Ct Form 1041

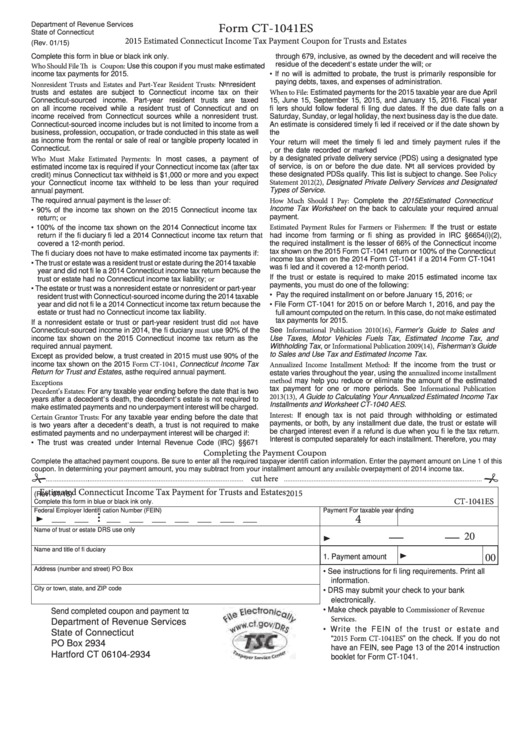

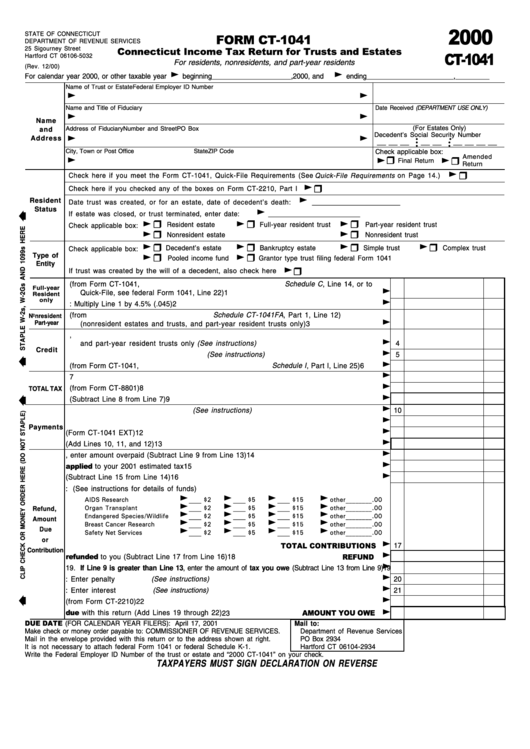

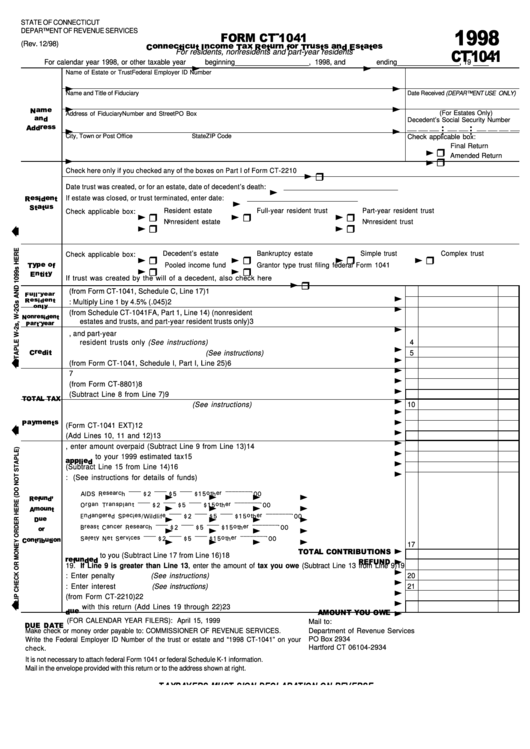

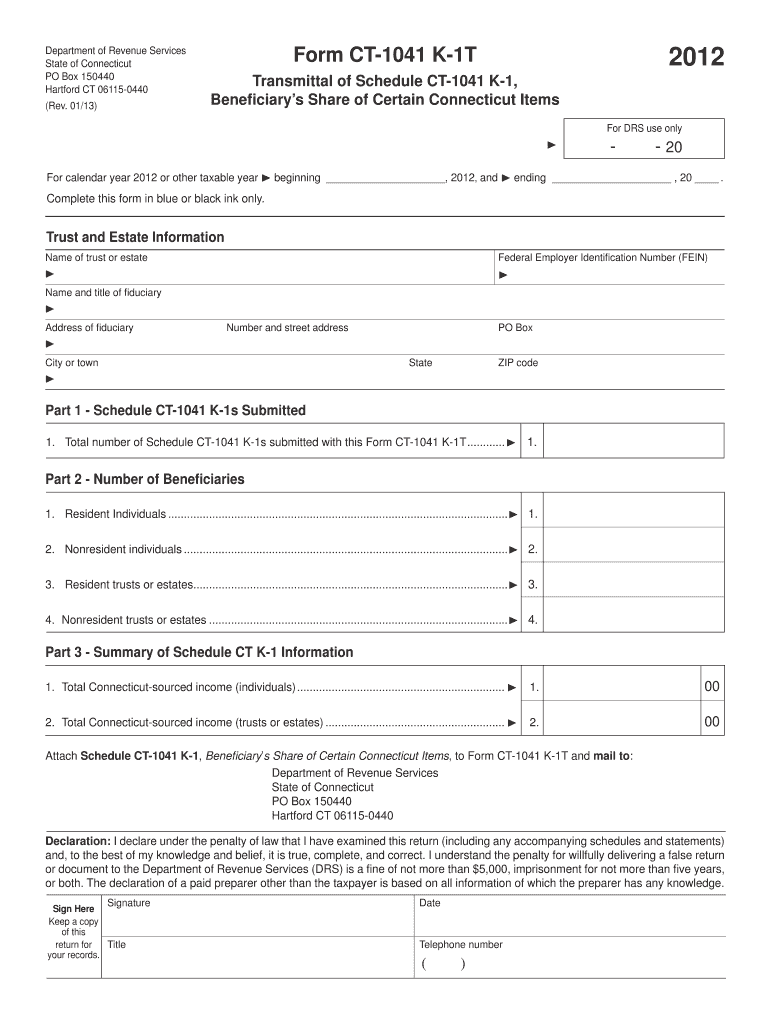

Ct Form 1041 - Get ready for tax season deadlines by completing any required tax forms today. Ad form 1041 schedule j—trusts & throwback rules. Connecticut income tax multiply line 1 by 5%. Ad access irs tax forms. 12/19) schedule i 2019 connecticut alternative minimum tax computation of trusts or estates any trust or estate subject to and required to pay. 12/22) connecticut income tax return for trusts and estates for residents, nonresidents, and. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Complete, edit or print tax forms instantly. Expert guidance on financial & estate planning. United states (english) united states (spanish) canada (english) canada (french). Ad access irs tax forms. Income tax return for estates and trusts. Except as provided below, a trust created in 2020 must use. 12/22) connecticut income tax return for trusts and estates for residents, nonresidents, and. Web the executor continues to file form 1041 during the election period even if the estate distributes all of its assets before the end. United states (english) united states (spanish) canada (english) canada (french). Complete, edit or print tax forms instantly. Enhance your skills & earn cpe. Name of trust or estate federal employer id number. Except as provided below, a trust created in 2020 must use. Please note that each form is. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. 12/19) schedule i 2019 connecticut alternative minimum tax computation of trusts or estates any trust or estate subject to and required to pay. Except as provided below, a trust created in 2020 must use. Web 2022. Ad access irs tax forms. Web the executor continues to file form 1041 during the election period even if the estate distributes all of its assets before the end of the election period. Income tax return for estates and trusts. See form ct‑1041 quick‑file requirements. Get ready for tax season deadlines by completing any required tax forms today. Prior year's trust & estate tax form. Web the executor continues to file form 1041 during the election period even if the estate distributes all of its assets before the end of the election period. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Connecticut income tax multiply line 1 by. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. For instructions and the latest information. Complete this schedule in blue or black ink only. Please note that each form is. Enhance your skills & earn cpe. Income tax return for estates and trusts, including recent updates, related forms and instructions on how to file. Income tax return for estates and trusts. Ad access irs tax forms. United states (english) united states (spanish) canada (english) canada (french). Web use 90% of the income tax shown on the 2020 connecticut income tax return as the required annual payment. For instructions and the latest information. Name of trust or estate federal employer id number. Ad access irs tax forms. Complete this schedule in blue or black ink only. Web you meet the form ct‑1041 quick‑file requirements. Web you meet the form ct‑1041 quick‑file requirements. Web use 90% of the income tax shown on the 2020 connecticut income tax return as the required annual payment. Income tax return for estates and trusts. Complete this schedule in blue or black ink only. Ad access irs tax forms. Ad access irs tax forms. Web use 90% of the income tax shown on the 2020 connecticut income tax return as the required annual payment. 12/19) schedule i 2019 connecticut alternative minimum tax computation of trusts or estates any trust or estate subject to and required to pay. Ad form 1041 schedule j—trusts & throwback rules. Web the executor continues. 12/22) connecticut income tax return for trusts and estates for residents, nonresidents, and. See form ct‑1041 quick‑file requirements. Web the executor continues to file form 1041 during the election period even if the estate distributes all of its assets before the end of the election period. Name of trust or estate federal employer id number. Web use 90% of the income tax shown on the 2020 connecticut income tax return as the required annual payment. Except as provided below, a trust created in 2020 must use. Connecticut income tax multiply line 1 by 5%. Web form is year specific.to prevent any delay in processing your return, the correct year’s formmust be submitted to the department of revenue services (drs). Complete this schedule in blue or black ink only. United states (english) united states (spanish) canada (english) canada (french). 12/19) schedule i 2019 connecticut alternative minimum tax computation of trusts or estates any trust or estate subject to and required to pay. Enhance your skills & earn cpe. For instructions and the latest information. Income tax return for estates and trusts. Web information about form 1041, u.s. Please note that each form is. Web 2022 schedule ct‐1041fa can be filed electronically. For instructions and the latest information. Web 19 rows trust & estate tax forms. Check here if you checked any of the boxes on form ct‑2210, part 1.Form Ct1041es Estimated Connecticut Tax Payment Coupon For

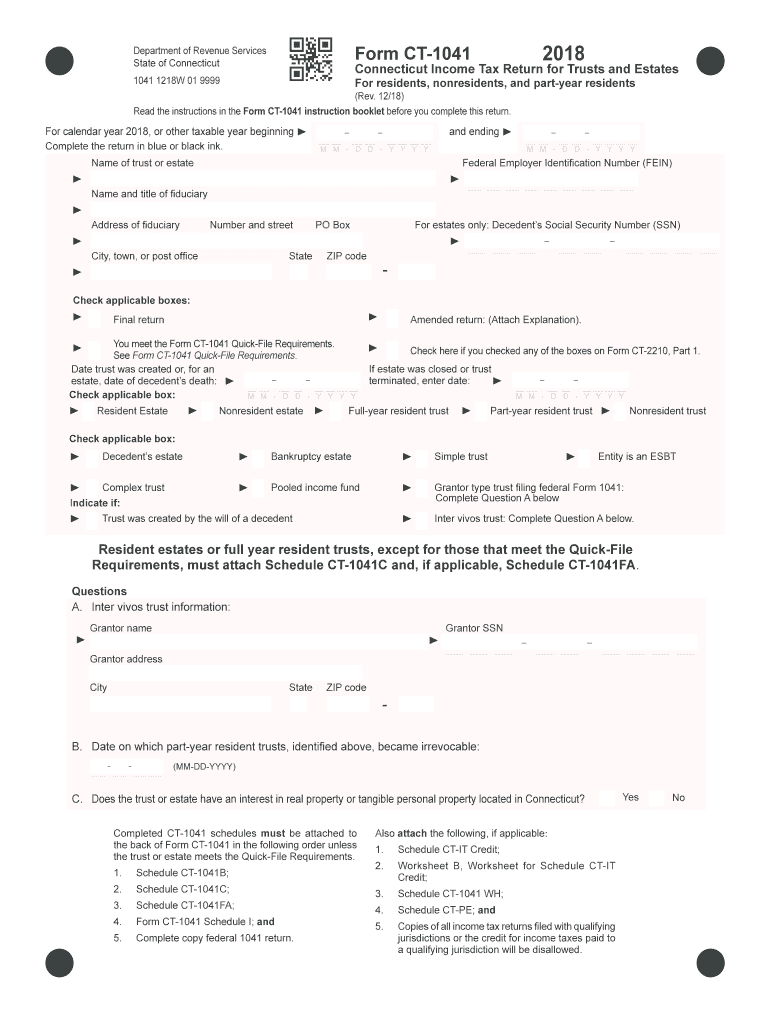

Form Ct1041 Connecticut Tax Return For Trusts And Estates

Fillable Form Ct1041 Connecticut Tax Return For Trusts And

1041k Form Fill Out and Sign Printable PDF Template signNow

Quick File Requirements For Ct 1041 Fill Out and Sign Printable PDF

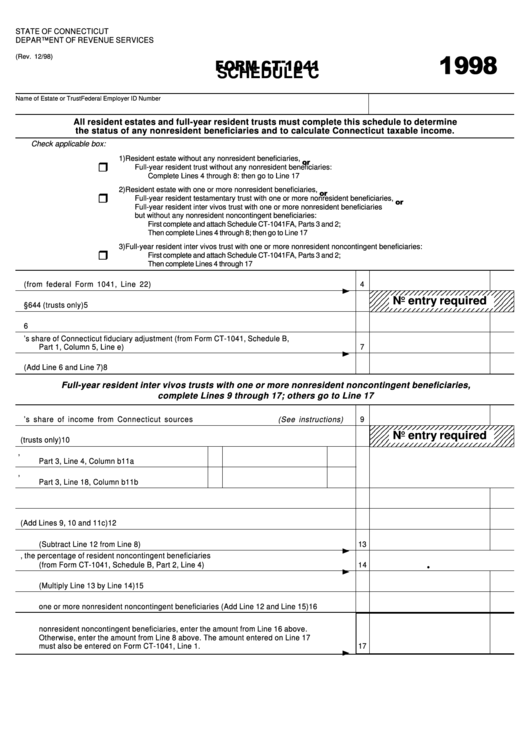

Fillable Form Ct1041 Schedule C Calculation Of Connecticut Taxable

2019 Form IRS 1041 Fill Online, Printable, Fillable, Blank pdfFiller

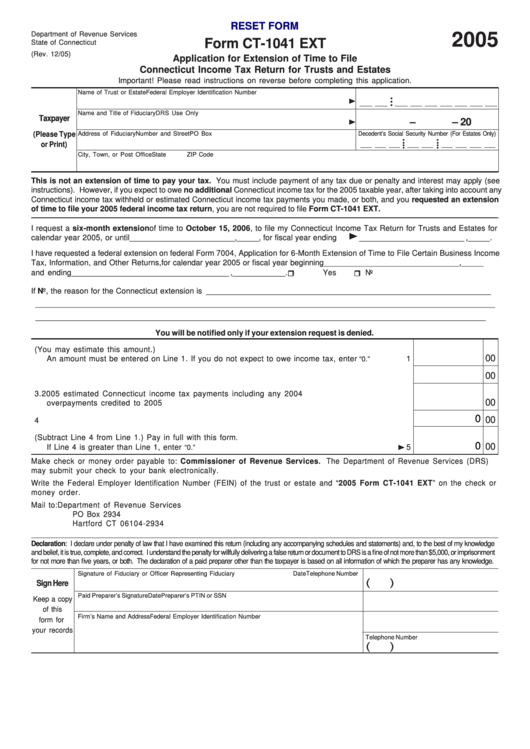

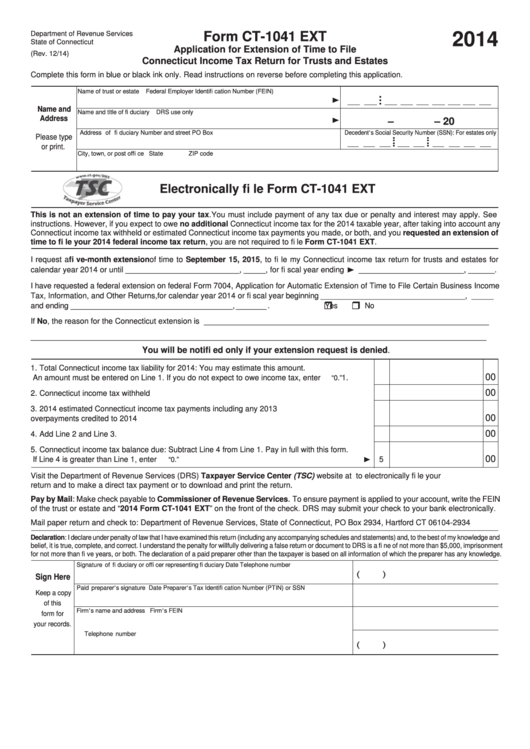

Fillable Form Ct1041 Ext Application For Extension Of Time To File

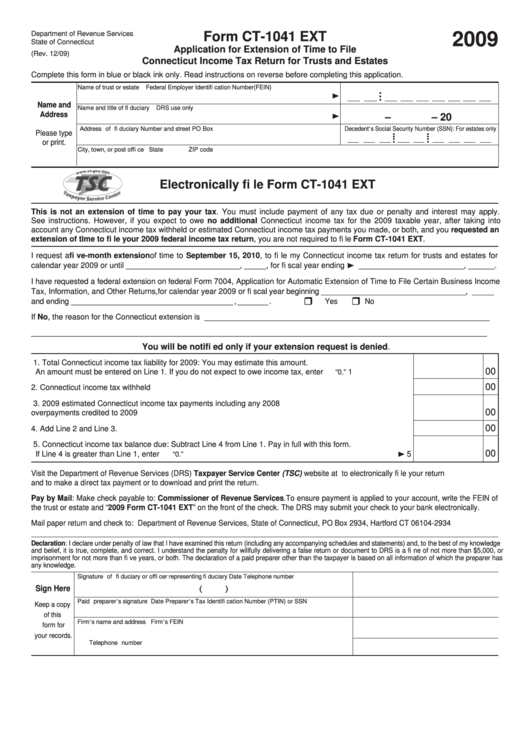

Form Ct1041 Ext Application For Extension Of Time To File

Form Ct1041 Ext Application For Extension Of Time To File

Related Post: