Example Of Completed Form 8958

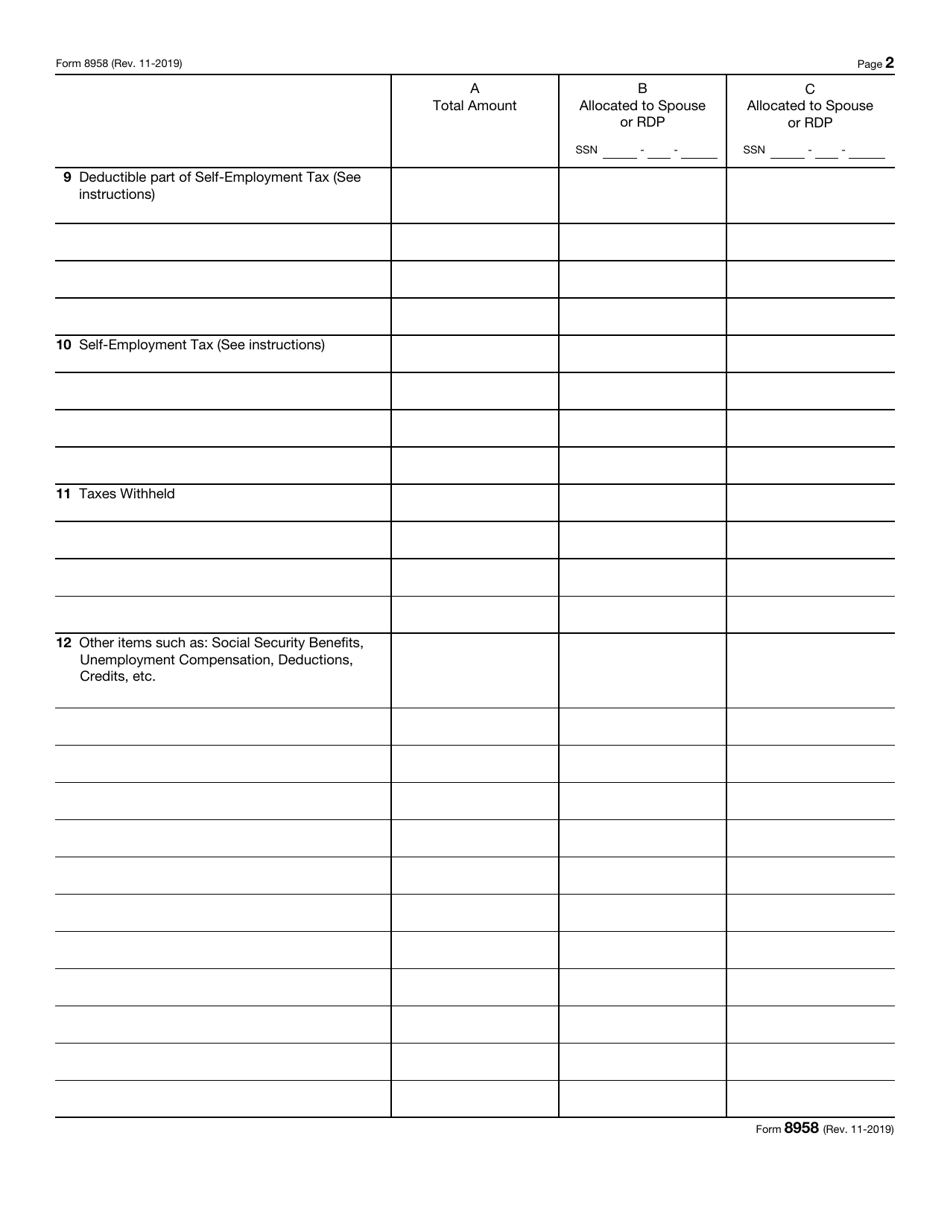

Example Of Completed Form 8958 - For flexibility, the application provides three methods for completing form 8958. Browse for the example of completed form 8958. Web per irs publication 555 community property, starting on page 2, you would only complete form 8958 allocation of tax amounts between certain individuals in community. Enter all required information in the required fillable areas. Web we last updated the allocation of tax amounts between certain individuals in community property states in february 2023, so this is the latest version of form 8958, fully. Web form 8958 is automatically included in the federal electronic file when filing electronically. Web the form 8958 essentially reconciles the difference between what employers (and other income sources) have reported to the irs and what the spouses. This is not intended as. Pick the web sample in the catalogue. Use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Override as needed to show community property income for both spouse. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Go digital and save time. Web per irs publication 555 community property, starting on page 2, you would only complete form 8958 allocation of tax amounts between certain individuals in community. For flexibility, the application provides three methods for completing form 8958. Printing and scanning is no longer the best way to manage documents. Solved • by intuit • 20 • updated august 14, 2023.. Web follow our simple steps to have your form 8958 examples prepared quickly: Override as needed to show community property income for both spouse. Printing and scanning is no longer the best way to manage documents. Web once you have completed the steps above, please complete the married filing separately allocations form 8958. This is a guide on preparing the. Web we last updated the allocation of tax amounts between certain individuals in community property states in february 2023, so this is the latest version of form 8958, fully. Customize and esign form 8958. Printing and scanning is no longer the best way to manage documents. Web per irs publication 555 community property, starting on page 2, you would only. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Go digital and save time with signnow, the best solution for. This is a guide on. Browse for the example of completed form 8958. Override as needed to show community property income for both spouse. This is a guide on preparing the tax return for a taxpayer/rdp and allocating community income on form 8958 in the taxslayer pro program. Web use this form to determine the allocation of tax amounts between married filing separate spouses or. Web per irs publication 555 community property, starting on page 2, you would only complete form 8958 allocation of tax amounts between certain individuals in community. Send out signed what happens if i don't file form 8958 or print it. Use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps). Web complete form 8958 (which is an informational worksheet, amounts will not go the 1040) a. Override as needed to show community property income for both spouse. For flexibility, the application provides three methods for completing form 8958. Use form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community.. Pick the web sample in the catalogue. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. For flexibility, the application provides three methods for completing form 8958. This is not intended as. Web we last updated the allocation. Form 8958 **say thanks by clicking the thumb icon in a post **mark the post that answers. Web common questions about entering form 8958 income for community property allocation in lacerte. For flexibility, the application provides three methods for completing form 8958. Web for instructions on how to complete form 8958, please check the link: Web follow our simple steps. This is not intended as. Send out signed what happens if i don't file form 8958 or print it. Enter all required information in the required fillable areas. Pick the web sample in the catalogue. Web you must attach form 8958 to your tax form showing how you figured the amount you’re reporting on your return. Override as needed to show community property income for both spouse. Web form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Web per irs publication 555 community property, starting on page 2, you would only complete form 8958 allocation of tax amounts between certain individuals in community. Web complete form 8958 (which is an informational worksheet, amounts will not go the 1040) a. For flexibility, the application provides three methods for completing form 8958. Web use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (rdps) with community property. Web handy tips for filling out form 8958 online. Go digital and save time with signnow, the best solution for. Printing and scanning is no longer the best way to manage documents. Web we last updated the allocation of tax amounts between certain individuals in community property states in february 2023, so this is the latest version of form 8958, fully. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half. This is a guide on preparing the tax return for a taxpayer/rdp and allocating community income on form 8958 in the taxslayer pro program. Web once you have completed the steps above, please complete the married filing separately allocations form 8958. Web common questions about entering form 8958 income for community property allocation in lacerte. Customize and esign form 8958.Form 8958 Allocation of Tax Amounts between Certain Individuals in

Form 8958 Allocation of Tax Amounts between Certain Individuals in

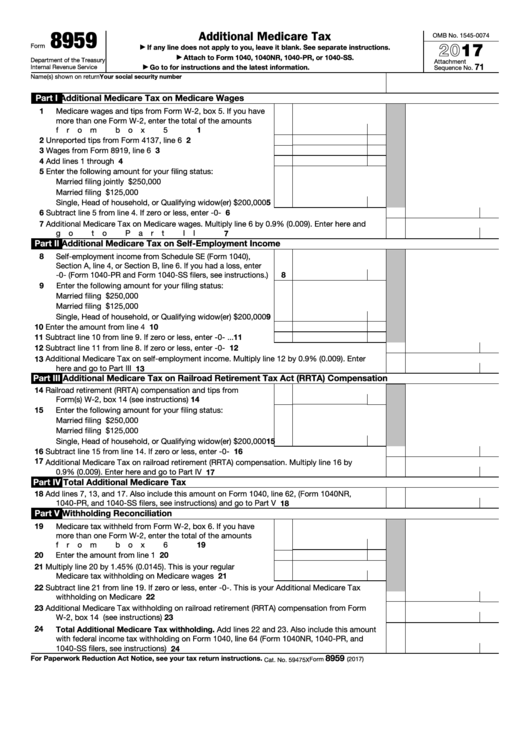

Top 9 Form 8959 Templates free to download in PDF format

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

Sample Forms For Authorized Drivers Resources And Forms For Auto

3.11.3 Individual Tax Returns Internal Revenue Service

Form 8958 instructions 2023 Fill online, Printable, Fillable Blank

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

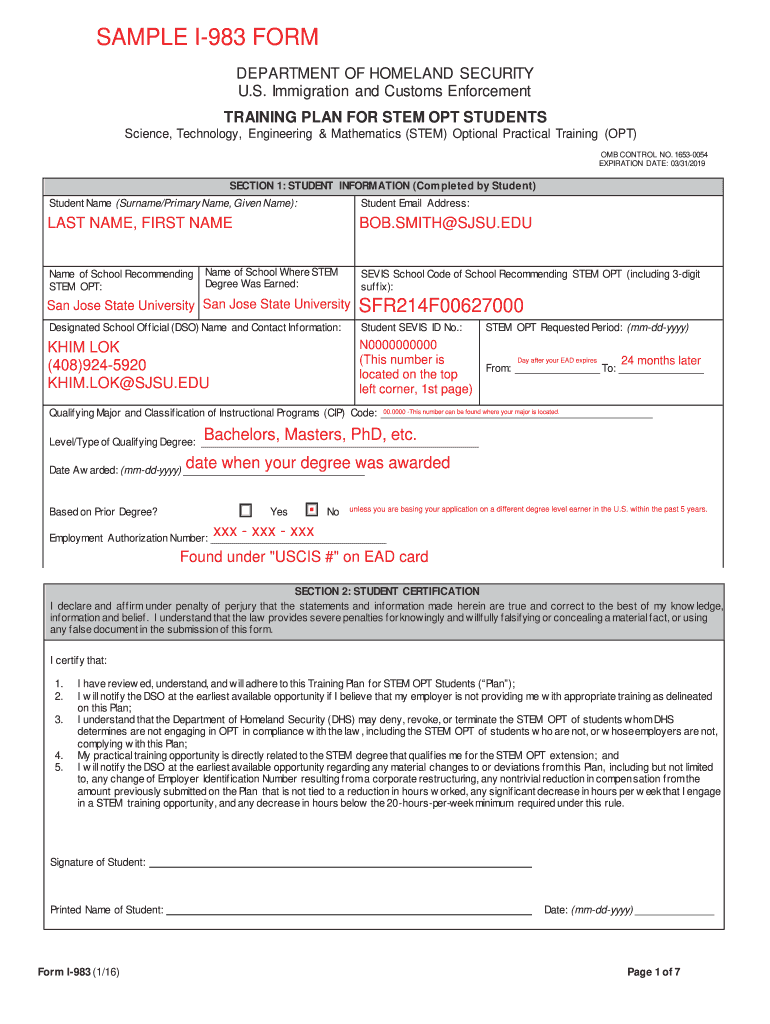

I983 fillable form no download needed Fill out & sign online DocHub

533FilledIn Form Examples

Related Post: