Irs Form 6513

Irs Form 6513 - Web file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an extension of time to file. It states my form 7004 extension request was denied because the application was filed after the deadline. Web tax insider irs notice response tips everyone should know these 13 tips can help practitioners and taxpayers respond effectively to notices from the irs. Get deals and low prices on irs form 1099 nec at amazon Web if an approved extension is posted, return the request to the taxpayer with form 6513, and check the 2nd and 8th boxes on the form. Web form 5213 is used by individuals, trusts, estates, and s corporations to elect to postpone an irs determination as to whether the presumption applies that an activity. Complete, edit or print tax forms instantly. If no approved extension transaction has. Deposited in the us post office in a properly addressed envelope with adequate. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Complete, edit or print tax forms instantly. Web form 5213 is used by individuals, trusts, estates, and s corporations to elect to postpone an irs determination as to whether the presumption applies that an activity. As we know, the 2020 filing season deadline was automatically postponed for all taxpayers until july 15, 2020. Web under section 6611(d), for income tax. Web if an approved extension is posted, return the request to the taxpayer with form 6513, and check the 2nd and 8th boxes on the form. It states my form 7004 extension request was denied because the application was filed after the deadline. Web therefore, section 6513 (time that payment of estimated tax payments are credited) refers to april 15. This page provides a quick guide for. Get ready for tax season deadlines by completing any required tax forms today. Web file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an extension of time to file. Web i received form 6513 in via usps mail today. Web a. Ad grab great deals and offers on forms & recordkeeping items at amazon. Web if an approved extension is posted, return the request to the taxpayer with form 6513, and check the 2nd and 8th boxes on the form. Ad we help get taxpayers relief from owed irs back taxes. Get deals and low prices on irs form 1099 nec. Web if an approved extension is posted, return the request to the taxpayer with form 6513, and check the 2nd and 8th boxes on the form. Get deals and low prices on irs form 1099 nec at amazon Web the partnership elects under section 444 to have a tax year other than a required tax year by filing form 8716,. Web therefore, section 6513 (time that payment of estimated tax payments are credited) refers to april 15 regardless of a postponement under section 7508a. As we know, the 2020 filing season deadline was automatically postponed for all taxpayers until july 15, 2020. Web any amount paid as estimated income tax for any taxable year shall be deemed to have been. Web under section 6611(d), for income tax withholding, the provisions of section 6513 generally apply in determining the date of payment for purposes of section 6611(a). Web if an approved extension is posted, return the request to the taxpayer with form 6513, and check the 2nd and 8th boxes on the form. Web therefore, section 6513 (time that payment of. Web the irs’ mailbox rule requires that a timely filed tax document or payment is: Deposited in the us post office in a properly addressed envelope with adequate. It states my form 7004 extension request was denied because the application was filed after the deadline. Web see irc § 6513 (a). Ad grab great deals and offers on forms &. Web the taxpayer’s 2019 tax liability was fully paid through withholding, which was deemed paid under irc § 6513 (b) on april 15, 2020, the original due date of the return. Web page last reviewed or updated: Web if an approved extension is posted, return the request to the taxpayer with form 6513, and check the 2nd and 8th boxes. As we know, the 2020 filing season deadline was automatically postponed for all taxpayers until july 15, 2020. Get deals and low prices on irs form 1099 nec at amazon Web therefore, section 6513 (time that payment of estimated tax payments are credited) refers to april 15 regardless of a postponement under section 7508a. It states my form 7004 extension. It states my form 7004 extension request was denied because the application was filed after the deadline. Web a comprehensive federal, state & international tax resource that you can trust to provide you with answers to your most important tax questions. Web file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns, to request an extension of time to file. This page provides a quick guide for. Web the partnership elects under section 444 to have a tax year other than a required tax year by filing form 8716, election to have a tax year other than a required tax year. Deposited in the us post office in a properly addressed envelope with adequate. Ad we help get taxpayers relief from owed irs back taxes. Web if an approved extension is posted, return the request to the taxpayer with form 6513, and check the 2nd and 8th boxes on the form. Get ready for tax season deadlines by completing any required tax forms today. Web under section 6611(d), for income tax withholding, the provisions of section 6513 generally apply in determining the date of payment for purposes of section 6611(a). If no approved extension transaction has. Web extensions for form 8612, form 8613, form 8725, form 8831, form 8876, form 8924, and form 8928 must be processed to nmf. Web any amount paid as estimated income tax for any taxable year shall be deemed to have been paid on the last day prescribed for filing the return under section 6012 for such. Web see irc § 6513 (a). As we know, the 2020 filing season deadline was automatically postponed for all taxpayers until july 15, 2020. Web claim for credit or refund of an overpayment of any tax imposed by this title in respect of which tax the taxpayer is required to file a return shall be filed by the taxpayer within 3. Web therefore, section 6513 (time that payment of estimated tax payments are credited) refers to april 15 regardless of a postponement under section 7508a. Complete, edit or print tax forms instantly. Web tax insider irs notice response tips everyone should know these 13 tips can help practitioners and taxpayers respond effectively to notices from the irs. Get deals and low prices on irs form 1099 nec at amazonIRS Form SS4 Download Fillable PDF or Fill Online Application for

Irs Tax Exempt Form 501c3 Form Resume Examples 86O78MakBR

Form 1041 Extension Due Date 2019 justgoing 2020

3.11.3 Individual Tax Returns Internal Revenue Service

IRS Form 941 2018 Fill Out, Sign Online and Download Fillable PDF

Irs Form 941 Schedule B 2014 Form Resume Examples 7mk9YKrkGY

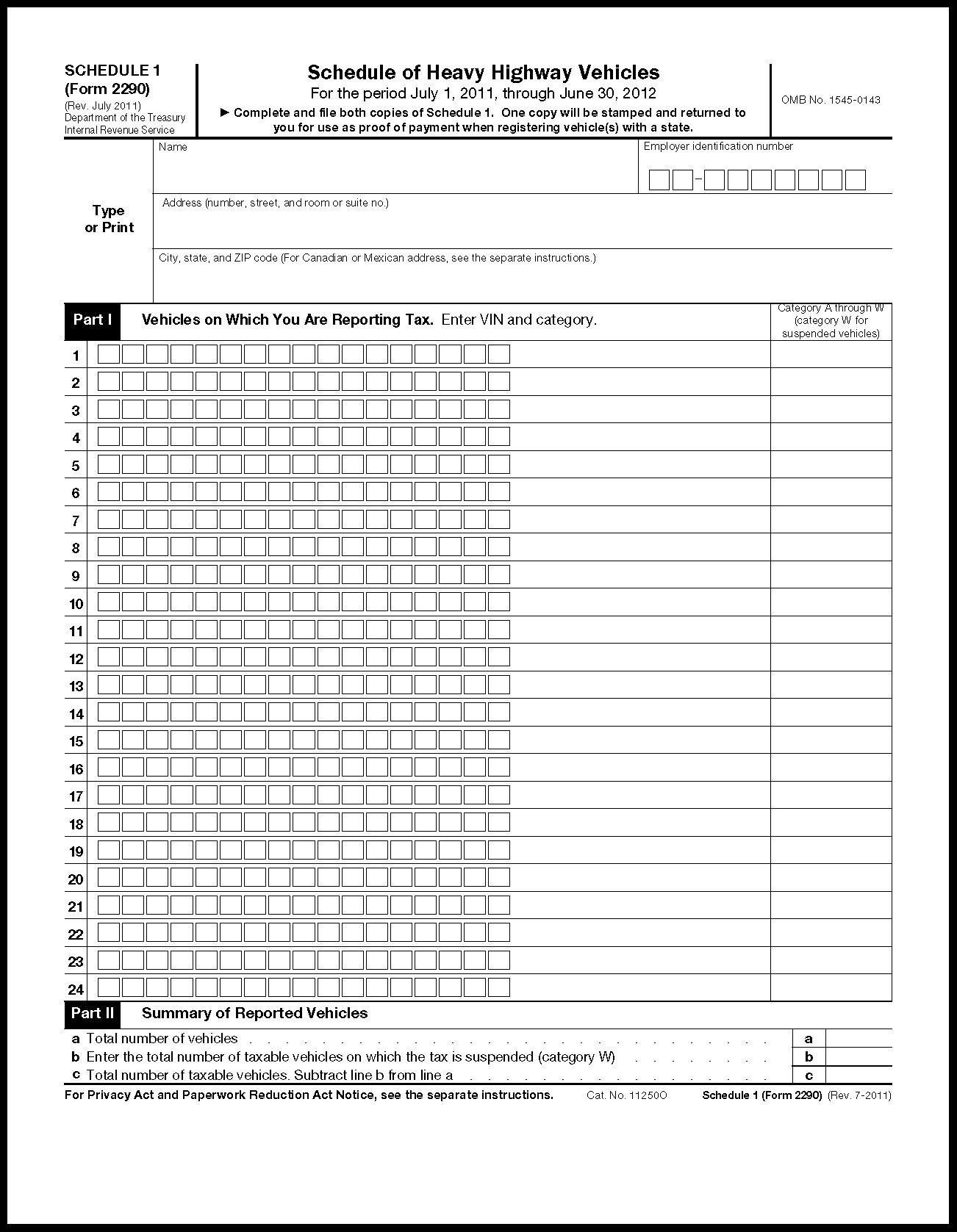

Irs 2290 Form Instructions Form Resume Examples bGwkQmzkWV

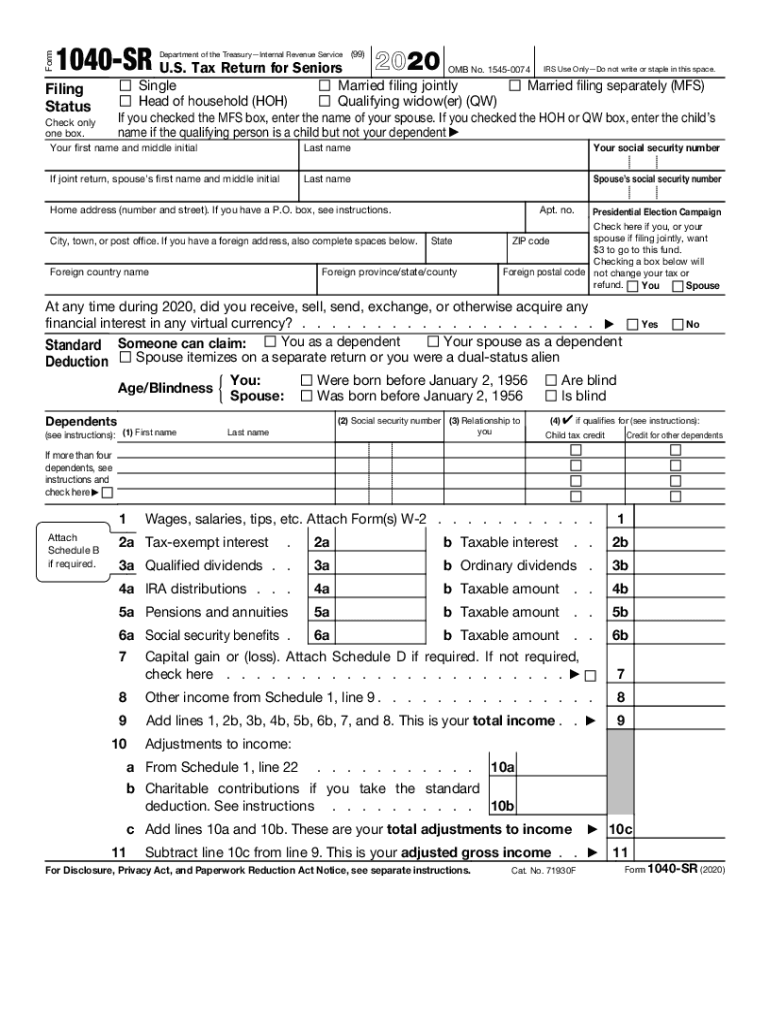

2019 1040 Sr Fill Out and Sign Printable PDF Template signNow

Irs Form 940 Instructions Mailing Address All Are Here

3.11.212 Applications for Extension of Time to File Internal Revenue

Related Post: