Colorado Senior Property Tax Exemption Form

Colorado Senior Property Tax Exemption Form - The income qualified senior housing income tax credit is claimed using the dr 0104cr. Line instructions line 1 entity information enter the entity’s identifying and. The three basic requirements are; Web the partial tax exemption for senior citizens was created for qualifying seniors as well as the surviving spouses of seniors who previously qualified. Remedies for recipients of notice of forfeiture of right to claim exemption. The long form is for surviving. Explore these zero income tax states. Web claim for exemption from real property taxes (rev 64 0002) if your residence is an asset of a trust. Web property tax relief programs for senior citizens. Web for qualifying seniors, this exemption reduces the property tax on the primary residence by exempting 50% of the first $200,000 in market value. Senior and veterans with disabilities property tax exemption. Late filing fee waiver request. Web the property tax, rent, heat (ptc) rebate is now available to colorado residents based on income including people with disabilities and older adults to help with their property. Web senior property tax exemption information. At least 65 years old on january 1, and. Other taxes may fill the void. Best tool to create, edit & share pdfs. The senior property tax exemption is available to senior citizens and the surviving spouses of senior citizens. Web how do i claim the income qualified senior housing income tax credit? Senior and veterans with disabilities property tax exemption. Web senior property tax exemption. Web colorado seniors 65 years of age or older at the end of 2022 may qualify for the income qualified senior housing income tax credit. The application deadline for the attached short form is july 15. The long form is for surviving. Ad vast library of fillable legal documents. At least 65 years old on january 1, and. Web proposition hh would blunt those rising property taxes in colorado for at least the next 10 years. This credit was allowed for tax year 2022. The income qualified senior housing income tax credit is claimed using the dr 0104cr. Web a qualifying entity may complete this form to apply for. Have been the primary occupant for. Web claim for exemption from real property taxes (rev 64 0002) if your residence is an asset of a trust. Web how do i claim the income qualified senior housing income tax credit? Web we would like to show you a description here but the site won’t allow us. The senior property tax exemption. Web a qualifying entity may complete this form to apply for a colorado sales tax exemption certificate. Other taxes may fill the void. Have been the primary occupant for. Web the partial tax exemption for senior citizens was created for qualifying seniors as well as the surviving spouses of seniors who previously qualified. Web for qualifying seniors, this exemption reduces. Web a qualifying entity may complete this form to apply for a colorado sales tax exemption certificate. The short form is for applicants who meet the basic eligibility requirements. Web on january 1st2023, the state of colorado is expandingthe deferral program to allow those who do not qualify for the senior or military personnel program to defer a portion of. Web property tax exemption for senior citizens in colorado. Web colorado seniors are eligible for a property tax exemption if they are: Web proposition hh would blunt those rising property taxes in colorado for at least the next 10 years. Web the property tax, rent heat (ptc) rebate is now available to colorado residents based on income including people with. Senior and veterans with disabilities property tax exemption. Pdffiller allows users to edit, sign, fill and share all type of documents online. Web property tax relief programs for senior citizens. Web senior property tax exemption information. Web property tax exemption for senior citizens in colorado. Late filing fee waiver request. Access senior citizens and veterans exemption. Explore these zero income tax states. The long form is for surviving. Best tool to create, edit & share pdfs. Web there are two application forms for the senior property tax exemption. The short form is for applicants who meet the basic eligibility requirements. Web colorado seniors are eligible for a property tax exemption if they are: The 3 basic requirements are. Web property tax relief programs for senior citizens. Web proposition hh would blunt those rising property taxes in colorado for at least the next 10 years. Web on january 1st2023, the state of colorado is expandingthe deferral program to allow those who do not qualify for the senior or military personnel program to defer a portion of their. Concerning the expansion of existing property tax exemptions for certain owner. Web claim for exemption from real property taxes (rev 64 0002) if your residence is an asset of a trust. Web we would like to show you a description here but the site won’t allow us. Late filing fee waiver request. Explore the attached documents for more information regarding the senior property tax exemption! Web senior property tax exemption. Have been the primary occupant for. Line instructions line 1 entity information enter the entity’s identifying and. Web property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. It is to be used only for purposes. Pdffiller allows users to edit, sign, fill and share all type of documents online. Ad vast library of fillable legal documents. Senior and veterans with disabilities property tax exemption.Il Senior Citizen Exemption Application Fill Online, Printable

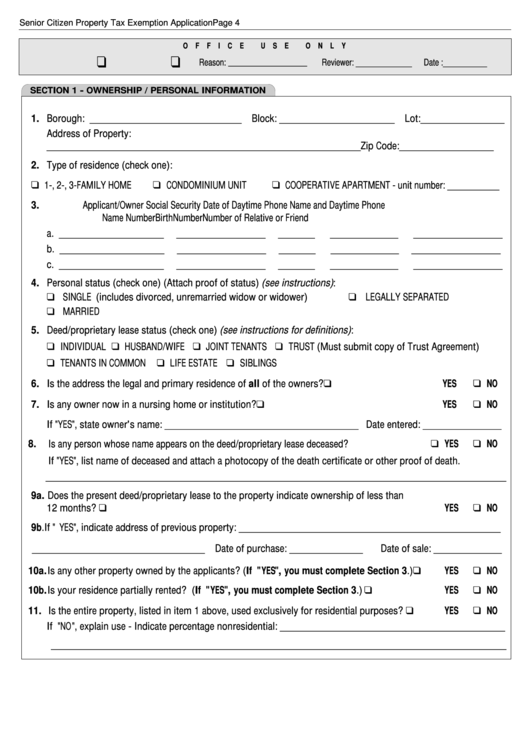

Senior Citizen Property Tax Exemption Application Form printable pdf

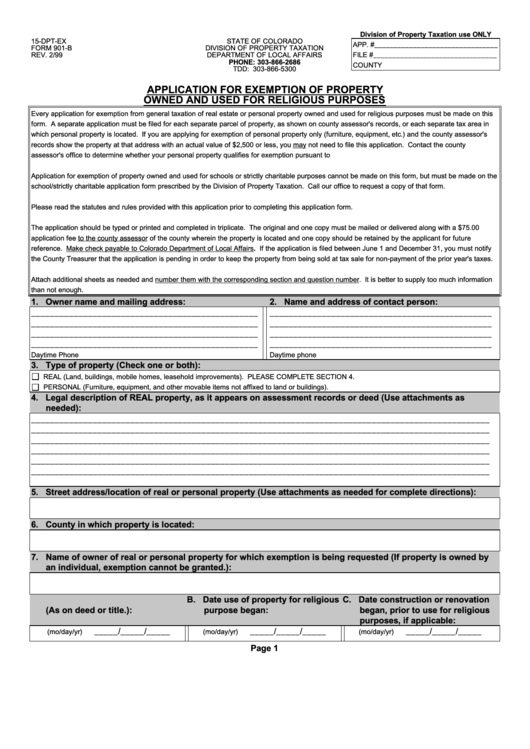

Cómo obtener un Certificado de Exención de Impuestos sobre las Ventas

Colorado Property Tax Exemption Form

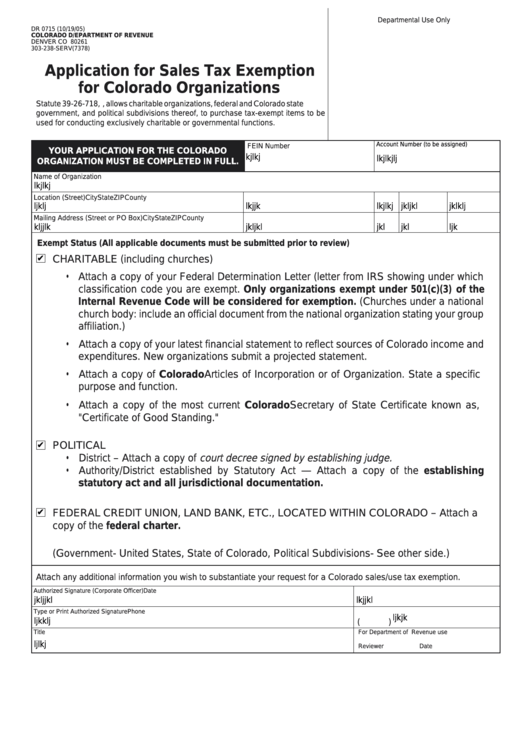

Fillable Form Dr 0715 Application For Sales Tax Exemption For

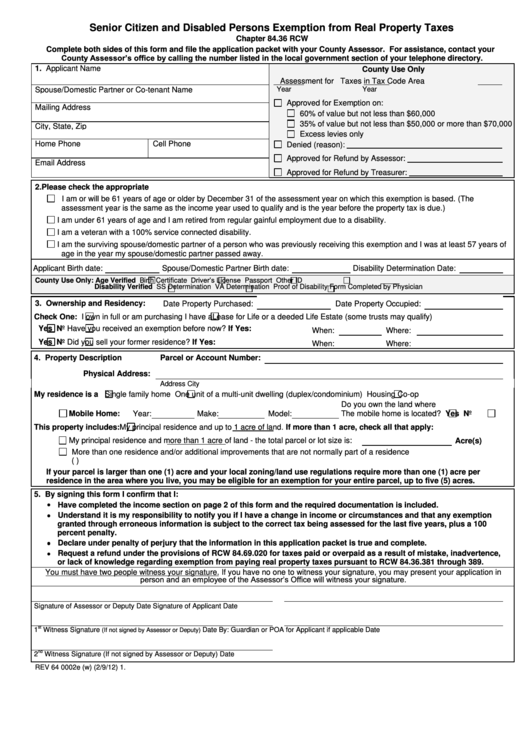

Fillable Form Rev 64 0002e Senior Citizen And Disabled Persons

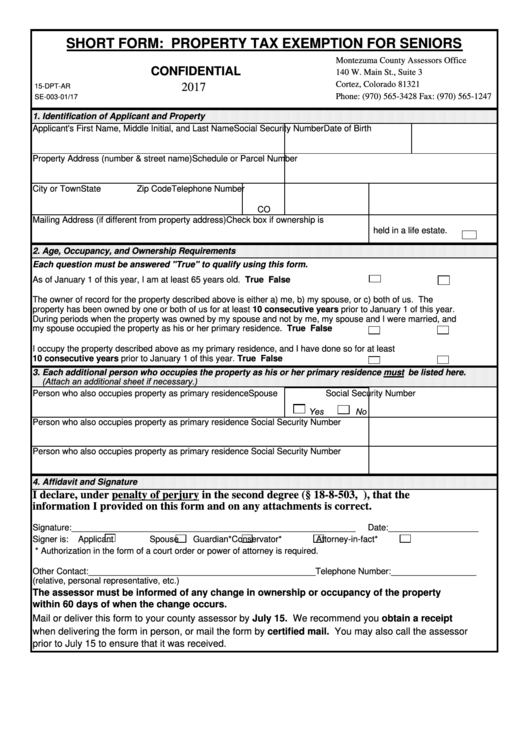

Fillable Short Form Property Tax Exemption For Seniors 2017

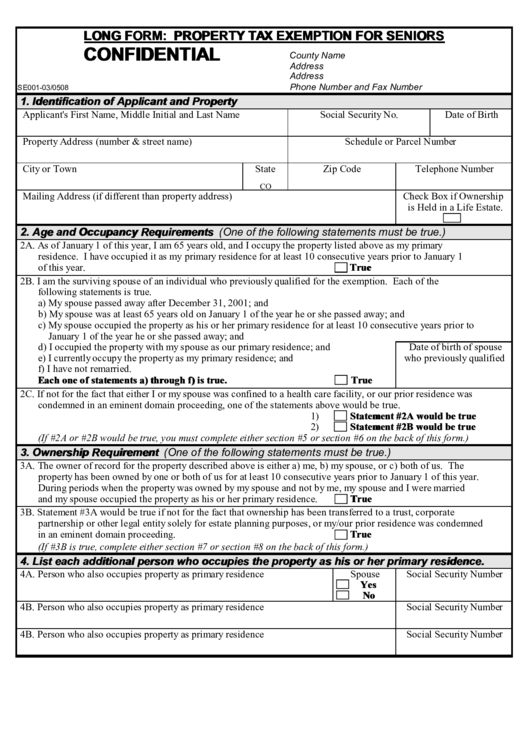

Fillable Long Form Property Tax Exemption For Seniors printable pdf

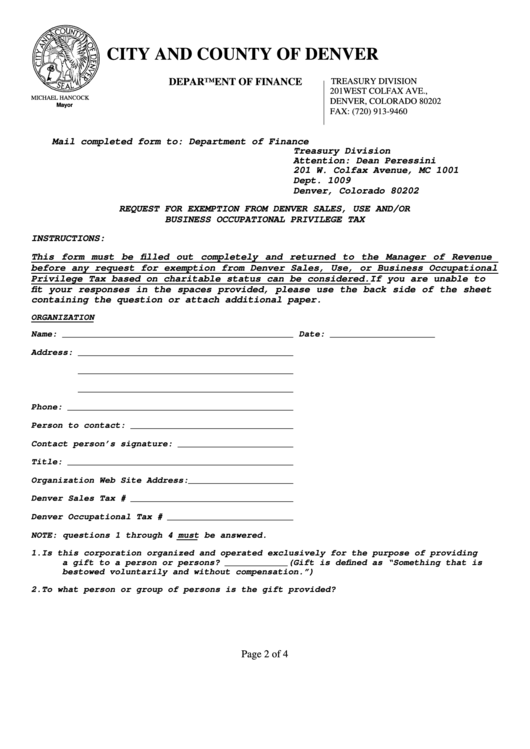

Request For Exemption From Denver Sales, Use And/or Business

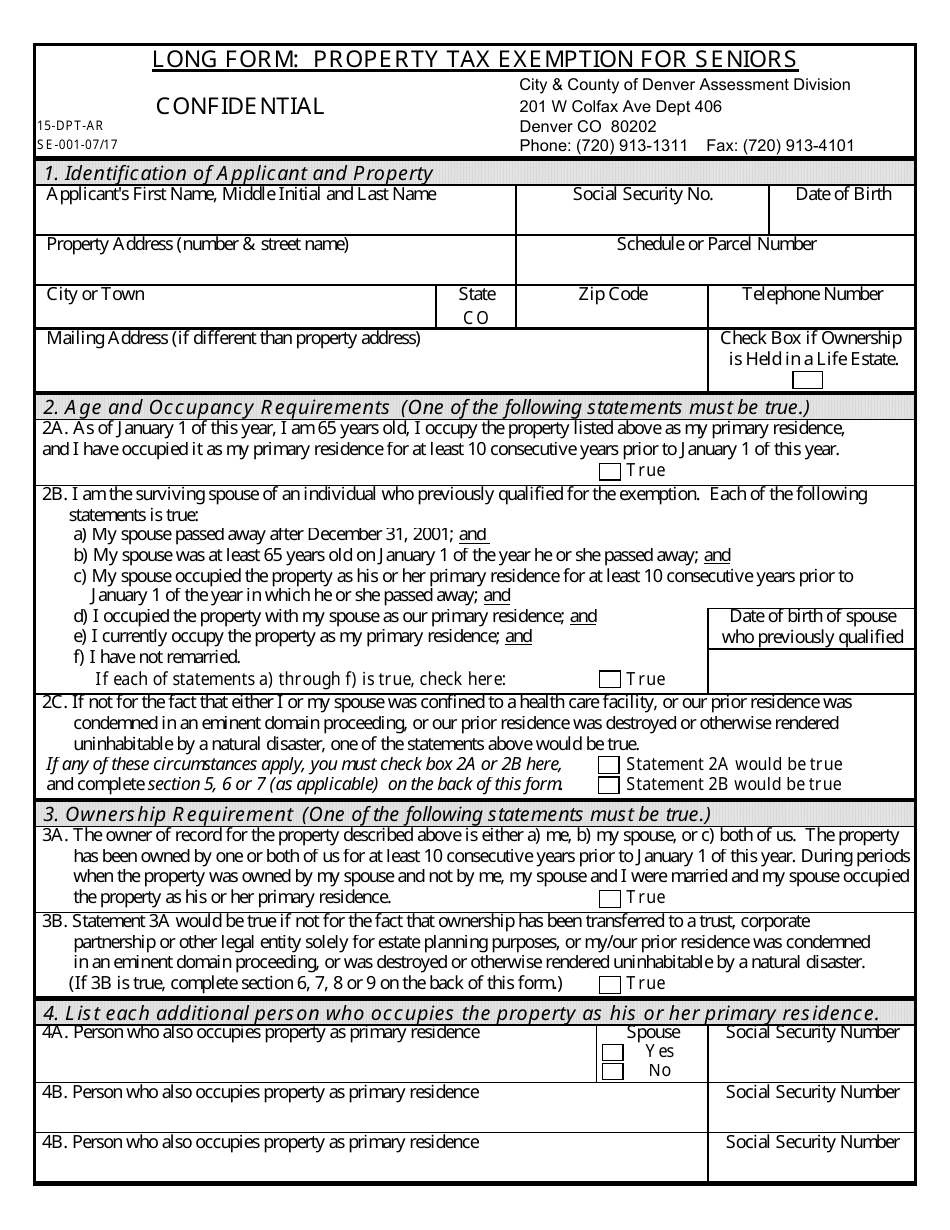

Form 15DPTAR Fill Out, Sign Online and Download Printable PDF

Related Post: