Example Of Form 8824 Filled Out

Example Of Form 8824 Filled Out - Web find out how to update your direct deposit information online for disability compensation, pension, or education benefits. Enter that result on line 19. I sold a rental property in a 1031 exchange for $280,000. Form 8824 figures the amount of gain deferred. Change your address find out how to. Taxpayer exchange property replacement property date closed. Form 8824 is the part of an investor’s tax return that contains 1031 exchange transaction information. Web filling out form 8824: Try it for free now! Web use parts i, ii, and iii of form 8824 to report each exchange of business or investment real property for real property of a like kind. Change your address find out how to. Web common questions for form 8824 in proseries. Web filling out form 8824: Web use parts i, ii, and iii of form 8824 to report each exchange of business or investment real property for real property of a like kind. Web use parts i, ii, and iii of form 8824 to report each. Exchanger would file irs form 8824 with 2015. I sold a rental property in a 1031 exchange for $280,000. Below are the most popular support articles associated with form. Web filling out form 8824: Upload, modify or create forms. Web for details on the exclusion of gain (including how to figure the amount of the exclusion), see pub. Do not enter name and social security number if shown on other side. What makes the form 8824 worksheet legally. Web use parts i, ii, and iii of form 8824 to report each exchange of business or investment real property for. Web filling out form 8824: Try it for free now! Change your address find out how to. Form 8824 figures the amount of gain deferred. 14, 2015, and then settles on replacement property may 1, 2016. Web use parts i, ii, and iii of form 8824 to report each exchange of business or investment real property for real property of a like kind. Web fill out form 8824 according to its instructions, with these exceptions: Web the irs guidance for multiple exchanges says to treat form 8824 as a summary, and to enter your name and. Web the irs guidance for multiple exchanges says to treat form 8824 as a summary, and to enter your name and taxpayer identification number on the form, along. On the dotted line next to line 19, enter section 121. Web use parts i, ii, and iii of form 8824 to report each exchange of business or investment real property for. What makes the form 8824 worksheet legally. Web the irs guidance for multiple exchanges says to treat form 8824 as a summary, and to enter your name and taxpayer identification number on the form, along. Try it for free now! Do not enter name and social security number if shown on other side. Browse for the form 8824 worksheet. Web subscribe to our youtube channel: Below are the most popular support articles associated with form. Web fill out form 8824 according to its instructions, with these exceptions: Browse for the form 8824 worksheet. 14, 2015, and then settles on replacement property may 1, 2016. Web page last reviewed or updated: Send out signed 8824 worksheet or print it. Form 8824 is the part of an investor’s tax return that contains 1031 exchange transaction information. Enter that result on line 19. Web use parts i, ii, and iii of form 8824 to report each exchange of business or investment real property for real property of. Enter that result on line 19. Web the irs guidance for multiple exchanges says to treat form 8824 as a summary, and to enter your name and taxpayer identification number on the form, along. Customize and esign form 8824. Web page last reviewed or updated: Web fill out form 8824 according to its instructions, with these exceptions: Customize and esign form 8824. Try it for free now! Subtract line 18 from line 17. Form 8824 figures the amount of gain deferred. Do not enter name and social security number if shown on other side. Ad download or email irs 8824 & more fillable forms, register and subscribe now! Taxpayer exchange property replacement property date closed. Web need help filling out form 8824 part 3, lines 15 through 25. Change your address find out how to. Solved • by intuit • 3 • updated 1 year ago. Form 8824 figures the amount of gain deferred. Web filling out form 8824: This information applies to all years of the ultimatetax software. Enter that result on line 19. Browse for the form 8824 worksheet. 8824 (2022) form 8824 (2022) page. Below are the most popular support articles associated with form. Exchanger settles on relinquished property on dec. Exchanger would file irs form 8824 with 2015. Tax deferred exchanges under irc § 1031 worksheet 1.How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

How can/should I fill out Form 8824 with the following information

How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

Form 8824 ≡ Fill Out Printable PDF Forms Online

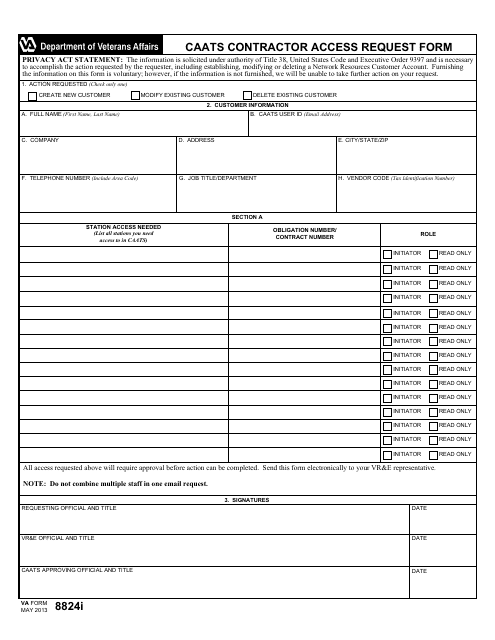

VA Form 8824i Fill Out, Sign Online and Download Fillable PDF

How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

Irs Form 8824 Instructions VA Form

Form 8824 Worksheet Fill Online, Printable, Fillable, Blank pdfFiller

Fill Free fillable Form 8824 LikeKind Exchanges 2019 PDF form

Related Post: