Federal Form 4972

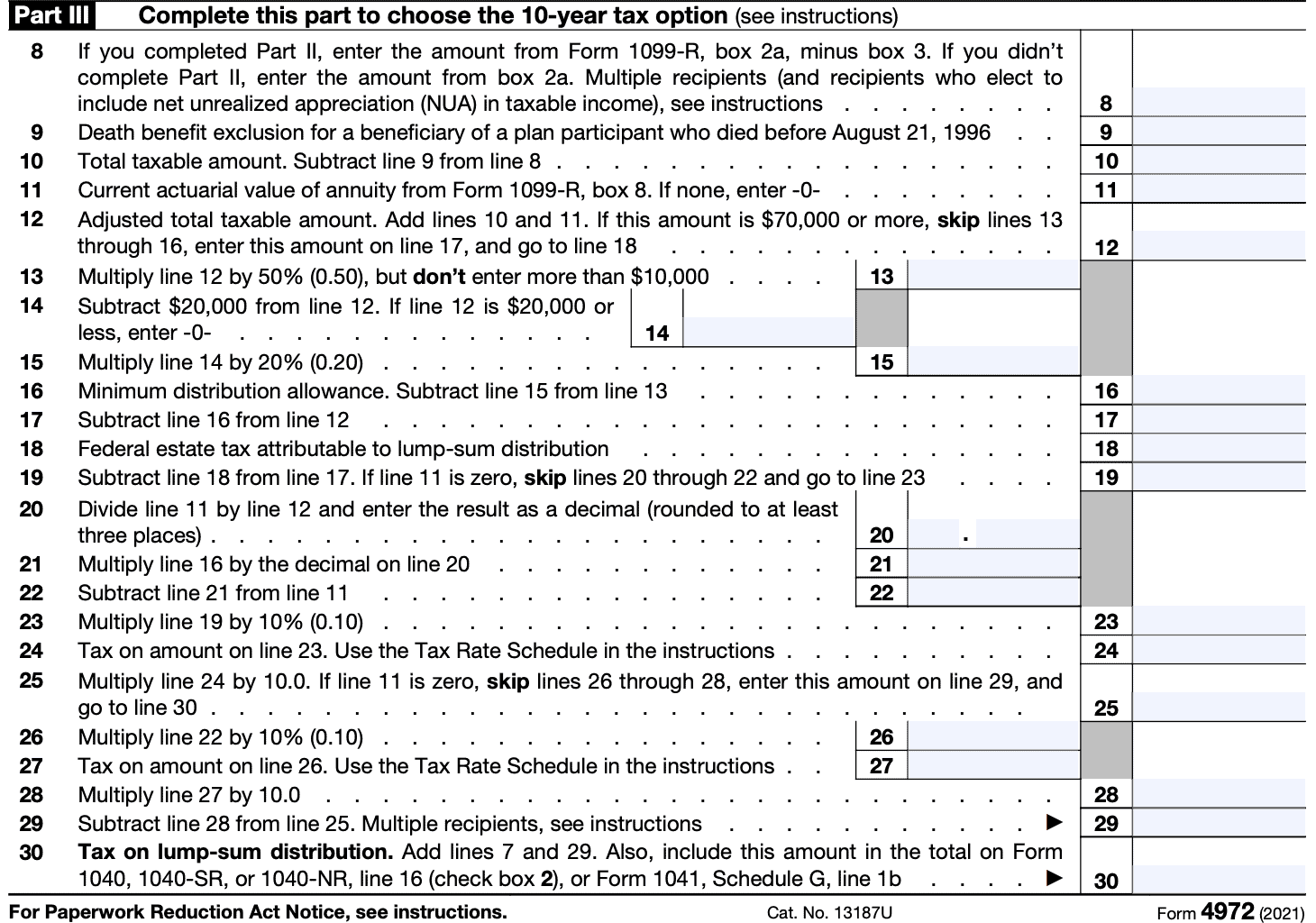

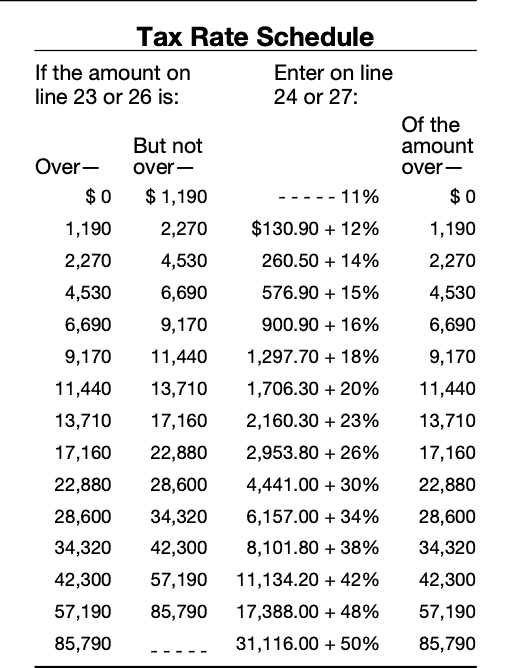

Federal Form 4972 - Download or email irs 4972 & more fillable forms, register and subscribe now! Web what is irs form 4972 used for? When computing wisconsin income, you must add both the capital gain part and the taxable amount under. Addition from line 7 of schedule m1home (enclose schedule. Web a $5,000 civil penalty for filing a frivolous return or submitting a specified frivolous submission as described by section 6702. It also covers common programs, deductions, and credits affecting seniors. How to report the distribution if you qualify to use form 4972, attach it to. Incomes of both spouses must be. Specific instructions lines 1 through 3. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Web if you were born before 1936, you may specify the tax treatment of retirement plan distributions using federal form 4972. You can download or print current. Web what is irs form 4972 used for? Complete, edit or print tax forms instantly. Use this form to figure the. Learn more instructions for form. It also covers common programs, deductions, and credits affecting seniors. Addition from line 7 of schedule m1home (enclose schedule. Web any amount of lump sum distribution separately taxed on federal form 4972, and any net operating loss carryforward note to married couples: Web if you were born before 1936, you may specify the tax treatment. The capital gain portion of the lump. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Web this fact sheet explains how seniors (age 65 or older) file and pay minnesota individual income tax. Complete, edit or print tax forms instantly. Learn more instructions for form. Web a $5,000 civil penalty for filing a frivolous return or submitting a specified frivolous submission as described by section 6702. Web this fact sheet explains how seniors (age 65 or older) file and pay minnesota individual income tax. Use this form to figure the. Ad access irs tax forms. This form is for income earned in tax year 2022,. Web what is irs form 4972 used for? Web a $5,000 civil penalty for filing a frivolous return or submitting a specified frivolous submission as described by section 6702. Learn more instructions for form. Ad access irs tax forms. Download or email irs 4972 & more fillable forms, register and subscribe now! Web a $5,000 civil penalty for filing a frivolous return or submitting a specified frivolous submission as described by section 6702. Web from the federal civil service retirement system (or the federal employees retirement system). Web if you file federal form 4972, tax on lump sum distributions, you must report part of the distribution as an addition to income. Ad. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. Use this form to figure the. Download or email irs 4972 & more fillable forms, register and subscribe now! You can download or print current. Web form 4972, you must also include the distribution in wisconsin income. Be sure to check box. Web any amount of lump sum distribution separately taxed on federal form 4972, and any net operating loss carryforward note to married couples: Web what is irs form 4972 used for? Learn more instructions for form. You can download or print current. Web if you were born before 1936, you may specify the tax treatment of retirement plan distributions using federal form 4972. Web this fact sheet explains how seniors (age 65 or older) file and pay minnesota individual income tax. Use this form to figure the. Specific instructions lines 1 through 3. Web form 4972, you must also include the distribution. It also covers common programs, deductions, and credits affecting seniors. When computing wisconsin income, you must add both the capital gain part and the taxable amount under. Ad access irs tax forms. Web any amount of lump sum distribution separately taxed on federal form 4972, and any net operating loss carryforward note to married couples: The capital gain portion of. Addition from line 7 of schedule m1home (enclose schedule. Learn more instructions for form. Or form 1041, schedule g, line 1b. Be sure to check box. Web form 4972, you must also include the distribution in wisconsin income. Web the purpose tax form 4972 is used for reducing taxes. The capital gain portion of the lump. Ad access irs tax forms. Taxpayers may use irs form 4972 to calculate the tax on a qualified lump sum distribution using the 20% capital gains. It also covers common programs, deductions, and credits affecting seniors. You can download or print current. Web a $5,000 civil penalty for filing a frivolous return or submitting a specified frivolous submission as described by section 6702. Do not misread the statement, it means that the form is filled and submitted to reduce the tax for enormous distributions. Download or email irs 4972 & more fillable forms, register and subscribe now! Web if you file federal form 4972, tax on lump sum distributions, you must report part of the distribution as an addition to income. How to report the distribution if you qualify to use form 4972, attach it to. Web we last updated federal form 4972 in december 2022 from the federal internal revenue service. Web any amount of lump sum distribution separately taxed on federal form 4972, and any net operating loss carryforward note to married couples: Download or email irs 4972 & more fillable forms, register and subscribe now! Ad access irs tax forms.2019 IRS Form 4972 Fill Out Digital PDF Sample

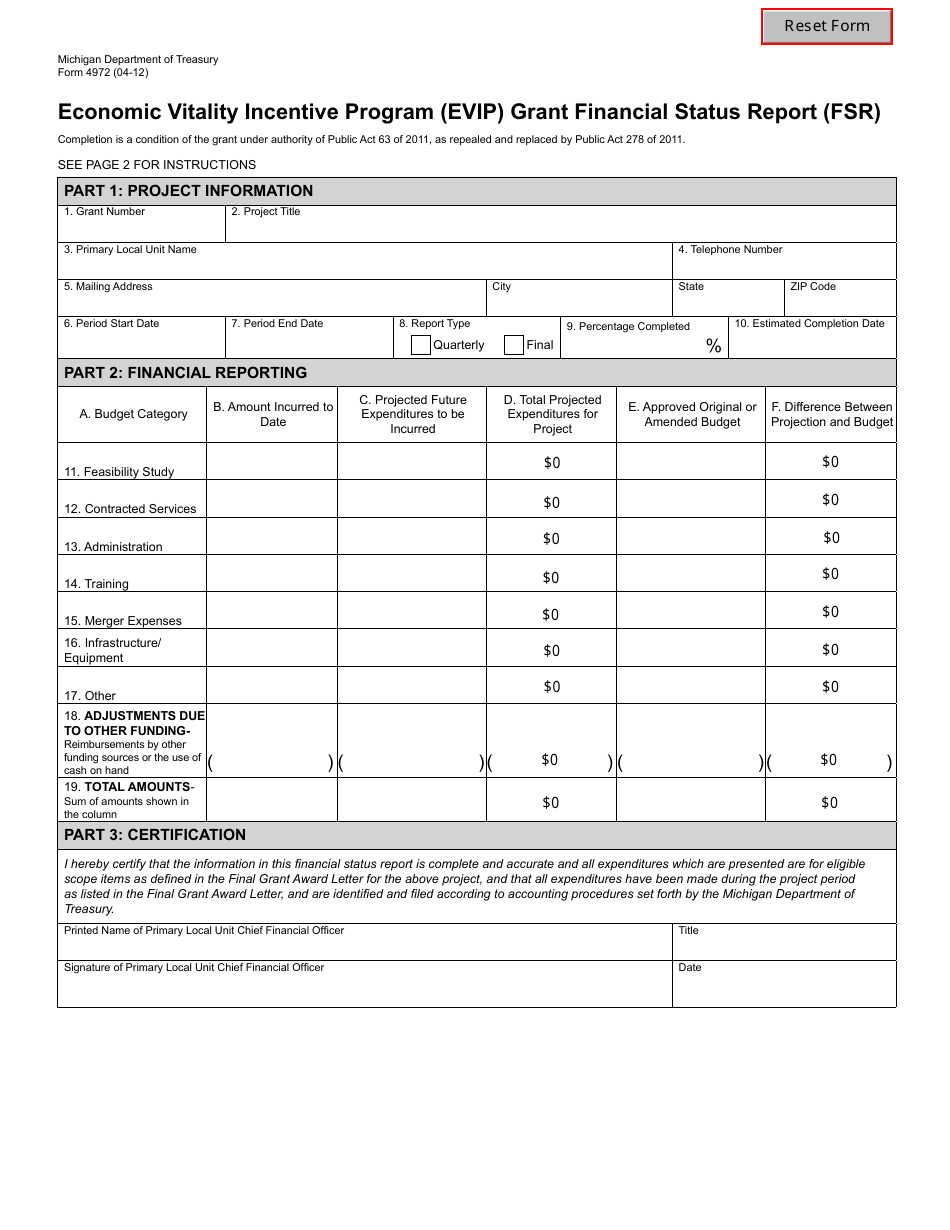

Form 4972 Download Fillable PDF or Fill Online Economic Vitality

Form 4972 Tax on LumpSum Distributions (2015) Free Download

IRS Form 4972A Guide to Tax on LumpSum Distributions

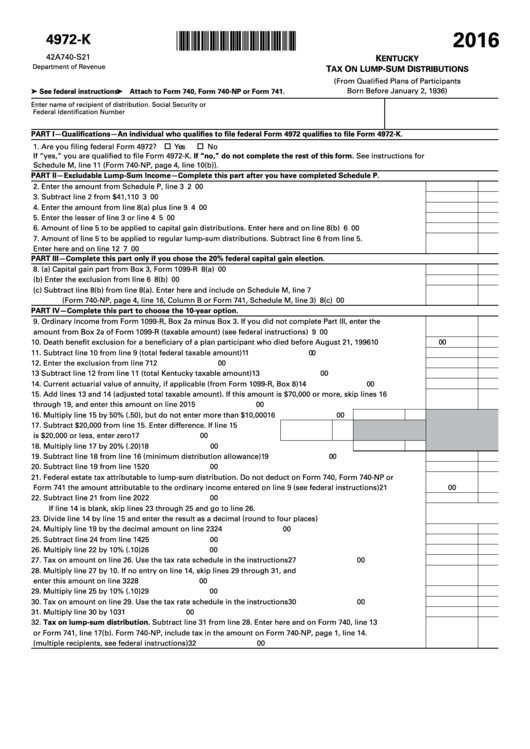

Fillable Form 4972K Kentucky Tax On LumpSum Distributions 2016

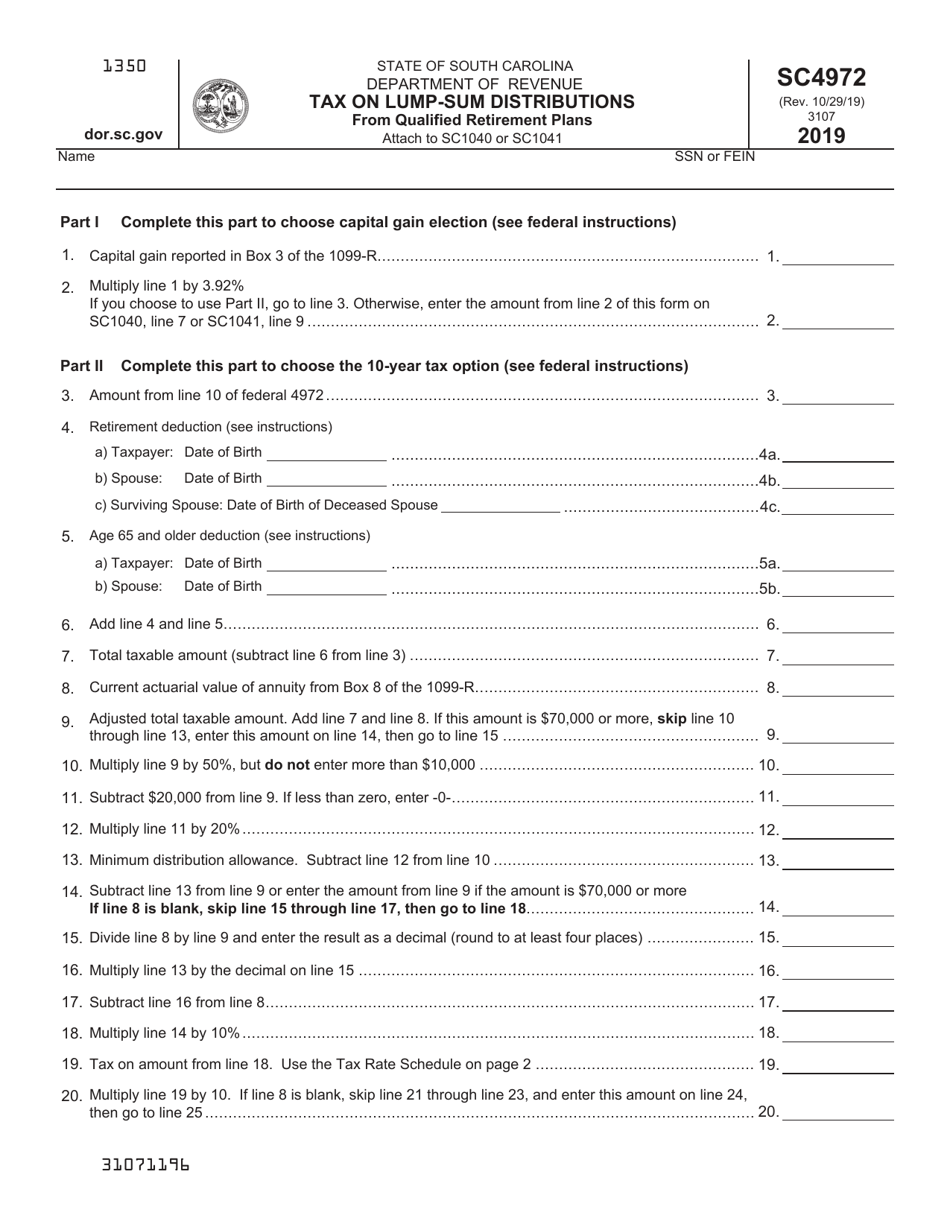

Form SC4972 Download Printable PDF or Fill Online Tax on LumpSum

Form 4972 Tax on LumpSum Distributions (2015) Free Download

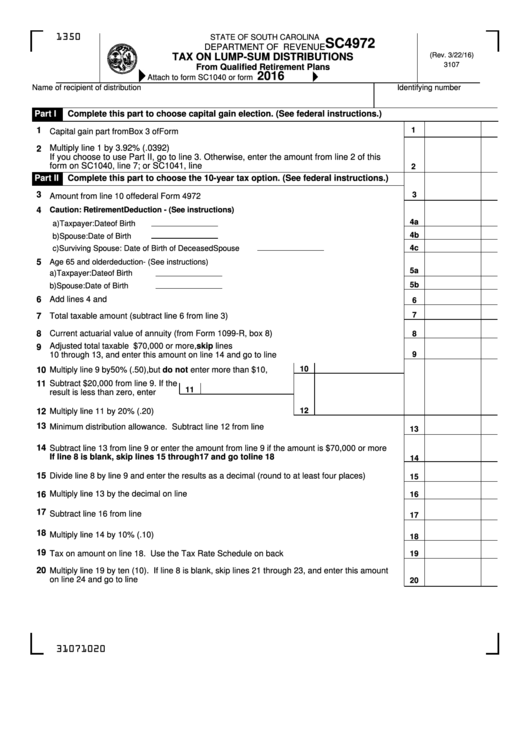

Sc4972 Tax On Lump Sum Distributions printable pdf download

IRS Form 4972A Guide to Tax on LumpSum Distributions

IRS Form 4972A Guide to Tax on LumpSum Distributions

Related Post: