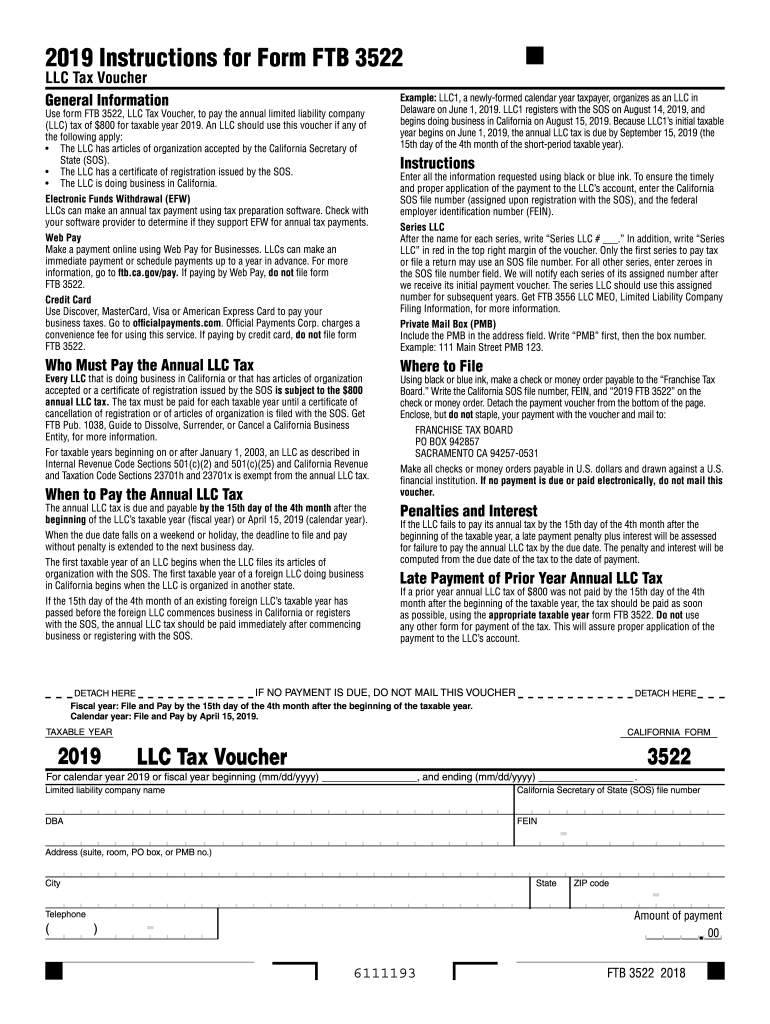

California Form 3522

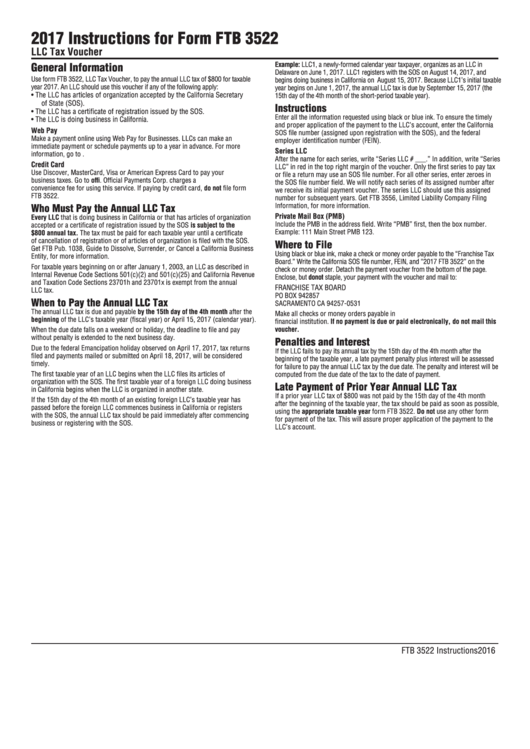

California Form 3522 - Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web the form 3522 which automatically prepares with llc return form 568 works in the software similarly to a type of estimated payment toward the next year tax. Complete, sign, print and send your tax documents easily with us legal forms. General information use form ftb 3522, llc tax voucher, to pay the annual llc. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2023. Web form 3522 is a california corporate income tax form. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. This annual tax amounts to about $800. An llc should use this. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2020. Web you need to submit form 3522 with the california ftb yearly, but you can also do it any time before the june 30 due date. Web we last updated california form 3522 in january 2023 from the california franchise tax board. Download blank or fill out online in pdf format. An llc should use this voucher if any of. An llc should use this. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Get ready for tax season deadlines by completing any required tax forms today. Web you need to submit form 3522 with the california ftb yearly, but you can also do it any time. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2020. Web payments up to a year in advance. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2023. An llc should use this. Web you. This form is for income earned in tax year 2022, with tax returns due in april. Web you need to submit form 3522 with the california ftb yearly, but you can also do it any time before the june 30 due date. All llcs in the state are required to pay this annual tax to stay compliant. Web we last. Every formed or registered llc that can do. Web we last updated california form 3522 in january 2023 from the california franchise tax board. This form is for income earned in tax year 2022, with tax returns due in april. Web the form 3522 which automatically prepares with llc return form 568 works in the software similarly to a type. An llc should use this. An llc should use this voucher if any of the following. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2019. Form 3522 will. The form 3522 is a tax voucher that llcs must use to pay yearly llc tax. Web payments up to a year in advance. An llc should use this voucher if any of the following. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue. Web the 3522 is for the. An llc should use this. Download blank or fill out online in pdf format. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2021. Web the form 3522 which automatically prepares with llc return form 568 works in the software similarly to a type of estimated payment. An llc should use this. Form 3522 will need to be filed in the 2nd. Web payments up to a year in advance. An llc should use this voucher if any of the following. Web what is california form 3522? Web what is california form 3522? Web we last updated california form 3522 in january 2023 from the california franchise tax board. Complete, sign, print and send your tax documents easily with us legal forms. This annual tax amounts to about $800. Web no, since your california llc doesn’t need to pay the $800 franchise tax for its 1st year,. An llc should use this. Web what is form 3522? Form 3522 will need to be filed in the 2nd. An llc should use this. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2021. Ad download or email ca ftb 3522 & more fillable forms, register and subscribe now! Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2019. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Web no, since your california llc doesn’t need to pay the $800 franchise tax for its 1st year, you don’t need to file form 3522. Use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2020. Form 3536 only needs to be filed if your income is $250,000. For more information go to ftb.ca.gov and search for web pay. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2023. All llcs in the state are required to pay this annual tax to stay compliant. Web the form 3522 which automatically prepares with llc return form 568 works in the software similarly to a type of estimated payment toward the next year tax. An llc should use this voucher if any of the following. General information use form ftb 3522, llc tax voucher, to pay the annual llc. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. An llc should use this voucher if any of the following. Every formed or registered llc that can do.2017 Instructions For Form Ftb 3522 Llc Tax Voucher printable pdf

2017 Form 3522 Llc Tax Voucher Edit, Fill, Sign Online Handypdf

Ca Form 3522 amulette

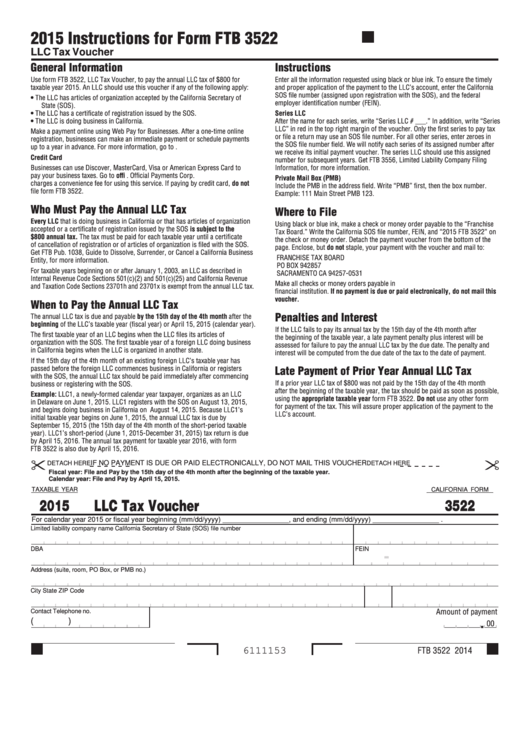

California Form 3522 Llc Tax Voucher 2015 printable pdf download

What is Form 3522?

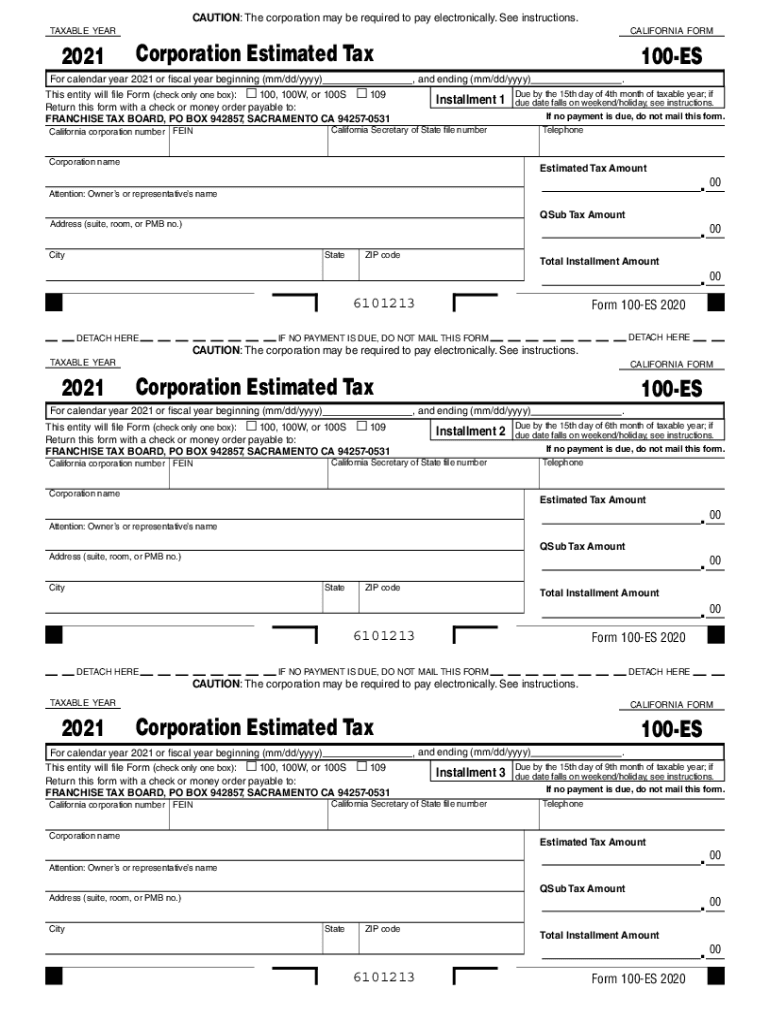

2021 Form CA FTB 100ES Fill Online, Printable, Fillable, Blank pdfFiller

2019 Form CA FTB 3522 Fill Online, Printable, Fillable, Blank pdfFiller

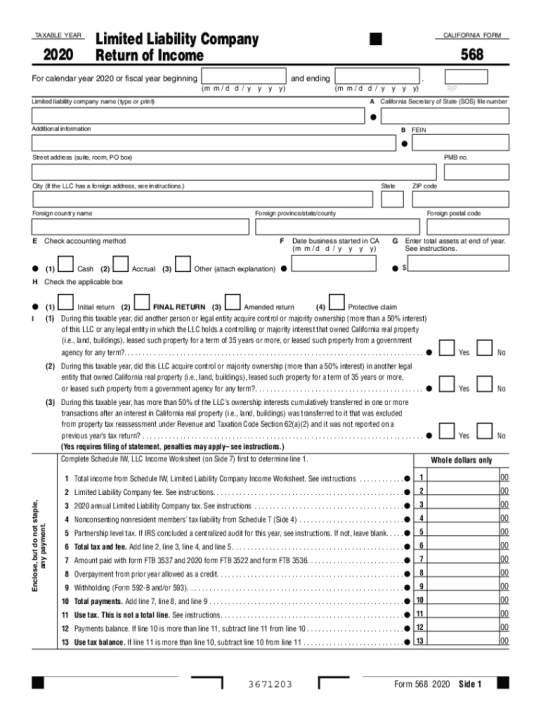

California Form 568 for LLCs and Payment Form 3522

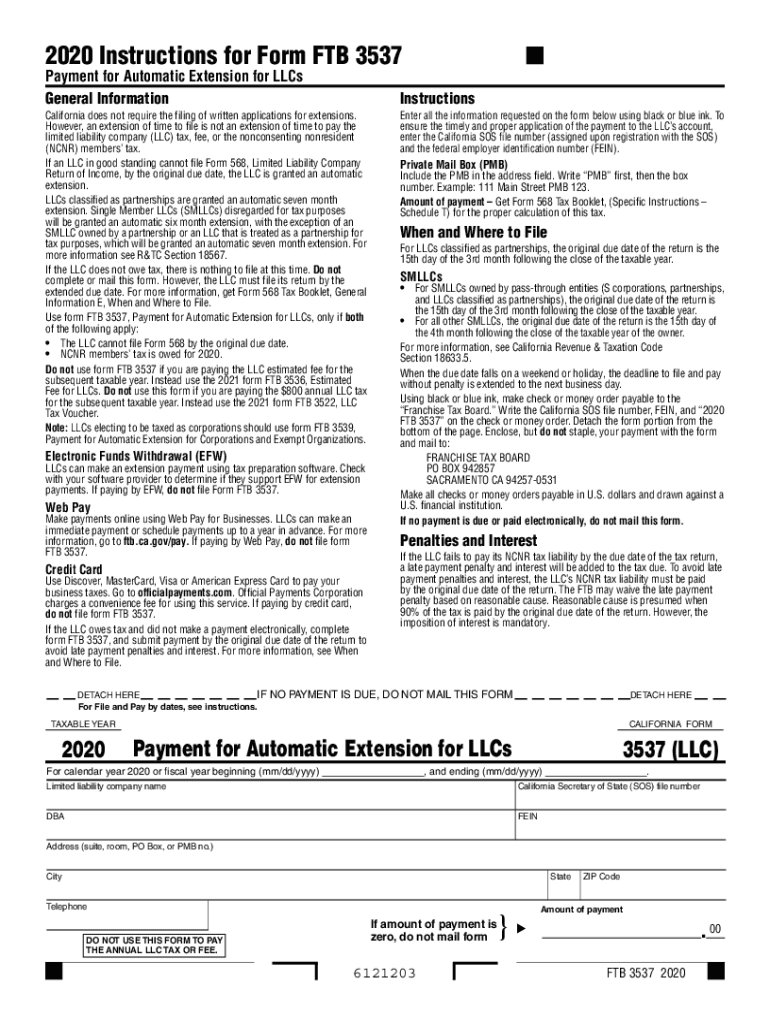

Ftb 3537 Fill out & sign online DocHub

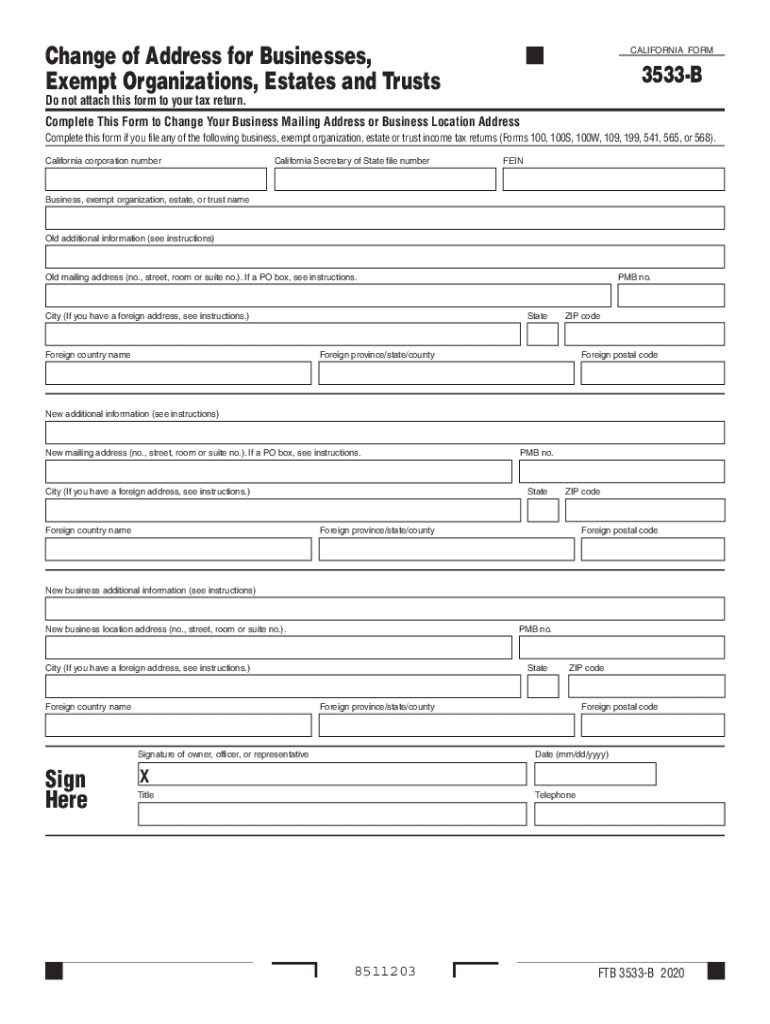

CA FTB 3533B 20202022 Fill out Tax Template Online US Legal Forms

Related Post: