Tax Form 5564

Tax Form 5564 - Web sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web it indicates your consent with the proposed decrease or increase in tax payments. Along with notice cp3219a, you should receive form 5564. You can avoid future problems by: Review the changes and compare them to your tax return. Page last reviewed or updated: Web sign and return form 5564, certified with a return receipt requested, as soon as possible to limit the amount of interest that accrues on the balance due. If you are making a. Web when the automated systems at the irs detect a problem with your tax payment you will receive a form 5564. Ad tax credit consulting, syndication legal & financial structuring. Web up to $40 cash back get the free irs form 5564 pdf. Page last reviewed or updated: Web this letter is your notice of deficiency, as required by law. Helping make your project a reality. How to fill out form 5564. Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of deficiency. Here are some timely tax tips and other. Ad if you owe more than $5,000 in back taxes tax advocates can help. Web sign and return form 5564, certified with a return receipt requested, as soon as possible to limit the amount of interest that accrues on the balance due. If you have no objections to the information on the. This form might arrive because the income you. To start the form, use the fill camp; Web what is irs form 5564? Individual tax return form 1040 instructions; Web if you agree with the notice of deficiency and don’t wish to challenge it, then simply sign form 5564, the notice of deficiency waiver, and send it back to the agency. Web this letter explains the changes and your right to challenge the increase in tax court. Ad tax credit consulting, syndication legal. If you have no objections to the information on the. If you are making a. This form might arrive because the income you. For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. You may be eligible for a difficulty of care federal income tax exclusion if you meet the. Web form 5564 get form 5564 how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save notice of deficiency waiver rating. Keeping accurate and full records. Call us for a free consultation Web how to complete the ir's form 5564 notice of deficiency waiver online: If you agree. If you are making a. Waiting until you get all your income statements before filing your tax return. If you agree with the information. Page last reviewed or updated: 5564 notice of deficiency waiver free ebay auction templatesvictoria secret coupons 2012 ×10. Helping make your project a reality. This form might arrive because the income you. Estimate how much you could potentially save in just a matter of minutes. Web this letter explains the changes and your right to challenge the increase in tax court. Page last reviewed or updated: For contributions made to an umbrella charitable organization, the qualifying charitable organization code and name of the qualifying charity are. Web form 5564 get form 5564 how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save notice of deficiency waiver rating. How to fill out form 5564. Web. You do not enter form 5564 in the program. If you are eligible for. Along with notice cp3219a, you should receive form 5564. Web when the automated systems at the irs detect a problem with your tax payment you will receive a form 5564. How to fill out form 5564. If you have no objections to the information on the. If you disagree you have the right to challenge this determination in u.s. Web if you agree with the notice of deficiency and don’t wish to challenge it, then simply sign form 5564, the notice of deficiency waiver, and send it back to the agency. Estimate how much you could potentially save in just a matter of minutes. Page last reviewed or updated: You do not enter form 5564 in the program. Waiting until you get all your income statements before filing your tax return. Web form 5564 get form 5564 how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save notice of deficiency waiver rating. Ad if you owe more than $5,000 in back taxes tax advocates can help you get tax relief. Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of deficiency. If you are making a. Web sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. If you agree with the information. Web up to $40 cash back get the free irs form 5564 pdf. Web 1 best answer. You can avoid future problems by: Web popular forms & instructions; Web what is irs form 5564? To start the form, use the fill camp; Web how to complete the ir's form 5564 notice of deficiency waiver online:Irs Form W4V Printable Federal Form W 4v Voluntary Withholding

Form 5564 Fill and Sign Printable Template Online US Legal Forms

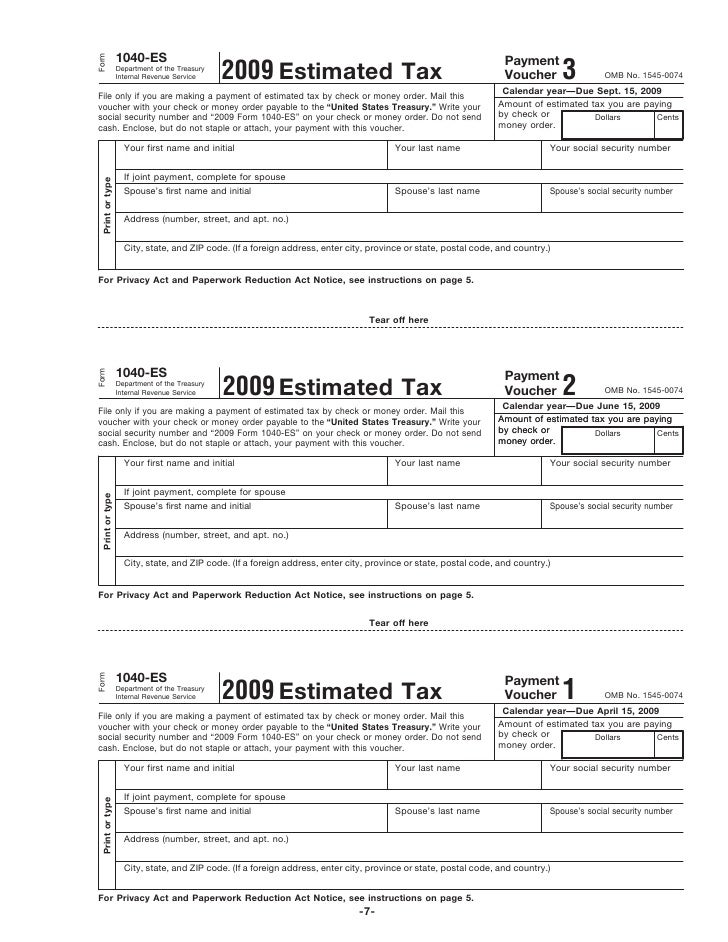

Federal Benefits Payment Irs 1040es Online Payment

6.2 The U.S. Federal Tax Process Business LibreTexts

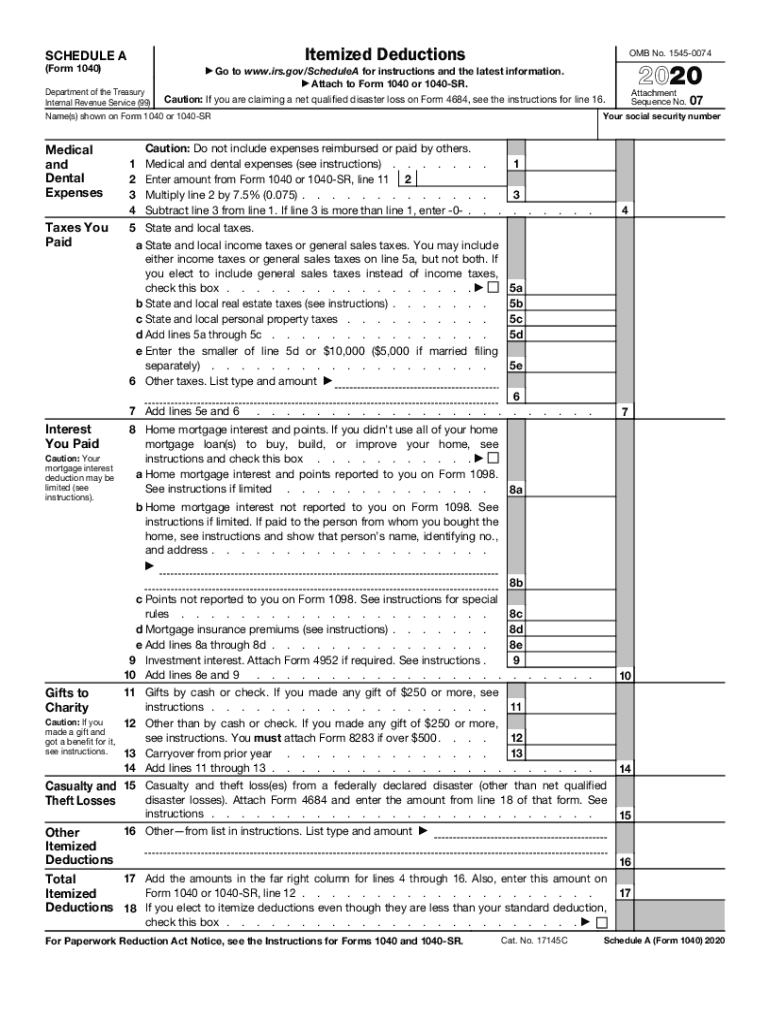

Irs Schedule A Fill Out and Sign Printable PDF Template signNow

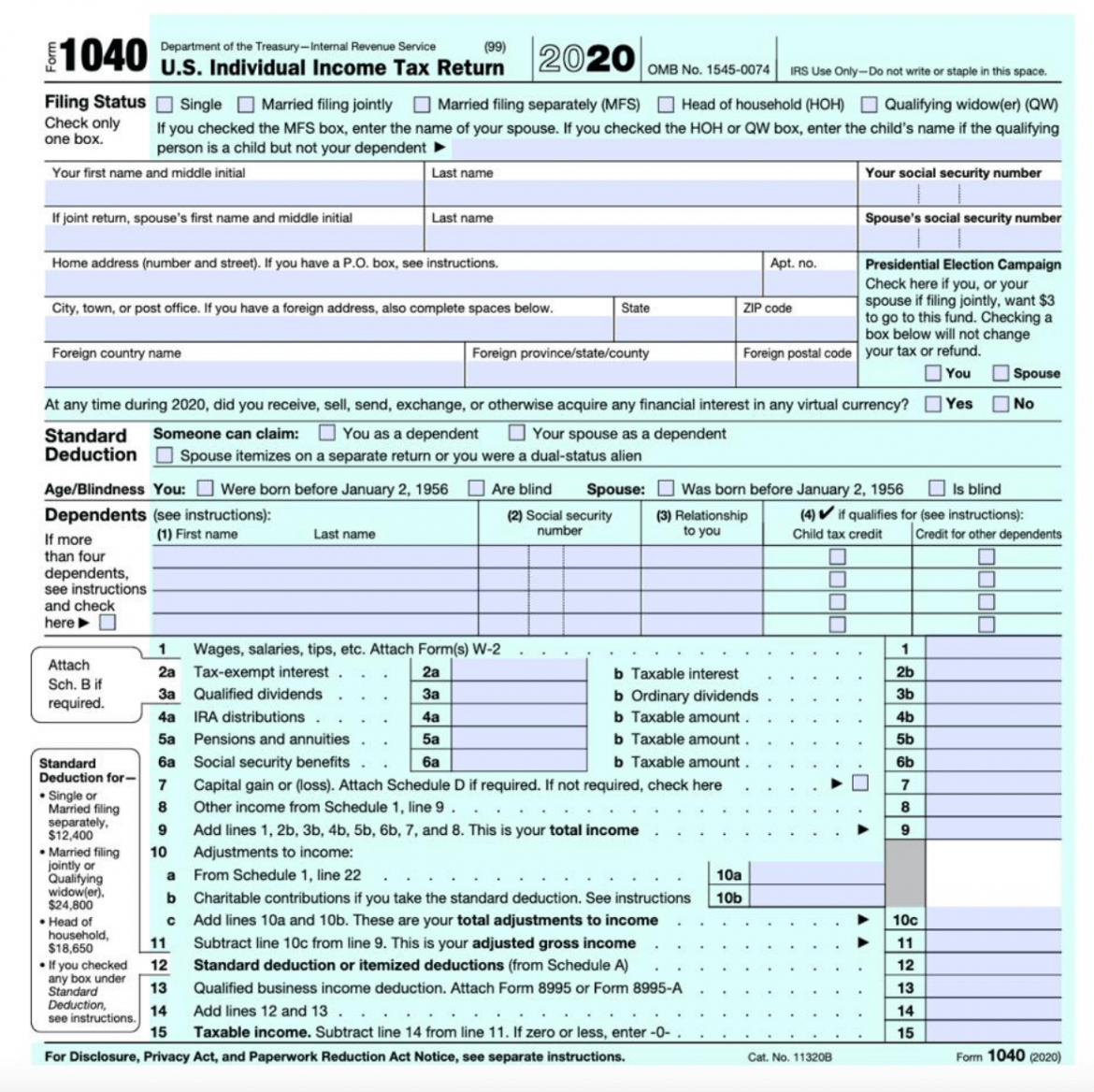

Completing Form 1040 The Face Of Your Tax Return US 2021 Tax Forms

Printable Irs Form 5564 Printable Forms Free Online

Download Federal and State Tax Forms Cherokee County Public Library

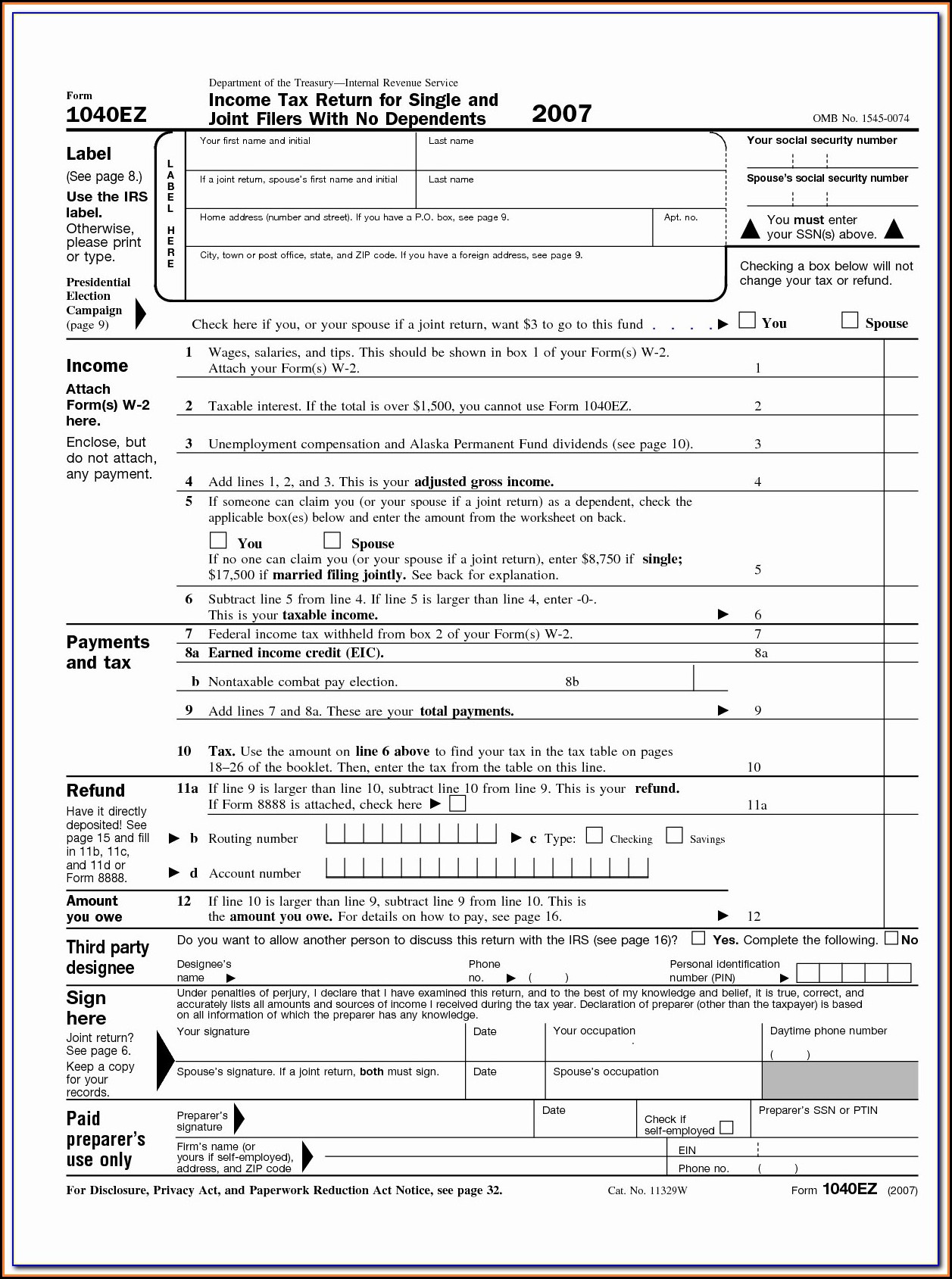

Irs Printable Forms 1040ez Form Resume Examples xz204Nm2ql

IRS Form 1040NR 2018 Fill Out, Sign Online and Download Fillable

Related Post: