023. Page last reviewed or updated: You can choose to use worksheet 1b even if you are not required to do so. Total distributions from all retirement plans (including iras), qualified 2020 disaster distributions, and. Page last reviewed or updated: Updates to the software are. Department of the treasury internal revenue service. Web generating form 8915 in proseries. (january 2022) qualified disaster retirement plan distributions and repayments. For information about drake20 and prior, see. Web open or continue your return in turbotax. See worksheet 1b, later, to determine whether you must use worksheet 1b. Solved•by intuit•598•updated january 17, 2023. Web from the main menu of the tax return select: January 2023) qualified disaster retirement plan distributions and repayments department of the treasury internal revenue service attach to form 1040,. Qualified 2020 disaster retirement plan distributions and repayments. You did not make a repayment until november 10, 2021, when you made a. Get ready for tax season deadlines by completing any required tax forms today. Web for 2019, none of the qualified 2016 disaster distribution is included in income. You can choose to use worksheet 1b even if you are not required to do so. Complete, edit or print tax forms instantly. In the left menu, select tax tools and then tools. Starting in tax year 2022,.8915 F 2020 Coronavirus Distributions for 2021 Tax Returns YouTube

8915e tax form instructions Somer Langley

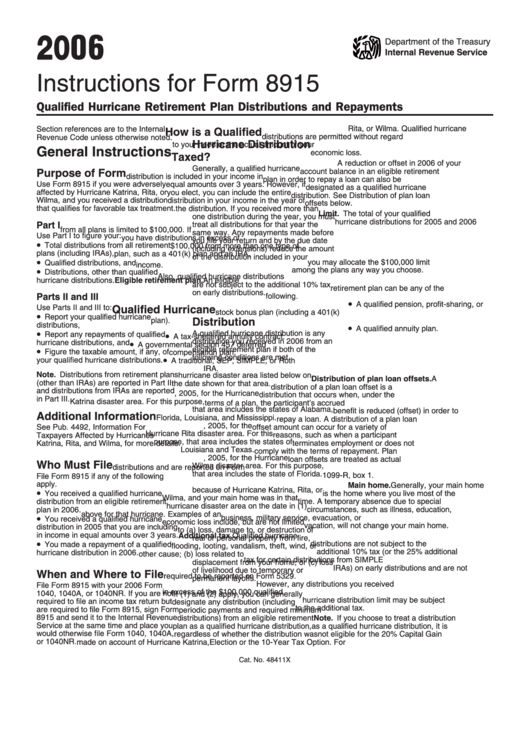

Instructions For Form 8915 2006 printable pdf download

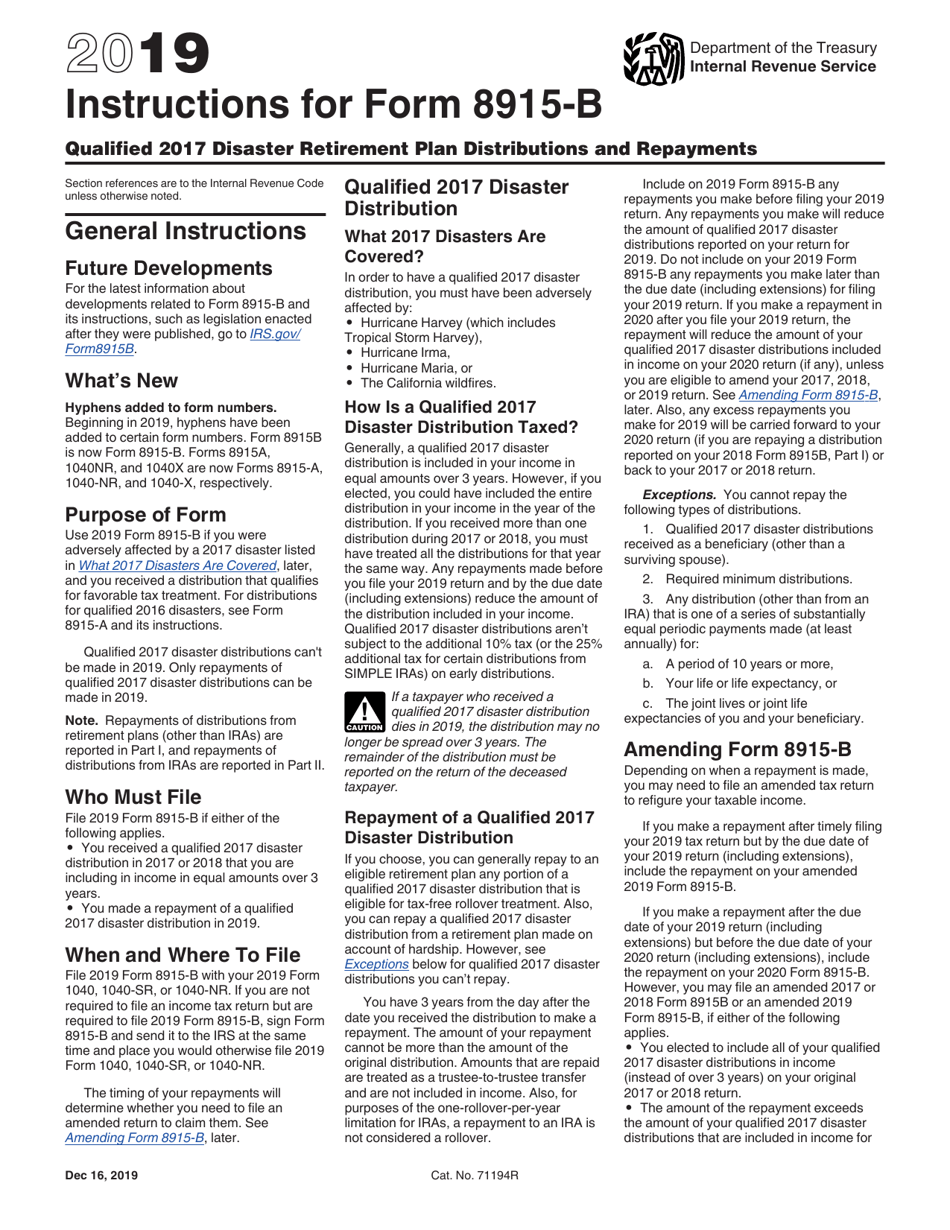

Download Instructions for IRS Form 8915B Qualified 2017 Disaster

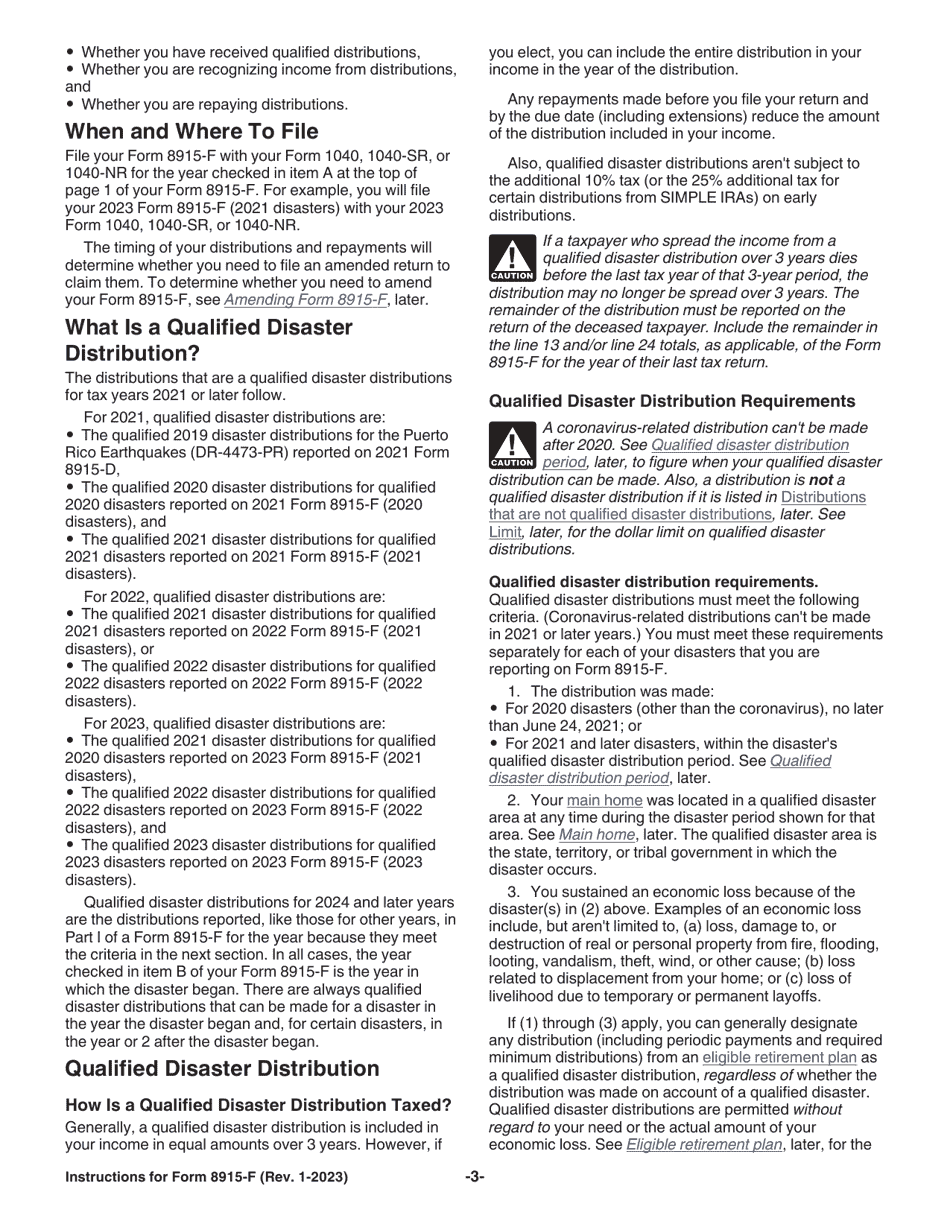

Download Instructions for IRS Form 8915F Qualified Disaster Retirement

Fill Free fillable Form 8915F Qualified Disaster Retirement Plan

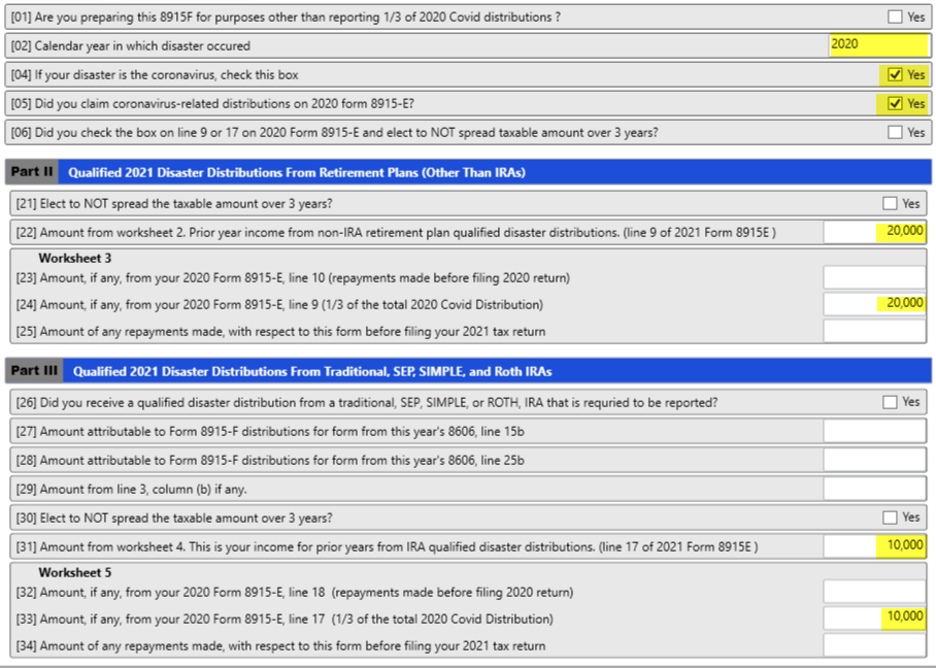

Basic 8915F Instructions for 2021 Taxware Systems

Fill Free fillable Form 8915F Qualified Disaster Retirement Plan

'Forever' form 8915F issued by IRS for retirement distributions Newsday

Définition du formulaire 1099R

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)