Form 1040Nr Instructions

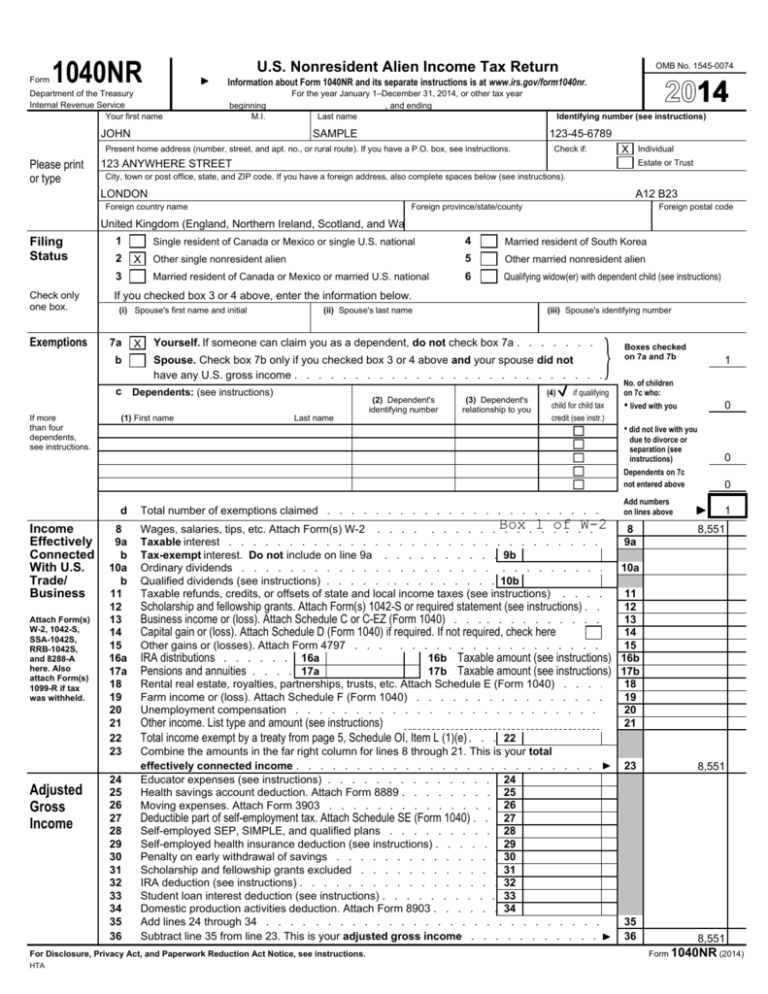

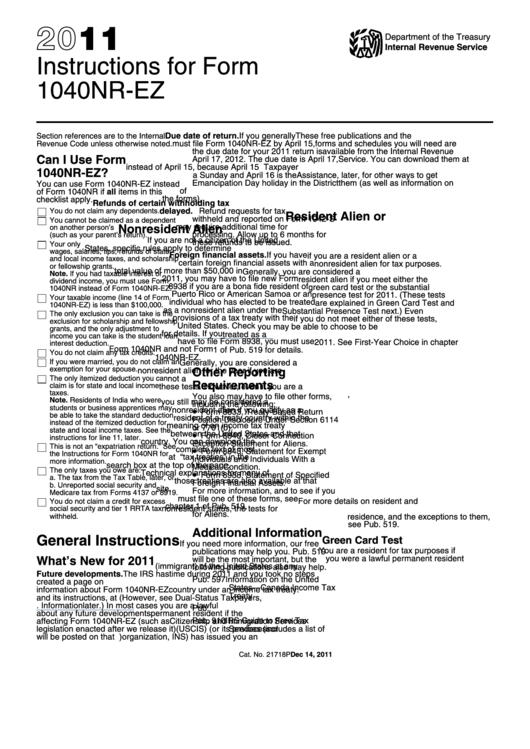

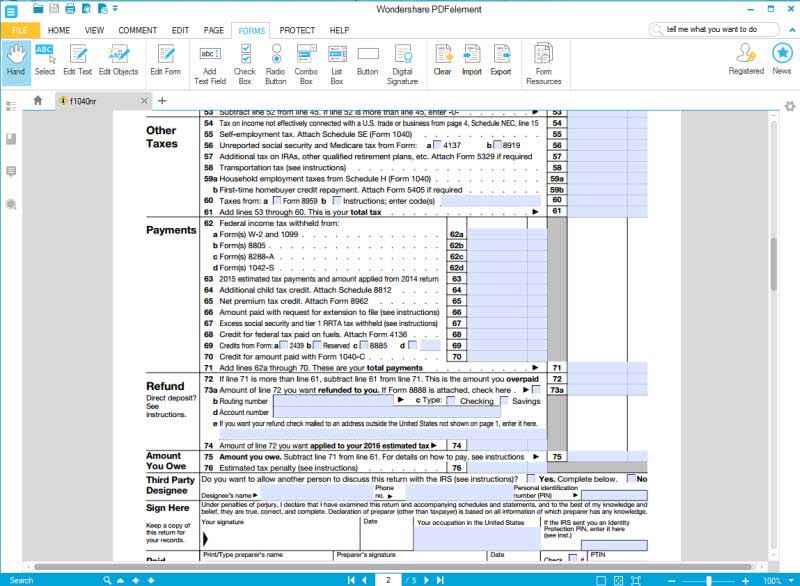

Form 1040Nr Instructions - Irs use only—do not write or staple in. Income tax return for certain nonresident aliens with no dependents, if you qualify),. March 2020) department of the treasury internal revenue service contents page what's new. Enter your status, income, deductions and credits and estimate your total taxes. Filing status name changed from qualifying widow(er) to quali ying surviving spouse. Nonresident alien income tax return (99) 2021. Nonresident alien income tax return only if you have income that is subject to tax, such as wages, tips, scholarship and. Web form 1040nr is the federal income tax form for nonresidents and foreign individuals that must file by the due date each year to avoid irs fines or penalties. A taxpayer is considered a u.s. Nonresident alien income tax return. Irs use only—do not write or. Nonresident alien income tax return. Page last reviewed or updated: Web instructions form 1040 has new lines. A taxpayer is considered a u.s. Nonresident alien income tax return (rev. Irs use only—do not write or staple in. Nonresident alien income tax return 2020 department of the treasury—internal revenue service (99) omb no. Nonresident if they do not have a green. Department of the treasury—internal revenue service. Nonresident alien income tax return (rev. Nonresident alien income tax return), we have partnered with sprintax to offer both federal and. Complete, edit or print tax forms instantly. Income tax return for certain nonresident aliens with no dependents, if you qualify),. Nonresident if they do not have a green. Nonresident alien income tax return. Nonresident alien income tax return (99) 2021. We have a simple example for a taxpayer with u.s. Web form 1040nr is the federal income tax form for nonresidents and foreign individuals that must file by the due date each year to avoid irs fines or penalties. Nonresident alien income tax return only if you have. Filing status name changed from qualifying widow(er) to quali ying surviving spouse. Nonresident alien income tax return. Web form 1040nr is the federal income tax form for nonresidents and foreign individuals that must file by the due date each year to avoid irs fines or penalties. Enter your status, income, deductions and credits and estimate your total taxes. Complete, edit. Ad access irs tax forms. Irs use only—do not write or. You may be eligible to claim the premium tax credit if you,. Estimated tax for nonresident alien individuals, including recent updates, related forms and instructions on how to file. Nonresident alien income tax return), we have partnered with sprintax to offer both federal and. Filing status name changed from qualifying widow(er) to quali ying surviving spouse. Complete, edit or print tax forms instantly. Estimated tax for nonresident alien individuals, including recent updates, related forms and instructions on how to file. Department of the treasury—internal revenue service. Schedule 1 has new lines. You may be eligible to claim the premium tax credit if you,. Irs use only—do not write or. We have a simple example for a taxpayer with u.s. Nonresident alien income tax return. Ad access irs tax forms. Nonresident alien income tax return (rev. Estimated tax for nonresident alien individuals, including recent updates, related forms and instructions on how to file. Nonresident alien income tax return), we have partnered with sprintax to offer both federal and. Filing status name changed from qualifying widow(er) to quali ying surviving spouse. Nonresident alien income tax return. Page last reviewed or updated: Schedule 1 has new lines. Web form 1040nr is the federal income tax form for nonresidents and foreign individuals that must file by the due date each year to avoid irs fines or penalties. March 2020) department of the treasury internal revenue service contents page what's new. Irs use only—do not write or. Nonresident alien income tax return. Nonresident alien income tax return (rev. Ad access irs tax forms. Filing status name changed from qualifying widow(er) to quali ying surviving spouse. Schedule 1 has new lines. Estimated tax for nonresident alien individuals, including recent updates, related forms and instructions on how to file. A taxpayer is considered a u.s. Income tax return for certain nonresident aliens with no dependents, if you qualify),. We have a simple example for a taxpayer with u.s. March 2020) department of the treasury internal revenue service contents page what's new. Web form 1040nr is the federal income tax form for nonresidents and foreign individuals that must file by the due date each year to avoid irs fines or penalties. Enter your status, income, deductions and credits and estimate your total taxes. The due date for irs tax returns is april 15 and the. Nonresident if they do not have a green. Nonresident alien income tax return 2020 department of the treasury—internal revenue service (99) omb no. Department of the treasury—internal revenue service. Complete, edit or print tax forms instantly. Ad discover helpful information and resources on taxes from aarp. Irs use only—do not write or staple in. Page last reviewed or updated:1040nr instructions line 40

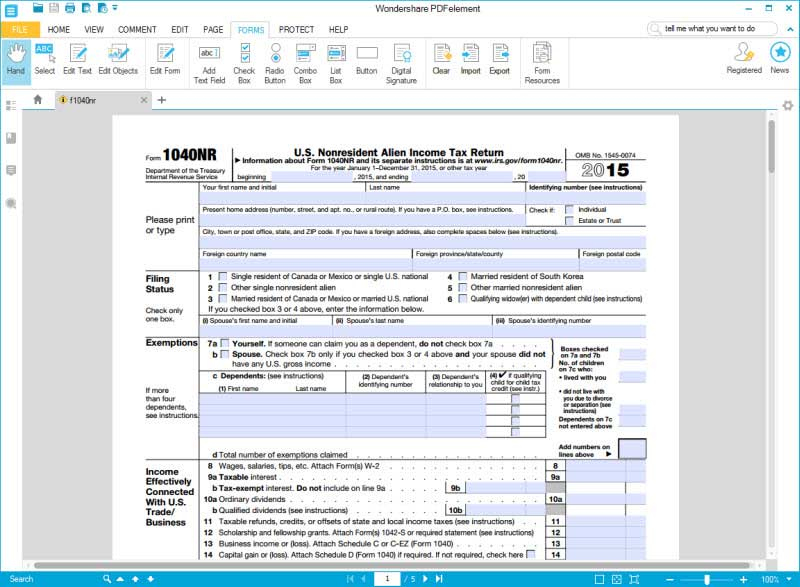

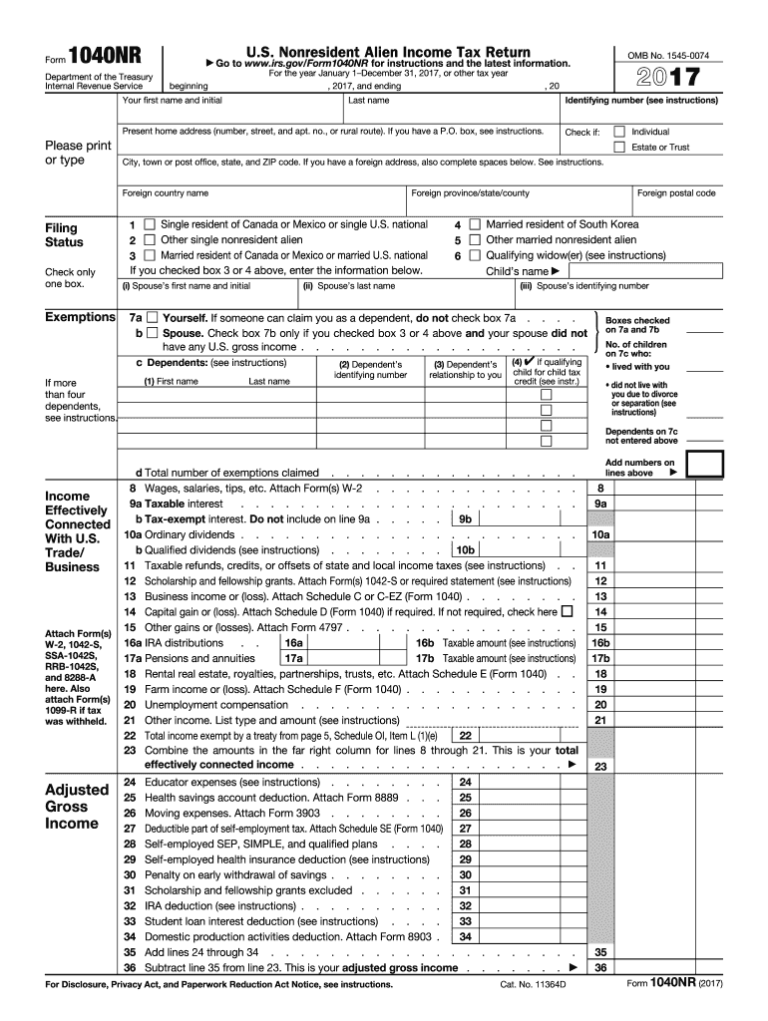

IRS Form 1040NR Read The Filling Instructions Before 2021 Tax Forms

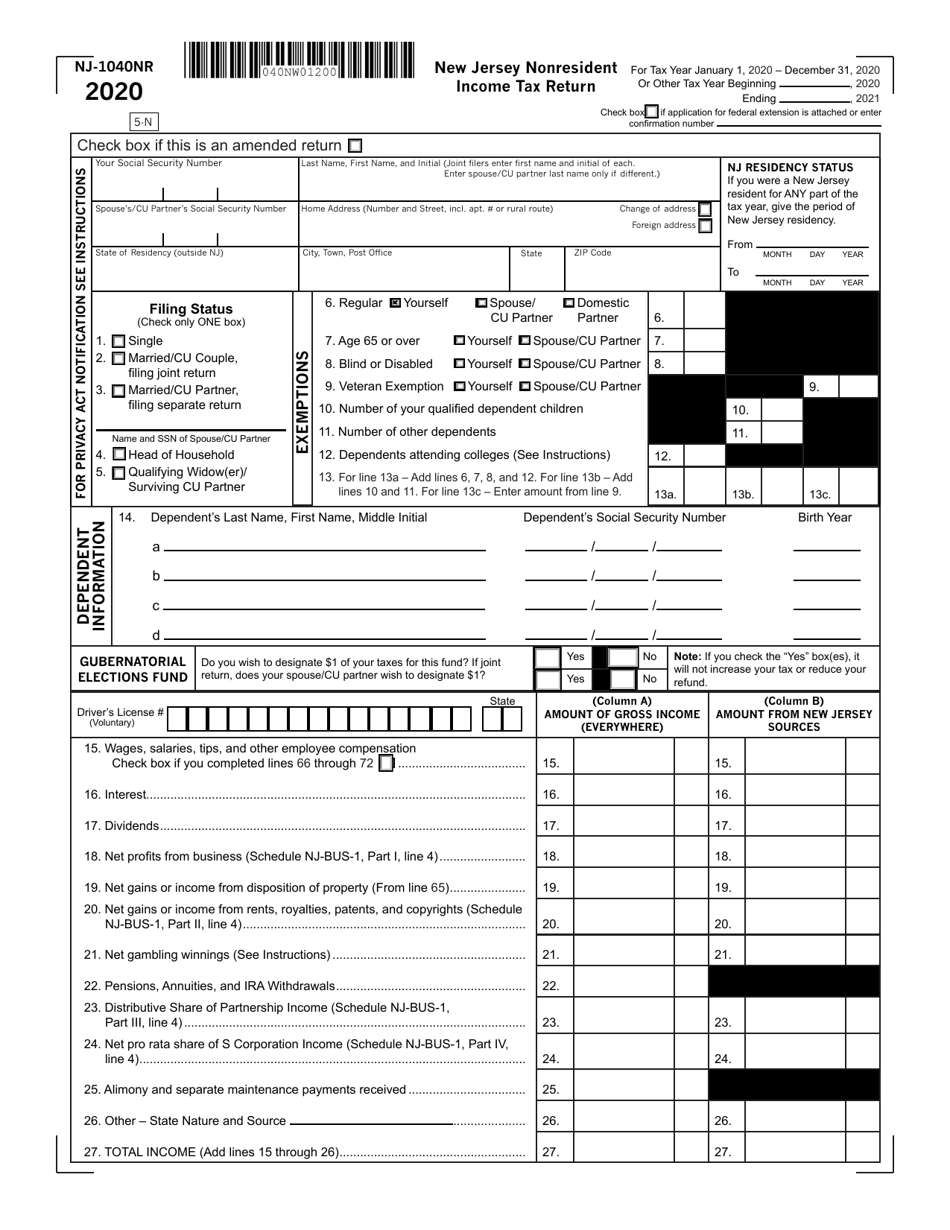

Form NJ1040NR Download Fillable PDF or Fill Online New Jersey

IRS Form 1040NR Read the Filling Instructions Before Filing it

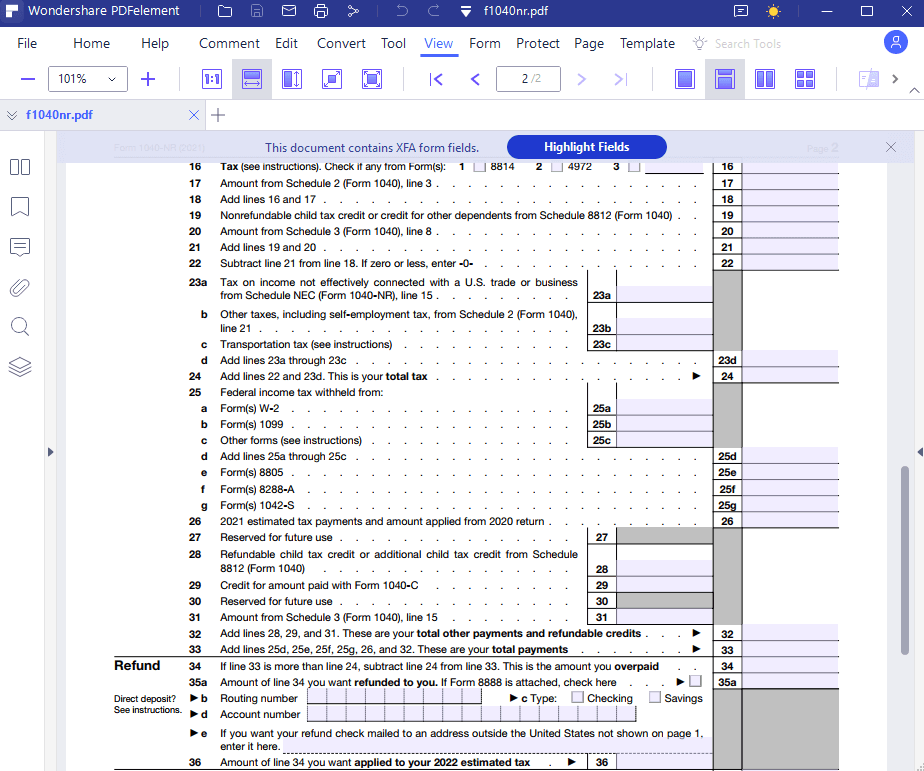

1040nr Fill Out And Sign Printable PDF Template SignNow 2021 Tax

Form 1040NR The Mountbatten Institute

1040NR Tax return preparation by YouTube

Instructions For Form 1040nrEz U.s. Tax Return For Certain

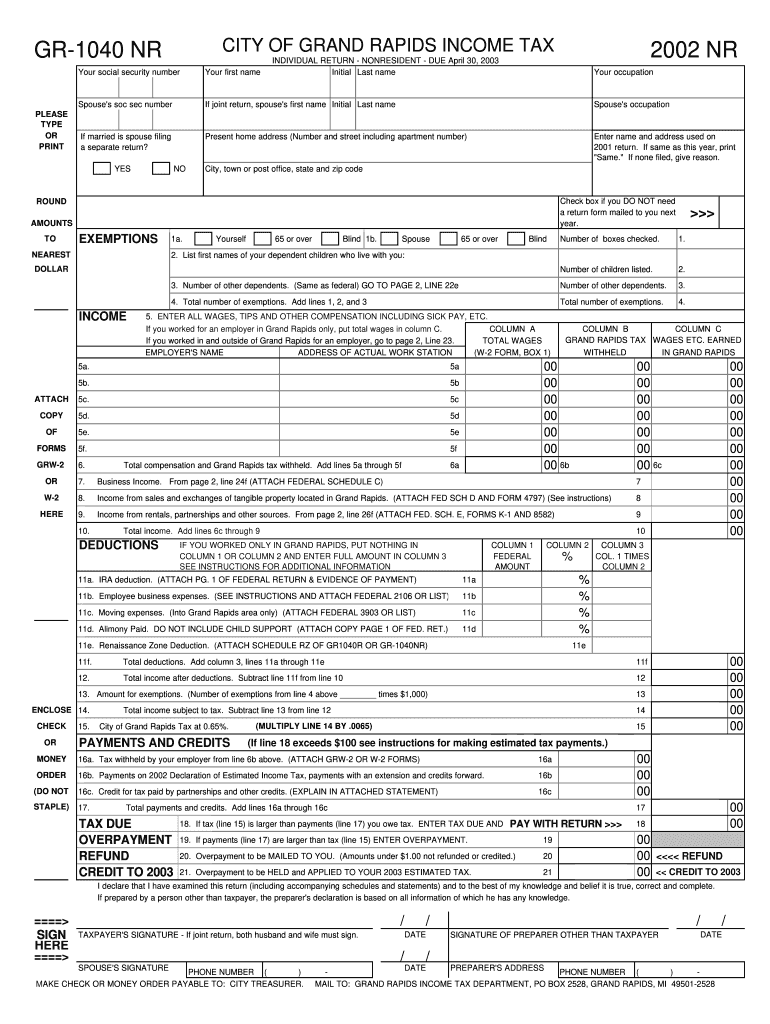

Gr 1040Nr Fill Out and Sign Printable PDF Template signNow

IRS Form 1040NR Read the Filling Instructions Before Filing it

Related Post: