Can You Efile Form 709

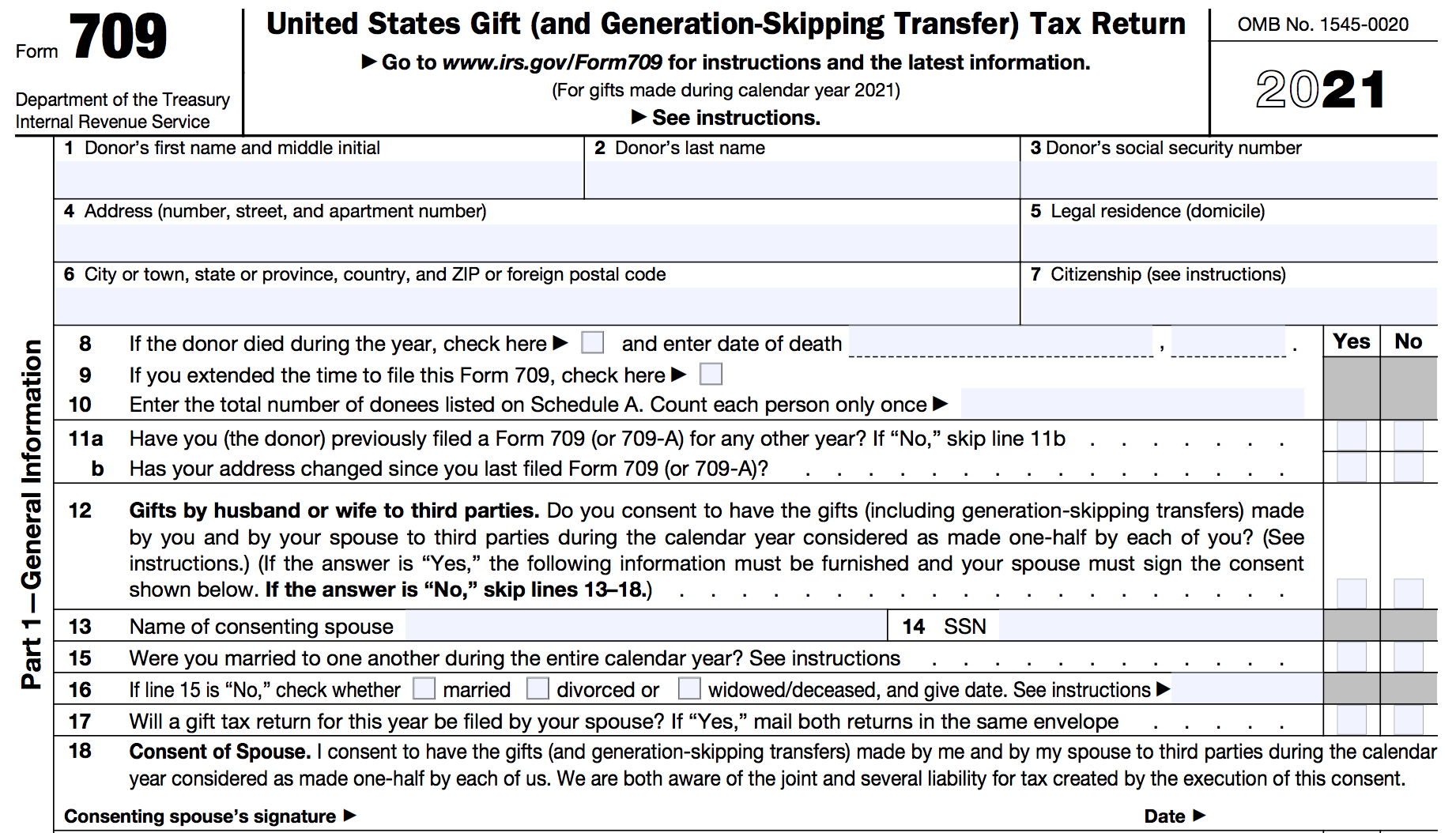

Can You Efile Form 709 - Web 31 rows where to file. File form 709 at the following address. Web generally, you must file form 709 no earlier than january 1, but not later than april 15, of the year after the gift was made. Complete, edit or print tax forms instantly. Web if a taxpayer makes a gift to a trust and fails to affirmatively elect whether to allocate gst exemption to the transfer on a timely filed form 709, the automatic. Web when should it be filed? If you’ve figured out you must fill out a form 709, follow the instructions below. Get ready for tax season deadlines by completing any required tax forms today. Web how to fill out form 709. First, complete the general information section on part one. First, complete the general information section on part one. Enter the total number of donees listed on schedule a. Web how to fill out form 709. Web if you’ve given someone cash or property valuing over $15,000 this year, you probably need to file irs form 709, the united states gift (and generation. Ad access irs tax forms. Affordable efiling with no monthly or hidden fees. Get ready for tax season deadlines by completing any required tax forms today. Web if a taxpayer makes a gift to a trust and fails to affirmatively elect whether to allocate gst exemption to the transfer on a timely filed form 709, the automatic. Web if you’ve given someone cash or property. Web generally, you must file form 709 no earlier than january 1, but not later than april 15, of the year after the gift was made. Web when should it be filed? Filing the form with the irs is the responsibility of the giver, but it’s only required in certain gift giving. Web if you extended the time to file. Count each person only once: While some items, such as standard tax returns, could be. Web if you’ve given someone cash or property valuing over $15,000 this year, you probably need to file irs form 709, the united states gift (and generation. Do i file form 709 separately? Affordable efiling with no monthly or hidden fees. While some items, such as standard tax returns, could be. File form 709 at the following address. First, complete the general information section on part one. Web in the past, the irs required taxpayers to send in certain forms with a handwritten signature on them. Complete, edit or print tax forms instantly. Web generally, you must file form 709 no earlier than january 1, but not later than april 15, of the year after the gift was made. Web to protect the health of taxpayers and tax professionals, the irs is temporarily allowing the use of digital signatures on some tax forms that can't be filed. Web 31 rows where to file.. Enter the total number of donees listed on schedule a. File form 709 at the following address. Count each person only once: Web 31 rows where to file. Web sjr gave you the answer, and if you check the instructions for 709 it will tell you to mail to: Count each person only once: Do i file form 709 separately? Affordable efiling with no monthly or hidden fees. Web sjr gave you the answer, and if you check the instructions for 709 it will tell you to mail to: While some items, such as standard tax returns, could be. Web sjr gave you the answer, and if you check the instructions for 709 it will tell you to mail to: Web how to fill out form 709. If you’ve figured out you must fill out a form 709, follow the instructions below. Web 31 rows where to file. Web if you’ve given someone cash or property valuing over $15,000. Affordable efiling with no monthly or hidden fees. Get ready for tax season deadlines by completing any required tax forms today. To help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital. Ad access irs tax forms. Taxpayers use irs form 709 to report gifts. To pay estate and gift tax online, use the secure and. If you’ve figured out you must fill out a form 709, follow the instructions below. Do i file form 709 separately? Get ready for tax season deadlines by completing any required tax forms today. Web sjr gave you the answer, and if you check the instructions for 709 it will tell you to mail to: Affordable efiling with no monthly or hidden fees. Enter the total number of donees listed on schedule a. Web how to fill out form 709. Web if a taxpayer makes a gift to a trust and fails to affirmatively elect whether to allocate gst exemption to the transfer on a timely filed form 709, the automatic. However, in instances when april 15 falls on a saturday, sunday, or legal holiday, form 709 will be due on the next business day. First, complete the general information section on part one. Web if you extended the time to file this form 709, check here. Complete, edit or print tax forms instantly. To help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital. Web 31 rows where to file. Filing the form with the irs is the responsibility of the giver, but it’s only required in certain gift giving. Web when should it be filed? Count each person only once: Web in the past, the irs required taxpayers to send in certain forms with a handwritten signature on them. Ad access irs tax forms.709 gift tax return instructions

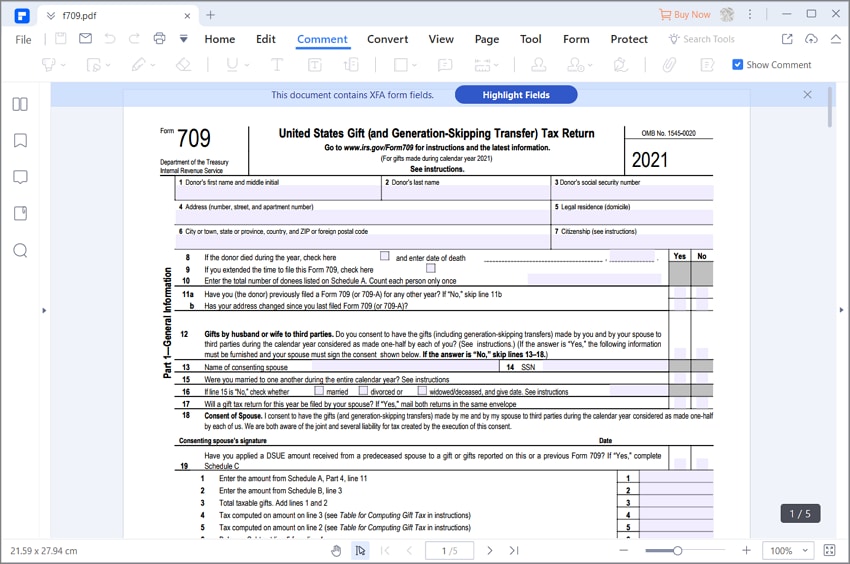

for How to Fill in IRS Form 709

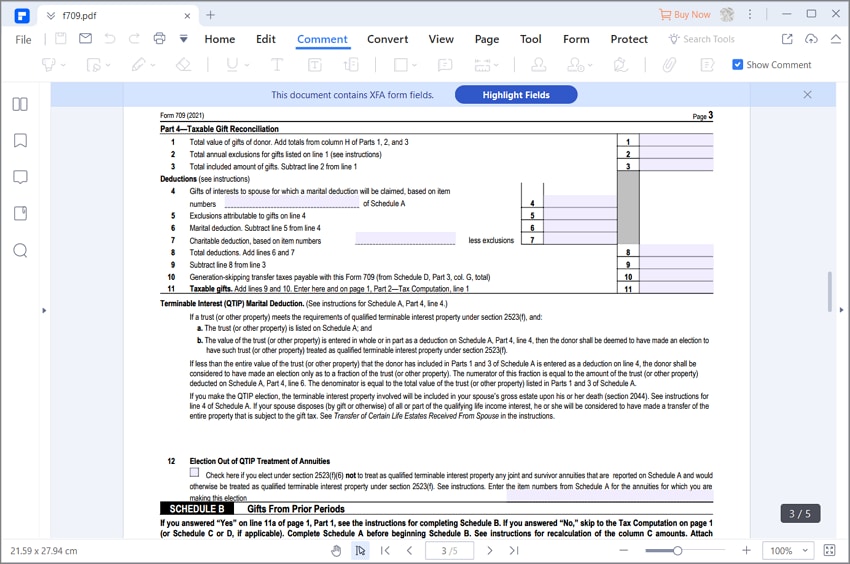

Form 709 Table For Computing Gift Tax Tax Walls

IRS Form 709 Definition and Description

for How to Fill in IRS Form 709

What Is Form 709?

709 Instructions Form Fill Out and Sign Printable PDF Template signNow

How to Fill Out Form 709 StepbyStep Guide to Report Gift Tax

Instructions For Form 709 2009 printable pdf download

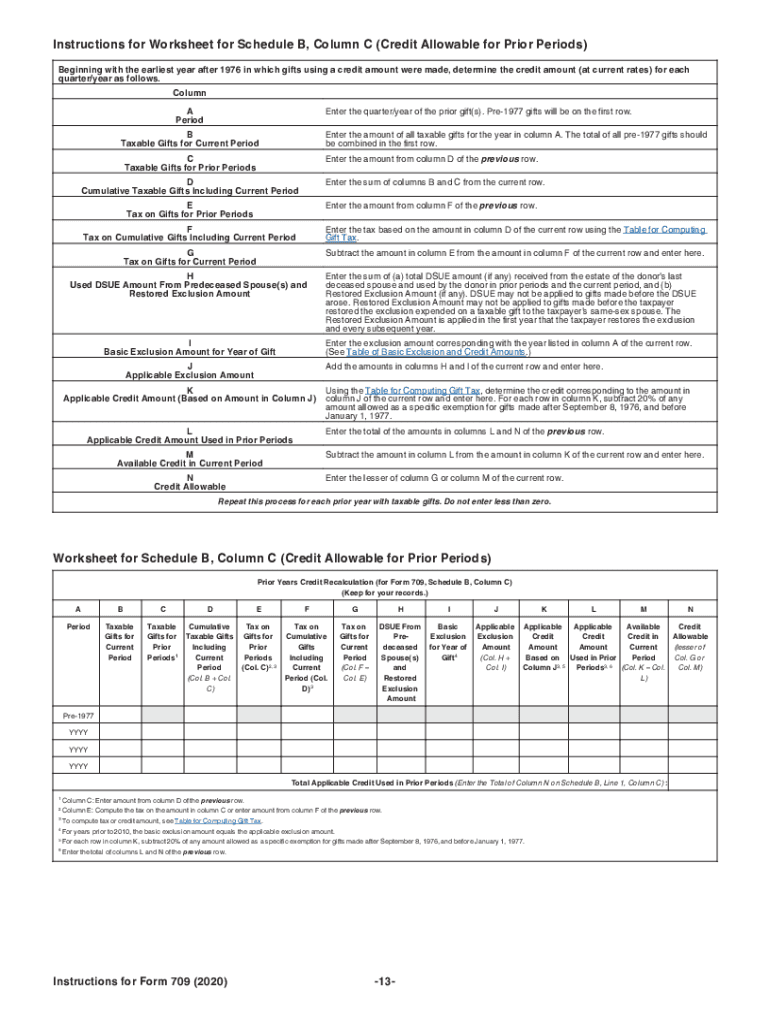

2020 Form IRS 709 Instructions Fill Online, Printable, Fillable, Blank

Related Post:

/Form-709-57686e0d3df78ca6e42bf9cc.png)

:max_bytes(150000):strip_icc()/ScreenShot2023-01-18at10.29.18AM-e267e40858b8414fb34572a6eb3d7594.png)