California Inheritance Tax Waiver Form

California Inheritance Tax Waiver Form - However, some states require the estate executor to. Web 540 2ez california resident income tax return. Like the majority of states, there is no inheritance tax in california. Web up to $40 cash back california inheritance tax waiver is a form that is filled out by the legal heir of a deceased person's estate and submitted to the california franchise tax board. 540 es estimated tax for individuals. Web california inheritance tax and gift tax. Ad get access to the largest online library of legal forms for any state. Web a stepwise guide to editing the california state inheritance tax waiver. Web this form is to be used only for estates of decedents who died on or after june 8, 1982 and before january 1, 2005. Web use form 588, nonresident withholding waiver request, to request a waiver from withholding on payments of california source income to nonresident payees. Web disaster victims also may receive free copies of their state returns to replace those lost or damaged. If you received a gift or inheritance, do not include it in your income. Web an inheritance tax waiver is a form that says you’ve met your estate tax or inheritance tax obligations. Taxpayers may complete form ftb 3516 and write the. You inherit and deposit cash that earns interest income. Web the state controller's office: Below you can get an idea about how to edit and complete a california state inheritance tax waiver. Web use form 588, nonresident withholding waiver request, to request a waiver from withholding on payments of california source income to nonresident payees. Uradu an inheritance or estate. It’s usually issued by a state tax authority. Ad get access to the largest online library of legal forms for any state. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income subject to. How the real property was title will determine. Web what states require an inheritance tax waiver. Web use form 588, nonresident withholding waiver request, to request a waiver from withholding on payments of california source income to nonresident payees. Web disaster victims also may receive free copies of their state returns to replace those lost or damaged. California estates must follow the federal estate tax, which taxes certain large estates. It’s usually issued by a state. Web up to $40 cash back california inheritance tax waiver is a form that is filled out by the legal heir of a deceased person's estate and submitted to the california franchise tax board. However, some states require the estate executor to. Web since there is no california inheritance tax, california does not require an inheritance tax waiver form. Web. Online / digital waiver forms for parties, sporting events & more. You inherit and deposit cash that earns interest income. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income subject to. Ad get access to the largest online library of legal forms for any state. Real estate, family law,. Online / digital waiver forms for parties, sporting events & more. Get your free trial today. Web how to get a inheritance tax waiver form (california)? Enter the amount from form 593, line 37, amount withheld from. Real estate, family law, estate planning, business forms and power of attorney forms. Web a stepwise guide to editing the california state inheritance tax waiver. It’s usually issued by a state tax authority. Web an inheritance tax waiver is a form that says you’ve met your estate tax or inheritance tax obligations. Web simplified income, payroll, sales and use tax information for you and your business You inherit and deposit cash that earns. Web 540 2ez california resident income tax return. If you received a gift or inheritance, do not include it in your income. Web the state controller's office: Online / digital waiver forms for parties, sporting events & more. (correct answer) alabama, alaska, arkansas, california, colorado, connecticut, delaware, district. You may be thinking of a exemption from reassessment for real property taxes. However, if the gift or inheritance later produces income, you will need to pay tax on that income. Web updated may 09, 2021 reviewed by lea d. Ad ca table of heirship & more fillable forms, register and subscribe now! Web a stepwise guide to editing the. It’s usually issued by a state tax authority. Ad ca table of heirship & more fillable forms, register and subscribe now! Online / digital waiver forms for parties, sporting events & more. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california source income subject to. Web california residents don’t need to worry about a state inheritance or estate tax as it’s 0%. Get your free trial today. Taxpayers may complete form ftb 3516 and write the name of the disaster. Ad quick & easy waiver forms for parties, sporting events & more. California estates must follow the federal estate tax, which taxes certain large estates. Web updated may 09, 2021 reviewed by lea d. Web what states require an inheritance tax waiver form? Web an inheritance tax waiver is a form that says you’ve met your estate tax or inheritance tax obligations. Web since there is no california inheritance tax, california does not require an inheritance tax waiver form. Web a stepwise guide to editing the california state inheritance tax waiver. However, if the gift or inheritance later produces income, you will need to pay tax on that income. Enter the amount from form 593, line 37, amount withheld from. Real estate, family law, estate planning, business forms and power of attorney forms. Web california inheritance tax and gift tax. Below you can get an idea about how to edit and complete a california state inheritance tax waiver. Like the majority of states, there is no inheritance tax in california.Inheritance Tax Waiver Form California Form Resume Examples Mj1vGyBKwy

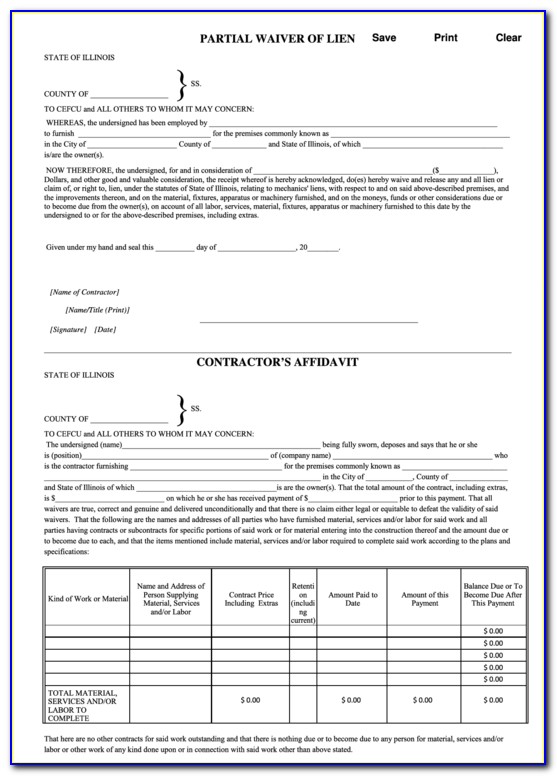

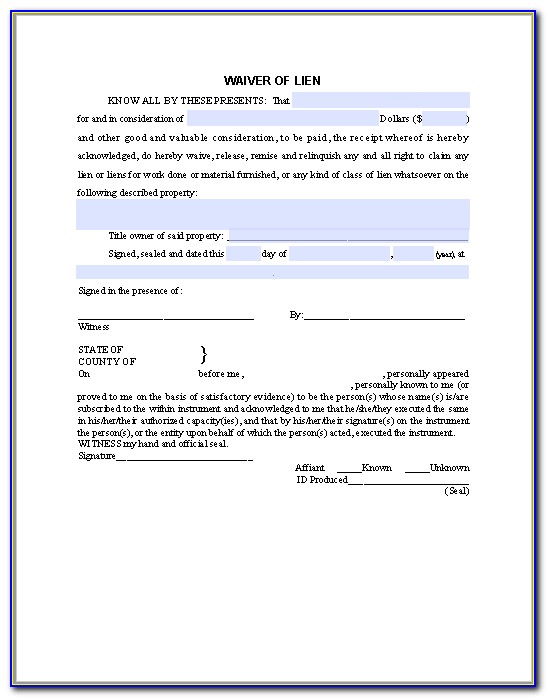

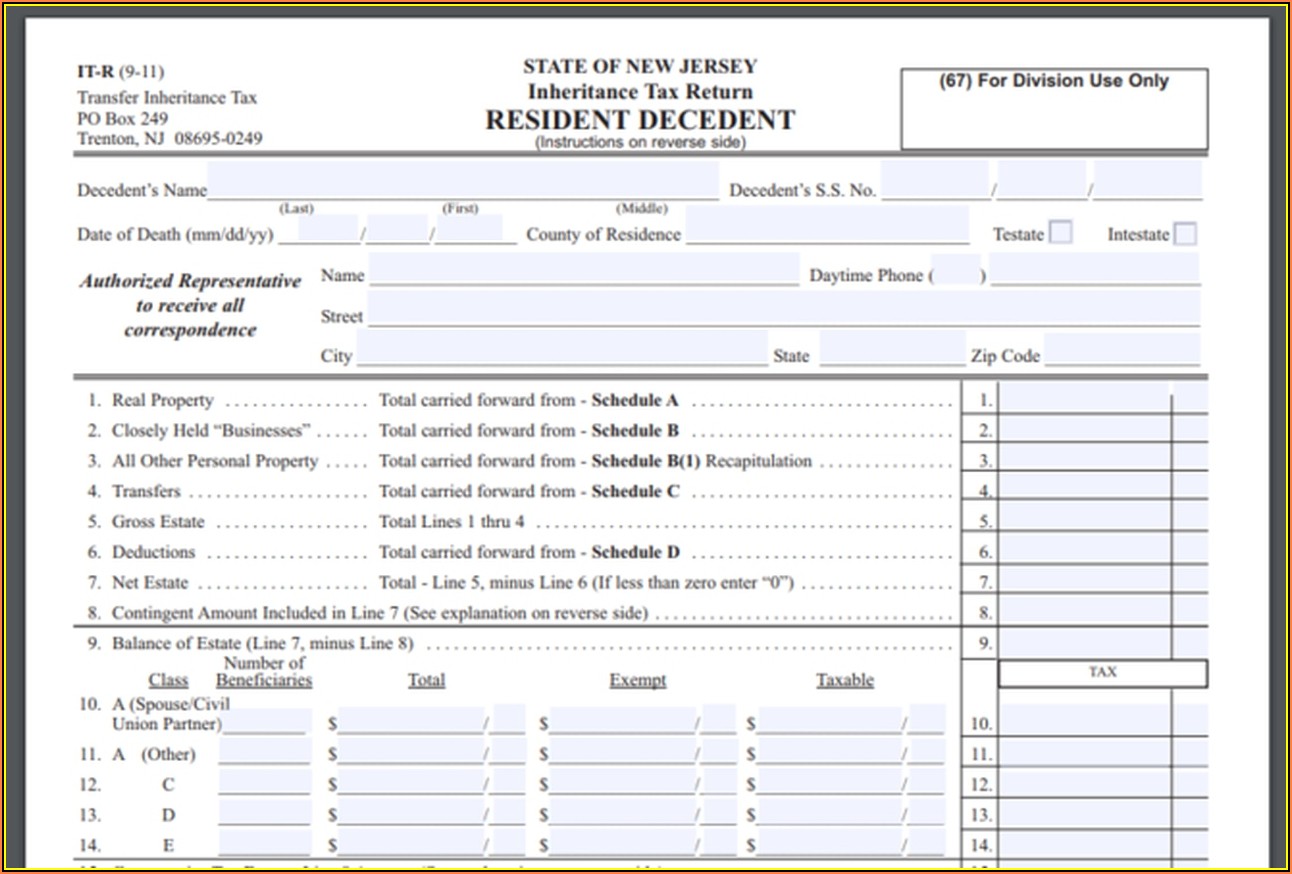

Inheritance Tax Waiver Form Illinois Form Resume Examples aEDvBW8D1Y

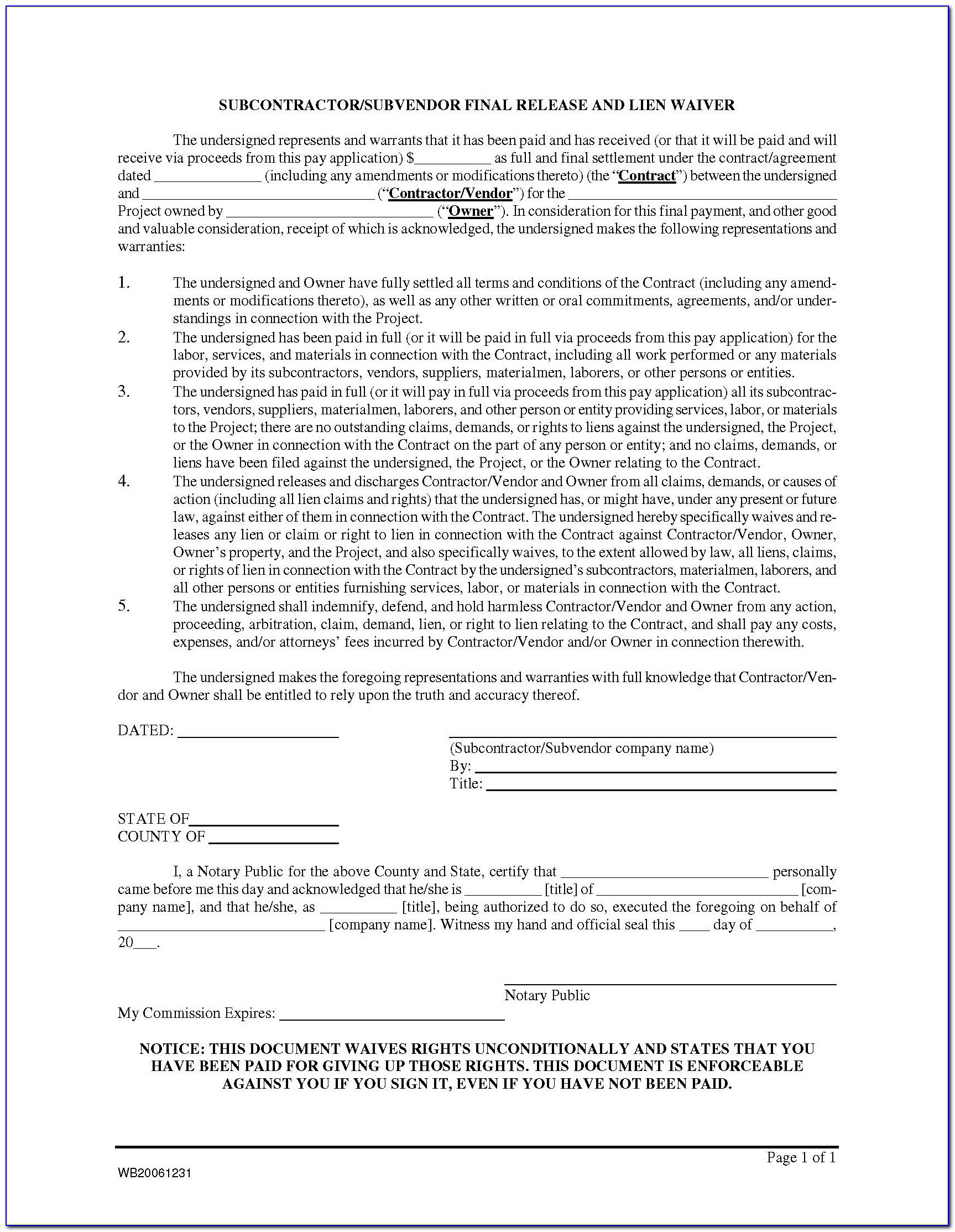

Inheritance Tax Waiver Form Missouri Form Resume Examples EpDLm675xR

Inheritance Tax Fill Out and Sign Printable PDF Template signNow

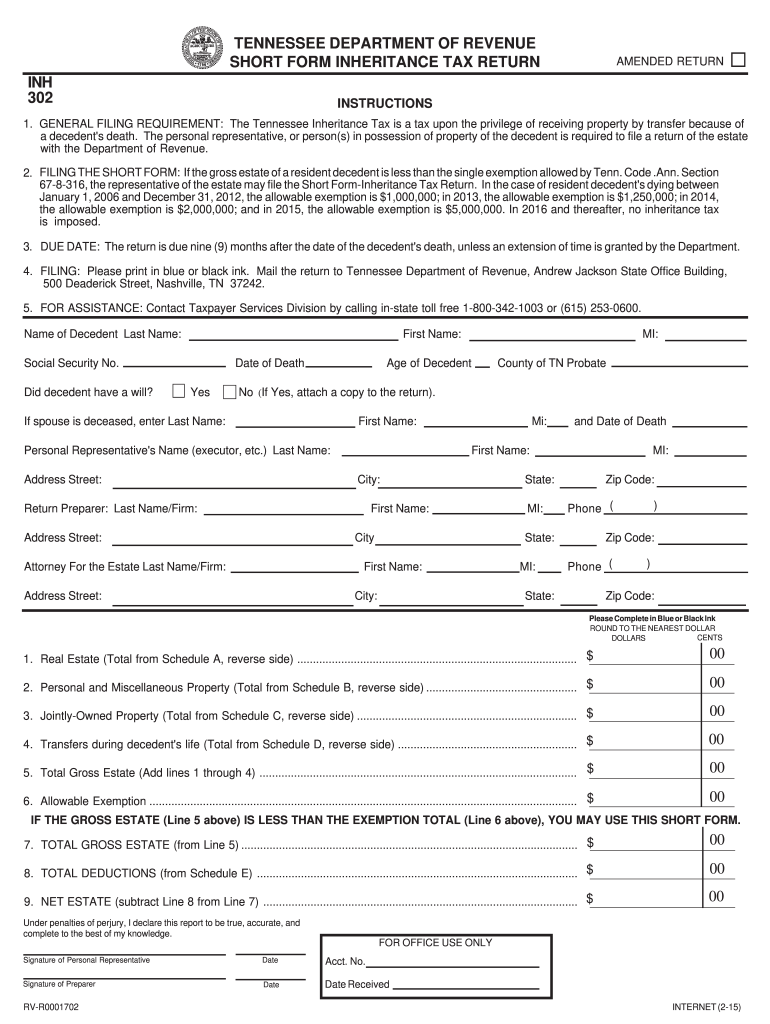

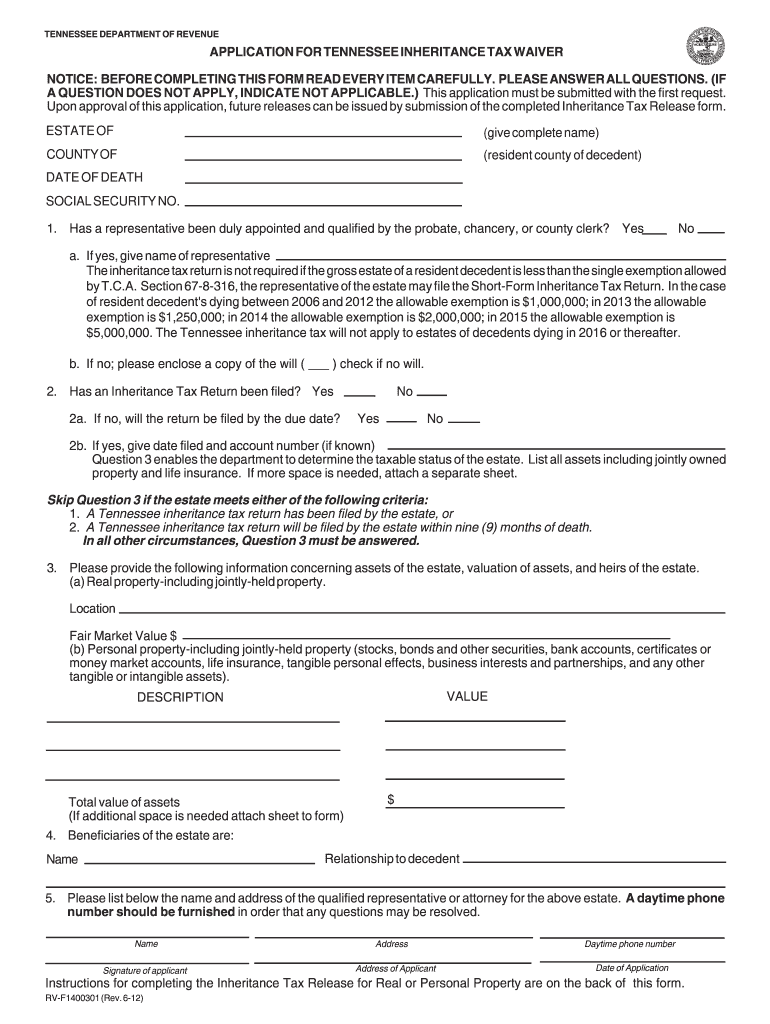

Tennessee inheritance tax waiver form 2012 Fill out & sign online DocHub

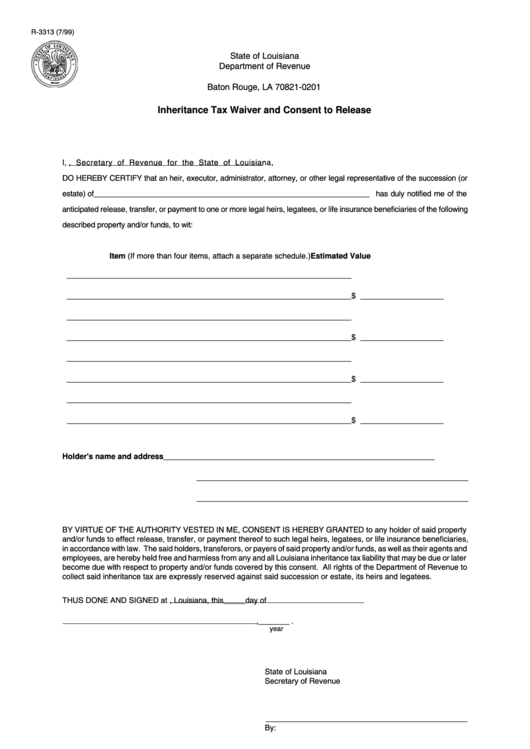

Fillable Form R3313 Inheritance Tax Waiver And Consent To Release

Inheritance Tax Waiver Form Ohio Form Resume Examples v19xB3bV7E

California Inheritance Tax Waiver Form Fill Online, Printable

Inheritance Tax Waiver Form Illinois Form Resume Examples aEDvBW8D1Y

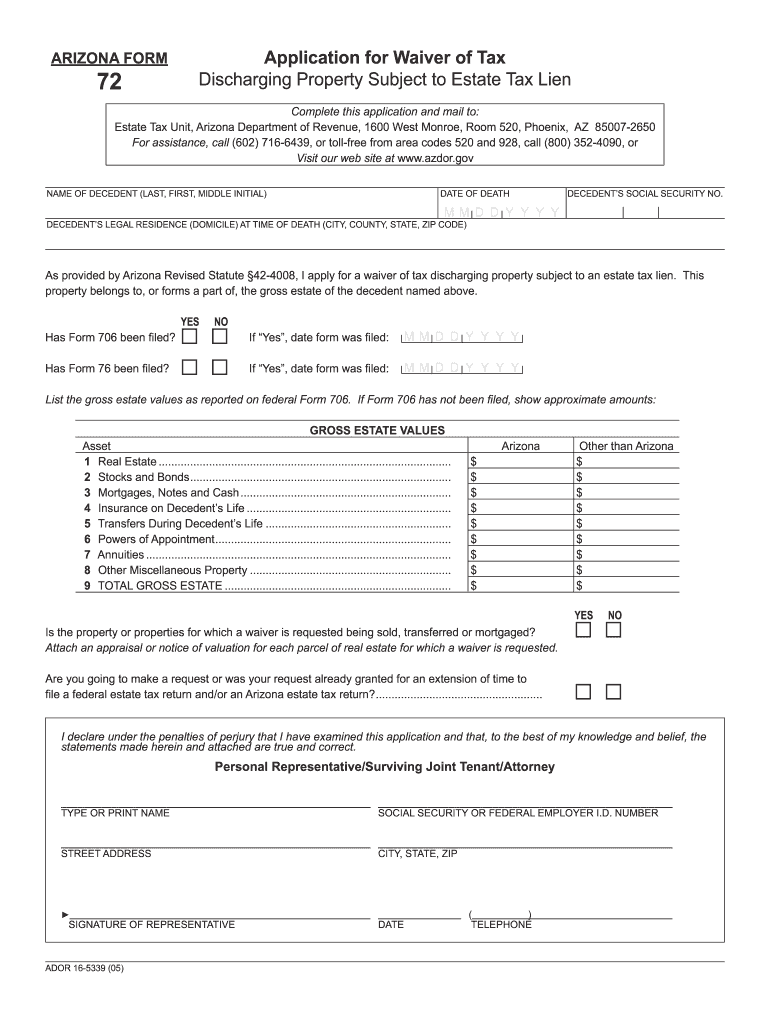

Arizona Inheritance Tax Form Fill Out and Sign Printable PDF Template

Related Post: