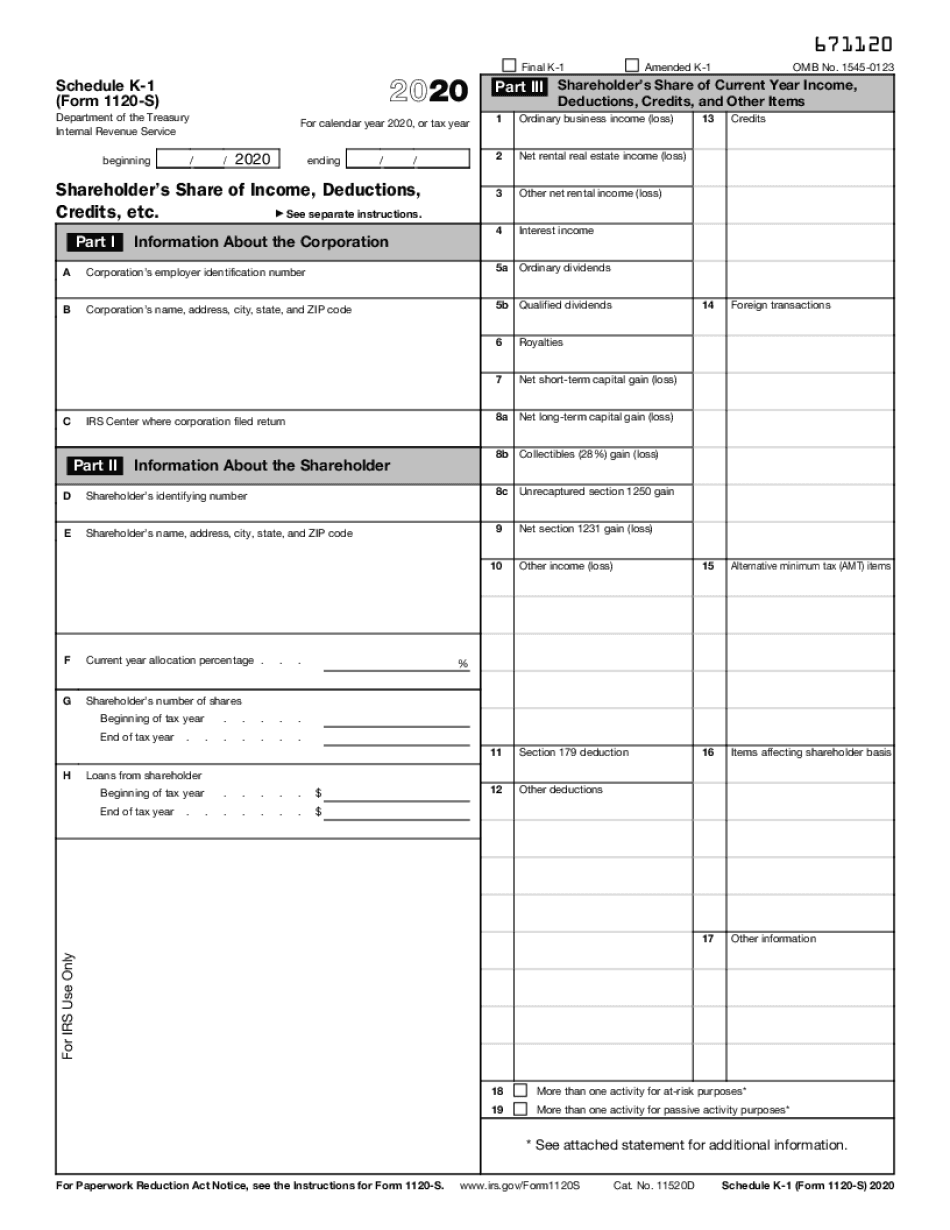

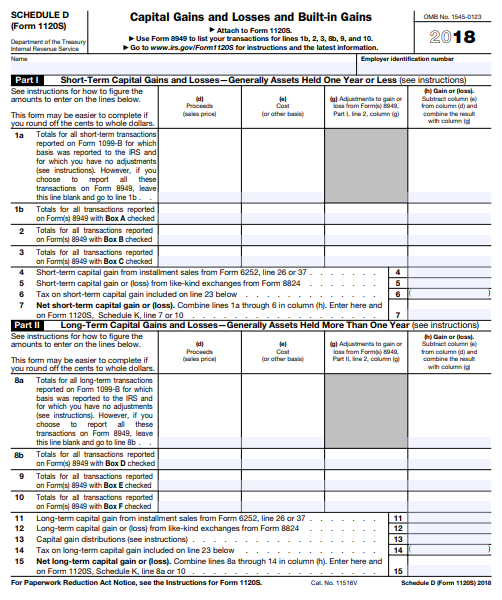

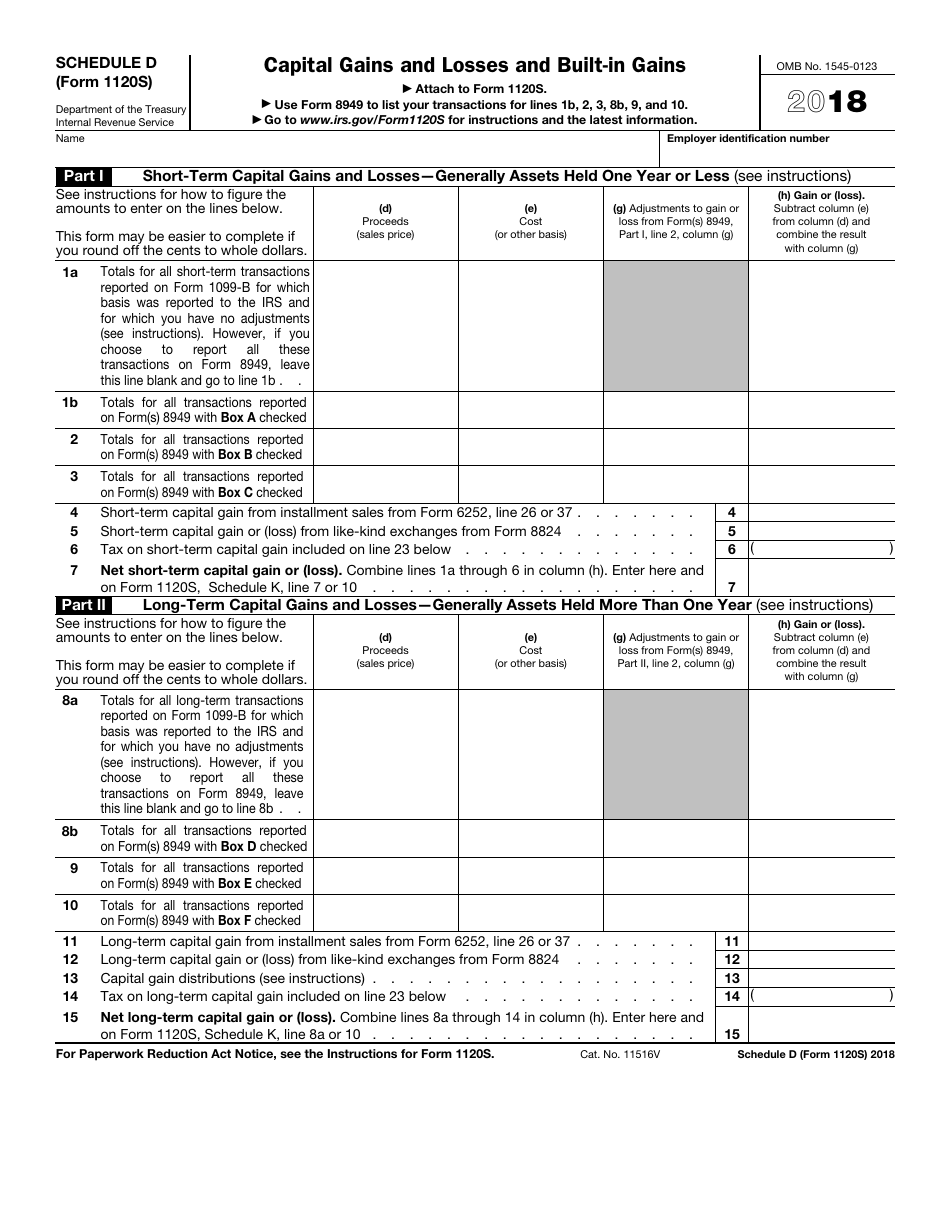

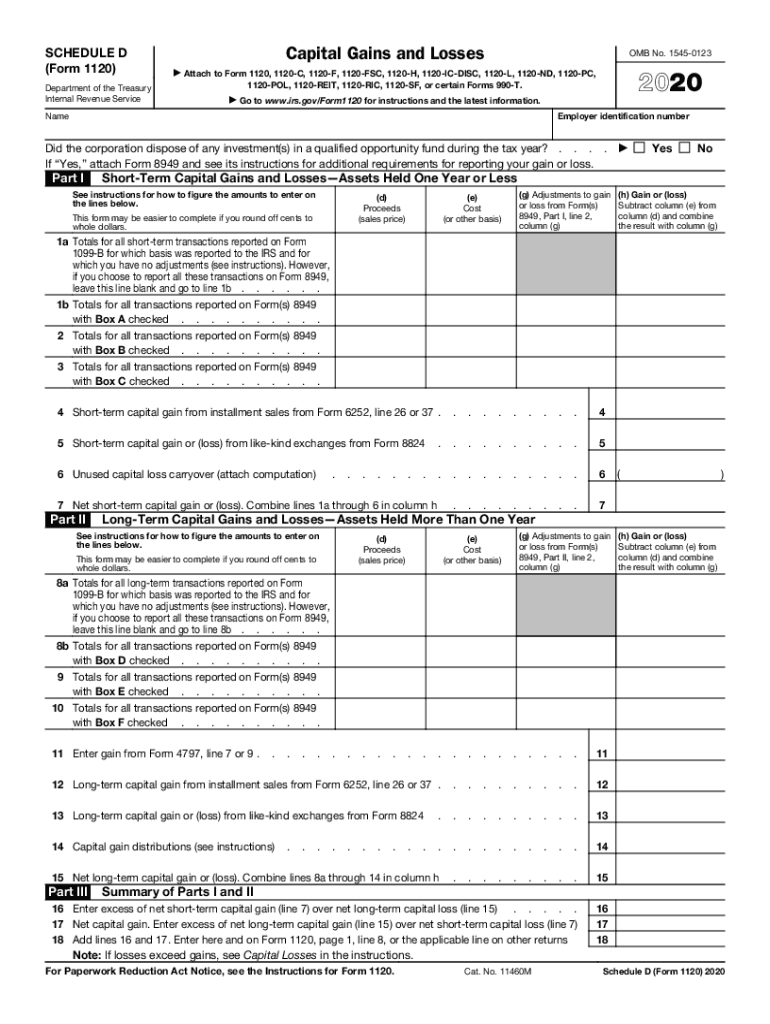

Form 1120S Schedule D

Form 1120S Schedule D - Channels, or who believe that an irs accounting period.6 3. Web what is the form used for? Easily fill out pdf blank, edit, and sign them. October 05, 2023 tax year 2023 1120 mef ats scenario 3: Ad easy guidance & tools for c corporation tax returns. Use schedule d (form 1120) to: Web written by a turbotax expert • reviewed by a turbotax cpa. Updated for tax year 2022 • june 2, 2023 8:43 am. Web we last updated the capital gains and losses in december 2022, so this is the latest version of 1120 (schedule d), fully updated for tax year 2022. Ad get ready for tax season deadlines by completing any required tax forms today. October 05, 2023 tax year 2023 1120 mef ats scenario 3: Other forms the corporation may have to. Web what is the form used for? Income tax return for an s corporation. Save or instantly send your ready documents. Do not file this form unless the corporation has filed or is attaching. Ad easy guidance & tools for c corporation tax returns. October 05, 2023 tax year 2023 1120 mef ats scenario 3: Form 4797, sales of business property. A cash b accrual c other (specify) 2 see the instructions and. October 05, 2023 tax year 2023 1120 mef ats scenario 3: Updated for tax year 2022 • june 2, 2023 8:43 am. Easily fill out pdf blank, edit, and sign them. Use schedule d (form 1120) to: Complete, edit or print tax forms instantly. Gather the information required for form 1120s whether you use tax software or hire a tax expert to prepare your taxes, you’ll need information and evidence. Channels, or who believe that an irs accounting period.6 3. 52684s schedule g (form 1120) (rev. October 05, 2023 tax year 2023 1120 mef ats scenario 3: Web accounting methods.5 schedule d (form 1120s). Sales or exchanges of capital assets. The schedule d form is what. Web form 1120s (2011) page 2 schedule b other information (see instructions) yes no 1 check accounting method: Figure the overall gain or loss from transactions reported on form 8949. Use schedule d (form 1120) to: Save or instantly send your ready documents. Web what is the form used for? Ad easy guidance & tools for c corporation tax returns. Income tax return for an s corporation. The schedule d form is what. Complete, edit or print tax forms instantly. Web d employer identification number e date incorporated f total assets (see instructions) $ g is the corporation electing to be an s corporation beginning with this tax year? The schedule d form is what. Web form 1120s (2011) page 2 schedule b other information (see instructions) yes no 1 check accounting method:. Ad easy guidance & tools for c corporation tax returns. Gather the information required for form 1120s whether you use tax software or hire a tax expert to prepare your taxes, you’ll need information and evidence. Web d employer identification number e date incorporated f total assets (see instructions) $ g is the corporation electing to be an s corporation. Use form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. Income tax return for an s corporation. Department of the treasury internal revenue service. Form 4797, sales of business property. 52684s schedule g (form 1120) (rev. Web accounting methods.5 schedule d (form 1120s). The schedule d form is what. October 05, 2023 tax year 2023 1120 mef ats scenario 3: Gather the information required for form 1120s whether you use tax software or hire a tax expert to prepare your taxes, you’ll need information and evidence. Web what is the form used for? Use form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. Ad easy guidance & tools for c corporation tax returns. Web d employer identification number e date incorporated f total assets (see instructions) $ g is the corporation electing to be an s corporation beginning with this tax year? Ad get ready for tax season deadlines by completing any required tax forms today. Income tax return for an s corporation. Form 4797, sales of business property. Do not file this form unless the corporation has filed or is attaching. Gather the information required for form 1120s whether you use tax software or hire a tax expert to prepare your taxes, you’ll need information and evidence. Web accounting methods.5 schedule d (form 1120s). Certain tax benefits for system or procedure is not working as. Department of the treasury internal revenue service. 52684s schedule g (form 1120) (rev. Sales or exchanges of capital assets. The schedule d form is what. Save or instantly send your ready documents. A cash b accrual c other (specify) 2 see the instructions and. You can download or print. Web what is the form used for? October 05, 2023 tax year 2023 1120 mef ats scenario 3: Web written by a turbotax expert • reviewed by a turbotax cpa.1120s Other Deductions Worksheet Promotiontablecovers

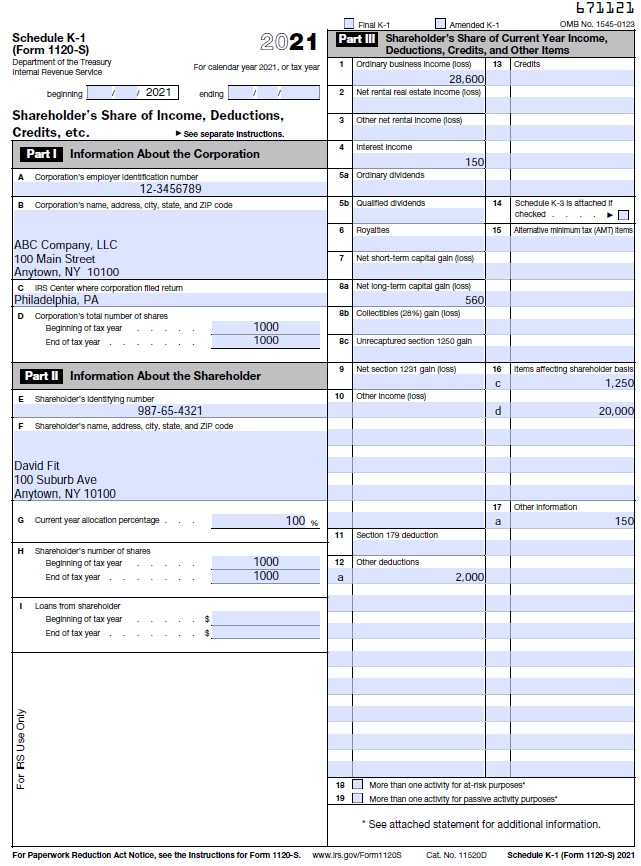

The Fastest Way To Edit Document Schedule K 1 Form Form 1120s

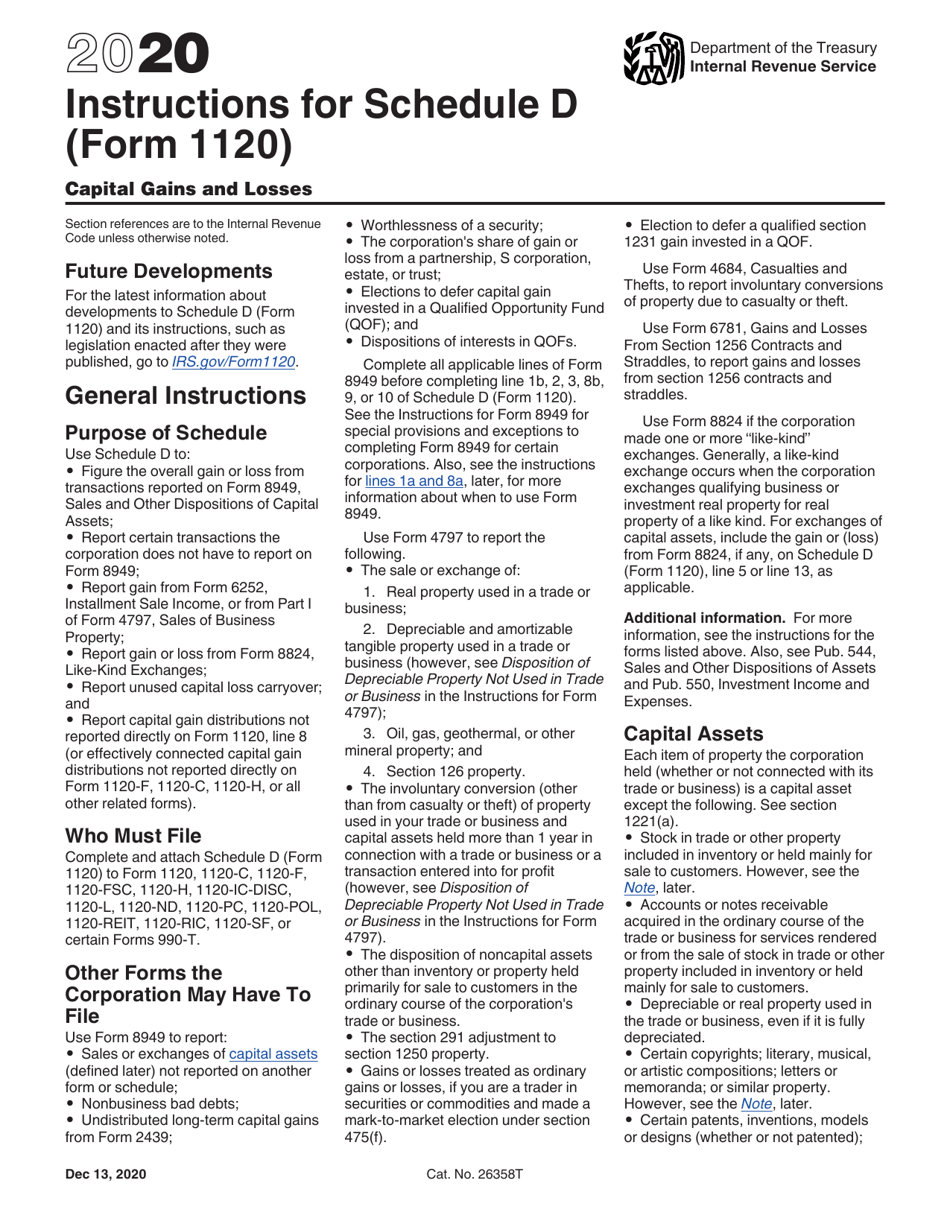

Download Instructions for IRS Form 1120 Schedule D Capital Gains and

IRS Form 1120S Definition, Download, & 1120S Instructions

How to Complete Form 1120S & Schedule K1 (With Sample)

IRS 1120S 2023 Form Printable Blank PDF Online

Form 1120S (Schedule D) Capital Gains and Losses and Builtin Gains

Can you look over this corporate tax return form 1120 I did based on

IRS Form 1120S Schedule D 2018 Fill Out, Sign Online and Download

IRS 1120 Schedule D 20202022 Fill out Tax Template Online US

Related Post: