Form 8824 Worksheet

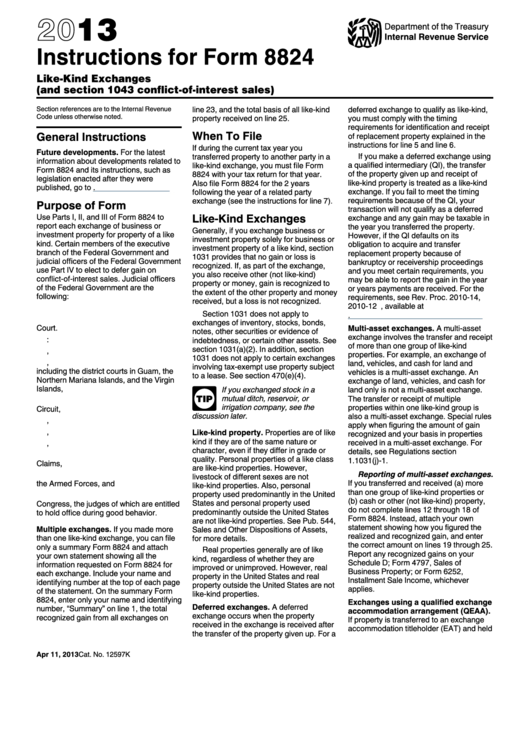

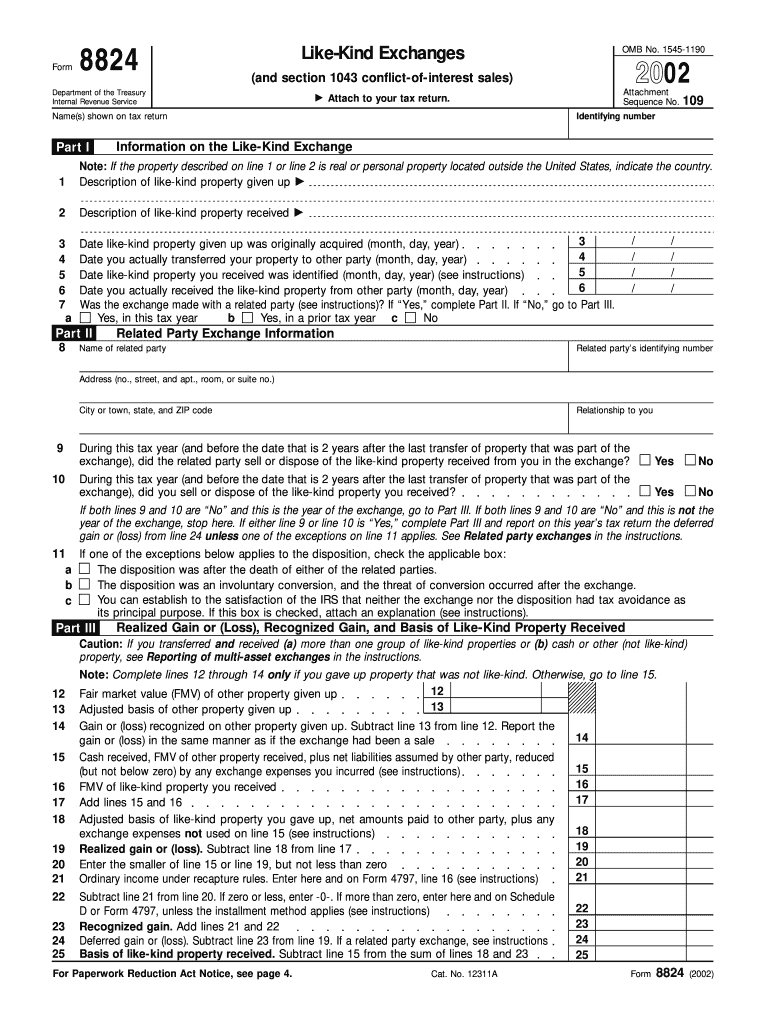

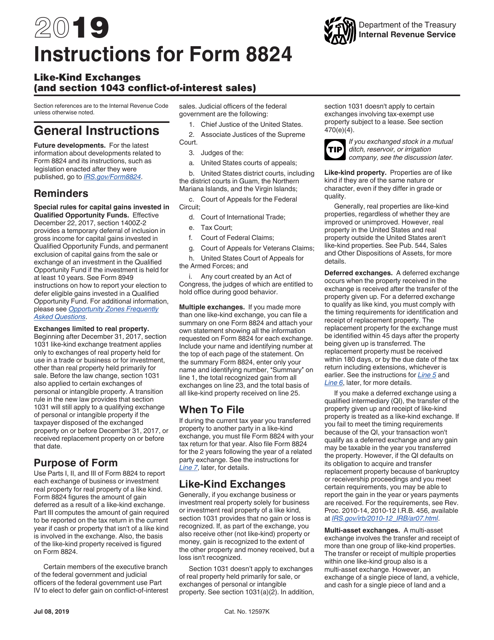

Form 8824 Worksheet - Ad download or email irs 8824 & more fillable forms, register and subscribe now! Taxpayer exchange property replacement property date closed. Part iii computes the amount of gain required to be reported on the tax return in the current year. Below are the most popular support articles associated with form. Web on the worksheet form 8824 for the part of the property used for business or investment, follow steps (1) through (3) above only if you can exclude at least part of any gain from. Tax deferred exchanges under irc § 1031 worksheet 1. Web common questions for form 8824 in proseries. Web the form 8824 is divided into four parts: Complete, edit or print tax forms instantly. You can either keep or shred your completed worksheets. Below are the most popular support articles associated with form. Web common questions for form 8824 in proseries. Web the form 8824 is divided into four parts: Part iii computes the amount of gain required to be reported on the tax return in the current year. Web choose the form called elections/statements. Calculation of recapture for form 8824, line 21. Web common questions for form 8824 in proseries. On the elections form, find the tab called statements. Web choose the form called elections/statements. Complete, edit or print tax forms instantly. Then generate a statement for the 8824 and type in the details of the. Ad download or email irs 8824 & more fillable forms, register and subscribe now! Web the form 8824 is divided into four parts: On the elections form, find the tab called statements. Part iii computes the amount of gain required to be reported on the tax. Use part iii to figure the amount of gain required to be reported on the tax return in the current. See the instructions for exceptions. Tax deferred exchanges under irc § 1031 worksheet 1. Part iii computes the amount of gain required to be reported on the tax return in the current year. Web on the worksheet form 8824 for. Tax deferred exchanges under irc § 1031 worksheet 1. Use part iii to figure the amount of gain required to be reported on the tax return in the current. Complete, edit or print tax forms instantly. Related party exchange information part iii. You can find instructions to the form 8824 worksheets in the paragraphs following. Web on the worksheet form 8824 for the part of the property used for business or investment, follow steps (1) through (3) above only if you can exclude at least part of any gain from. Web form 8824 worksheet is a useful tool for preparing the tax return of a 1031 exchange, a transaction that allows you to defer capital. Web choose the form called elections/statements. Part iii computes the amount of gain required to be reported on the tax return in the current year. See the instructions for exceptions. Below are the most popular support articles associated with form. You can either keep or shred your completed worksheets. Taxpayer exchange property replacement property date closed. Part iii computes the amount of gain required to be reported on the tax return in the current year. Web the form 8824 is divided into four parts: Web common questions for form 8824 in proseries. Calculation of recapture for form 8824, line 21. Web the form 8824 is divided into four parts: Web common questions for form 8824 in proseries. Solved • by intuit • 3 • updated 1 year ago. Related party exchange information part iii. Part iii computes the amount of gain required to be reported on the tax return in the current year. Web choose the form called elections/statements. Solved • by intuit • 3 • updated 1 year ago. Use part iii to figure the amount of gain required to be reported on the tax return in the current. Realized gain or (loss), recognized. Web the form 8824 is divided into four parts: Calculation of recapture for form 8824, line 21. Ad download or email irs 8824 & more fillable forms, register and subscribe now! Web common questions for form 8824 in proseries. Realized gain or (loss), recognized. Click below to download the form 8824 worksheets. Web the form 8824 is divided into four parts: Below are the most popular support articles associated with form. Part iii computes the amount of gain required to be reported on the tax return in the current year. Related party exchange information part iii. Solved • by intuit • 3 • updated 1 year ago. Web choose the form called elections/statements. Part iii computes the amount of gain required to be reported on the tax return in the current year. Web on the worksheet form 8824 for the part of the property used for business or investment, follow steps (1) through (3) above only if you can exclude at least part of any gain from. Complete, edit or print tax forms instantly. See the instructions for exceptions. Ad download or email irs 8824 & more fillable forms, register and subscribe now! Tax deferred exchanges under irc § 1031 worksheet 1. You can find instructions to the form 8824 worksheets in the paragraphs following. You can either keep or shred your completed worksheets. Then generate a statement for the 8824 and type in the details of the.Instructions For Form 8824 LikeKind Exchanges (And Section 1043

Form 8824 LikeKind Exchanges (2015) Free Download

How can/should I fill out Form 8824 with the following information

Fillable Online FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges

Form 8824 Vehicle Example Best Reviews

Form 8824 ≡ Fill Out Printable PDF Forms Online

Form 8824 Example Fill Out and Sign Printable PDF Template signNow

Irs Form 8824 Worksheet

Download Instructions for IRS Form 8824 LikeKind Exchanges PDF, 2019

Online IRS Form 8824 2019 Fillable and Editable PDF Template

Related Post: