Can I File Form 8862 Electronically

Can I File Form 8862 Electronically - Web go to the overview. Add certain credit click the green button to add information to claim a certain credit after disallowance. If your return was rejected. Your earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. How do i file 8862? Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Enter the appropriate number in qualifying children: Web in either of these cases, you can take the credit(s) without filing form 8862 if you meet all the credit’s eligibility requirements. Web click on eic/ctc/aoc after disallowances (8862). 1=one, 2=two, 3=three, 4=none (mandatory for eic claim). Web if your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the irs. The h&r block online program supports most federal forms: I'm still not clear, i claimed my biological children, no one else were. Web open the form in the online editor.. Taxact desktop click the forms button in. Web turbotax live en español. Get ready for tax season deadlines by completing any required tax forms today. Web you need to complete form 8862 and attach it to your tax return if: How do i file 8862? December 2022) information to claim certain credits after disallowance section. Your earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Web 1,511 reply bookmark icon cameaf level 5 if your return was efiled and rejected or still in progress, you can submit form 8862 online with your return. If your return was rejected. Web if your earned. Complete, edit or print tax forms instantly. Affordable efiling with no monthly or hidden fees. December 2022) information to claim certain credits after disallowance section. Click on the fillable fields and put the necessary information. Web go to the overview. 1=one, 2=two, 3=three, 4=none (mandatory for eic claim). Web open the form in the online editor. Web if your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the irs. Click on the fillable fields and put the necessary information. Web go to the. Irs form 8862 information to claim certain refundable credits after disallowance is used if your earned income credit (eic). Web open the form in the online editor. Web if you need to share the form with other parties, you can easily send it by electronic mail. Ad access irs tax forms. Web you can download form 8862 from the irs. Sign in to efile.com sign in to efile.com 2. Click on the fillable fields and put the necessary information. Tax law & stimulus updates. Your earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. By jason luthor updated may 28, 2019. Get ready for tax season deadlines by completing any required tax forms today. Click on the fillable fields and put the necessary information. Enter the appropriate number in qualifying children: Taxact desktop click the forms button in. Look through the recommendations to find out which info you will need to include. Under form availability, choose view federal forms. December 2022) information to claim certain credits after disallowance section. Upload, modify or create forms. Web you can download form 8862 from the irs website, and can file it electronically or by mail. Do not file form 8862 for the: Web in either of these cases, you can take the credit(s) without filing form 8862 if you meet all the credit’s eligibility requirements. How do i file 8862? Web 1,511 reply bookmark icon cameaf level 5 if your return was efiled and rejected or still in progress, you can submit form 8862 online with your return. Irs form 8862 information. December 2022) information to claim certain credits after disallowance section. Web click on eic/ctc/aoc after disallowances (8862). Web go to the overview. Taxact desktop click the forms button in. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Web home forms and instructions about form 8822, change of address about form 8822, change of address use form 8822 to notify the internal revenue service. Affordable efiling with no monthly or hidden fees. Web open the form in the online editor. Do not file form 8862 for the: How do i file 8862? Web turbotax live en español. Tax law & stimulus updates. Your earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. Enter the appropriate number in qualifying children: Web how to electronically file form 8862? Upload, modify or create forms. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Try it for free now!Printable Irs Form 8862 Printable Forms Free Online

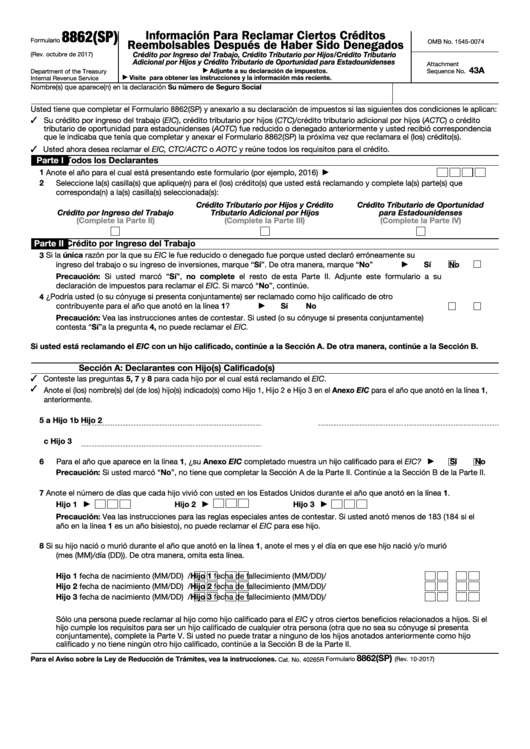

Top 14 Form 8862 Templates free to download in PDF format

What Does Form 8862 Look Like Fill Online, Printable, Fillable, Blank

IRS Form 8862 Disallowed Child Tax Credits? YouTube

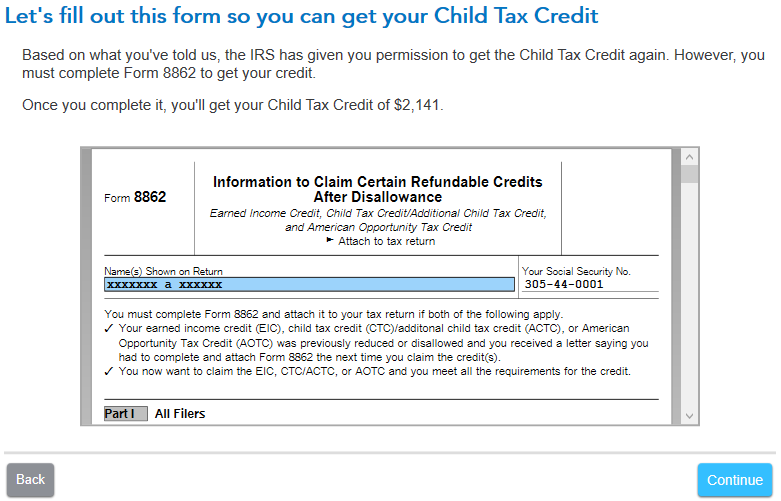

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

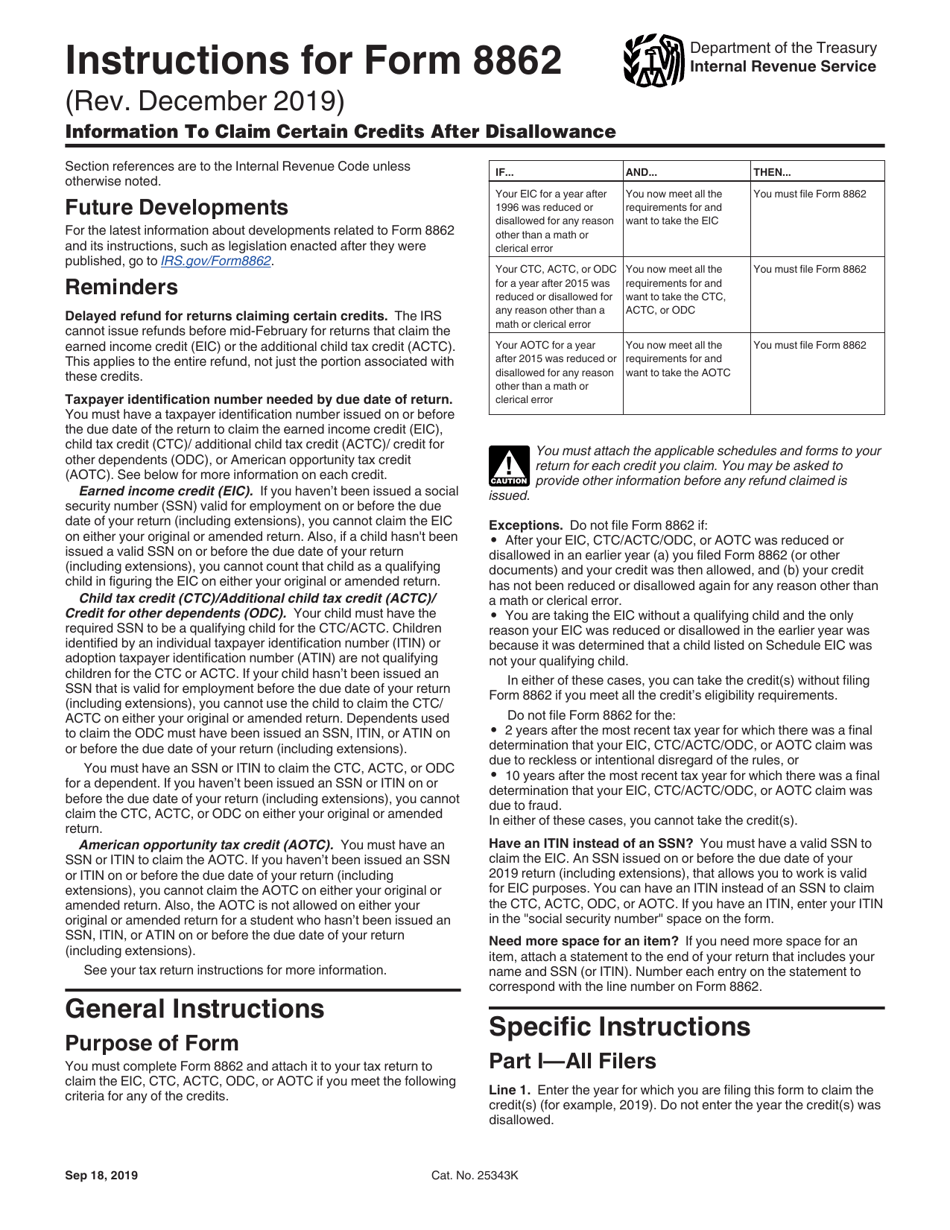

Instructions for IRS Form 8862 Information To Claim Certain Credits

Which IRS Form Can Be Filed Electronically?

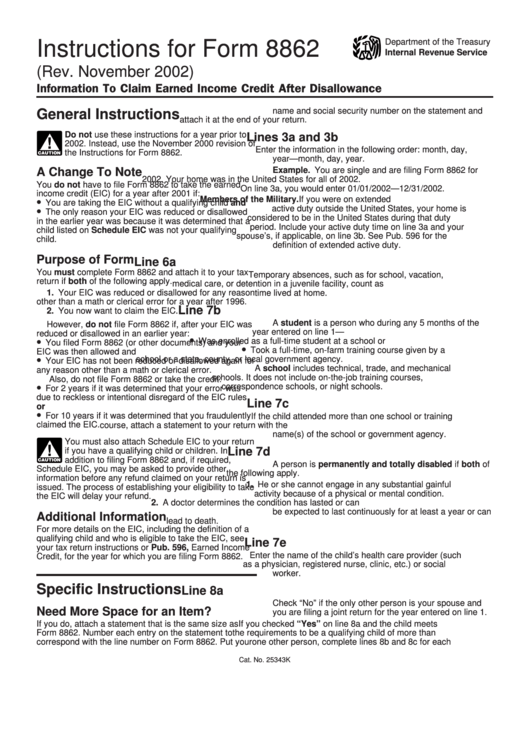

Form 8862Information to Claim Earned Credit for Disallowance

Download Instructions for IRS Form 8862 Information to Claim Certain

how do i add form 8862 TurboTax® Support

Related Post:

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170516.jpg)