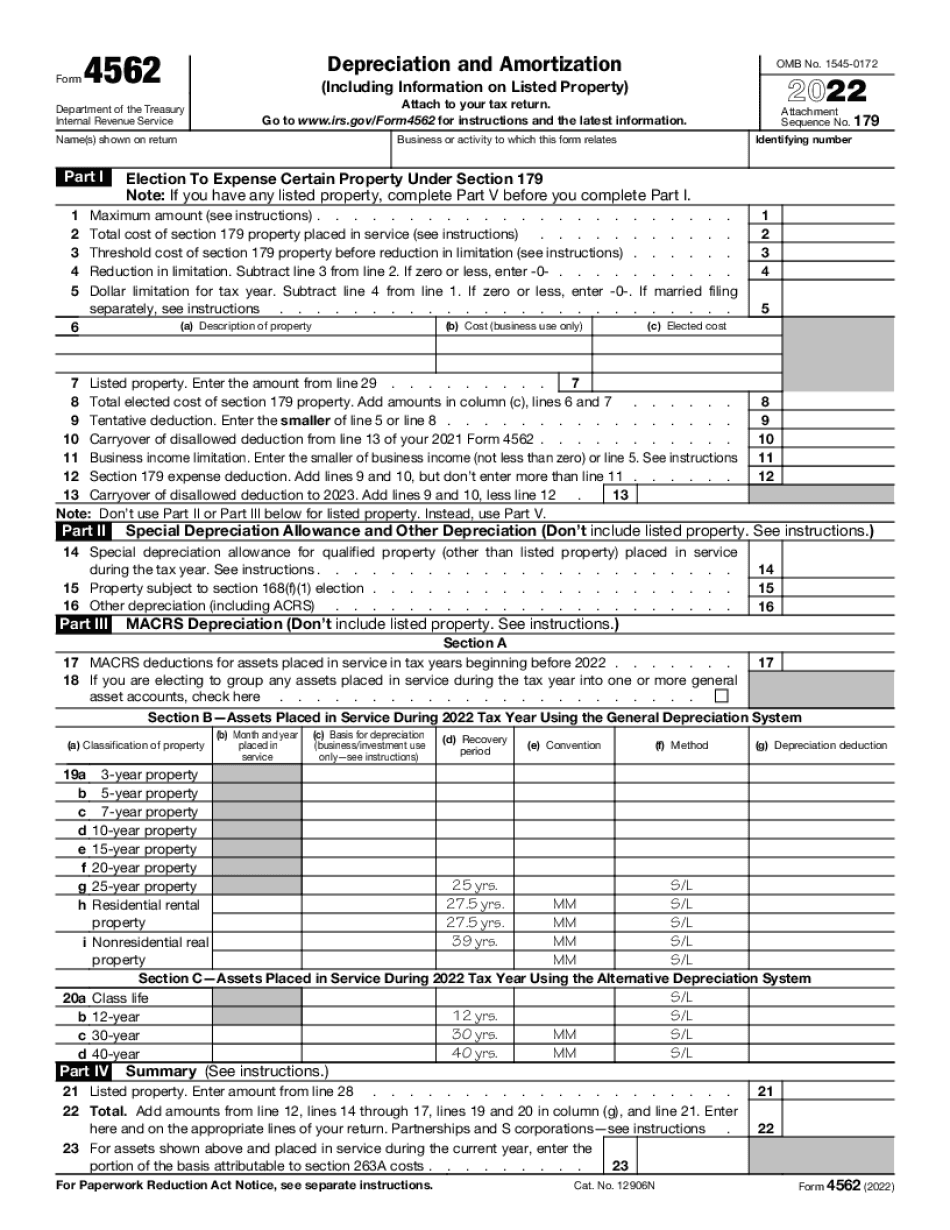

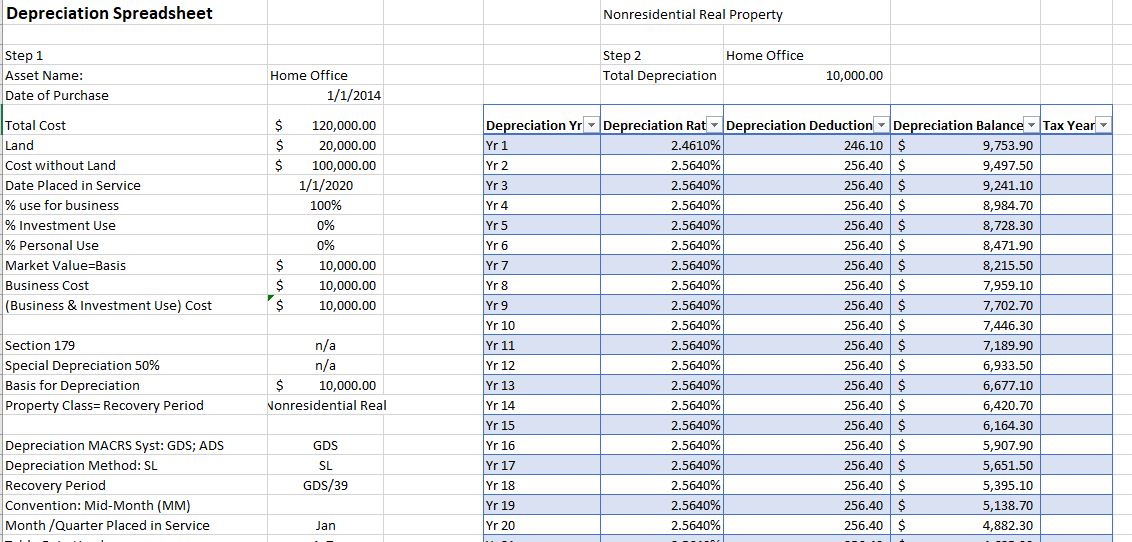

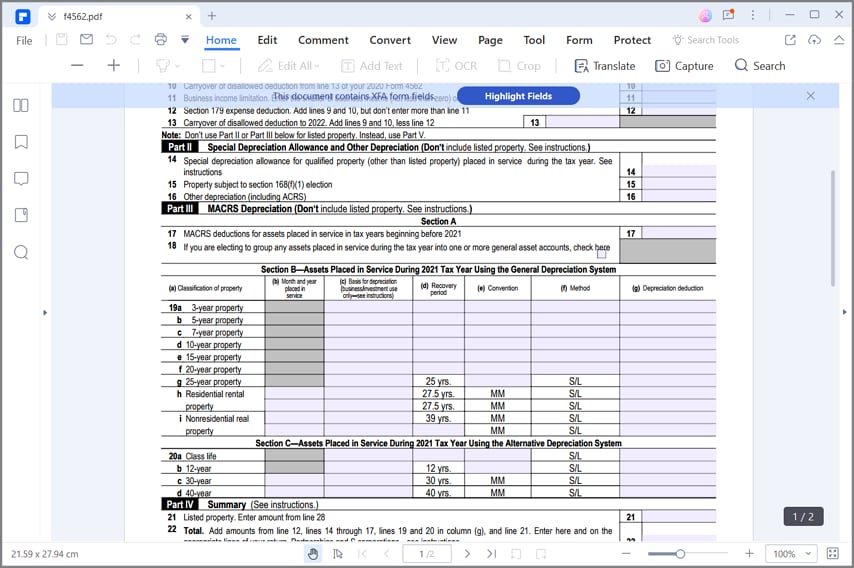

Form 4562 Depreciation And Amortization Worksheet

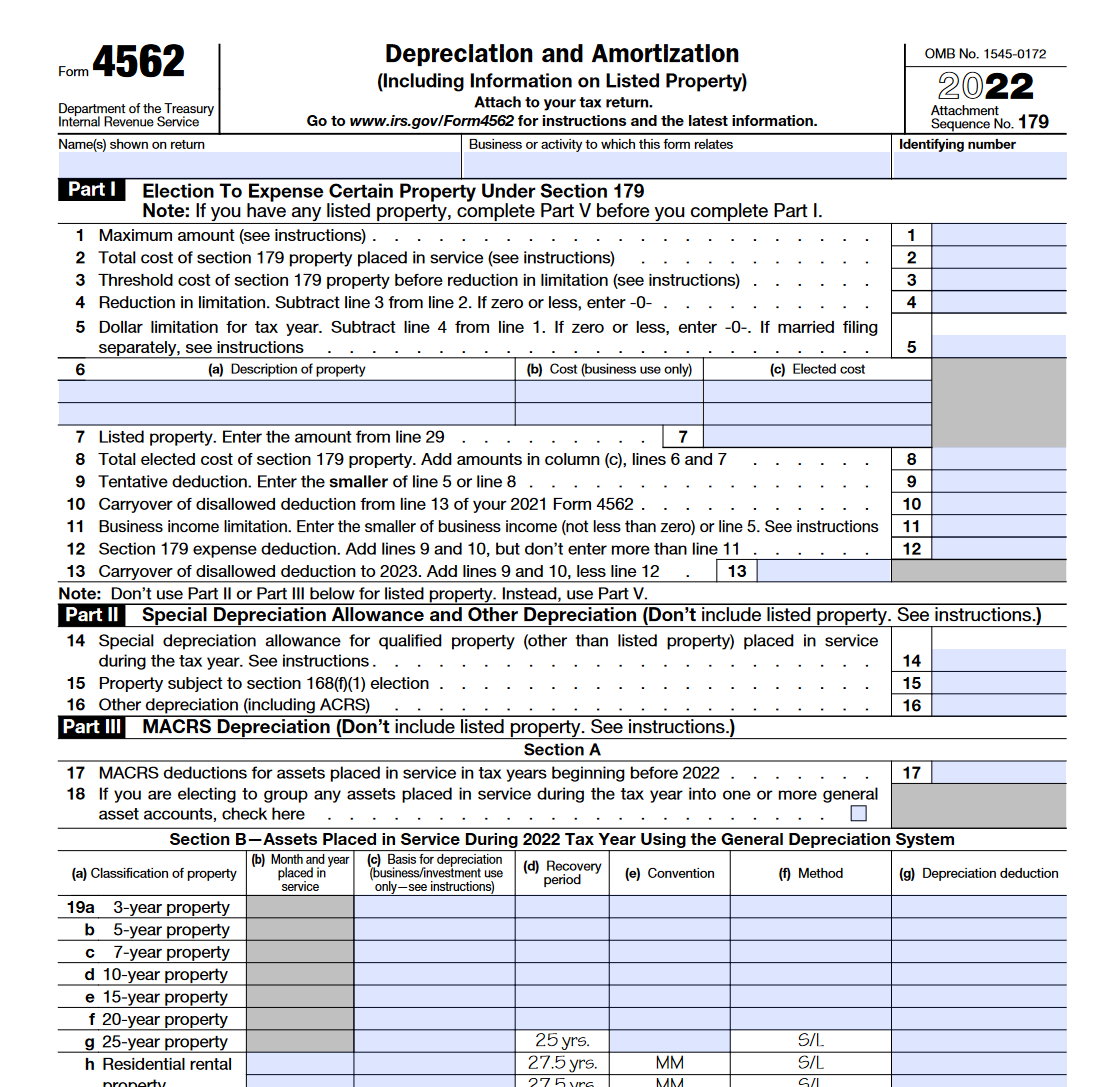

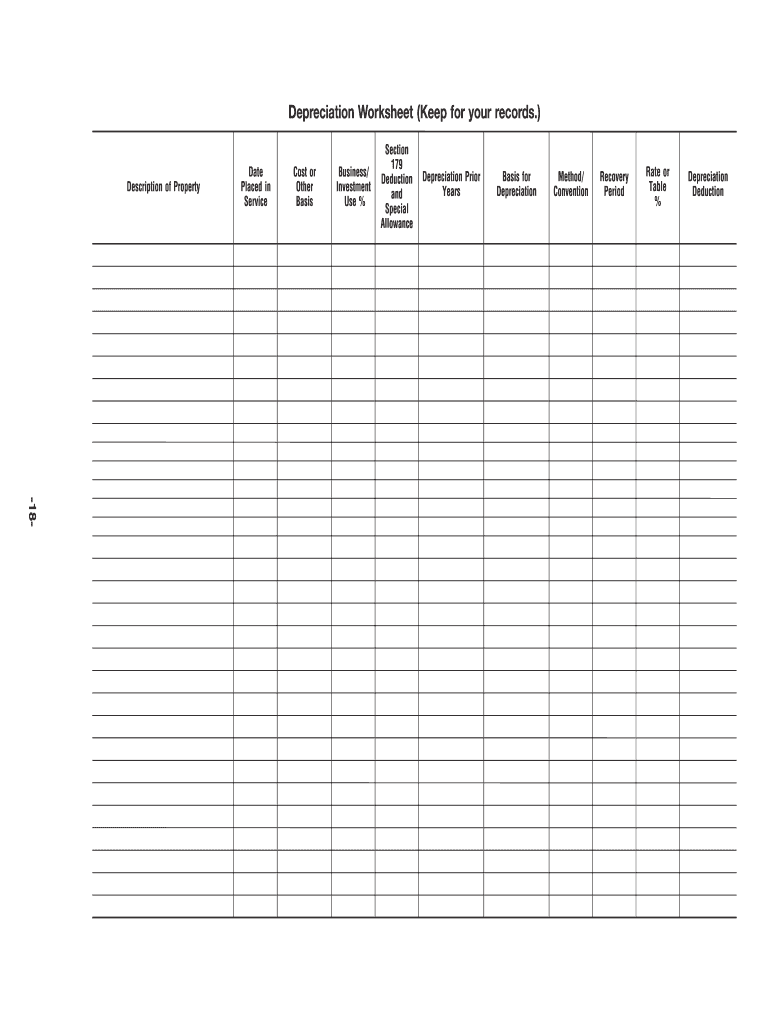

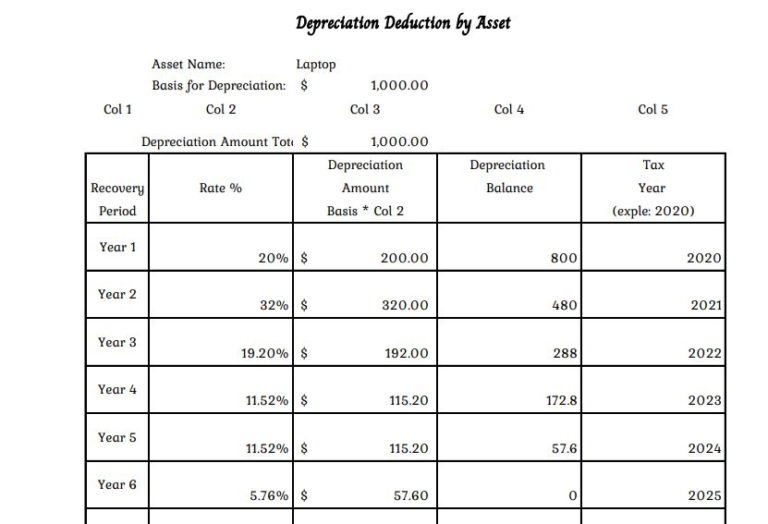

Form 4562 Depreciation And Amortization Worksheet - Web use form 4562 to: Web irs form 4562 is used to calculate and claim deductions for depreciation and amortization. Web federal depreciation and amortization (including information on listed property) form 4562 pdf. It appears you don't have a pdf plugin for this. To complete form 4562, you'll need to know the cost. Ad get ready for tax season deadlines by completing any required tax forms today. In line 2 > macrs convention; In a matter of seconds,. • claim your deduction for depreciation and amortization, • make the election under section 179 to expense certain property, and •. Form 4562 is used to. Web go to federal > depreciation overrides and depletion options; In the asset list, click add.; Web irs form 4562 is used to calculate and claim deductions for depreciation and amortization. To complete form 4562, you'll need to know the cost. Web instructions for form 4562 (rev. Web when does depreciation begin and end?.6 what method can you use to depreciate your property?.7 what is the basis of your depreciable property?.11 how do you. Web federal — depreciation and amortization (including information on listed property) download this form. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Form 4562 is. In line 2 > macrs convention; Click detail located above the grid. A deduction for any vehicle reported on a form other than. This report is sorted by balancing segment, fiscal year added,. Ad pdffiller.com has been visited by 1m+ users in the past month It appears you don't have a pdf plugin for this. Lists asset depreciation amounts for the specified fiscal year. Web however, you can deduct a portion of your costs each year by claiming a depreciation deduction and reporting it on irs form 4562, depreciation and. Web instructions for form 4562 (rev. You may need to keep additional records for accounting. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web go to the income/deductions > business worksheet. Web use your original ' date in service ' and ' cost' and turbotax will calculate depreciation for you on form 4562 for each asset. Web depreciation on any vehicle or other listed. When you enter depreciable assets—vehicles, buildings, farm. Form 4562 is used to. Ad get ready for tax season deadlines by completing any required tax forms today. Click detail located above the grid. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web go to the income/deductions > business worksheet. Web purpose of form use form 4562 to: In the show assets for list, click the form that relates to the amortization expense.; Ad get ready for tax season deadlines by completing any required tax forms today. In a matter of seconds,. Lists asset depreciation amounts for the specified fiscal year. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web open screen 22, depreciation (4562). Form 4562 is used to. Web when does depreciation begin and end?.6 what method can you use to depreciate your property?.7 what is the basis of. Top 13 mm (1⁄ 2), center sides. Web depreciation on any vehicle or other listed property (regardless of when it was placed in service). Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. In a matter of seconds,. In line 2 > macrs convention; In the show assets for list, click the form that relates to the amortization expense.; Web form 4562, page 1 of 2 margins: Lists asset depreciation amounts for the specified fiscal year. You may need to keep additional records for accounting and state income tax purposes. In a matter of seconds,. •claim your deduction for depreciation and amortization, •make the election under section 179 to expense certain property, and. Web open screen 22, depreciation (4562). Web use form 4562 to: This report is sorted by balancing segment, fiscal year added,. Learn what assets should be included on form 4562, as. Web instructions for form 4562 (rev. You may need to keep additional records for accounting and state income tax purposes. In the asset list, click add.; A deduction for any vehicle reported on a form other than. • claim your deduction for depreciation and amortization, • make the election under section 179 to expense certain property, and •. Ad pdffiller.com has been visited by 1m+ users in the past month Web form 4562 department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. In the show assets for list, click the form that relates to the amortization expense.; Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. When you enter depreciable assets—vehicles, buildings, farm. In line 2 > macrs convention; Complete, edit or print tax forms instantly. Web form 4562, page 1 of 2 margins: However, the worksheet is designed only for federal income tax purposes. Web federal depreciation and amortization (including information on listed property) form 4562 pdf.Form 4562 Depreciation And Amortization Worksheet

Fill Free fillable Form 4562 2019 Depreciation and Amortization PDF form

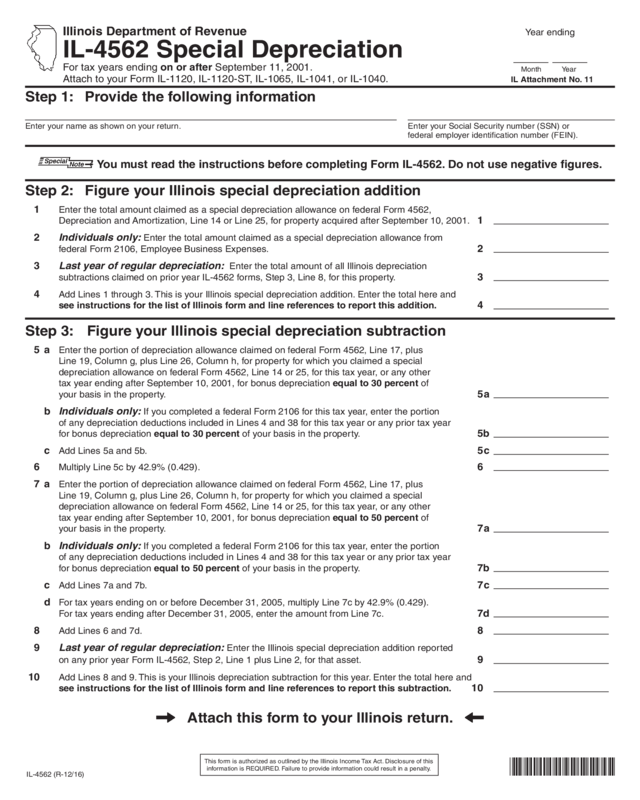

2016 Form Il4562, Special Depreciation Edit, Fill, Sign Online

IRS Form 4562. Depreciation and Amortization Forms Docs 2023

Depreciation Worksheet Pdf Fill Online, Printable, Fillable, Blank

IRS Form 4562 Explained A StepbyStep Guide

2020 Form 4562 Depreciation and Amortization16 Nina's Soap

Form 4562 depreciation and amortization worksheet Fill online

2020 Form 4562 Depreciation and Amortization20 Nina's Soap

for Fill how to in IRS Form 4562

Related Post: