Form 3520 Turbotax

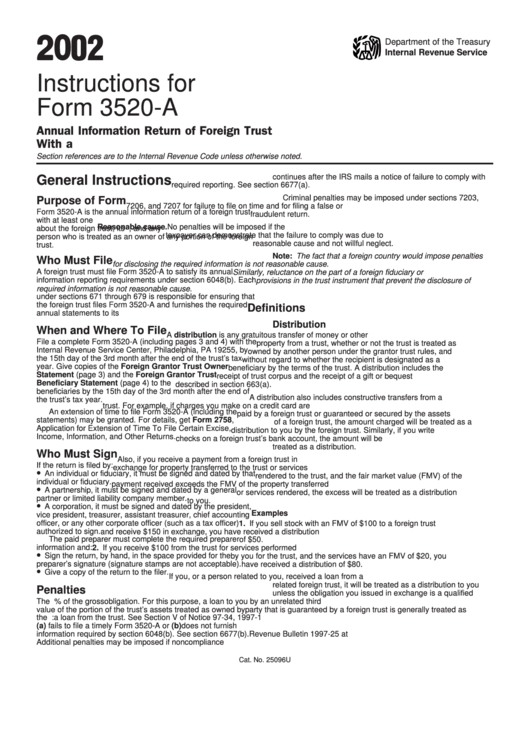

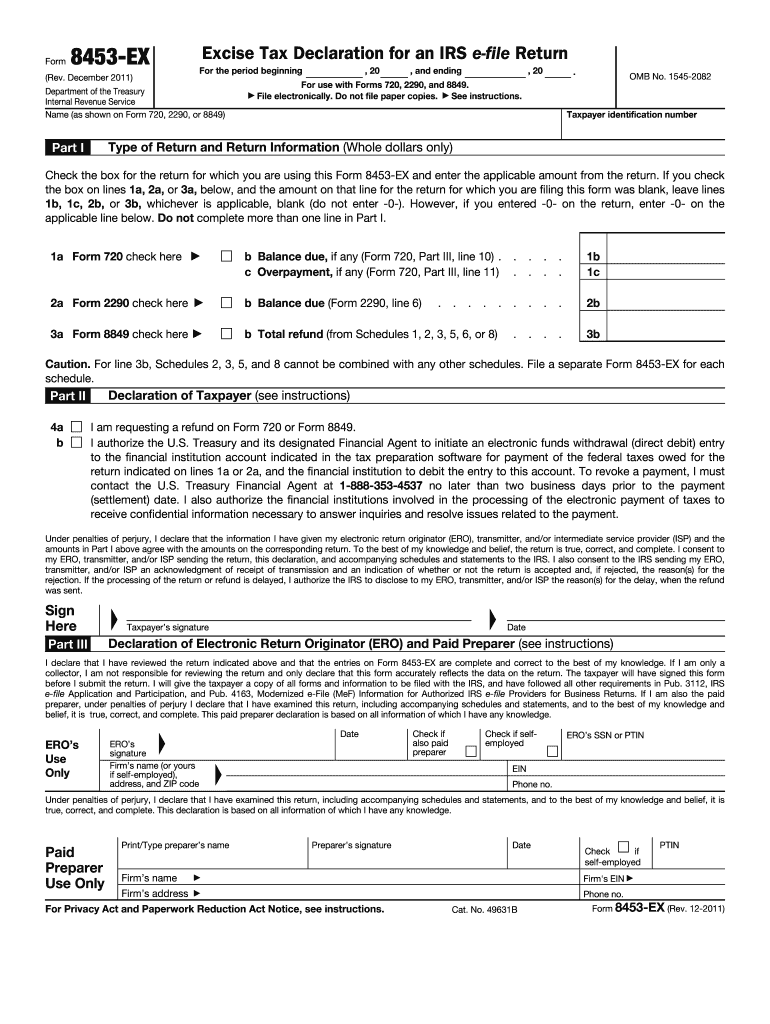

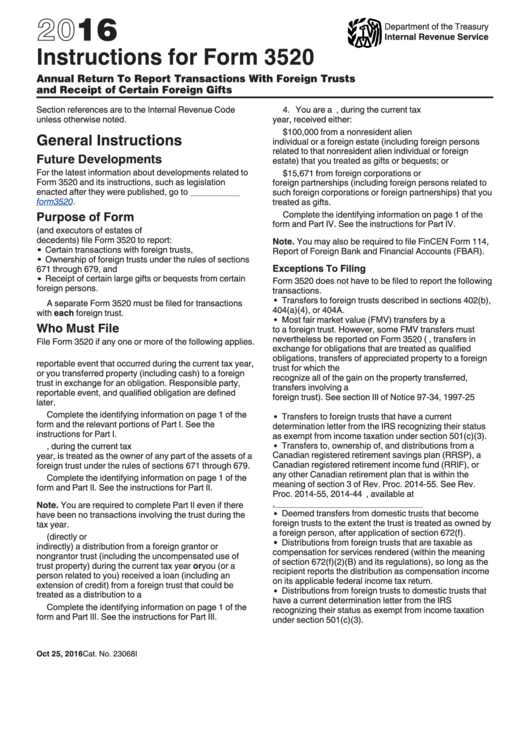

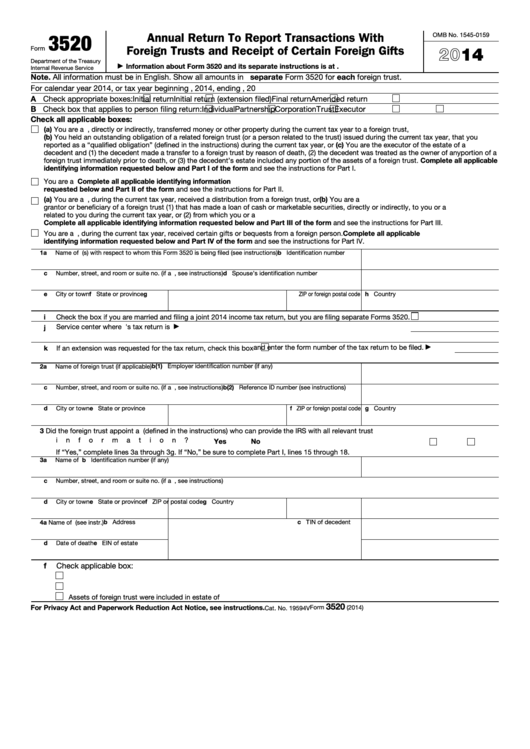

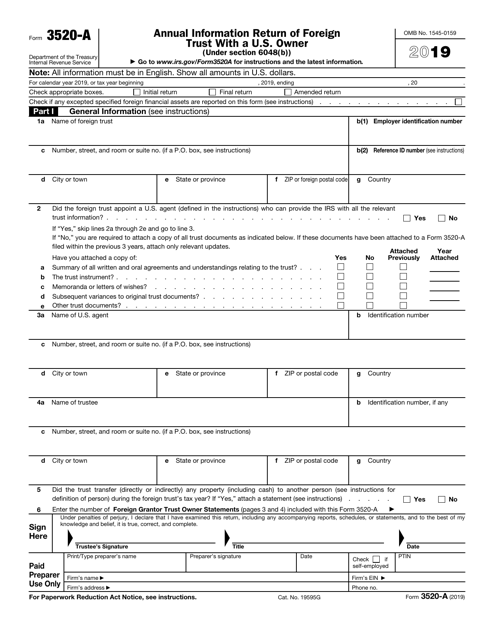

Form 3520 Turbotax - Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Persons (and executors of estates of u.s. Web form 3520 is a disclosure document, really, and there is never any actual tax due with it. Web need help on filing form 3520 dear turbotax community, thanks for the help with my previous questions, we learned that she would need to file form 3520 to. Owner, as well as between the trust and us beneficiary. For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate boxes: Person who is treated as an owner of. Get ready for tax season deadlines by completing any required tax forms today. I am doing my 2022 tax returns in turbo tax (have an extension). Web form 3520 is an informational return in which u.s. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms, and. Owner, as well as between the trust and us beneficiary. Ad access irs tax forms. Owner files this form annually to provide information about the trust, its u.s. Web form 3520 is a disclosure document,. For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate boxes: Web need help on filing form 3520 dear turbotax community, thanks for the help with my previous questions, we learned that she would need to file form 3520 to. Initial return final returnamended return b. Get ready for tax season deadlines by completing. However, if you meet the conditions of having to file form 3250 (receipt of more than $100,000 in value from a foreign source), then failure to file it can lead to a fine of. Web if you are a u.s. Owner files this form annually to provide information about the trust, its u.s. Complete, edit or print tax forms instantly.. Receiving a large gift from a foreign. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Web turbotax does not support irs form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Taxpayers report transactions with. Receiving a large gift from a foreign. Ad access irs tax forms. Web form 3520 for each foreign trust. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms, and. Not all trust owners need to file. Start completing the fillable fields and carefully. Ad access irs tax forms. Web form 3520 is an informational return in which u.s. Certain transactions with foreign trusts, ownership of foreign trusts under. Owner, as well as between the trust and us beneficiary. However, if you meet the conditions of having to file form 3250 (receipt of more than $100,000 in value from a foreign source), then failure to file it can lead to a fine of. Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms, and. Web. Web in general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is required to be filed when a u.s. Web let’s review the basics of form 3520: Web for purposes of the form 3520, a u.s. Web in particular, late filers of form 3520, “annual return to report transactions with foreign. Web turbotax does not support irs form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts. Taxpayers report transactions with certain foreign trusts, ownership of foreign trusts, and receipts of large. Not all trust owners need to file. Web form 3520 is a disclosure document, really, and there is never any actual tax due. Owner, as well as between the trust and us beneficiary. Web form 3520 for each foreign trust. Web if you are a u.s. Get ready for tax season deadlines by completing any required tax forms today. I am doing my 2022 tax returns in turbo tax (have an extension). Web form 3520 is an informational return in which u.s. Not all trust owners need to file. Web for purposes of the form 3520, a u.s. Decedents) file form 3520 with the irs to report: Complete, edit or print tax forms instantly. Use get form or simply click on the template preview to open it in the editor. For calendar year 2022, or tax year beginning , 2022, ending , 20 a check appropriate boxes: 1) a citizen or resident alien of the united states; Web information about form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts, including recent updates, related forms, and. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Web let’s review the basics of form 3520: Owner, as well as between the trust and us beneficiary. Form 3520 is technically referred to as the annual return to report transactions with. Owner files this form annually to provide information about the trust, its u.s. The form provides information about the foreign trust, its u.s. Web form 3520 is an international reporting forum that requires us persons to report certain foreign gift and trust transactions, including: Certain transactions with foreign trusts, ownership of foreign trusts under. Web in general, a form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts is required to be filed when a u.s. Web a foreign trust with at least one u.s. Web need help on filing form 3520 dear turbotax community, thanks for the help with my previous questions, we learned that she would need to file form 3520 to.Instructions For Form 3520A Annual Information Return Of Foreign

Form 3520 Annual Return to Report Transactions with Foreign Trusts

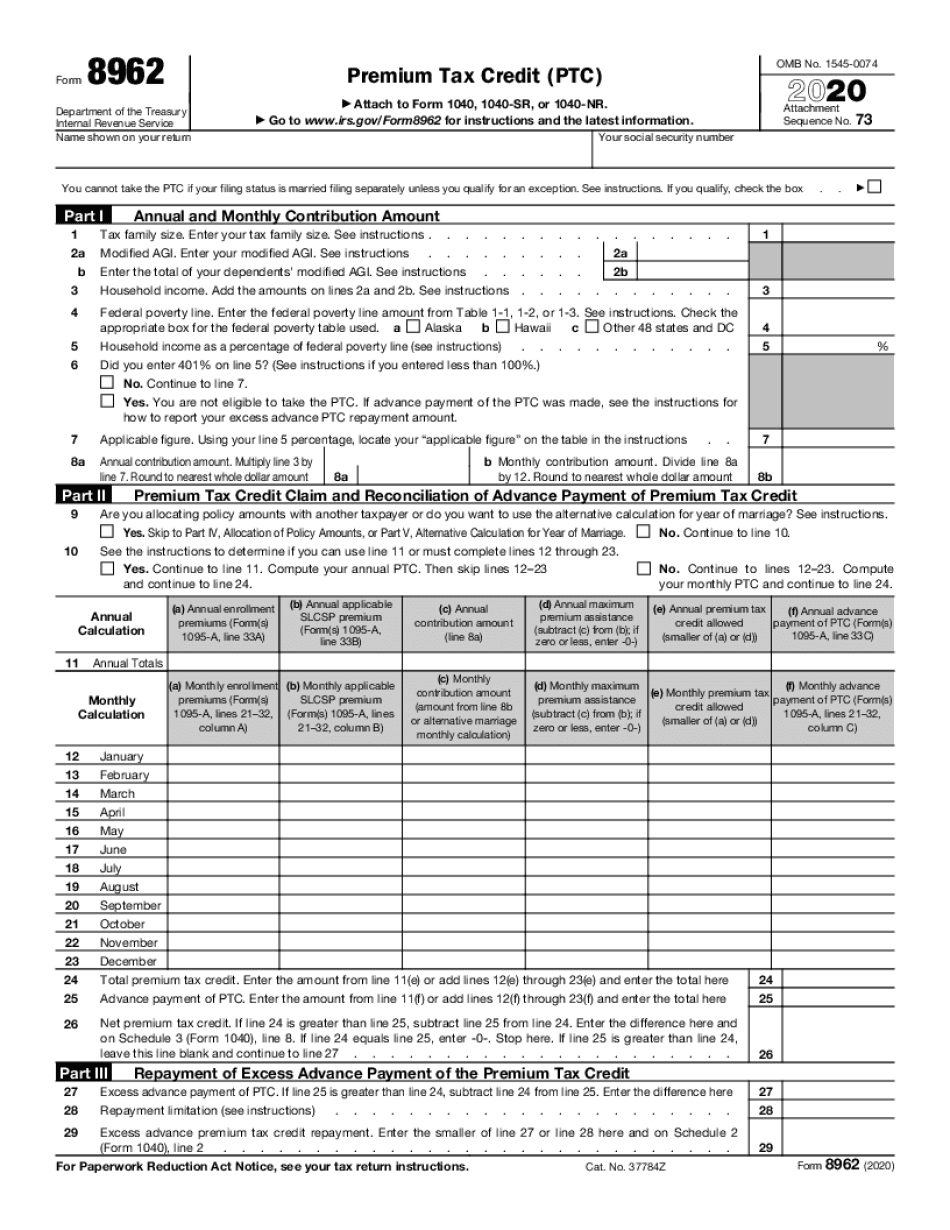

How To Upload Your Form 1099 To Turbotax Turbo Tax

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Instructions For Form 3520 Annual Return To Report Transactions With

Fillable Form 3520A Annual Information Return Of Foreign Trust With

Fillable Form 3520 Annual Return To Report Transactions With Foreign

IRS Form 3520A Download Fillable PDF or Fill Online Annual Information

Form 3520 Examples and a HowTo Guide to Filing for Americans Living Abroad

1040 Form 3520 New Form

Related Post: