Form 1096 Corrected

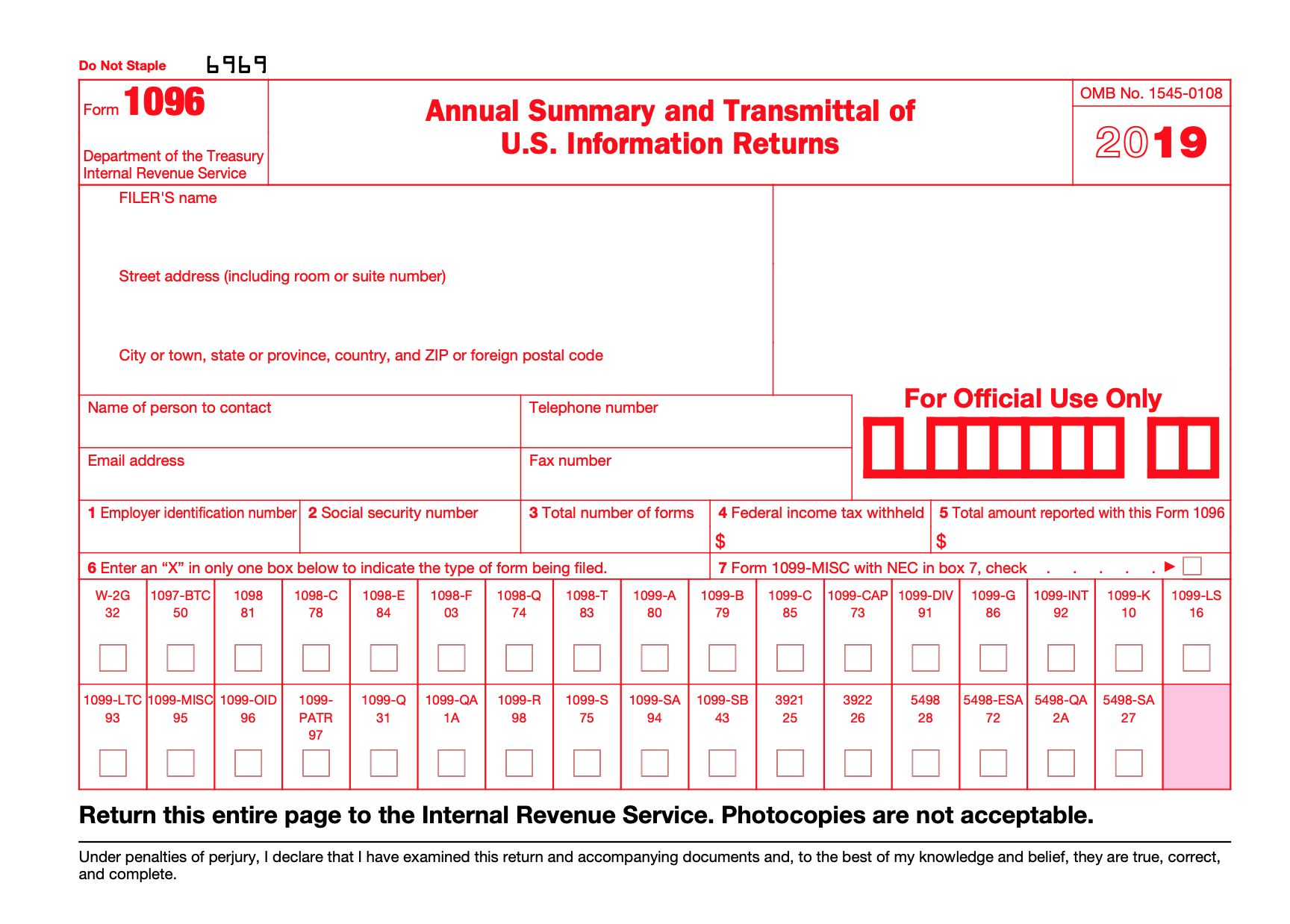

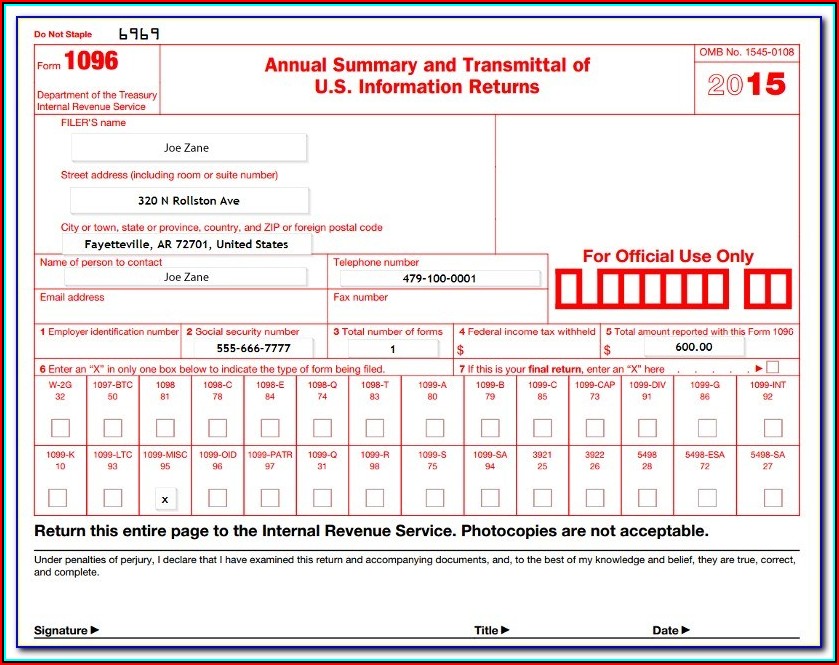

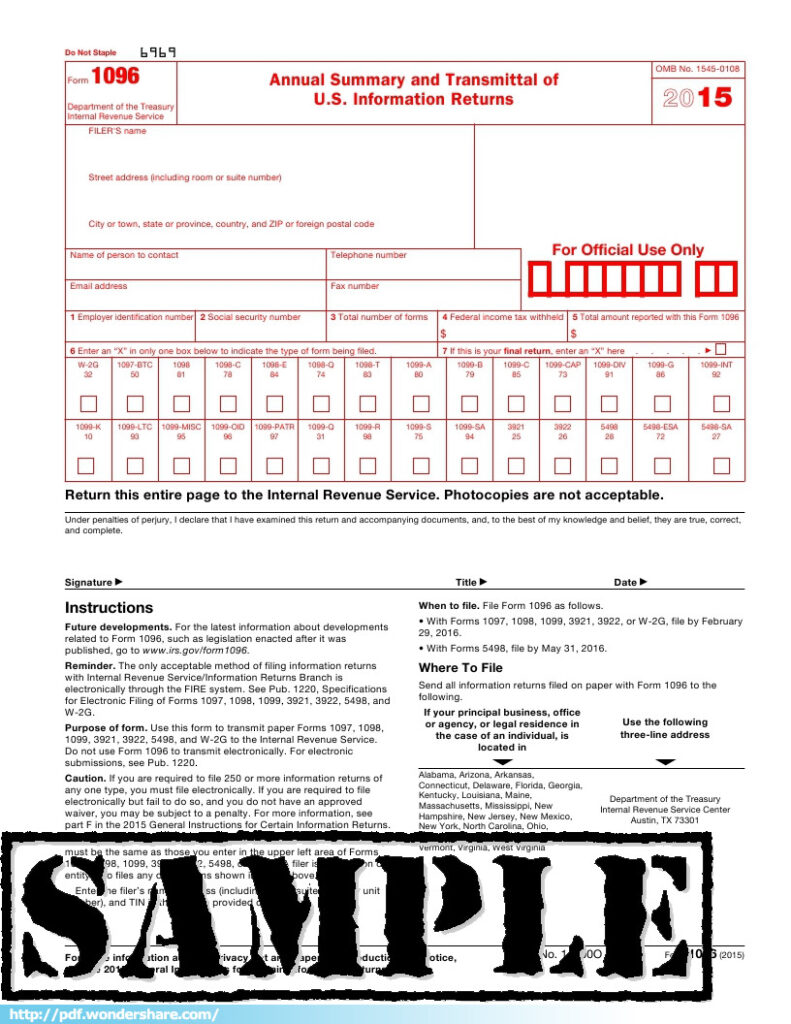

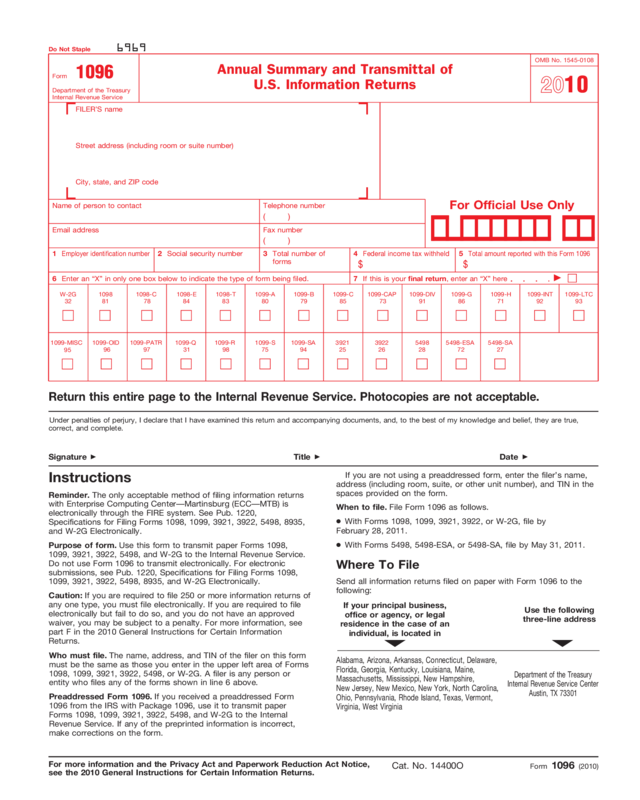

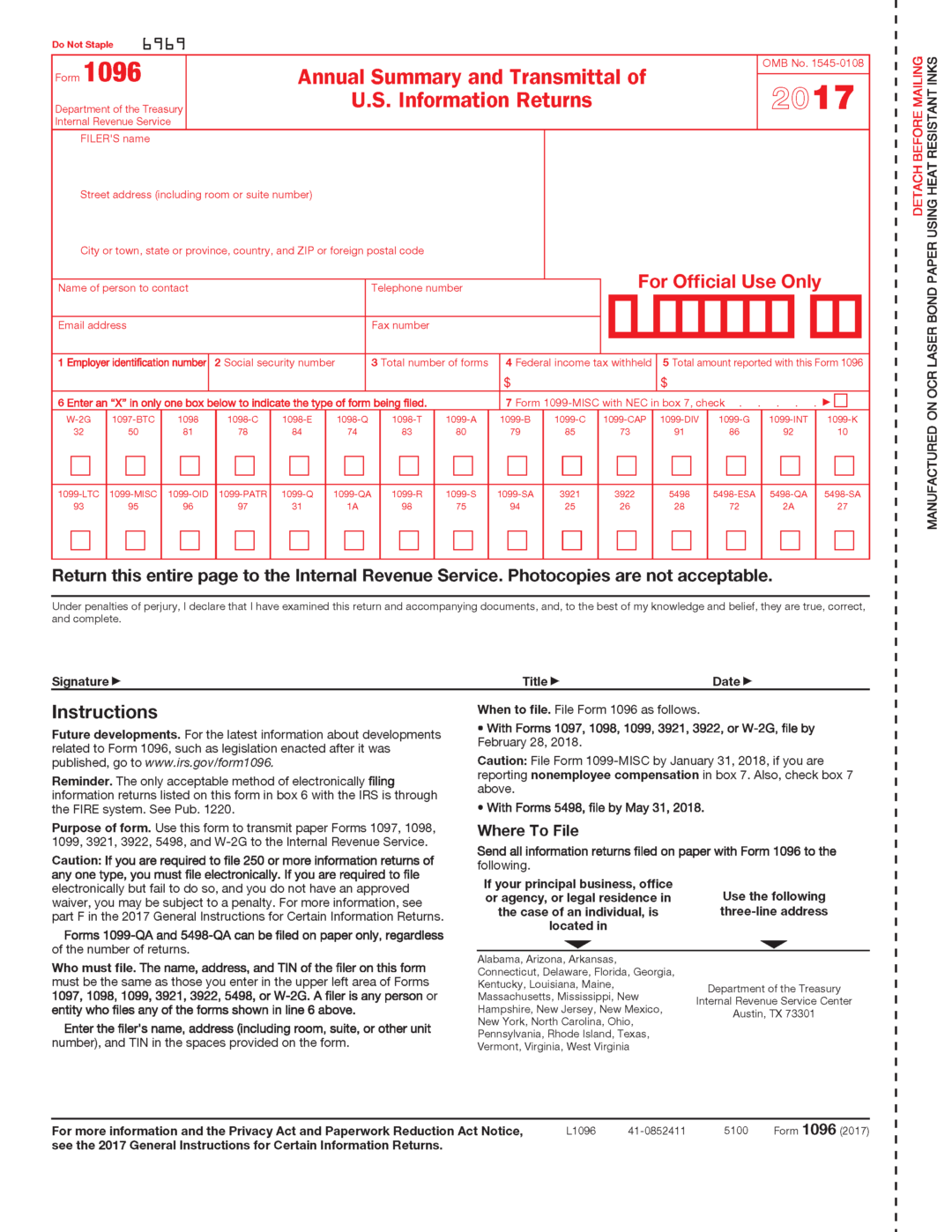

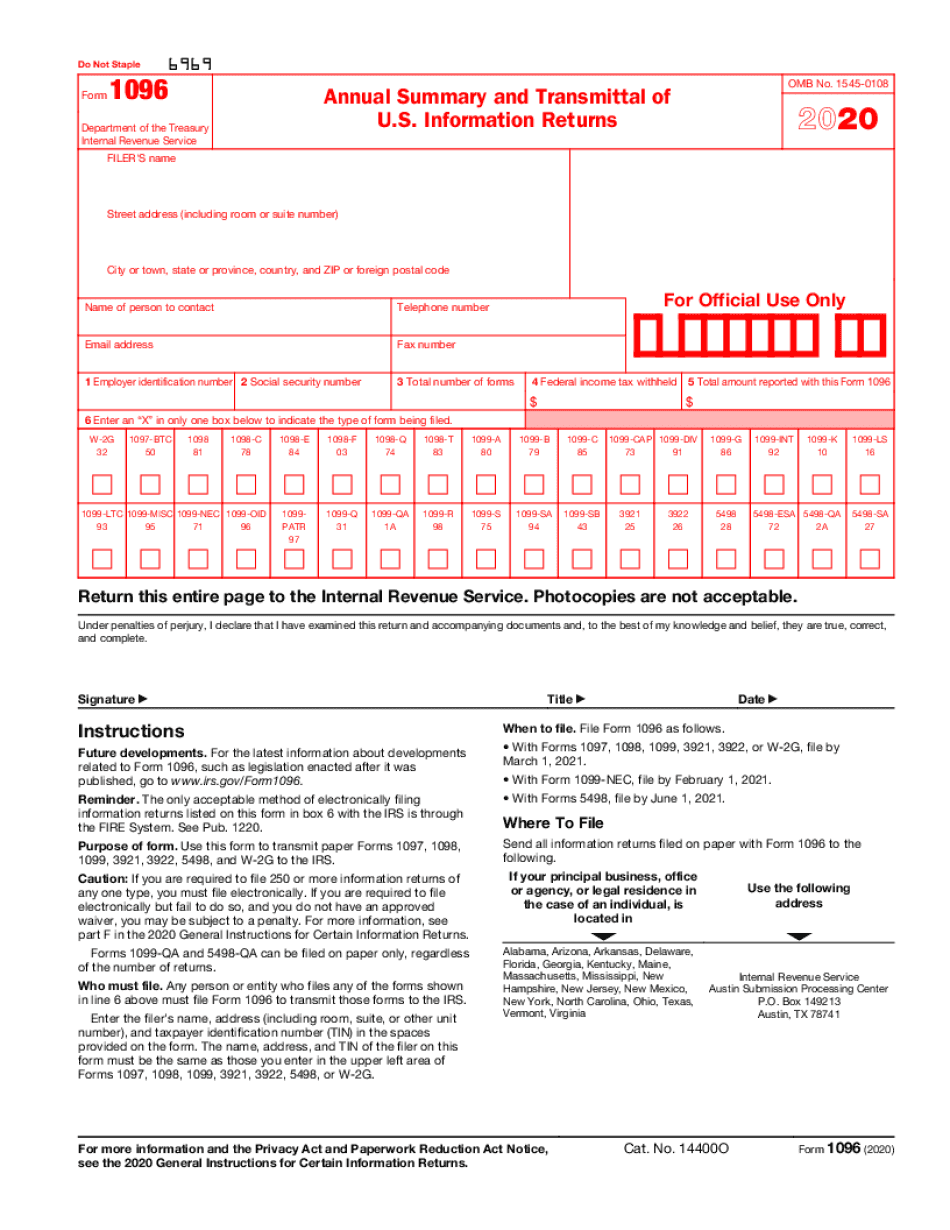

Form 1096 Corrected - Do not send a form (1099, 5498, etc.) containing summary (subtotal) information with form 1096. Information returns in april 2022, so this is the latest version of form 1096, fully updated for tax year 2022. Follow these steps to generate a corrected 1099. I know i also have to send form 1096. Irs form 1096 offers more information for the employees at the irs who need to. Should this new 1096 reflect my new. Web building your business. Do not include blank or voided forms or the form 1096 in your total. Include one of the following phrases at the top of form 1096, “filed to correct ssn”, “filed to correct name”. Web you need not submit original and corrected returns separately. Web prepare a new form 1096 with corrected information. Web how to generate a corrected form 1099 or 1096 in easyacct. I know i also have to send form 1096. Do not include blank or voided forms or the form 1096 in your total. Web building your business. Solved•by intuit•updated 1 year ago. I know i also have to send form 1096. Web prepare a new form 1096 with corrected information. Ad download or email irs 1096 & more fillable forms, register and subscribe now! Enter the number of correctly completed forms, not the number of pages, being transmitted. Web you need not submit original and corrected returns separately. You need not submit original and corrected returns separately. Enter the words filed to correct tin, filed to correct name and address, or file to correct return in the. Web how to generate a corrected form 1099 or 1096 in easyacct. I know i also have to send form 1096. Do not include blank or voided forms or the form 1096 in your total. Web use form 1096 to send paper forms to the irs. Tax form 1096 explained in less than 5 minutes. Do not send a form (1099, 5498, etc.) containing summary (subtotal) information with form 1096. Solved•by intuit•updated 1 year ago. Solved•by intuit•updated 1 year ago. Web in many cases, you can simply fill out a new form with the correct information, checking the box at the top of the form to indicate that it is a corrected. Web use form 1096 to send paper forms to the irs. Prepare a new transmittal form 1096. *for the majority of information returns,. Irs form 1096 offers more information for the employees at the irs who need to. Web building your business. You need not submit original and. Web do not include blank or voided forms or the form 1096 in your total. Web we last updated the annual summary and transmittal of u.s. I know i also have to send form 1096. Fill out and include form 1096 to indicate how many of which type of form you’re correcting. Follow these steps to generate a corrected 1099. Irs form 1096 offers more information for the employees at the irs who need to. Fill, edit, download & print. Do not send a form (1099, 5498, etc.). Web check the box at the top of the form to indicate the filing is a corrected form. Prepare a new transmittal form 1096. Web if you previewed the 2022 form 1096, annual summary and transmittal of u.s. Web we last updated the annual summary and transmittal of u.s. Should this new 1096 reflect my new. Web prepare a new form 1096 with corrected information. Web check the box at the top of the form to indicate the filing is a corrected form. Include one of the following phrases at the top of form 1096, “filed to correct ssn”, “filed to correct name”. Enter the number of correctly completed. Enter the number of correctly completed forms, not the number of pages, being transmitted. Do not include blank or voided forms or the form 1096 in your total. Web check the box at the top of the form to indicate the filing is a corrected form. What is irs form 1096? Web we last updated the annual summary and transmittal. Enter the words filed to correct tin, filed to correct name and address, or file to correct return in the. Fill out and include form 1096 to indicate how many of which type of form you’re correcting. You need not submit original and. Web use form 1096 to send paper forms to the irs. Tax form 1096 explained in less than 5 minutes. Information returns, online prior to april 4, 2022, please be advised that the form has been revised. Enter the number of correctly completed forms, not the number of pages, being transmitted. Web i am correcting it by mail, by sending a corrected form 1099 with the box checked. Should this new 1096 reflect my new. What is irs form 1096 used for? Web in many cases, you can simply fill out a new form with the correct information, checking the box at the top of the form to indicate that it is a corrected. Fill, edit, download & print. Web building your business. Follow these steps to generate a corrected 1099. *for the majority of information returns, form 1096 is due february 28 of the year immediately following the tax year. Web you need not submit original and corrected returns separately. Do not include blank or voided forms or the form 1096 in your total. Web if you already mailed or efiled your form 1099's to the irs and now need to make a correction, you will need to file by paper copy a red copy a and 1096, fill out. Information returns in april 2022, so this is the latest version of form 1096, fully updated for tax year 2022. Web check the box at the top of the form to indicate the filing is a corrected form.Form 1096 A Simple Guide Bench Accounting

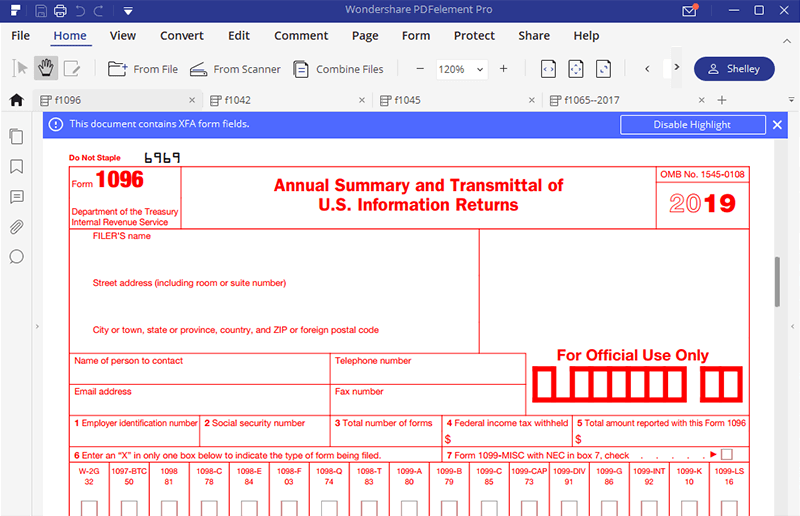

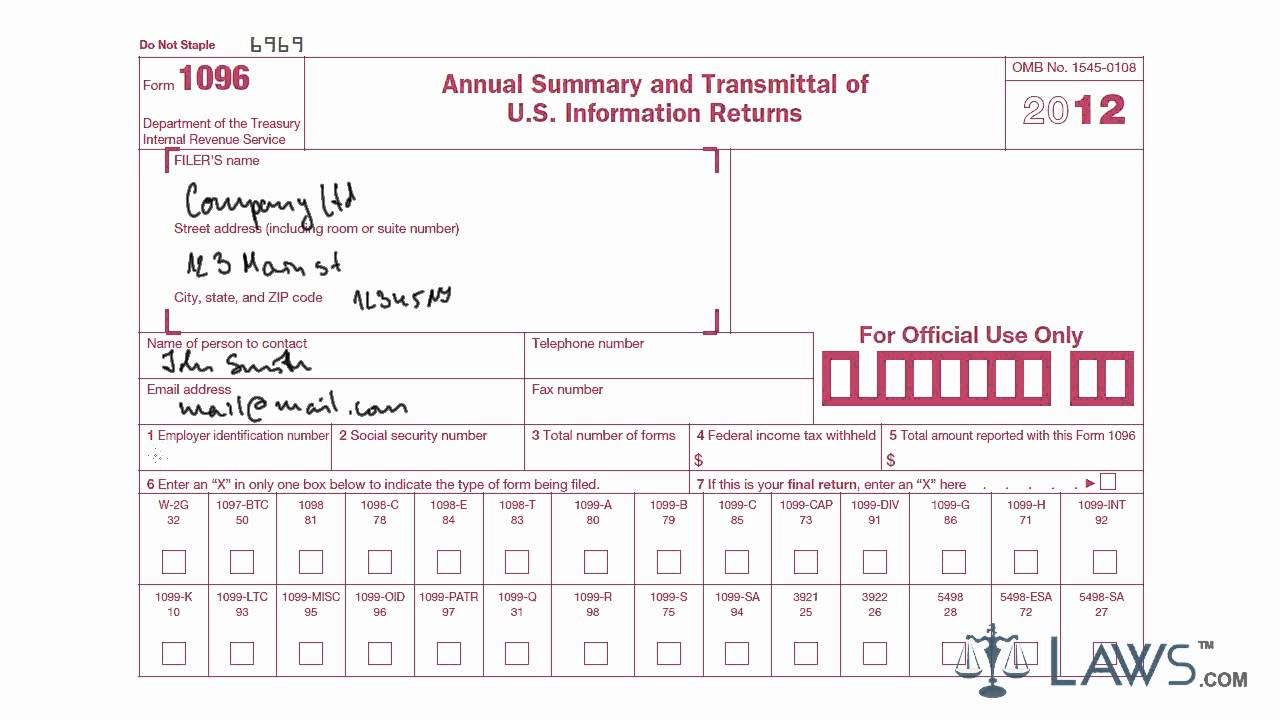

Free Printable 1096 Form Printable Templates

Printable 1096 Form 2021 Customize and Print

Form 1096 Annual Summary and Transmittal of U.S. Information Returns

Printable 1096 Form Printable World Holiday

IRS Form 1096 Filling Instructions for How to Fill it out

Learn How to Fill the Form 1096 Annual Summary And Transmittal Of U.S

Fillable Form 1096 Edit, Sign & Download in PDF PDFRun

1096 Annual Summary Transmittal Forms & Fulfillment

Boost Efficiency With Our Page Numbering For 1096 Form

Related Post: