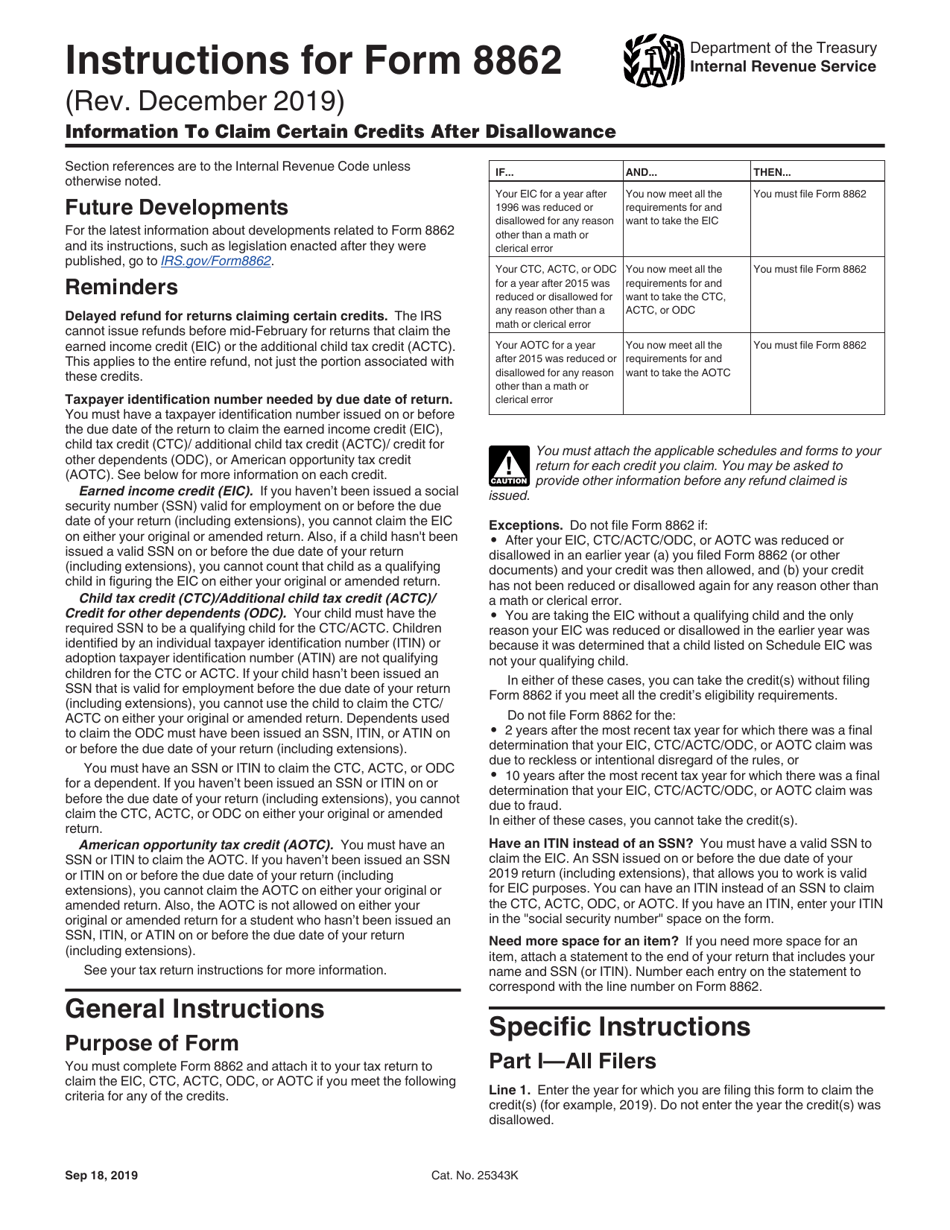

Eic Form 8862

Eic Form 8862 - Do not file form 8862 and do not take the eic. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Web taxpayers complete form 8862 and attach it to their tax return if: Web form 8862 is a federal individual income tax form. Web certain filers claiming the earned income credit (eic) without a qualifying child. Web earned income credit (eic), child tax credit (ctc), refundable child tax credit (rctc), additional child tax credit (actc), credit for other dependents (odc), and american. Web you can claim one or more of the following credits: Web if your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the irs allows. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Web information to claim earned income credit after disallowance before you begin: Web certain filers claiming the earned income credit (eic) without a qualifying child. To find out who is a qualifying child. If your eic was disallowed. Earned income credit (eic), child tax credit (nonrefundable or refundable)/additional child tax credit/credit. December 2022) department of the treasury internal revenue service. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. Ad edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Try it for free now! Web delayed refund for returns. Go to screen 77.1, eic/ctc/aoc after disallowances (8862). Web • determine if a taxpayer is eligible for the earned income credit • calculate the earned income credit. Web generating individual form 8862 for earned income credit (eic) after disallowance in proconnect you can generate form 8862, information to claim certain. Web form 8862 is a federal individual income tax form.. Web • determine if a taxpayer is eligible for the earned income credit • calculate the earned income credit. Earned income credit (eic), child tax credit (nonrefundable or refundable)/additional child tax credit/credit. Web taxpayers complete form 8862 and attach it to their tax return if: Web you can claim one or more of the following credits: Ad download or email. See your tax return instructions or pub. Web generating individual form 8862 for earned income credit (eic) after disallowance in proconnect you can generate form 8862, information to claim certain. Web information to claim earned income credit after disallowance before you begin: Web in either of these cases, you can take the eic without filing form 8862 if you meet. Earned income credit (eic) what do i need? Download or email irs 8862 & more fillable forms, register and subscribe now! December 2022) department of the treasury internal revenue service. Web in either of these cases, you can take the eic without filing form 8862 if you meet all the eic eligibility requirements. Web form 8862 information to claim certain. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Try it for free now! Web follow these steps to generate form 8862: Upload, modify or create forms. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. For 2022, filers without a qualifying child must be at least age 25 but under age 65. If your eic was disallowed. December 2022) department of the treasury internal revenue service. See your tax return instructions or pub. Web to filing form 8862 and, if required, schedule eic, you may be asked to provide other information before any refund resulting. If you have a qualifying child, complete. Enter the appropriate number in qualifying. Web delayed refund for returns claiming certain credits. Download or email irs 8862 & more fillable forms, register and subscribe now! Earned income credit (eic) what do i need? Earned income credit (eic) what do i need? December 2022) department of the treasury internal revenue service. Web • determine if a taxpayer is eligible for the earned income credit • calculate the earned income credit. Web delayed refund for returns claiming certain credits. Ad download or email irs 8862 & more fillable forms, register and subscribe now! Web information to claim earned income credit after disallowance before you begin: Try it for free now! Web this form to make sure you can take the earned income credit (eic) and. To find out who is a qualifying child. Enter the appropriate number in qualifying. Web delayed refund for returns claiming certain credits. Web you can claim one or more of the following credits: Web if your earned income credit (eic) was disallowed or reduced for something other than a math or clerical error, you may need to file form 8862 before the irs allows. Web form 8862 is a federal individual income tax form. Do not file form 8862 and do not take the eic. Information to claim certain credits after disallowance. Go to screen 77.1, eic/ctc/aoc after disallowances (8862). Web delayed refund for returns claiming certain credits. Web file form 8862 if we denied or reduced your eitc for a tax year after 1996 (ctc, actc, odc or aotc for a tax year after 2015) for any reason other than a math. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),. If your eic was disallowed. Web form 8862 information to claim certain credits after disallowance is used to claim the earned income credit (eic) if this credit was previously reduced or disallowed by the. Upload, modify or create forms. Web generating individual form 8862 for earned income credit (eic) after disallowance in proconnect you can generate form 8862, information to claim certain. December 2022) department of the treasury internal revenue service.Download Instructions for IRS Form 8862 Information to Claim Certain

Form 8862 Earned Tax Credit Government Finances

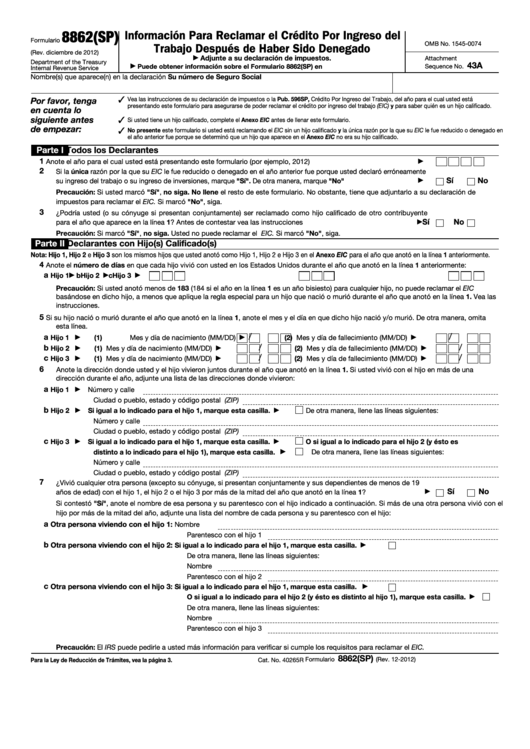

Form 8862(Sp) Informacion Para Reclamar El Credito Por Ingreso Del

Form 8862Information to Claim Earned Credit for Disallowance

Top 14 Form 8862 Templates free to download in PDF format

Form 8862 Information to Claim Earned Credit After

Form 8862Information to Claim Earned Credit for Disallowance

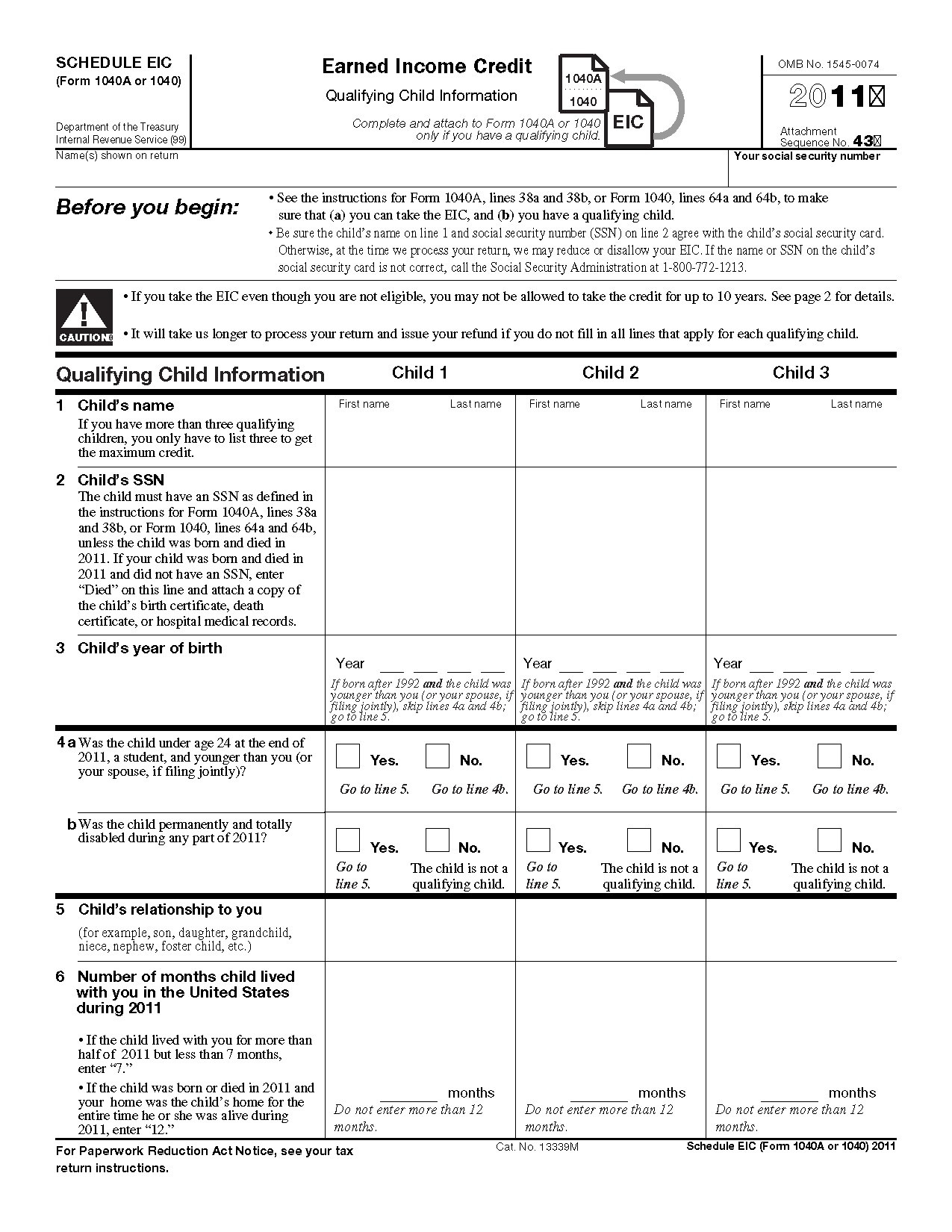

Worksheet For Earned Tax Credit

Form 8862 Information to Claim Earned Credit After

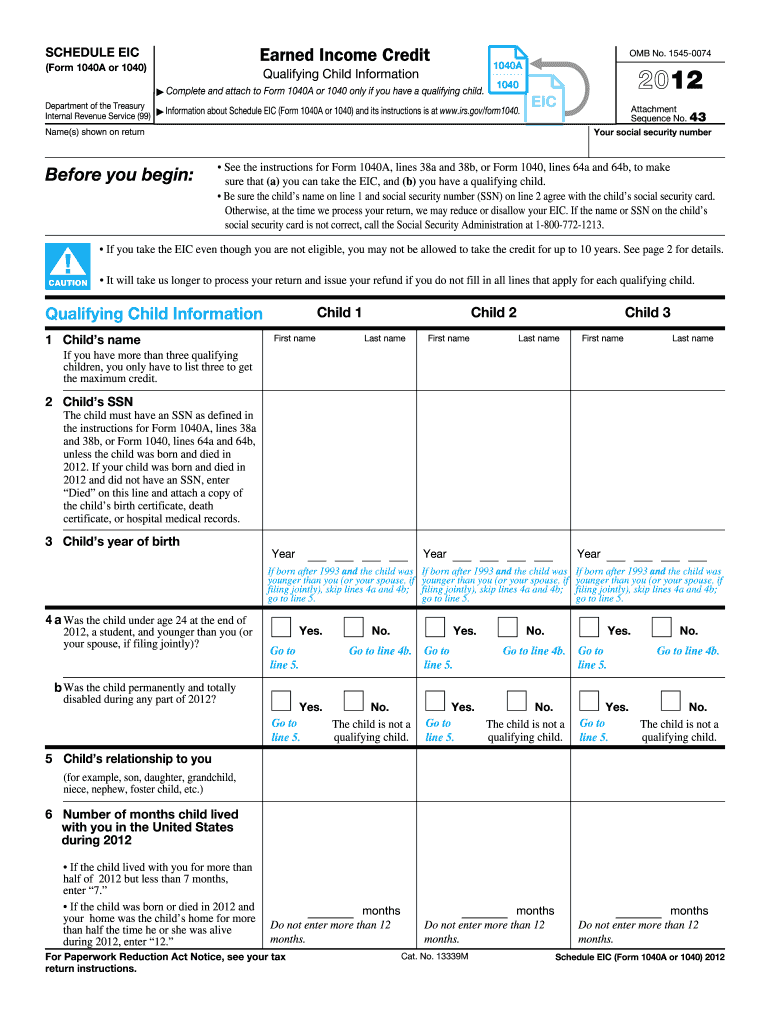

2012 form eic Fill out & sign online DocHub

Related Post: