City Of Olympia B&O Tax Form

City Of Olympia B&O Tax Form - This tax classification applies to you if there are sales of goods and certain services to a person who will resell to others. Gross amount column 3 deductions from worksjheet. B&o returns must be completed and returned even if no tax is due. If it’s more than that,. Web business & occupation (b&o) taxes all businesses must file an annual olympia b&o tax return. Web address if final return. Web many cities impose a local business & occupation (b&o) tax. Locate the b&o tax classification for your business. It is measured on the value of products, gross proceeds of sale, or gross income of the business. Web address if final return. Gross amount column 3 deductions from worksjheet. Businesses with annual income greater than $750,000 in olympia must file. Web step # annual or quarterly make sure you have the correct form. Web business & occupation (b&o) taxes. Zip if total taxable amount in column 4 is less than $5,000.00, no tax is due, but report must be. Web total tax penalty (% times total tax).00100.00200.00100.00100.00100 day of city treasurer po box 2009 olympia, wa 98507‐2009 the undersigned taxpayer. Web any city or town may levy a business and occupation (b&o) tax on local businesses, in addition to any state b&o taxes. Web address if final return. Web businesses should distribute the minimum across each quarterly filing as. Web business number statement number period date due. Web the council will review the draft ordinance at their june 21, meeting and determine then whether or not to move it on to the november ballot for the voters of. Web business & occupation (b&o) taxes all businesses must file an annual olympia b&o tax return. Complete, edit or print tax. Locate the b&o tax classification for your business. This tax is in addition to the b&o tax imposed by the state of washington. This tax classification applies to you if there are sales of goods and certain services to a person who will resell to others. Wa quarterly tax report & more fillable forms, register and subscribe now! Businesses with. If quarterly tax due is more than $25, pay what is due. If quarterly tax due is less than $25, pay $25; Web businesses should distribute the minimum across each quarterly filing as follows: Wa quarterly tax report & more fillable forms, register and subscribe now! Zip if total taxable amount in column 4 is less than $20,000.00, no tax. Web business & occupation (b&o) taxes. Web business & occupation (b&o) taxes all businesses must file an annual olympia b&o tax return. Wa quarterly tax report & more fillable forms, register and subscribe now! It is measured on the value of products, gross proceeds of sale, or gross income of the business. B&o returns must be completed and returned even. If quarterly tax due is less than $25, pay $25; Ad get deals and low prices on turbo tax online at amazon. Web the state b&o tax is a gross receipts tax. Zip if total taxable amount in column 4 is less than $5,000.00, no tax is due, but report must be. Use the annual form if your annual business. Web business & occupation (b&o) taxes. If quarterly tax due is more than $25, pay what is due. Ad get deals and low prices on turbo tax online at amazon. Web are there exemptions that apply to the city of olympia b&o tax? Web step # annual or quarterly make sure you have the correct form. Web businesses with annual income greater than $750,000 in olympia must file quarterly b&o tax returns. Web step # annual or quarterly make sure you have the correct form. Web business & occupation (b&o) taxes. Web the state b&o tax is a gross receipts tax. The available exemptions are described in omc title 5, section 5.04.110. Setting up your business licensing and tax account. Web business & occupation (b&o) taxes. Web the council will review the draft ordinance at their june 21, meeting and determine then whether or not to move it on to the november ballot for the voters of. This tax is in addition to the b&o tax imposed by the state of washington.. How to add a city license. B&o returns must be completed and returned even if no tax is due. Web address if final return. Zip if total taxable amount in column 4 is less than $5,000.00, no tax is due, but report must be. Use the annual form if your annual business income in olympia is less than $750,000. Web business & occupation (b&o) taxes. If quarterly tax due is less than $25, pay $25; B&o taxes have three parts. Zip if total taxable amount in column 4 is less than $20,000.00, no tax is due, but report must be. Setting up your business licensing and tax account. Gross amount column 3 deductions from worksjheet. Apply for a new business license. Enter the gross income from your business activities under gross amount. Web business & occupation (b&o) taxes. It is measured on the value of products, gross proceeds of sale, or gross income of the business. Web the state b&o tax is a gross receipts tax. Web businesses should distribute the minimum across each quarterly filing as follows: If quarterly tax due is more than $25, pay what is due. This tax is in addition to the b&o tax imposed by the state of washington. Web businesses with annual income greater than $750,000 in olympia must file quarterly b&o tax returns.Free Printable State Tax Forms Printable Templates

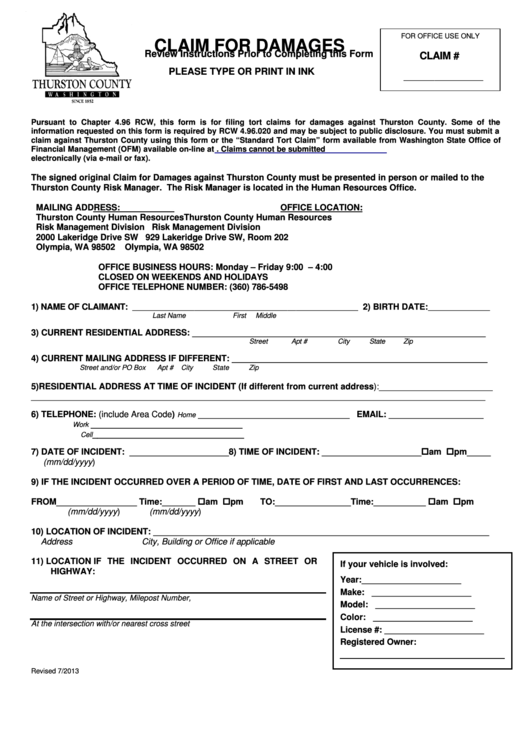

Thurston County Claim For Damages Form 2013 printable pdf download

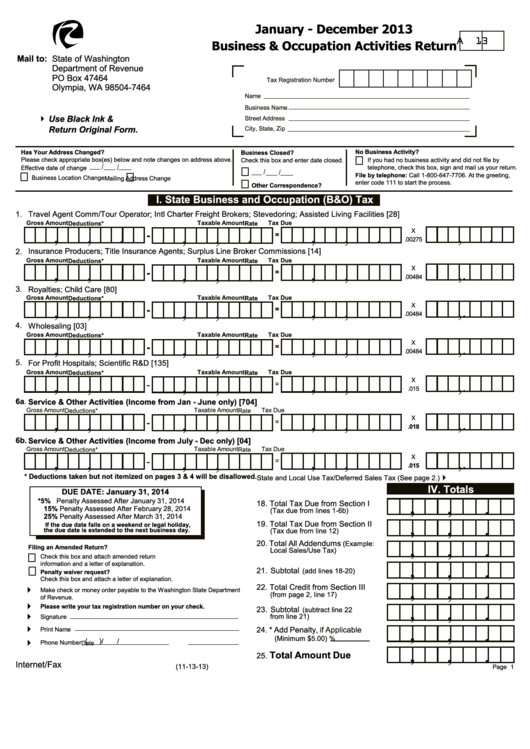

Form A13 Business & Occupation Activities Return 2013 printable

15 Best Things to Do In Olympia, WA

City of Olympia on Twitter "The City of Olympia, ThurstonCounty and

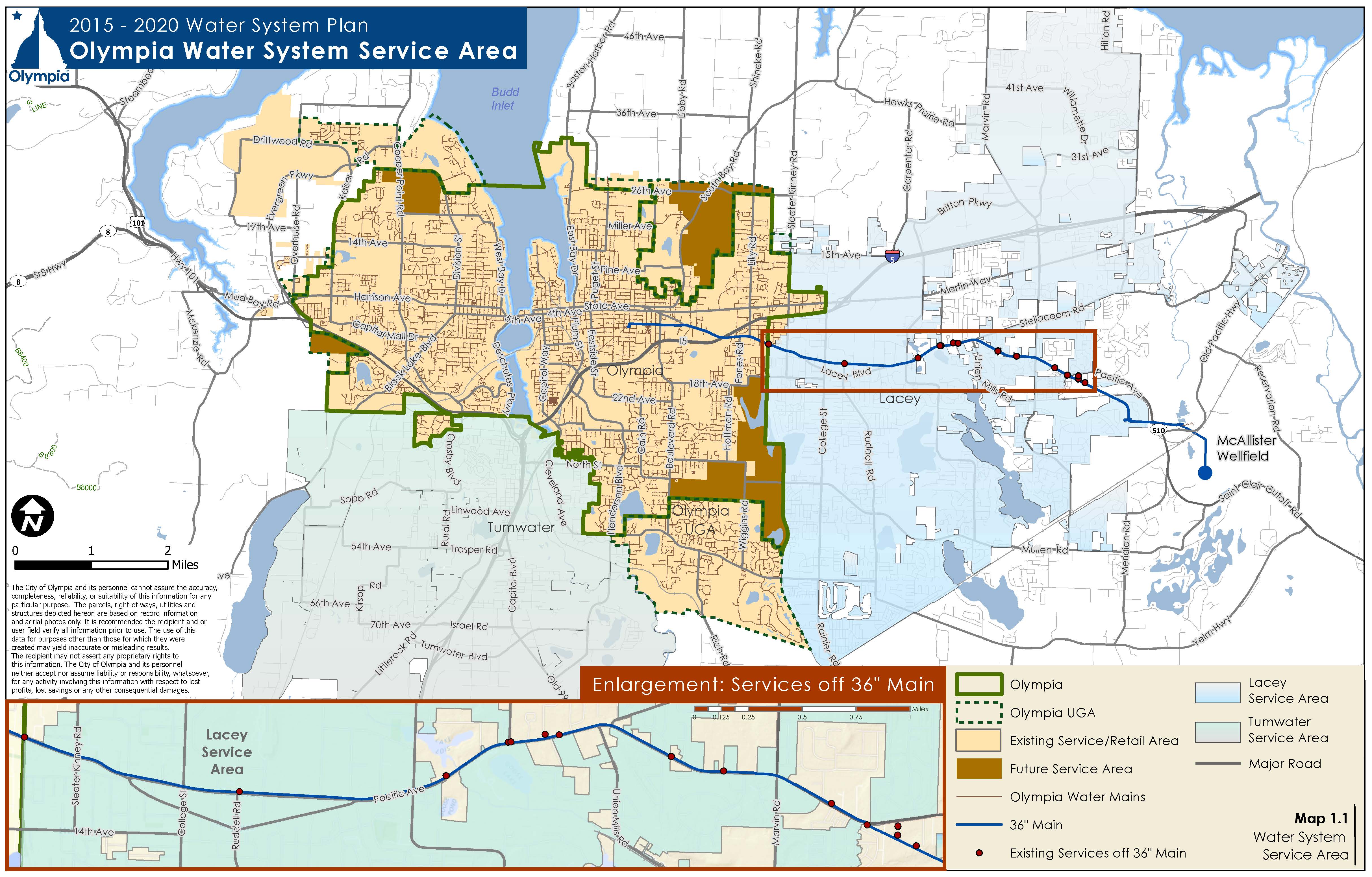

Chapter 1

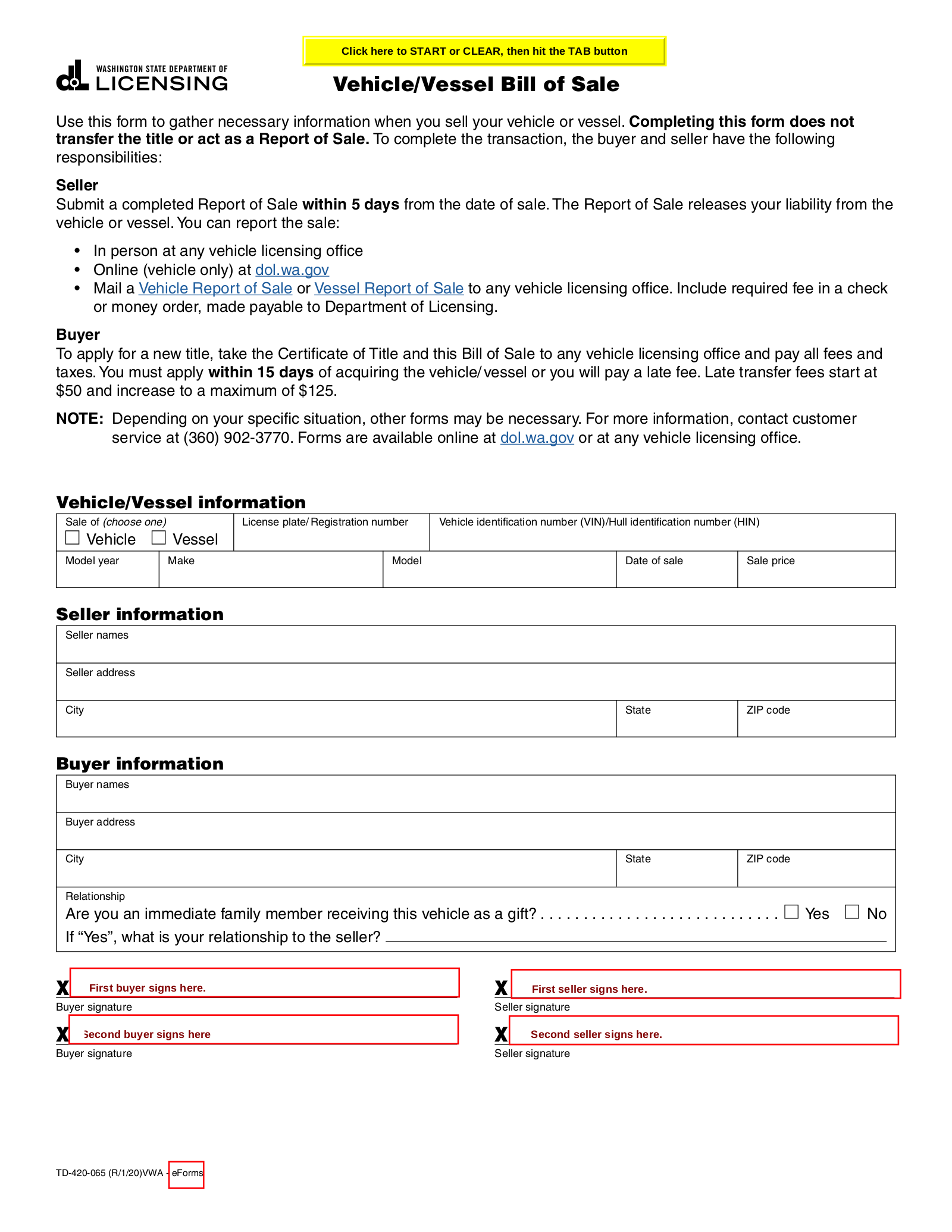

Washington Vehicle or Vessel Bill of Sale Form TD420065 eForms

Fill Free fillable forms City of Olympia

b&o tax form Nelida Morley

b&o tax form Good It Webzine Photographic Exhibit

Related Post: