Irs Form 8869

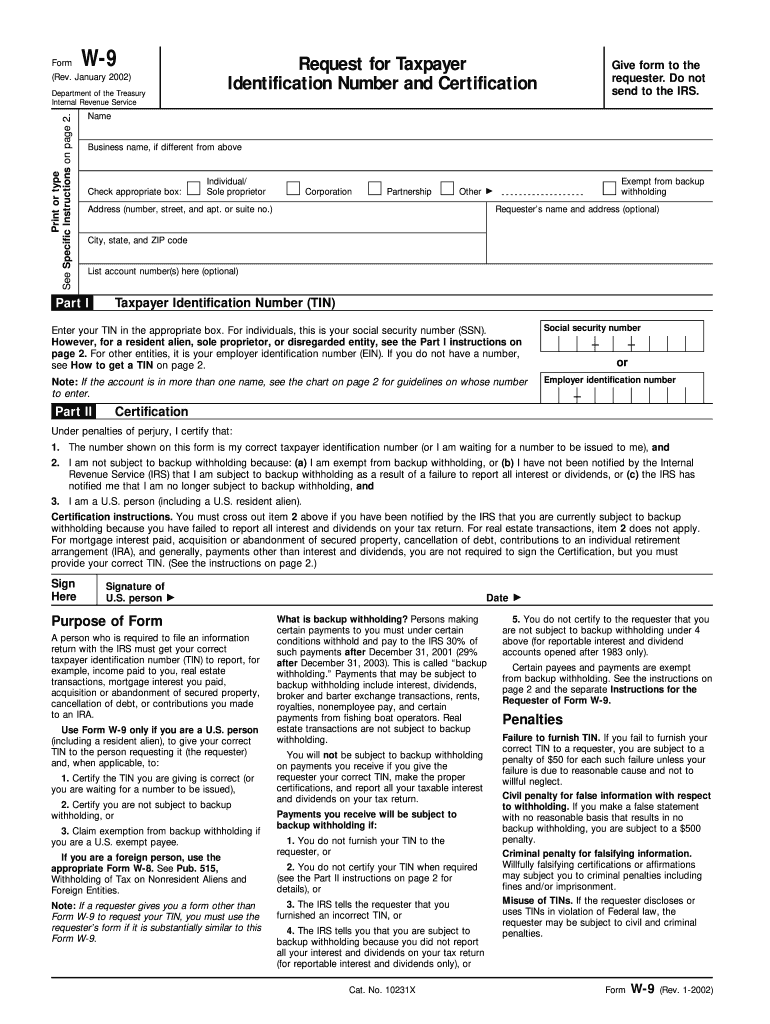

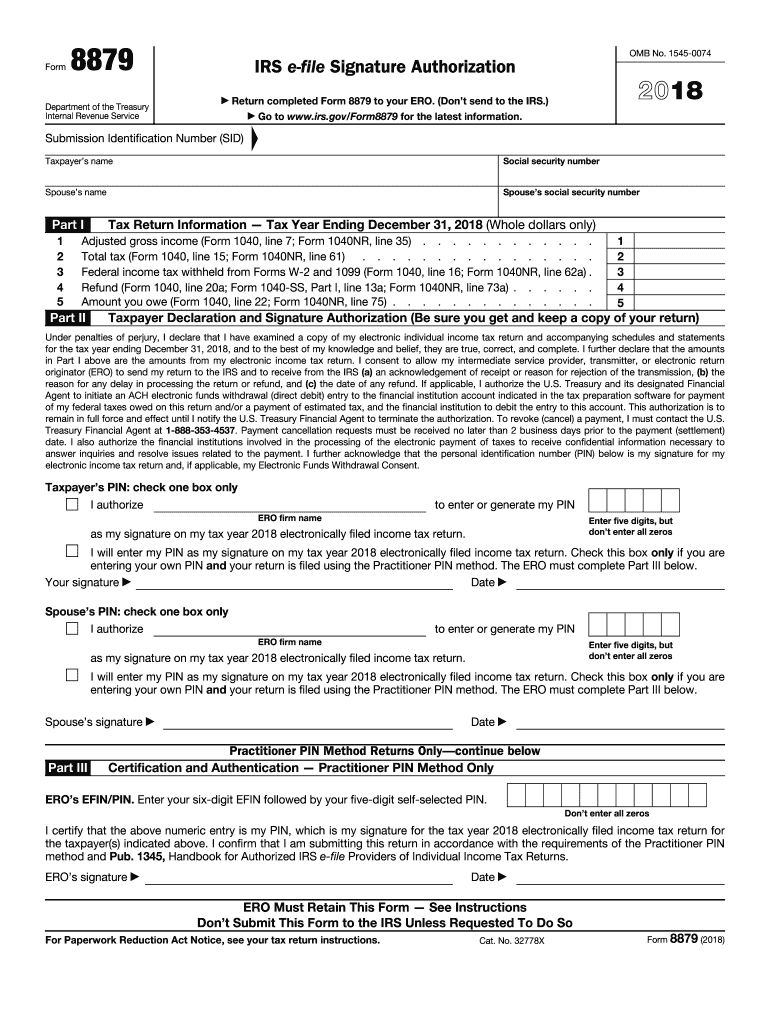

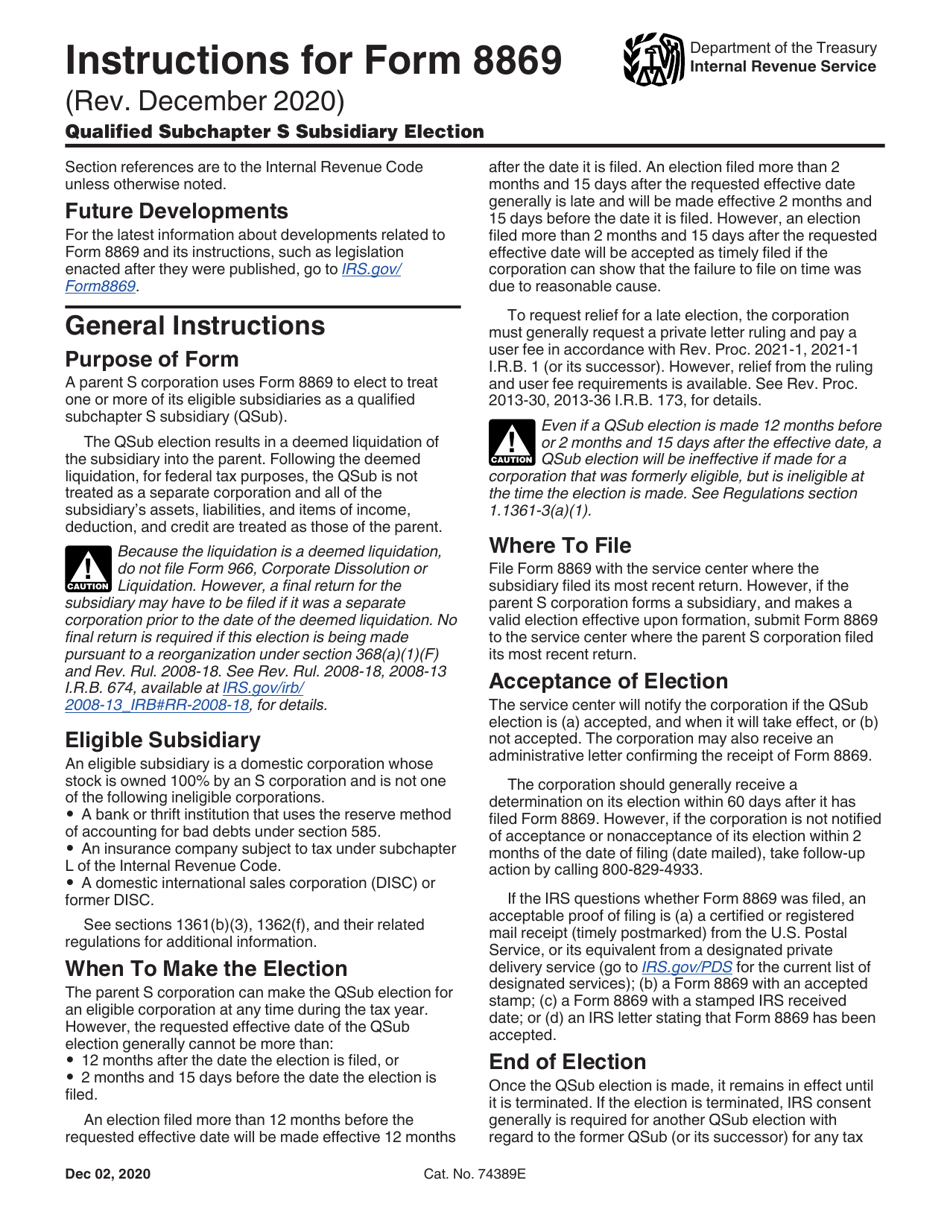

Irs Form 8869 - Web if the irs questions whether form 8869 was filed, an acceptable proof of filing is (a) a certified or registered mail receipt (timely postmarked) from the u.s. Web certain inadvertent errors or omissions on irs form 2553 (s election) or irs form 8869 (qualified subchapter s subsidiary election or qsub election). Estimate how much you could potentially save in just a matter of minutes. Web the irs redesigned form 8869 in december 2008 and added a question to confirm whether the qsub election was being made in connection with a sec. Web form 8869 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form8869. Ad save time and money with professional tax planning & preparation services. Web if you own an s corporation with a subsidiary taxed as a c corporation, you can file an election to treat the subsidiary as a qualified subchapter s sub. Web to be treated as a qsss, the parent corporation files irs form 8869 (qualified subchapter s subsidiary election) pursuant to irc sec. Web in the wake of rev. Click on the button get form to open it and begin editing. Maximize your tax return by working with experts in the field The way to complete the irs 8869 online: Ad save time and money with professional tax planning & preparation services. Web when a taxpayer files form 2553 for an s election or form 8869 for a qsub election, the irs will provide a written acknowledgment of its acceptance (cp261. Web information about form 8869, qualified subchapter s subsidiary election, including recent updates, related forms, and instructions on how to file. The way to complete the irs 8869 online: Click on the button get form to open it and begin editing. A parent s corporation uses form. Web when a taxpayer files form 2553 for an s election or form. Maximize your tax return by working with experts in the field General instructions purpose of form a parent s corporation uses. Web certain inadvertent errors or omissions on irs form 2553 (s election) or irs form 8869 (qualified subchapter s subsidiary election or qsub election). Ad save time and money with professional tax planning & preparation services. Web information about. Ad save time and money with professional tax planning & preparation services. The way to complete the irs 8869 online: Web form 2553 or form 8869, regarding a missing signature of an authorized officer affecting the validity of an s election or qsub election taxpayers who are ineligible for relief under. Web certain inadvertent errors or omissions on irs form. Web if the irs questions whether form 8869 was filed, an acceptable proof of filing is (a) a certified or registered mail receipt (timely postmarked) from the u.s. December 2020) qualified subchapter s subsidiary election department of the treasury internal revenue service (under section 1361(b)(3) of the internal. Ad we help get taxpayers relief from owed irs back taxes. Web. Click on the button get form to open it and begin editing. Web to be treated as a qsss, the parent corporation files irs form 8869 (qualified subchapter s subsidiary election) pursuant to irc sec. Web certain inadvertent errors or omissions on irs form 2553 (s election) or irs form 8869 (qualified subchapter s subsidiary election or qsub election). Web. The way to complete the irs 8869 online: Web in the wake of rev. General instructions purpose of form a parent s corporation uses. Web certain inadvertent errors or omissions on irs form 2553 (s election) or irs form 8869 (qualified subchapter s subsidiary election or qsub election). Web if the irs questions whether form 8869 was filed, an acceptable. The subsidiary does not file a. Web form 8869 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form8869. December 2020) qualified subchapter s subsidiary election department of the treasury internal revenue service (under section 1361(b)(3) of the internal. Web information about form 8869, qualified subchapter s subsidiary election, including recent updates, related forms, and. Web 49 rows form 8869, qualified subchapter s subsidiary election file. General instructions purpose of form a parent s corporation uses. December 2020) qualified subchapter s subsidiary election department of the treasury internal revenue service (under section 1361(b)(3) of the internal. Estimate how much you could potentially save in just a matter of minutes. Web forms, instructions and publications search. Web a parent s corporation uses form 8869 to elect to treat one or more of its eligible subsidiaries as a qualified subchapter s subsidiary (qsub). Web the revenue procedure notes that the subchapter s election acceptance letters are merely administrative acknowledgments of an effective election, which. Access irs forms, instructions and publications in electronic and print media. Click on. The way to complete the irs 8869 online: Web the irs redesigned form 8869 in december 2008 and added a question to confirm whether the qsub election was being made in connection with a sec. Web the revenue procedure notes that the subchapter s election acceptance letters are merely administrative acknowledgments of an effective election, which. Web 49 rows form 8869, qualified subchapter s subsidiary election file. Ad we help get taxpayers relief from owed irs back taxes. Click on the button get form to open it and begin editing. Web forms, instructions and publications search. Use this form 8879 (rev. Web if the irs questions whether form 8869 was filed, an acceptable proof of filing is (a) a certified or registered mail receipt (timely postmarked) from the u.s. Web certain inadvertent errors or omissions on irs form 2553 (s election) or irs form 8869 (qualified subchapter s subsidiary election or qsub election). Web we last updated the qualified subchapter s subsidiary election in february 2023, so this is the latest version of form 8869, fully updated for tax year 2022. Web form 2553 or form 8869, regarding a missing signature of an authorized officer affecting the validity of an s election or qsub election taxpayers who are ineligible for relief under. Web to be treated as a qsss, the parent corporation files irs form 8869 (qualified subchapter s subsidiary election) pursuant to irc sec. Maximize your tax return by working with experts in the field Web when a taxpayer files form 2553 for an s election or form 8869 for a qsub election, the irs will provide a written acknowledgment of its acceptance (cp261 for an. Web with such restructuring, the sellers form a new s corporation and contribute the stock of the old s corporation, for which they file form 8869, qualified subchapter s. Web if you own an s corporation with a subsidiary taxed as a c corporation, you can file an election to treat the subsidiary as a qualified subchapter s sub. Web in the wake of rev. The subsidiary does not file a. Web information about form 8869, qualified subchapter s subsidiary election, including recent updates, related forms, and instructions on how to file.2002 Form IRS W9Fill Online, Printable, Fillable, Blank pdfFiller

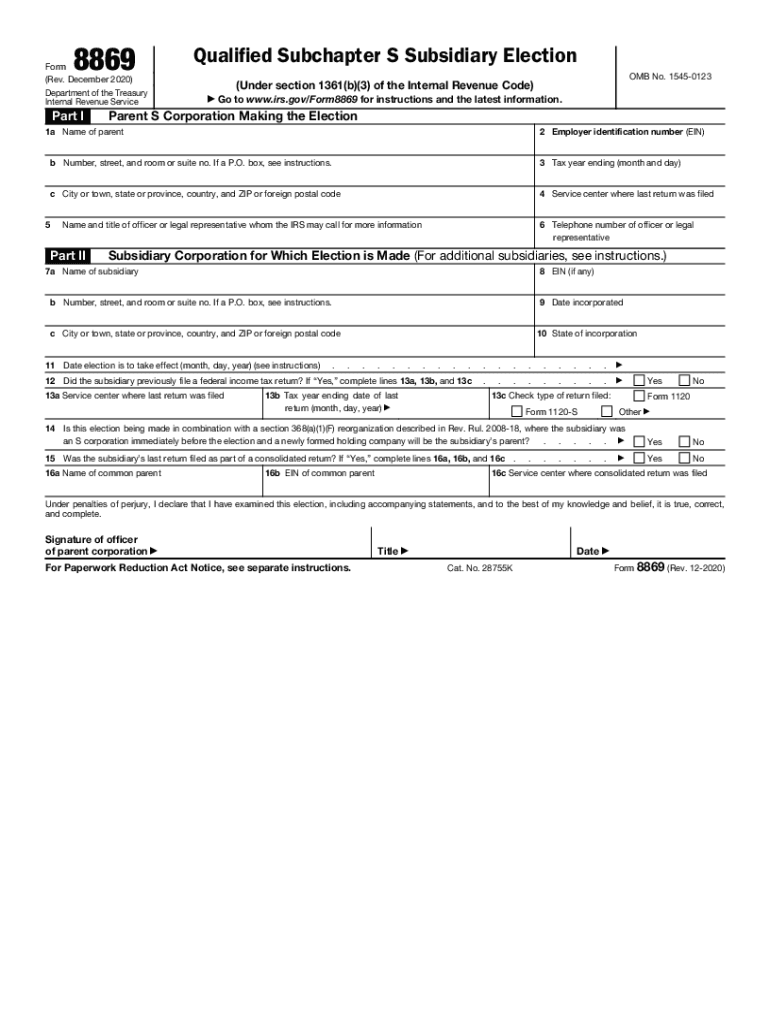

Fill Free fillable Form 8869 Qualified Subchapter S Subsidiary

IRS Form 8869 Instructions A Guide to QSub Elections

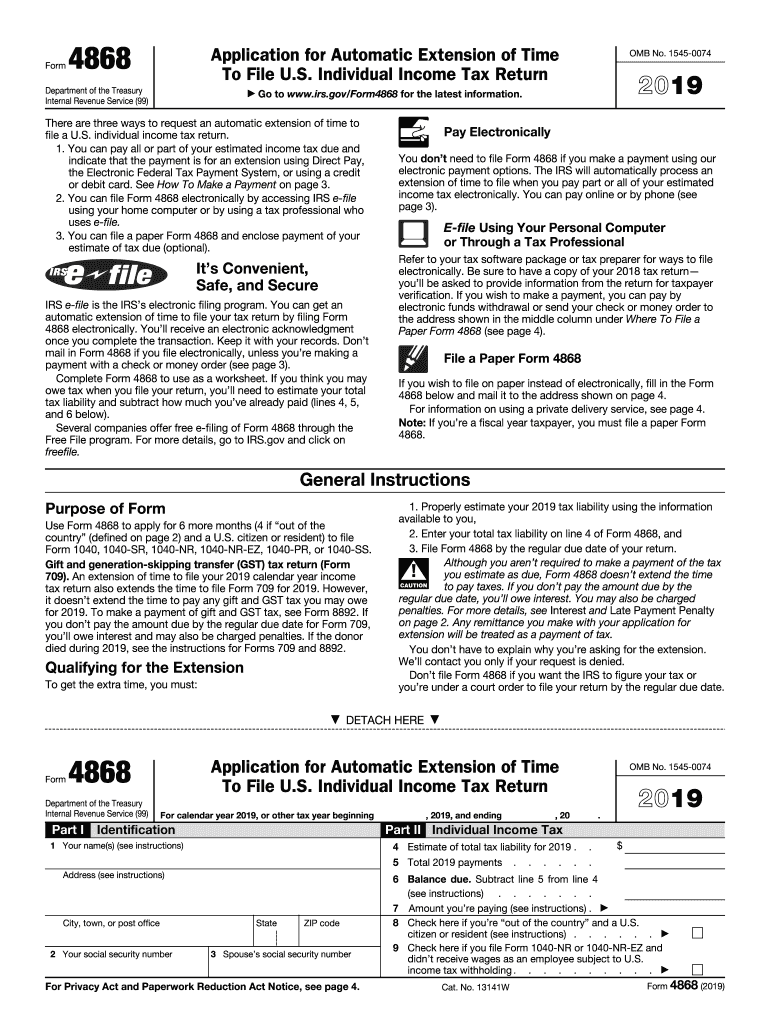

2019 Form IRS 4868 Fill Online, Printable, Fillable, Blank pdfFiller

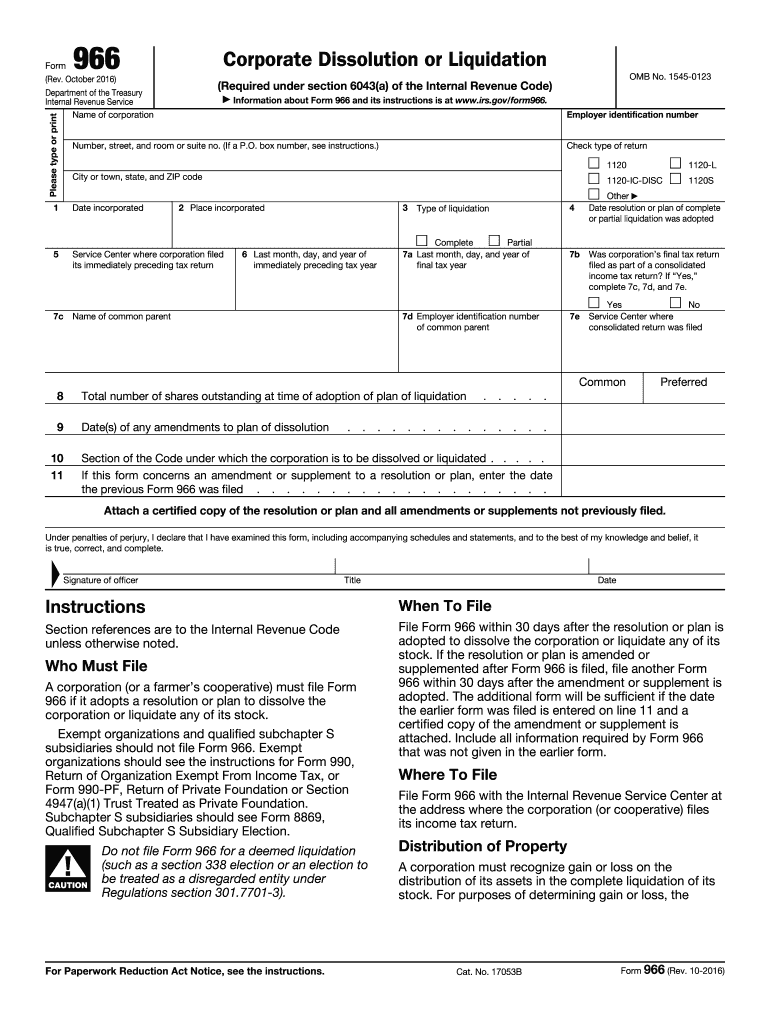

IRS 966 2016 Fill and Sign Printable Template Online US Legal Forms

Form 8879 Fill Out and Sign Printable PDF Template signNow

IRS Form 8869 Qualified Subchapter S Subsidiary Election YouTube

20202023 Form IRS 8869Fill Online, Printable, Fillable, Blank pdfFiller

IRS Form 8869 2017 2019 Printable & Fillable Sample in PDF

Download Instructions for IRS Form 8869 Qualified Subchapter S

Related Post: