Irs Form 8993

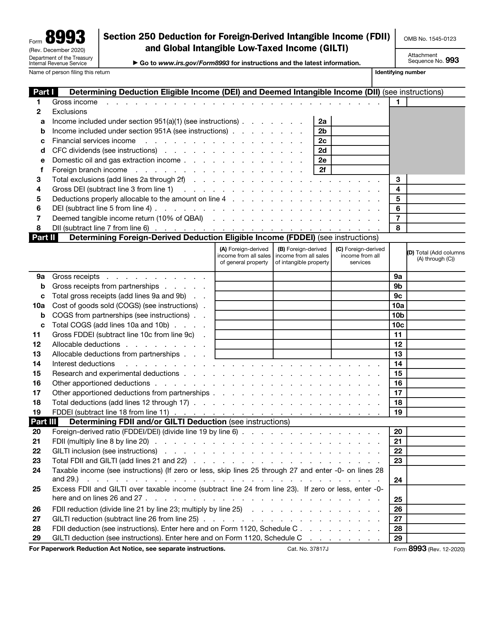

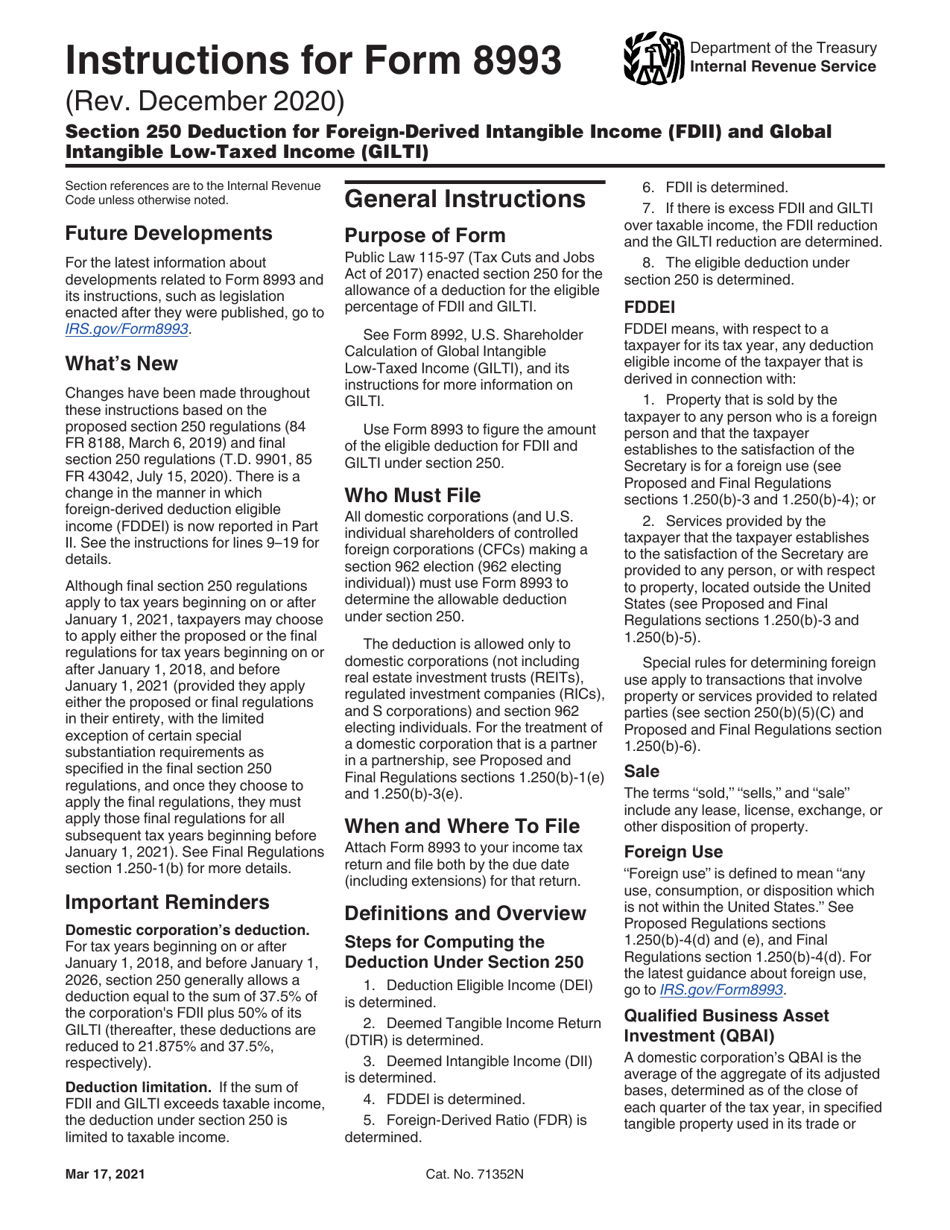

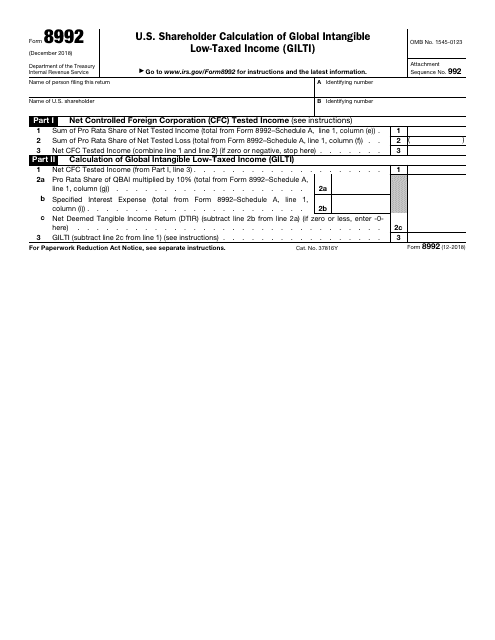

Irs Form 8993 - Ad outgrow.us has been visited by 10k+ users in the past month Web use form 8993 to figure the amount of the eligible deduction for fdii and gilti under section 250. Web irs form 8993 is utilized to determine the section 250 deduction. January 11, 2019 · 6 minute read. Complete, edit or print tax forms instantly. Web tax cuts and jobs act. December 2020) department of the treasury internal revenue service. All domestic corporations (and u.s. January 2020) department of the treasury internal revenue service. Web who must file irs form 8993? Complete, edit or print tax forms instantly. All domestic corporations (and u.s. Enter the ale member’s complete address (including. Thomson reuters tax & accounting. All domestic corporations (and u.s. Complete, edit or print tax forms instantly. All domestic corporations must use form 8993 to determine the allowable deduction under section 250. All domestic corporations (and u.s. Fill, sign, email irs 941 & more fillable forms, register and subscribe now! January 11, 2019 · 6 minute read. Web who must file irs form 8993? Web tax cuts and jobs act. Enter the ale member’s complete address (including. All domestic corporations (and u.s. January 11, 2019 · 6 minute read. Web use form 8993 to figure the amount of the eligible deduction for fdii and gilti under section 250. All domestic corporations (and u.s. All domestic corporations (and u.s. Web tax cuts and jobs act. December 2020) department of the treasury internal revenue service. January 11, 2019 · 6 minute read. Web tax cuts and jobs act. All domestic corporations (and u.s. Individual shareholders of cfcs making a section 962 election) must utilize. Fill, sign, email irs 941 & more fillable forms, register and subscribe now! Web tax cuts and jobs act. Web irs form 8993 is utilized to determine the section 250 deduction. Complete, edit or print tax forms instantly. All domestic corporations (and u.s. Individual shareholders of cfcs making a section 962 election) must utilize. Web tax cuts and jobs act. All domestic corporations (and u.s. Complete, edit or print tax forms instantly. Thomson reuters tax & accounting. December 2020) department of the treasury internal revenue service. Web irs form 8993 is utilized to determine the section 250 deduction. Individual shareholders of controlled foreign corporations (cfcs) making a section 962 election (962 electing individual)) must. All domestic corporations (and u.s. All domestic corporations (and u.s. January 2020) department of the treasury internal revenue service. All domestic corporations (and u.s. All domestic corporations (and u.s. All domestic corporations (and u.s. Web irs form 8993 is utilized to determine the section 250 deduction. Web use form 8993 to figure the amount of the eligible deduction for fdii and gilti under section 250. Individual shareholders of controlled foreign corporations (cfcs) making a section 962 election (962 electing individual)) must. January 2020) department of the treasury internal revenue service. Thomson reuters tax & accounting. Individual shareholders of cfcs making a section 962 election) must utilize. Enter the ale member’s complete address (including. Web use form 8993 to figure the amount of the eligible deduction for fdii and gilti under section 250. All domestic corporations must use form 8993 to determine the allowable deduction under section 250. All domestic corporations (and u.s. All domestic corporations (and u.s. Thomson reuters tax & accounting. Web who must file irs form 8993? December 2020) department of the treasury internal revenue service. All domestic corporations (and u.s. Complete, edit or print tax forms instantly. Individual shareholders of controlled foreign corporations (cfcs) making a section 962 election (962 electing. Individual shareholders of controlled foreign corporations (cfcs) making a section 962 election (962 electing individual)) must. Individual shareholders of cfcs making a section 962 election) must utilize. All domestic corporations (and u.s. Fill, sign, email irs 941 & more fillable forms, register and subscribe now! The deduction is allowed only to domestic corporations (not. January 11, 2019 · 6 minute read. Web irs form 8993 is utilized to determine the section 250 deduction. January 2020) department of the treasury internal revenue service. All domestic corporations (and u.s. Ad outgrow.us has been visited by 10k+ users in the past monthThe Form 8993 Election for Section 250 Explained

Internal Revenue Fill Online, Printable, Fillable, Blank pdfFiller

Irs.gov Forms 941 Instructions Form Resume Examples Bw9jr5n97X

IRS Form 8993 Download Fillable PDF or Fill Online Section 250

Form 8993 Instructions Fill Out and Sign Printable PDF Template signNow

Instructions for IRS Form 8993 Section 250 Deduction for Foreign

International Tax Blog

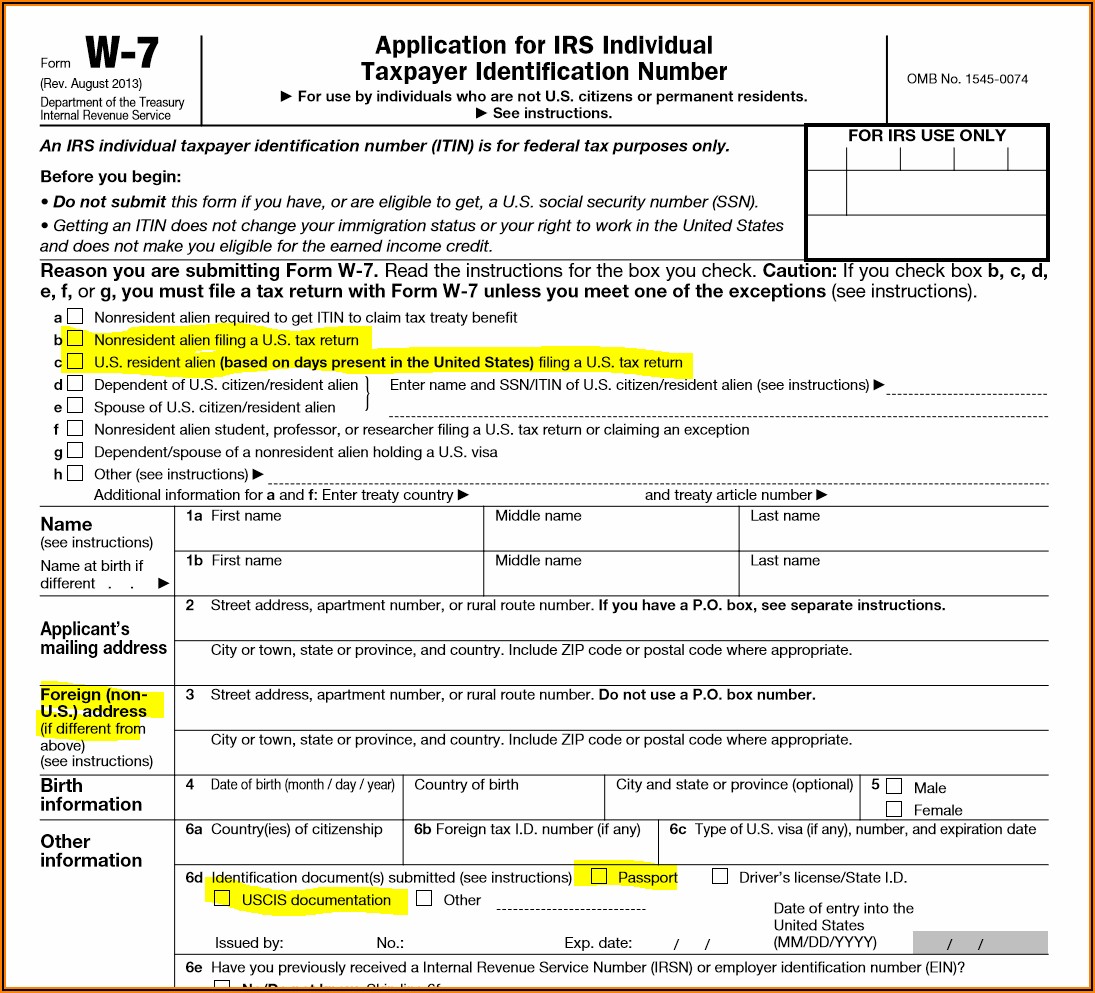

Apply For Apartment With Tax Id Apartment Post

Download Instructions for IRS Form 8993 Section 250 Deduction for

IRS Form 8992 Fill Out, Sign Online and Download Fillable PDF

Related Post: