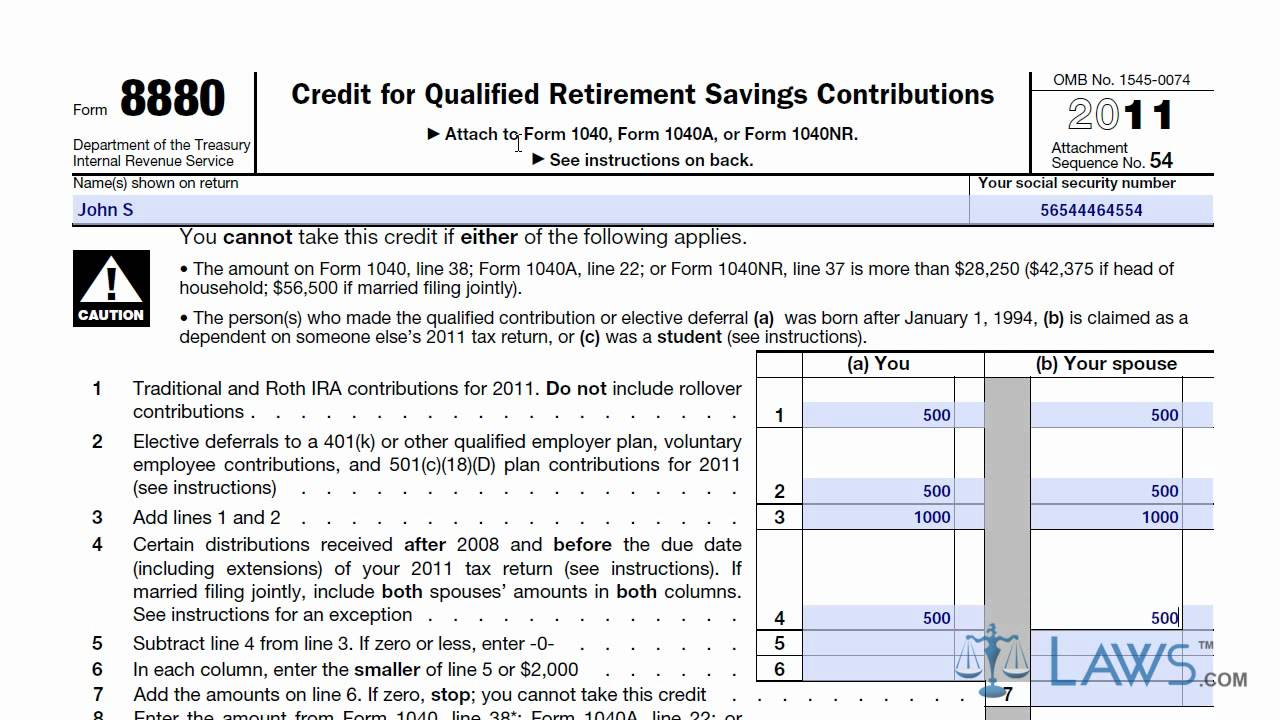

Form 8880 Credit Limit Worksheet

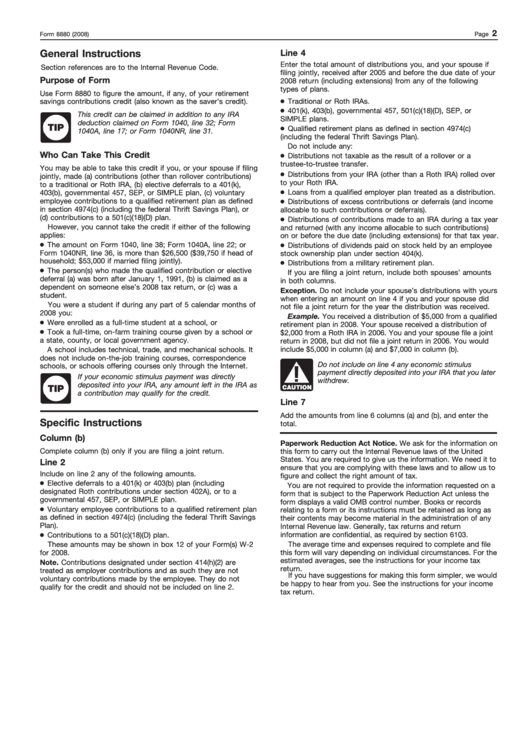

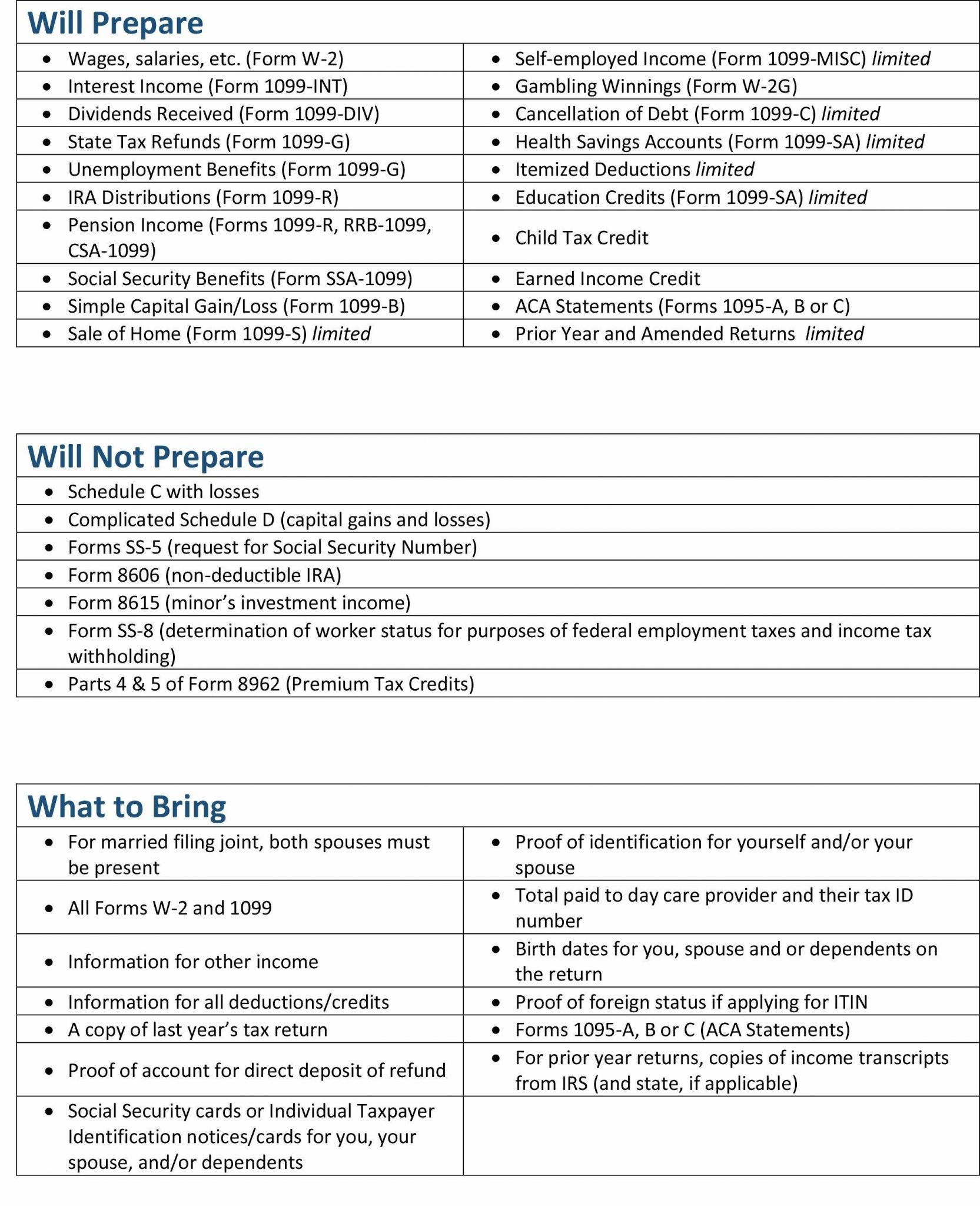

Form 8880 Credit Limit Worksheet - Certain distributions made before tax return due date. Enter the amount from the credit limit worksheet in the instructions Web before you complete the following worksheet, figure the amount of any credit for the elderly or the disabled you are claiming on form 1040, line 54. Ira and able account contributions. Enter the amount from form. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). Complete, edit or print tax forms instantly. Web 11 limitation based on tax liability. Enter the amount from the credit limit worksheet in the instructions 11. Web the limits for 2020 are as follows: Enter the amount from the credit limit worksheet in the instructions Enter the amount from form. Web if the taxpayer seems to qualify for the credit, be sure to visit the form 8880 entry screen in the credits menu and address any necessary questions there. Web purpose of form use form 8880 to figure the amount, if any, of your. Complete, edit or print tax forms instantly. Enter the amount from the credit limit worksheet in the instructions 11. Below is the information from the exact form, and is not what is shown in turbotax. Web the limits for 2020 are as follows: Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Enter the amount from form 8863, line 18: Web before you complete the following worksheet, figure the amount of any credit for the elderly or the disabled you are claiming on form 1040, line 54. Web enter the amount from the credit limit worksheet in the instructions 11 12 credit for qualified retirement. Web for 2022, single filers with an agi of $34,000 or more, head of household filers with agi of $51,000 or more and joint filers with an agi of $68,000 or more are. Use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Use schedule 8812 (form 1040) to. Enter the amount from the credit limit worksheet in the instructions Web 11 limitation based on tax liability. Web before you complete the following worksheet, figure the amount of any credit for the elderly or the disabled you are claiming on form 1040, line 54. Web the limits for 2020 are as follows: Web for 2022, single filers with an. Complete this worksheet to figure the amount to enter on line 19. Certain distributions made before tax return due date. But if you’re filing form 2555 or 4563, or you’re excluding income from puerto rico, see pub. Web purpose of form use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the. Complete this worksheet to figure the amount to enter on line 19. Web for 2022, single filers with an agi of $34,000 or more, head of household filers with agi of $51,000 or more and joint filers with an agi of $68,000 or more are. Web form 8880, credit for qualified retirement savings contributions, is used to claim this credit.. Enter the amount from form. Below is the information from the exact form, and is not what is shown in turbotax. Certain distributions made before tax return due date. Use schedule 8812 (form 1040) to figure your child tax credit (ctc), credit for other dependents (odc), and additional child tax credit (actc). See schedule r (form 1040a or. Complete, edit or print tax forms instantly. Web for 2022, single filers with an agi of $34,000 or more, head of household filers with agi of $51,000 or more and joint filers with an agi of $68,000 or more are. Web we last updated the credit for qualified retirement savings contributions in december 2022, so this is the latest version. Enter the amount from the credit limit worksheet in the instructions Complete this worksheet to figure the amount to enter on line 11. Complete, edit or print tax forms instantly. Below is the information from the exact form, and is not what is shown in turbotax. Web form 8880, credit for qualified retirement savings contributions, is used to claim this. Web enter the amount from the credit limit worksheet in the instructions 11 12 credit for qualified retirement savings contributions. But if you’re filing form 2555 or 4563, or you’re excluding income from puerto rico, see pub. Complete, edit or print tax forms instantly. Enter the amount from the credit limit worksheet in the instructions Credit for qualified retirement savings contributions. Web purpose of form use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Department of the treasury internal revenue service. Enter the amount from form 8863, line 18: Web for 2022, single filers with an agi of $34,000 or more, head of household filers with agi of $51,000 or more and joint filers with an agi of $68,000 or more are. Ira and able account contributions. Enter the amount from the credit limit worksheet in the instructions 11. Certain distributions made before tax return due date. Web 11 limitation based on tax liability. Web before you complete the following worksheet, figure the amount of any credit for the elderly or the disabled you’re claiming on schedule 3 (form 1040), line 6d. Enter the smaller of line 10 or line 11 here Web it is the form 8880 worksheet that needs corrected. Web up to $3 cash back form 8880 credit limit worksheet. Web we last updated the credit for qualified retirement savings contributions in december 2022, so this is the latest version of form 8880, fully updated for tax year 2022. Enter the amount from form. This credit can be claimed in.Form 8880 Credit for Qualified Retirement Savings Contributions

Credit limit worksheet Fill online, Printable, Fillable Blank

Learn How to Fill the Form 8880 Credit for Qualified Retirement Savings

Credit Limit Worksheet 8880 —

Instructions For Form 8880 2008 printable pdf download

Downloadable worksheets Fill out & sign online DocHub

Credit Limit Worksheet a Form Fill Out and Sign Printable PDF

Irs Credit Limit Worksheet A

Credit Limit Worksheet 8880 —

credit limit worksheet a schedule 8812

Related Post:

:max_bytes(150000):strip_icc()/Form8880.ScreenShot2022-07-05at12.02.49PM-ef2c8c7c2181487fba28a314c04900db.jpg)