Form 8960 Turbotax

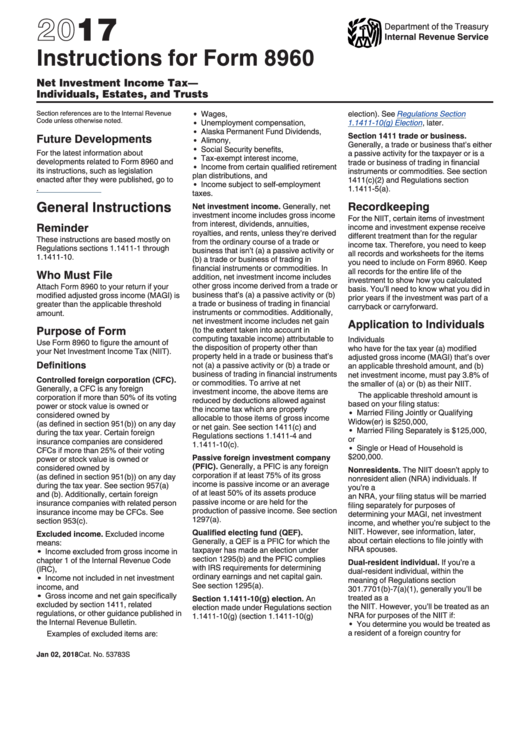

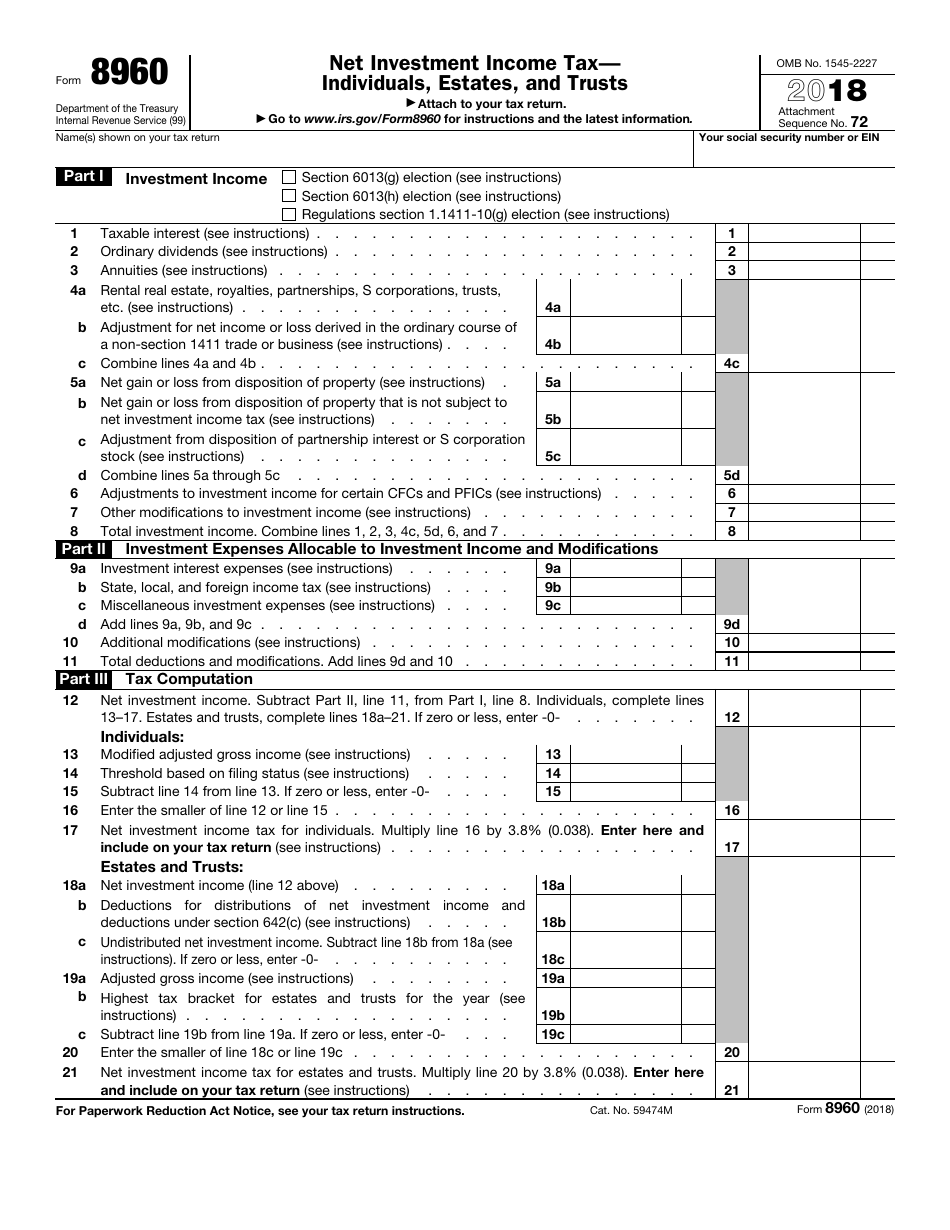

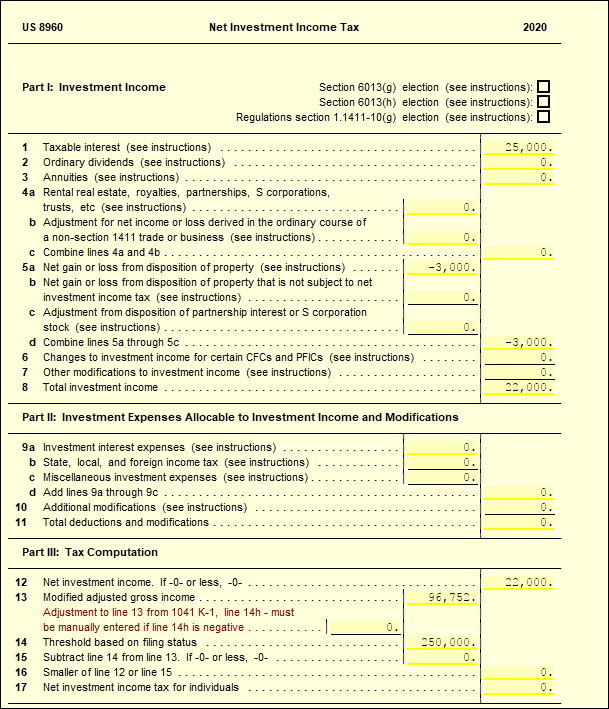

Form 8960 Turbotax - In the left margin, scroll through your list of forms to find form 8960. Web attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount. Greater than the applicable threshold amount. Line 9b provides that i can deduct a large part of my state income tax (the. Taxpayers use this form to figure the amount of their net. Web for more help determining your magi and net investment income tax liability, talk to a tax professional or search for form 8960 at www.irs.gov. Ad tax return preparation and expat tax advice. Web it first appeared in tax year 2013. How much could you owe? Per irs, the form is not required only sch d and form 8949 if you have gain/loss to. Instructions for form 8960, net investment income tax individuals, estates,. Complete irs tax forms online or print government tax documents. In the left margin, scroll through your list of forms to find form 8960. Ad access irs tax forms. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. This issue will be resolved. Web part one of form 8960 lists the various types of earnings considered investment income. Tt does not reduce your investment income by state and local taxes when calculating the investment surcharge. Web there is a tt oversight regarding form 8960. Web see what tax forms are included in turbotax basic, deluxe, premier and home. Greater than the applicable threshold amount. Web attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount. This return cannot be electronically filed due to a processing error on form 8960, net investment income tax. Line 9b provides that i can deduct a large part of my state income tax. What needs to be done: Web for more help determining your magi and net investment income tax liability, talk to a tax professional or search for form 8960 at www.irs.gov. This is the net investment income tax to finance obamacare. Per irs, the form is not required only sch d and form 8949 if you have gain/loss to. Web page. If you have income from investments and your modified adjusted gross income (magi) exceeds $200,000 for individuals, $250,000. What needs to be done: Web about form 8960, net investment income tax individuals, estates, and trusts | internal revenue. Web irs form 8960 line 9b. Web for more help determining your magi and net investment income tax liability, talk to a. Web attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount. This is the net investment income tax to finance obamacare. Web irs form 8960 line 9b. Use form 8960 to figure the. Attach to your tax return. Taxpayers use this form to figure the amount of their net. Web page last reviewed or updated: Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Per irs, the form is not required only sch d and form 8949 if you have gain/loss to. Web form 8960, line 5a does not. Web if you are using turbotax cd/download, then click on forms, upper right of your screen. Net investment income tax— individuals, estates, and trusts. They speak the tricky language of taxes and can help you better. Per irs, the form is not required only sch d and form 8949 if you have gain/loss to. Web attach form 8960 to your. Ad tax return preparation and expat tax advice. Instructions for form 8960, net investment income tax individuals, estates,. Web solved•by turbotax•1399•updated january 13, 2023. Web it first appeared in tax year 2013. Complete irs tax forms online or print government tax documents. Line 9b provides that i can deduct a large part of my state income tax (the. Per irs, the form is not required only sch d and form 8949 if you have gain/loss to. Web it first appeared in tax year 2013. Net investment income tax— individuals, estates, and trusts. Department of the treasury internal revenue service. Greater than the applicable threshold amount. Web irs form 8960 line 9b. Use form 8960 to figure the. Taxpayers use this form to figure the amount of their net. Attach to your tax return. Modified adjusted gross income (magi) is. Ad tax return preparation and expat tax advice. Web page last reviewed or updated: Department of the treasury internal revenue service. Web there is a tt oversight regarding form 8960. How much could you owe? Instructions for form 8960, net investment income tax individuals, estates,. Web part one of form 8960 lists the various types of earnings considered investment income. Web it first appeared in tax year 2013. Web attach form 8960 to your return if your modified adjusted gross income (magi) is greater than the applicable threshold amount. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web solved•by turbotax•1399•updated january 13, 2023. Tt does not reduce your investment income by state and local taxes when calculating the investment surcharge. If you have income from investments and your modified adjusted gross income (magi) exceeds $200,000 for individuals, $250,000. They speak the tricky language of taxes and can help you better.IRS Form 8960 Instructions Guide to Net Investment Tax

Instructions For Form 8960 Net Investment Tax Individuals

irs form 8960 for 2019 Fill Online, Printable, Fillable Blank form

IRS Form Investment Tax

How to Complete IRS Form 8960 Net Investment Tax of 3.8 YouTube

Form 8960 Obamacare Tax implications for US Taxpayers in Canada

IRS Form 8960 2018 Fill Out, Sign Online and Download Fillable PDF

8960 Net Investment Tax UltimateTax Solution Center

Is an Anomaly in Form 8960 Resulting in an Unintended Tax on TaxExempt

IRS Form 8960 walkthrough Investment Tax for Individuals

Related Post: